Margin trading and leverage tokens trading are two terms that wouldn’t sound new to intermediate crypto traders. On the other hand, both terms may seem new to newbies. Well, the purpose of today’s article is to make both terms more understandable. I’d explain in simple words so that everyone can have a good understanding. First we’d start with margin trading, then proceed to leveraged tokens trading, and lastly, we’d do a price prediction for a token.

1. What is crypto margin trading?

Think of it as borrowing money from someone to use to execute trades. Margin traders borrow funds from third parties in order to trade an amount that is bigger than their capital. For example, on Binance Savings, the platform gives the money users save to margin traders for them to trade. While margin trading is volatile, the exchange ensures that the borrowed funds are not lost.

Margin trading makes it possible for traders to make huge profits while taking high risks. Just as it is possible to make profits, so traders are also likely to lose all the sum deposited. On other exchanges, the amount given to margin traders are gotten from lenders and brokers.

In order to participate in margin trading, a trader would have to deposit a sum to serve as collateral. Different exchanges have different rules as regards this type of trading. In summary, when you borrow funds for margin trading, your trading funds and collateral are exposed if the market moves in a opposite direction.

2. How To Plan For Trading In Crypto Margin Trading

Use small leverages

If you just recently started margin trading, it is best to start with small leverages. You can start with x3 or x4 leverages. When you start with lesser leverages, you reduce the risk of getting easily liquidated.

Start with Small capital

It is best to test the market before you move your trading capital to your margin trading wallet. If for example you use $5,000 for spot trading, it is advisable not to use more than 10% of that sum for margin trading. That would help to reduce potential losses.

Trade with what you can afford to lose

Since margin trading is high risk, it is best to trade with an amount of money that you can afford to lose. This is not the kind of trading that you should use your entire savings for. It is not advisable to use all your trading balance for margin trading just because you feel that the market will go your way.

Use Stop Loss

At times stop loss, could save you from getting liquidated. When you set a stop loss, it helps to save a part of your deposit. Hence, when the market doesn’t go as planned, you are not completely exposed.

It is an active investment

It is wrong to take margin trading as a passive investment. It is not the kind of trading that you simply open and abandon. You have to regularly monitor your trades because the market can move in any direct at any point in time. So you have to keep yourself updated with the situation of your trades.

No panic buy

Do not jump into trades simply because others are buying the token or because it is trending on social media. There are several pump-and-dump schemes out there, you’d definitely not want to be another victim. People tend to manipulate their assets with social media so have to be on guide.

3. Crypto Exchanges Name That Provide Margin Trading Service and What Margin They Provide?

| Exchange | Margin leverage |

|---|---|

| BITMEX | 100X |

| Bybit | 50X - 100X |

| Binance | 1X- 25X |

| Kraken | 5X |

| Poloniex | 2.5X - 5X |

From the table, it can be observed that Bybit and BITMEX give the highest leverage. Hence, for users that want to want more leverage, they can simply use the exchange for margin trading.

On the other hand, Kraken and Poloniex give lower leverages.

4. What Is Leveraged Tokens Trading?

The use of leveraged tokens is one way to participate in leverage trading without using margin trading or futures trading. The interesting thing about leveraged tokens trading is that there is lower possibility of liquidation as it reinvests your profits when market moves in an opposite direction.

Leveraged token trading is not advisable for newbies as they can also lose money as well. However, it is the best introduction to leverage trading for newbies.

For the purpose of this article, we’d be looking at the 1INCHUP and 1INCHDOWN that is offered by Binance. They are the leverage versions of the 1INCH token on Binance.

- Screenshot showing 1INCH/USDT pair on Binance

- Screenshot showing 1INCHUP/USDT pair on Binance

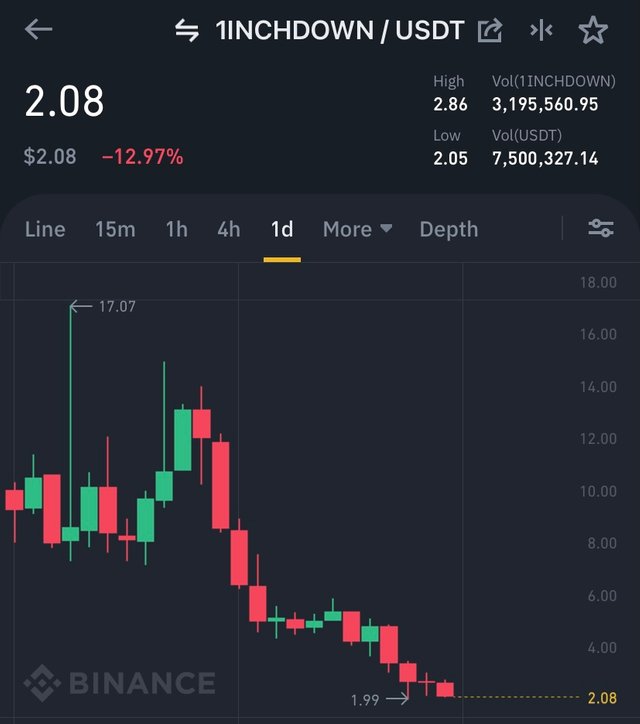

- Screenshot showing 1INCHDOWN/USDT pair on Binance

Comparing the charts from 1INCH/USDT, 1INCHUP/USDT and 1INCHDOWN/USDT:

It can be observed that the chart of 1INCH/USDT and 1INCHUP/USDT look more similar. While 1INCHDOWN/USDT looks quite opposite.

1INCHUP/USDT offers a leveraged position when the price of 1INCHUP/USDT is appreciating.

1INCHDOWN/USDT offers a leveraged position when the price of 1INCH/USDT is falling.

Please note that both 1INCHUP/USDT and 1INCHDOWN/USDT are leverage tokens. On Binance, leveraged tokens cannot be withdrawn directly into an external wallet.

5. How To Plan For Trading In Leveraged Tokens?

Analysis Before Buying

Before buying a leveraged token, a user should understand the basic concepts and the possible risks involved. It is important to understand whatever you want you put money on. The charts of the token should be examined, before even studying to charts of the leveraged token.

Not for Long-term holding

Leveraged tokens are not for long-term holding. Hence, a user should consider how long he is willing to hold the token before buying. The token is not recommended for long term because of rebalancing. Everyday, most exchanges rebalance leveraged tokens.

Transparency of Token

Also, traders want to do well to see if the exchanges are transparent regarding the leveraged tokens. A good exchange would place the rules for rebalancing their leveraged tokens in public articles. This so that traders can confirm if it is accurate. So when exchanges hide this, it is best to avoid dealing with them.

6. Crypto Exchanges Name That Provide Leveraged Tokens Service and What Margin They Provide In Leveraged Tokens?

| Exchange | Leveraged Token Margin (max) |

|---|---|

| Kucoin | 10X |

| Huobit | 5X |

| Kraken | 5X |

| Binance | 4X |

| FTX | 3X |

| BITMEX | 3X |

| Pionex | 3X |

From the above, it can be observed that Kucoin offers the highest margin for leveraged tokens. Whereas the highest margin offered by FTX, BITMEX and Pionex is 3X.

7. Price Forecast For Crypto Assets

Screenshot of TradingView displaying the Chart of 1NCH

The 1INCH/USDT chart shows the price movements of 1INCH from the 1st of February to the 8th of May, 2021. In the subsequent chart, we will look closely at the resistance level.

Screenshot showing the Resistance Line for 1INCH/USDT

From the chart of 1INCH/USDT above, it can be observed that a new trend has started outside the support zone. This is a new all time high for the token and we can await price discovery. As a result, it can be predicted that if the price of BTC stabilise at the current levels, the price of 1INCH is likely to go further upwards.

The breakout was expected because it has been in accumulation zone for a while. Currently, 1INCH is a big competitor to Uniswap. While Uniswap has a market of of $20 Billion, 1INCH has a market cap of $1 Billion. It is only a matter of time before 1INCH becomes a top 50 coin by market cap. Hence, the price is more likely to go up from here.

My price prediction for 1INCH in the next one week is between: $9.4 - $10.65. With a stable BTC price for the week, that is likely to happen.

Conclusion

In today’s article we’ve discussed margin trading and leveraged tokens trading, two types of trading that brings high profits with a degree of exposure. If you are a newbie, it is advisable to learn the concepts before trading. If you have a solid plan and know when to set stop losses, then it is unlikely for you to lose all your money in these high-risk trading.

Key Notes

- Start small and grow the capital

- Set a stop-loss

- Monitor your trades

- No panic buys (FOMO)

Thanks to @stream4u for the lecture.

Thank you for joining The Steemit Crypto Academy Courses and participated in the Homework Task.

thank you very much for taking interest in this class

Grade : 7

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit