Good day guys, after @alphafx lecture on blockchains and platforms, I will be participating in this week’s assignment. In today’s article, I’ll be comparing two blockchain that are thriving in the NFT and Defi sectors, namely; Ethereum blockchain and Binance Smart Chain.

Smart Contracts

Binance Smart Chain and Ethereum blockchain are amongst the top three Blockchains that exists. If you are interested in building smart contracts, dApps or DeFi projects, these are blockchains that will probably cross your mind.

It was in July 2015, that the ethereum blockchain included the ability of adding smart contract to the chain. That upgrade made in possible for developers and other techies to build their ERC-20 tokens on ethereum blockchain.

On the other hand, I’d like to describe the Binance Smart Chain (BSC) as a child of the ethereum blockchain. Initially, the BNB coin was running as an ERC-20 token before the creation of Binance Smart Chain’s BEP-20. However, BEP-20 has become ERC-20 biggest competitor since it was launched in 2019.

ERC-20 vs BEP-20 tokens

Another interesting feature of the Binance Smart Chain was the introduction of BEP-20 tokens. They are also some tokens that run on both blockchain, e.g. DODO.

The main advantage of BEP-20 tokens over ERC-20 tokens is cheaper transaction fees. An average transfer on the Binance Smart Chain will have a transaction fee of about $0.20, whereas on the Ethereum blockchain it could cost up to $25.

It is not surprising that many developers looking to building new DeFi and NFT projects turning to the Binance Smart Chain instead of Ethereum. That is not also forgetting the Ethereum’s scalability issues as well.

From personal experience, transactions on the Binance Smart Chain have been faster compared to those on Ethereum chain. This is due to the BSC 3-second block times.

DeFi and Swaps

Both blockchain have different swaps. For example, on the Binance Smart Chain, you’ll find Pancakeswap, 1inch, Sushiswap, Bakeryswap, Julswap, etc. Whereas on the ethereum blockchain, you’ll find Uniswap and Sushiswap. Also, note that Sushiswap is available on both blockchains.

When swapping tokens, it is also cheaper to swap on BSC network. Hence, transaction costs on Pancakeswap is over 10 times than that of uniswap due to the very high ethereum gas fee. Earlier in the year, the gas fee on uniswap was up to $60. Imagine paying $60 to trade a token that is worth less than $100. Shocking! For that reason, I stay away from ethereum swaps.

Conclusion

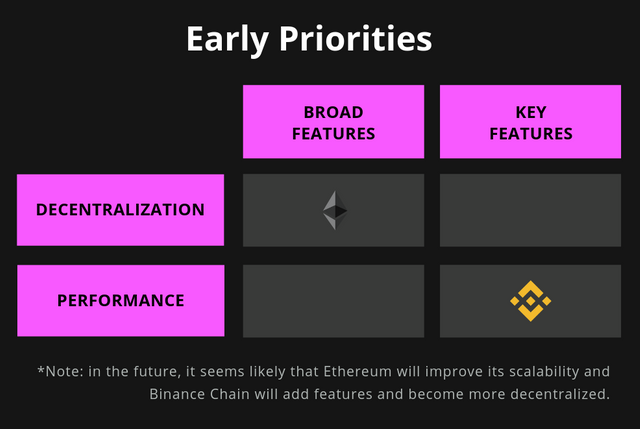

With my comparison of both blockchains, it is obvious that the Binance Smart Chain is getting more traction because of its interesting ecosystem, low transaction costs and high scalability.

The ETH 2.0 upgrade will probably be a better competitor to the Binance Smart Chain. I feel the BSC will only be better in the short term because it is centralised, whereas ETH is decentralised. Well, we will wait and see how things turn out between the two blockchains.

Please note that Binance Smart Chain (BSC) is different from Binance Chain. While the former supports smart contracts, the later doesn’t. The Binance Chain was created for a different purpose.

Scoring

Thanks for participating

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit