Hello All Steemians !!!

Today I'm going to make my Steemit Crypto Academy Homework task by professor @allbert that talking about Trading with Accumulation / Distribution (A/D) Indicator. Very interesting lessons. Actually I have very little knowledge about this, but I will try to discuss it to improve my writing skills. On this occasion I will try to discuss it.

Explain in your own words what the A/D Indicator is and how and why it relates to volume

A/D Indicator is a tool used by traders in conducting technical analysis by observing and identifying the accumulation and distribution of crypto assets. In this case the accumulation and distribution in the market is a factor and a key concern of traders. Accumulation is a situation where traders own and accumulate crypto assets so that their prices rise due to the law of supply and demand. Distribution is a situation where traders distribute and sell crypto assets so that their prices fall due to the law of supply and demand.

A/D Indicator provides traders with data and information about the trading volume of crypto assets on the market within a certain period of time. This is very helpful for traders in carrying out good technical analysis because the trading volume indicates the liquidity of the market. This is because the role of indicators is very important in providing signals where when demand increases, many traders buy or accumulate the crypto assets. And when the supply increases, many traders sell or distribute the crypto asset.

Trading volume is closely related to the A/D Indicator because traders can observe and analyze the number of buy or sell transactions in the market that cause price movements in crypto assets. When an uptrend or accumulation phase in the market occurs, it indicates that the crypto asset is being traded or bought in large quantities and indicates that there is trading volume causing the price to increase. When a downtrend or distribution phase in the market occurs, it indicates that crypto assets is being traded or sold in large quantities and indicates that there is trading volume causing the price to decrease.

Based on the chart above, the XMR/USDT market is showing an uptrend and an accumulation phase. A/D Indicator shows increasing lines and scales. The indicator provides data and information regarding the trading volume and liquidity of the XMR/USDT market. The use of this indicator provide technical analysis results so that traders can make good decisions in carrying out trades.

Through some platforms, show the process of how to place the A/D Indicator

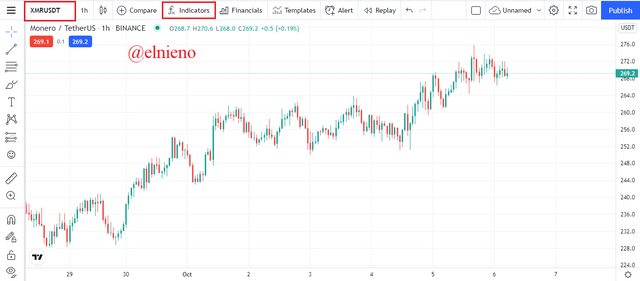

Here I use the Tradingview platform to do technical analysis and place the A/D Indicator.

Here I do a technical analysis of the XMR/USDT market. I clicked on Fx Indicator to add an indicator.

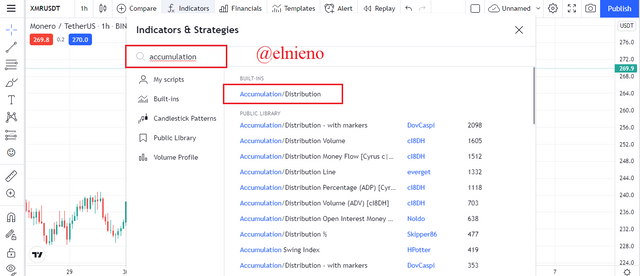

Source Tradingview Here I type and select the Accumulation / Distribution Indicator.

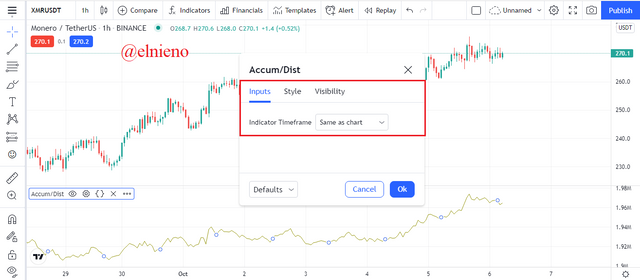

Source Tradingview Here the Accumulation / Distribution Indicator has been added to the XMR/USDT market chart. I clicked on the settings logo.

Source Tradingview Here inputs, style, visibility options are available. However I can't change the configuration and it's the default.

Source Tradingview

Explain through an example the formula of the A/D Indicator

The formula for A/D Indicator is as follows:

Money Flow Multiplier (High, Low and Close prices)

(Close Price of the period - Low Price of the period ) - (High Price of the period - Close Price of the period) / High - LowMoney Flow Volume

Money Flow Multiplier x Volume of the periodA/D Indicator

Previous A/D + Money Flow Volume of the period

Based on the chart XMR/USDT market above, the calculation of the A/D Indicator is as follows:

Close Price of the period = $268

Low Price of the period = $241

High Price of the period = $275

Volume of the period & Previous A/D = $2M

Money Flow Multiplier

= ($268 - $241) - ($275 - $268) / $275 - $241

= ($27 - $7) / $34

= $20 / $34

= $0.59Money Flow Volume

= $0.59 x $2m

= $1.18mA/D Indicator

= $2m + $1.18m

= $3.18M

How is it possible to detect and confirm a trend through the A/D indicator?

Uptrend

A/D indicator is useful and helps traders identify the uptrend in the market. The upward movement of the crypto asset price followed by the rising indicator line on the chart is a confirmation. This indicates that the crypto asset is in the accumulation phase. The accumulation phase shows that traders buy and accumulate crypto assets over a certain period of time causing the price to rise.

Based on the chart above, the XMR/USDT market is showing an uptrend. The price of XMR/USDT has increased significantly. A/D indicator shows a rising line and indicates the XMR/USDT market is in an accumulation phase. Here the uptrend has been detected and confirmed on the chart by relying on the A/D Indicator.

Downtrend

A/D indicator is useful and helps traders identify the downtrend in the market. The downward movement of the crypto asset price followed by the falling indicator line on the chart is a confirmation. This indicates that the crypto asset is in the distribution phase. The distribution phase shows that traders sell and distribute crypto assets over a certain period of time causing the price to fall.

Based on the chart above, the XMR/USDT market is showing a downtrend. The price of XMR/USDT has decreased significantly. A/D indicator shows a falling line and indicates the XMR/USDT market is in a distribution phase. Here the downtrend has been detected and confirmed on the chart by relying on the A/D Indicator.

Through a DEMO account, perform one trading operation (BUY or SELL) using the A/D Indicator only

Sell Entry

Based on the chart above, I did a technical analysis on the SC/USDT market using the A/D Indicator. I found a divergence where the price went up and the A/D Indicator line went down. This indicates that the uptrend will end in the near future. I created an ascending trend line and concatenated several candles on the chart. The downward price movement broke through the trend line and I placed a sell entry on the next candle. I placed stop loss slightly above the resistance level with a stop loss and take profit ratio of 1:1. SC/USDT trading details are as follows:

What other indicator can be used in conjunction with the A/D Indicator. Justify, explain and test

Sell Entry

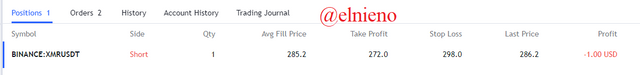

Based on the chart above, I did a technical analysis on the XMR/USDT market using the A/D Indicator. I added the EMA 21 and EMA 55 indicators to the chart. The EMA line indicates that there is a golden cross formed in the market and indicates the time to place a sell order thereafter within a certain period of time. I found a divergence where the price went up and the A/D Indicator line went down. This indicates that the uptrend will end in the near future. I created an ascending trend line and concatenated several candles on the chart. The downward price movement broke through the trend line and I placed a sell entry on the next candle. I placed stop loss slightly above the resistance level with a stop loss and take profit ratio of 1:1. XMR/USDT trading details are as follows:

Conclusion

In the world of cryptocurrencies, the use of indicators is very useful and helps traders in technical analysis of the crypto asset market so that traders can make good decisions in carrying out trades. The A/D Indicator is a very useful tool because it can indicate the situation and cycle of the crypto asset market when it is in the accumulation and distribution phase. The use of this indicator relates to trading volume and market trends. Everything provided by this indicator can be relied on by traders to place profitable buy and sell orders.

Hello @elnieno Thank you for participating in Steemit Crypto Academy season 4 week 5.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit