Hello All Steemians !!!

Today I'm going to make my Steemit Crypto Academy Homework task by professor @allbert that talking about Trading with Contractile Diagonals. Very interesting lessons. Actually I have very little knowledge about this, but I will try to discuss it to improve my writing skills. On this occasion I will try to discuss it.

Define in your own words what a contractile diagonal is and why it is important to study it. Explain what happens in the market for this chart pattern to occur

Contractile diagonal is a pattern or structure that forms in the market of a crypto asset that shows bullish and bearish price movements within a certain period of time. Analysis can be done by identifying price changes on the chart by creating and joining diagonal lines at certain points. It is based on the price movement which is indicated by the points 1-2-3-4-5 and forms a wave pattern of the highest and lowest points. This serves to predict and provide trend reversal signals for traders to be able to determine profitable buy and sell orders.

Contractile diagonals provide traders with trend reversal confirmation in analyzing crypto asset charts. This is evidenced by the existence of a pattern or structure that shows price movements in the opposite direction of the trend and breaking through one of the diagonal lines in the market. Here diagonal lines are drawn and connected based on the points 1-2-3-4-5 which indicate the support and resistance levels of the wave formed.

The analysis and observation of the formation of a contractile diagonal wave is said to be similar to that of an elliott wave. This is indicated by the movement of the price of crypto assets which is characterized by waves 1-2-3-4-5. Points 1-3-5 of the formed wave indicate a price movement in line with the current trend. Points 2-4 of the formed wave indicate a price movement in the opposite direction which means a pullback.

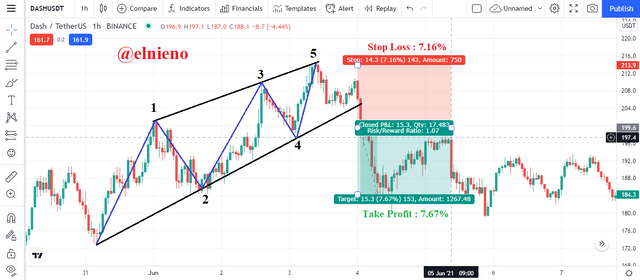

Based on the chart above, the price movement of DASH/USDT shows a price increase and is currently an uptrend in the market. The upward price movement followed by the pullback from time to time is decreasing in volume. When the price moves in the opposite direction and breaks through the diagonal line, a confirmation of a trend reversal in the market has occurred and the trader can place an order.

Give an example of a Contractile Diagonal that meets the criteria of operability and an example of a Contractile Diagonal that does NOT meet the criteria

In the world of cryptocurrency, trading strategy is one of the important factors that traders must understand and consider. Each trading strategy has criteria such as contractile diagonal as follows:

- Wave 1 is bigger than wave 3.

- Wave 3 is bigger than wave 5.

- Wave 2 is bigger than wave 4.

- Diagonal line 1 connecting or joining points 1-3-5.

- Diagonal line 2 connecting or joining points 2-4.

- Diagonal lines 1 and 2 can meet and cross.

Based on the chart above, the price movement and the waves formed on DASH/USDT indicate the correct and appropriate criteria of the contractile diagonal operation. Wave 1 is bigger than wave 3 and wave 3 is bigger than wave 5. Likewise wave 2 is bigger than wave 4. Then the price movement showed a break of the diagonal line and indicated a trend reversal and fulfills the criteria of contractile diagonal operation.

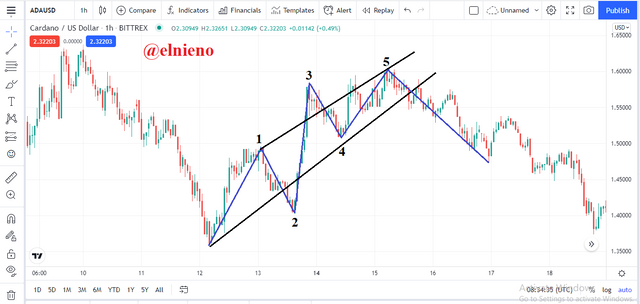

Based on the chart above, the price movement and the waves formed on ADA/USD indicate the wrong and inappropriate contractile diagonal operating criteria. Wave 1 is smaller than wave 3. Wave 2 is not connected to wave 4. The price movement shows a break of the diagonal line and indicates a trend reversal but still it does not meet the criteria of contractile diagonal operation.

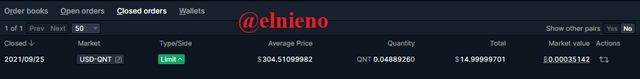

Through your Verified exchange account, perform one REAL buy operation (15 USD minimum), through the Contractile Diagonal method. Explain the process and demonstrate the results and graphical analysis through screenshots.

Buy Orders QNT/USD

Based on the chart above, the QNT/USD market analysis on the chart using a 2-hour timeframe shows a contractile diagonal pattern that meets the criteria. This is evidenced by the price movement is down and the dowtrend in the market is forming a wave which is indicated by the points 1-2-3-4-5. After the price movement breaks through the diagonal line and shows a change in trend, buy orders can be placed at a certain time.

I use the Bittrex exchange to place a buy order for QNT/USD. In this case I was late in entering the market because the confirmation of the diagonal contractile pattern that had broken through the diagonal line had been crossed by several candlesticks. The price movement is up and uptrend in the market is predicted to continue so that I can place a buy order of 15 USD and get 0.0488926 QNT. Trade details are as follows:

Through a DEMO account, perform one sell operation, through the Contractile Diagonal method. Explain the process and demonstrate the results and graphical analysis through screenshots

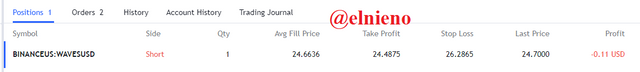

Sell Orders WAVES/USD

Based on the chart above, the WAVES/USD market analysis on the chart using a 1-hour timeframe shows a contractile diagonal pattern that meets the criteria. This is evidenced by the price movement is up and the uptrend in the market is forming a wave which is indicated by the points 1-2-3-4-5. After the price movement breaks through the diagonal line and shows a change in trend, sell orders can be placed at a certain time.

I use the Paper Trading exchange to place a sell order for WAVES/USD. Here I set the stop loss level at point 5 and the take profit level at point 2 based on the waves formed in the market. The price movement is down and downtrend in the market is predicted to continue so that I can place a sell order of WAVES/USD. Trade details are as follows:

Explain and develop why not all contractile diagonals are operative from a practical point of view

In the world of cryptocurrencies, the risk/reward ratio also plays an important role in trading. All traders expect a large profit compared to risk, so the risk/reward ratio should be as expected and not contradictory. This is one of the factors that must be considered to produce good risk management. Trading using contractile diagonal strategies and patterns is to help traders place trades that can increase profits. In some cases the contractile diagonal pattern meets the criteria, but sometimes the pattern is not operative due to an adverse risk/reward ratio factor.

Based on the chart above, the risk/reward ratio of DASH/USDT shows that it is operative and meets the contractile diagonal criteria. This is evidenced by the take profit margin is greater than the stop loss margin. The risk/reward ratio = 1.07 and the take profit level is 0.51% greater than the stop loss level. This shows the trade has good risk management and a favorable risk/reward ratio.

Based on the chart above, the risk/reward ratio of XRP/USDT shows that it is not operative and does not meet the contractile diagonal criteria. This is evidenced by the stop loss margin is greater than the take profit margin. The risk/reward ratio = 0.44 and the stop loss level is 3.69% greater than the take profit level. This shows the trade has bad risk management and an adverse risk/reward ratio.

Conclusion

Contractile diagonals are patterns or structures on the charts of crypto assets that traders use in predict and analyze market trend reversals so as to place profitable trades. Here the important point is the wave 1-2-3-4-5 and the diagonal line indicating bullish and bearish price movement in the market. The risk/reward ratio in the contractile diagonal pattern must also be operative and meet the criteria so as to produce profitable trades. Many strategies are very helpful for traders in the cryptocurrency world.