INTRODUCTION

COMMODITY CHANNEL INDEX(CCI)

The commodity channel index (CCI) works just like the relative strength index cause they both help us to determine the overbought and the oversold region of a curreny pair, unlike the relative strength index (RSI) which has a scale of 0-100: for the overbought it's 70-100 and for the oversold it's 30-0, but the scales of the commodity channel index is so different cause it's has no limit it could range from positive infinity to negative infinity.

- The CCI also has a neutral scale which is zero(0).

- The overbought is when The price reaches +100 or even more which means price is going to fall .

- The oversold is when price is reaches the -100 or even more which means that the price is going to rise.

The commodity channel index helps us to identify the overbought and the oversold region in the chart, it's calculated by change in price and average provided momentum of the asset.

Open a demo account on any trading broker and select five cryptocurrency pairs

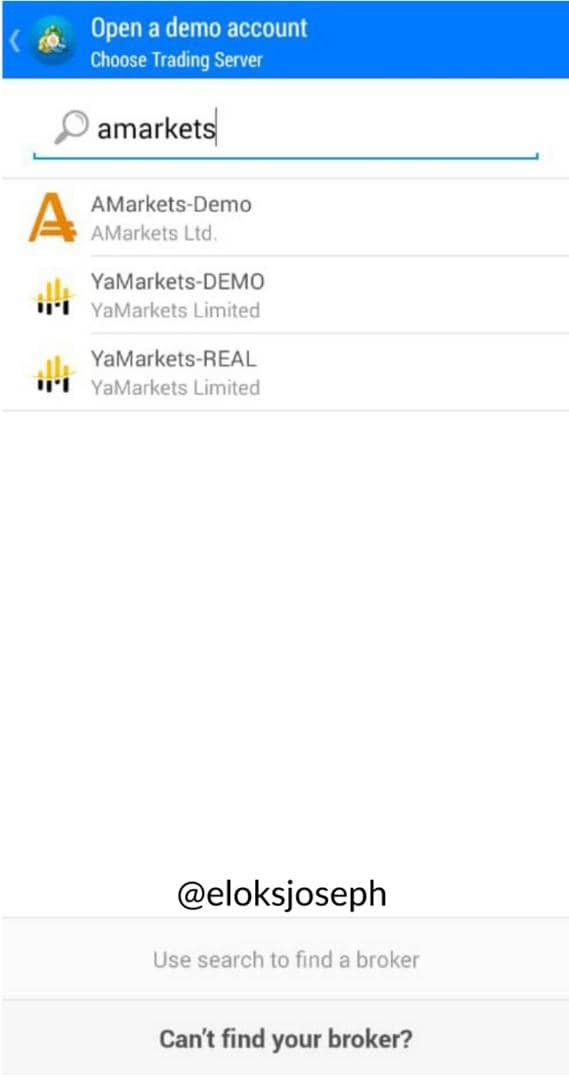

I'm using the metatrader 4 app and the broker I selected is the Amarkets demo because they do have alot of crypto currencies I could trade with

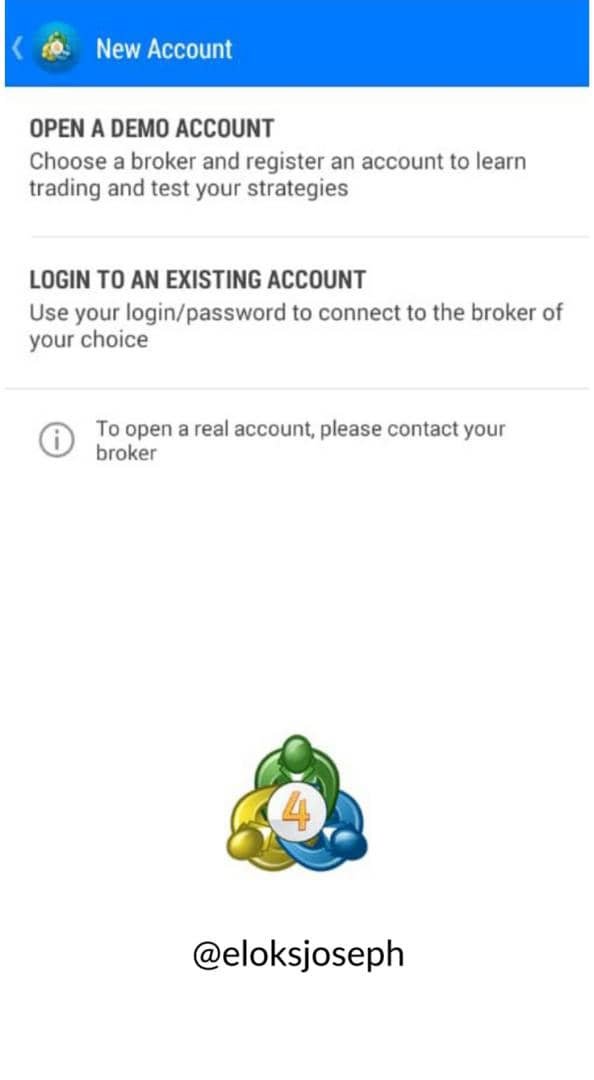

Step 1:

You open a demo account or a real account depending on you but for the sake of the assignment I'm opening a demo account

Step 2:

Select the broker you want to trade with or search the name of the broker and your demo account is created.

Create a market entry and exit strategy

I use the 7 and the 14 moving average to determine my entry, whenever the 7 and the 14 moving average meet I enter my trade. I also set Another moving average indicator that enables me to identify the trend of the market the 200 and 89 moving average, If they are above the chart it's shows a downward movement in price and whenever it's below the chart it shows an upward movement in price and I also use the commodity channel index(CCI) to know if it's in an overbought or oversold region. Like we all know the more confirmation the better.

For buy

• It should be in the oversold region of the CCI (+100 and above )

• the 200 and 89 moving must be below the chart

• And the 7 and 14 moving average must meet to enter the trade

For sell

• It should be on the overbought region of the CCI (-100 and below )

• The 200 and 89 moving average must be above the chart

• The moving average must meet to enter the trade

Use the signals of the Commodity Channel Index (CCI) to buy and sell the coins you have selected

I've selected 5 different currency pairs as instructed

- ADA/USD

I entered the trade when my CCI was below -100, 200 and 80 ma were below the chart and also when my 7 and 14 ma met following my entry and exit strategy.

- Bitcoin/euro

Followed my entry and exit strategy also, I entered this grade when my CCI was at -107 which indicates that price is going to rise .

- DOT/USD

My 200 and 89 moving average were above the chart which indicates a downtrend and I entered the trade when my CCI was above +100.

- ETHEREUM/BITCOIN

I saw a sell opportunity here also when my CCI was at +152 and my 20p and 89 moving average were above the chart.

- RIPPLE/USD

I saw a buy opportunity here although my 200 and 89 ma were above the chart which tells me it's a downtrend but my CCI was below -100 so I decided to go long.

Declare your profit or loss

ADA/USD

Entry: 1.1175

Exit: 1.1853

Profit: 102pipsBITCOIN/EURO

Entry: 27381.36

Exit: 27600.18

Profit: 219pipsDOT/USD

Entry: 11.500

Exit: 11.310

Profit: 210pipsETHEREUM/BITCOIN

Entry: 0.0590

Exit: 0.0580

Profit: 10pipsRIPPLE/USD

Entry 0.5178

Exit 0.5255

Didn't meet my exit so I went into a loss on this one, if I were patient enough it would have been a profit also

Loss: 77pips

Explain your trade management technique

It is necessary to have more confirmations before entering a trade cause the more confirmation the better . These confirmations can be gotten by adding more technical indicators and analysing the trade more before going in.

Also, the ability to manage your money is a very important technique in order for you not to blow your account. I'd advise all traders to learn the technique of Money management cause if you can manage your money you can make 10-15 trade or more with just $100 unlike someone that does have the knowledge of money management could lose the whole $100 in seconds and for you to manage your money you should know the right risk reward ratio for you to use. An advisable risk reward ratio for beginners is the 1:1 ratio as the reward is the same amount you risk. As you trade further, you can then chnage the ratio e.g 3:5, 3:7 ,etc.

CONCLUSION

This practical trading was really an interesting one thank you sir @asaj for this one and like I said earlier "the more confirmation the better" do not limit yourself to certain indicators learn more and combine then together to achieve better result in your trading thank you.

x x x

All screenshots are from metatrader 4

Hi @eloksjoseph, thanks for performing the above task in the fourth week of Steemit Crypto Academy Season 3. The time and effort put into this work is appreciated. Hence, you have scored 5.5 out of 10. Here are the details:

Remarks:

Commendable effort but fair performance. You could have earned more points had you attach a screenshot of your profit or loss in the fourth task.

Also, take a second look at what you wrote in the third task:

The above statement is unclear and inconclusive. As a suggestion, pay attention to your grammar. Again, we appreciate effort and time.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit