INTRODUCTION

Hi guys welcome to another week in steemit crypto academy.I am so happy I got a chance to partake in this lecture because I have been busy with exams. Earlier in the week I read the professors post and I have decided to do his task.Without further ado;

1. What is meant by order book and how crypto order book differs from our local market ?(explain with examples)

An order book is a list that contains items or assets we wish to purchase.Some people refer to it as a shopping list.An order book is often taken to a market place containing things we need to get at the market.Most times we'll have an estimate price for each of the things we set to buy but the seller will pick the final price and it is our decision to accept his price to finalize the trade.

A crypto order book is used in making trades in exchanges.It gives information on the buy an sell price of an asset in a pair (steem/btc) .An order can be made by a trader based on the price he wants to buy or sell an asset. The crypto order book is important as it gives instant market pricing of an asset so as not to make a mistake of paying for an asset for more than it's worth.

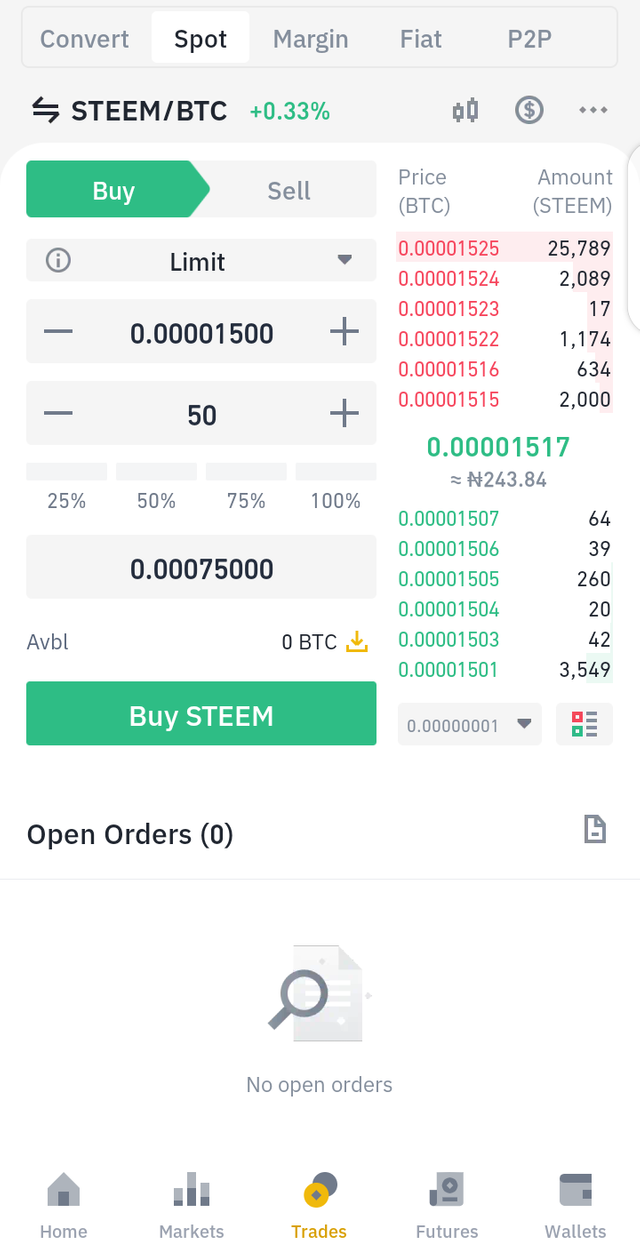

This is an example of a crypto order book. The green theme indicates buying and the red theme indicates sell. From the screenshot above ,you can see about 8090 steem was bought for 0.00001511 btc and about 270 steem was sold for 0.00001516 btc . From the screenshot you can see the instantaneous price of steem at the time of the screenshot (0.00001522btc).

Our local market isn't much different from this if we put it into thinking because assets are also sold and bought there.The main difference being that there's not as much information on trades in the local market as much as there is in the crypto order book.

2. How to find order book in any exchange through screenshot .

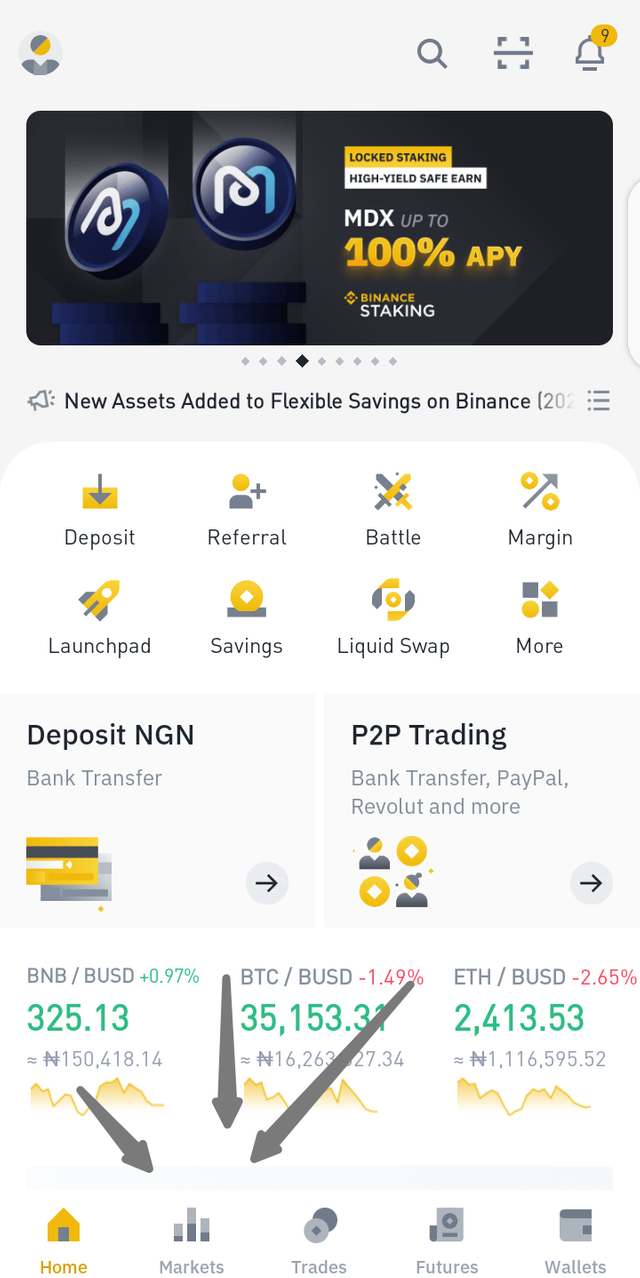

- For this question I'll be explaining using my binance exchange mobile app.

Once you enter an exchange, you'll see a market option,I have noted it in my screenshot below.

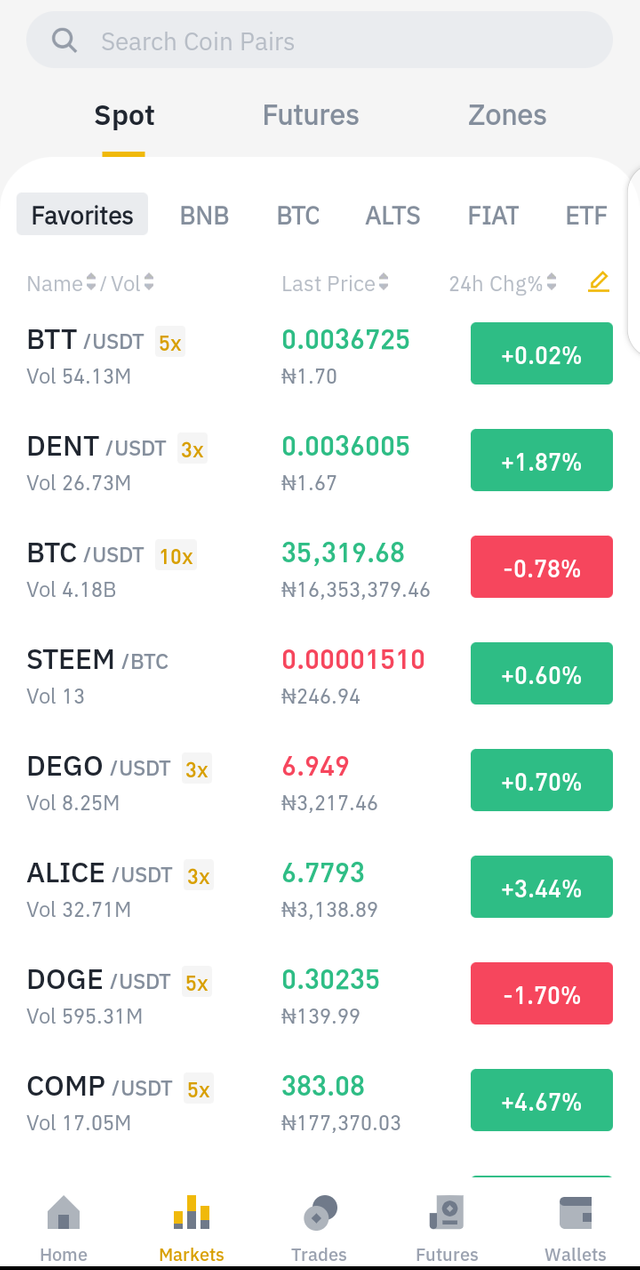

Once you click on the market tab,you'll be directed to a new page where you'll be required to search for pairs and you'll also see common cryptocurrency pairs( eg btc ,bnb ,eth and some fiat currencies).It is also possible to keep favorite pairs of coins on your watchlist.

Here you'll search for the coin you want to trade and then you'll see the pairs that the coin is available with.As you can see I used steem/btc even though steem is also paired with eth.

After clicking the steem/btc pair, you'll be taken to the market where you can see the graph be it a line graph,1 day graph, 1 week graph,1 month graph or even 1 minute.(the time limit available may depend on the Exchange).

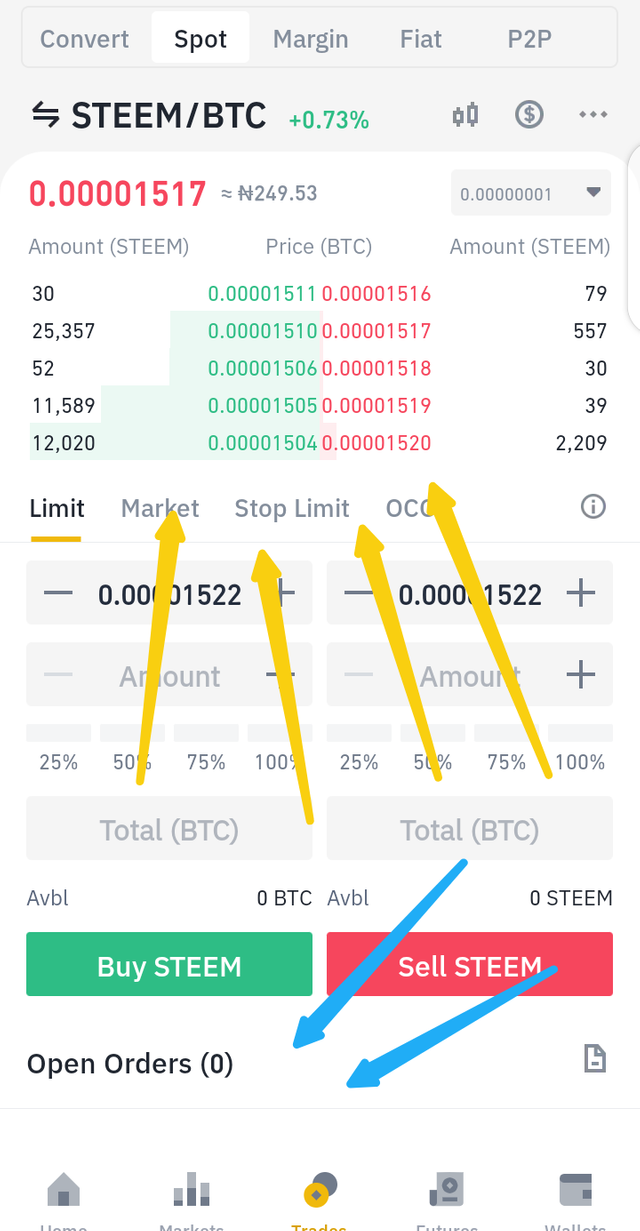

In this market place,you can click the buy or click the sell button and you'll be redirected to page where to place an order and in that page , you'll see the order book.

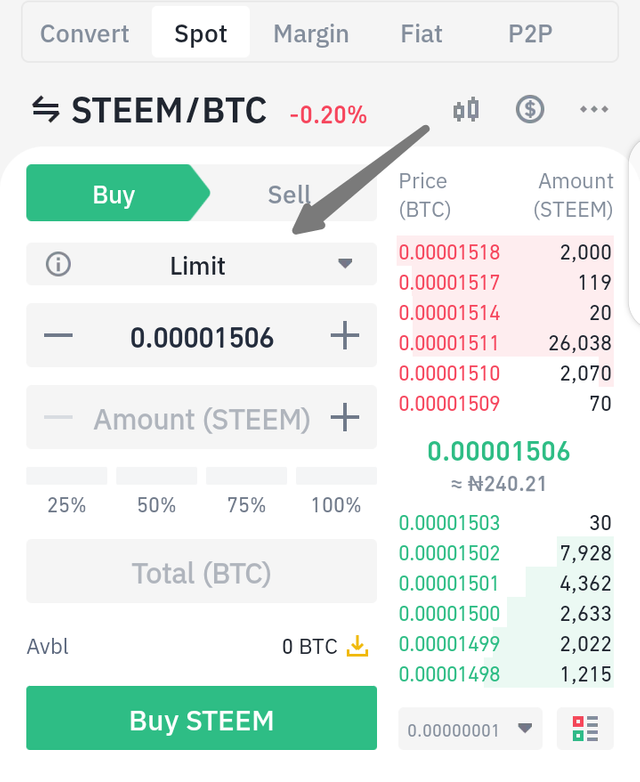

In the screenshot above, I'll used the yellow arrows to point to the order book .If you make an order, it'll reflect on the order book (blue arrow).I have no current orders in place so it's currently 0.

In an order book,you can set a buy price or sell price for your assets, you can also see current worth of the asset but you can change the price to the one which suits you but know your order won't go through until it hits that price you set.

I will explain with an example.If I want to buy steem at the moment and I'm in haste,from the screenshot the current price of 1 steem is 0.00001517 BTC but since I'm in haste I can buy at 0.00001518 BTC since that's more than worth the asset worth at the moment. If I'm not in haste and I have studied the graph seeing that the price would go down,I can place an order for lower e.g 0.00001500 BTC. In this case,the trade will reflect in your order book and if steem price drops to that ,it'll buy. On the other hand,if I want to sell steem at the current price or lower than the current price,it will sell instantly but if I want to cash in at an higher amount,I can set my sell price to maybe 0.00001535 btc per steem and if the asset rises to that value, it'll sell.

Now , I'll explain the following terms;

PAIRS;

In a crypto exchange market, trading is done in pairs.Pairs are simply one crypto currency against another .That is to get a cryptocurrency,you'll have to give another one.Some common pairs are btc/usdt ,steem/btc ,trx/usdt.

Taking the steem/ btc pair, if I want one steem,I'll need to trade with about 0.00001520 btc for it

SUPPORT AND RESISTANCE

Support is the the lowest limit a crypto asset can drop to.It is also known as double bottom.Most times when an asset has dropped below it's support price,a lot of panic sellers will sell their asset because most times this happens ,it often leads to a bearish run.

Resistance is the highest limit a crypto asset can rise to.It is often called a double top.When an asset has broken resistance,it is often a call to sell and can also sometimes be the start of a bullish run. Most people often sell their assets after resistance has been broken.

I have identified the support and resistance in a btc/usd pair graph.

Support and resistance is a trading strategy that is used by crypto traders. It should be known that this strategy doesn't always work and more research is often required in the crypto market.

LIMIT ORDER

When trading,you can decide a price you can choose to sell or buy an asset and whenever the price you set is met,your order will go through.

Most times traders use this option to attain more gain or to recover little losses in a trade.

This is an example of setting a limit order.As you can see in the right side of the screenshot,the price of one steem against BTC is 0.00001517 but I set my buy price at 0.00001500 so once the price drops to my limit, it'll buy instantly.

MARKET ORDER

Unlike the limit order where you put your own price, in this case,the asset will buy or sell at the current market price.Most exchanges set their default to limit order so sometimes you might have to change it to market order.

See steps below;

Most times when market order is used,it hardly enters the order book as it buys or sells immediately.

3. Explain the important feature of order book with the help of screenshot. In the meantime, a screenshot of your exchange account verified profile should appear.

Some important features of the order book include;

- Buying and selling orders:

This part of the order book shows the buying and selling orders and also gives the price and the amount of crypto that was sold at a given prove.

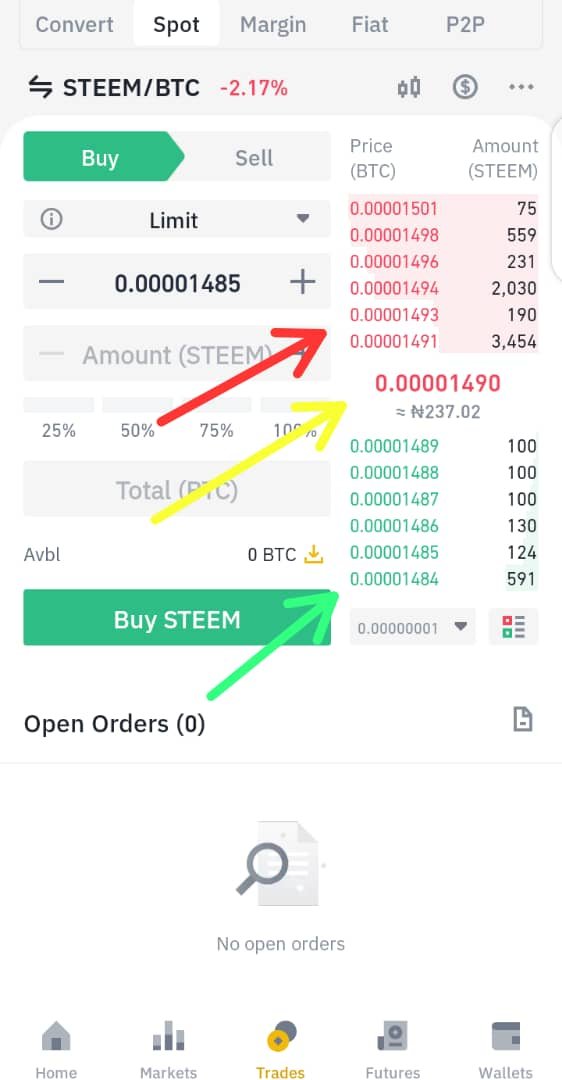

In the screenshot below the red arrow shows the selling orders, you'll see the worth of the asset and the amount that was sold being shown.The green arrow also shows the buying orders,here you'll see the buying prices and the amounts bought .

Market price:

This is the current price of the asset at that time.The market price of an asset is the instantaneous price of an asset.

In the screenshot above,I have identified the current market price with a yellow arrow.Amount:

This is the amount of crypto you want to buy or sell.

- Total:

This is the total amount of crypto you'll pay to buy another crypto or the total amount of crypto you'll get from selling another crypto currency.

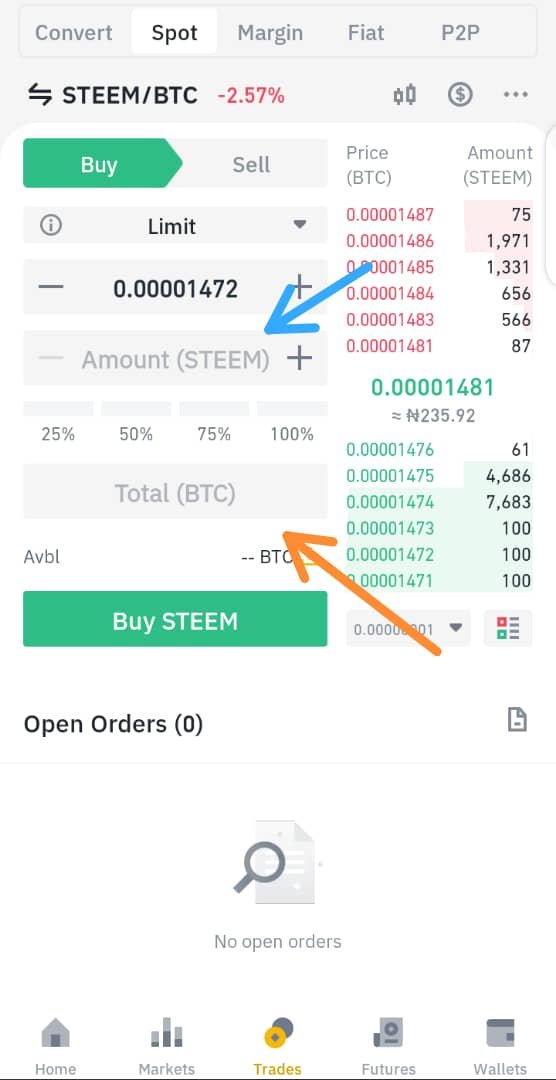

In the steem/btc pair above,I have identified the amount (blue arrow) and the total ( orange arrow)

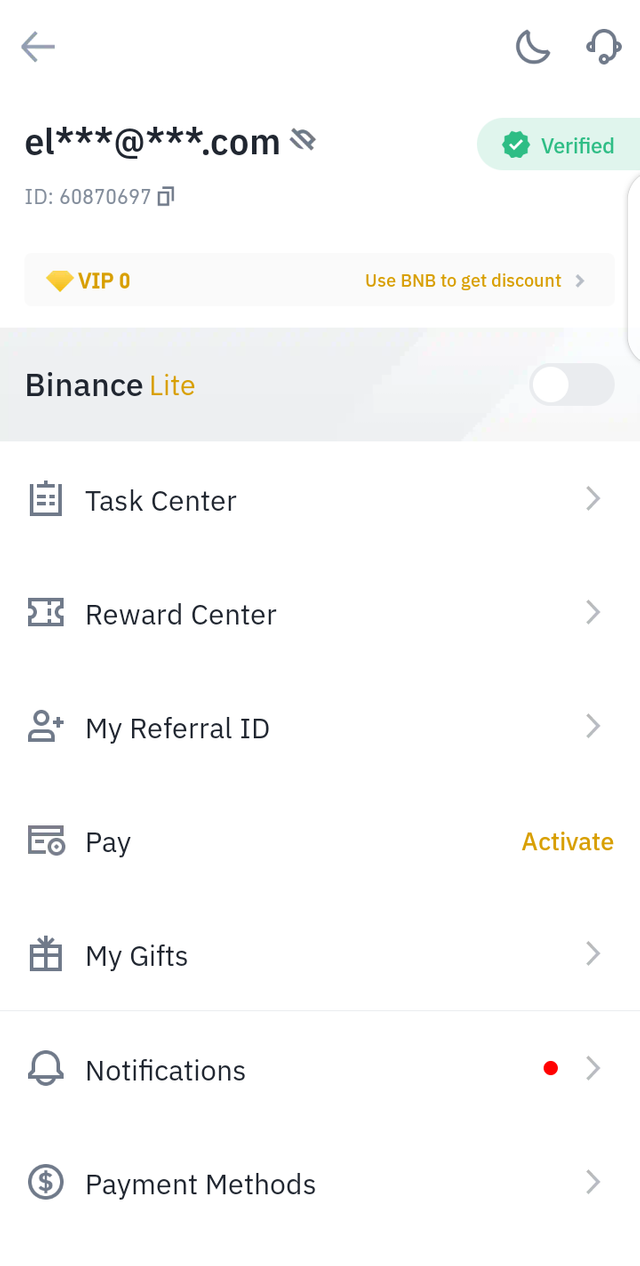

Screenshot of my verified binance account

4. How to place Buy and Sell orders in Stop-limit trade and OCO ,? explain through screenshots with verified exchange account. you can use any verified exchange account.

- Stop limit

Using a stop limit in trade helps a lot and I'd very effective.When you set a stop limit for a crypto,if the price of the assets goes below that price,the crypto will automatically sell.

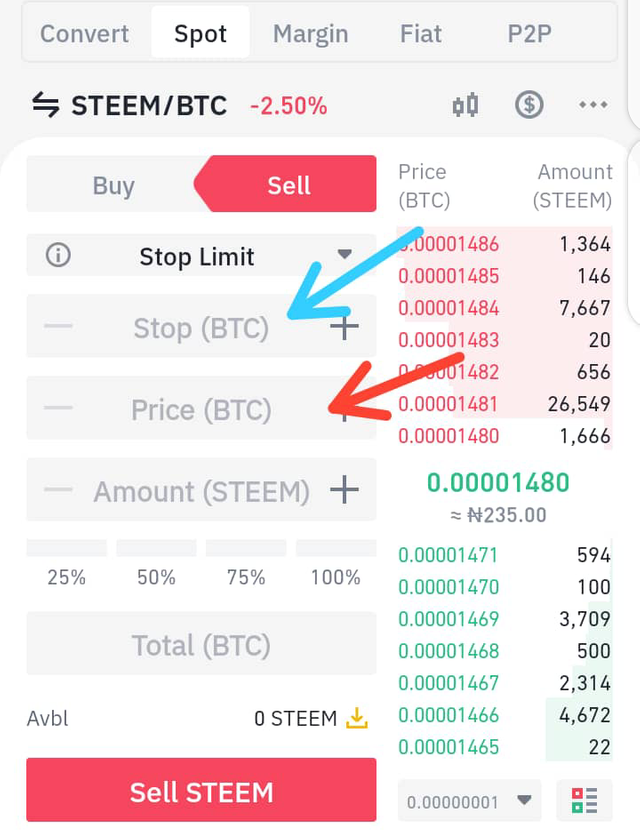

In the picture above ,the blue arrow signifies the stop limit while the red arrow signifies the sell price.This means that if the stop limit has been reached,an order to sell at the sell price is created .

.

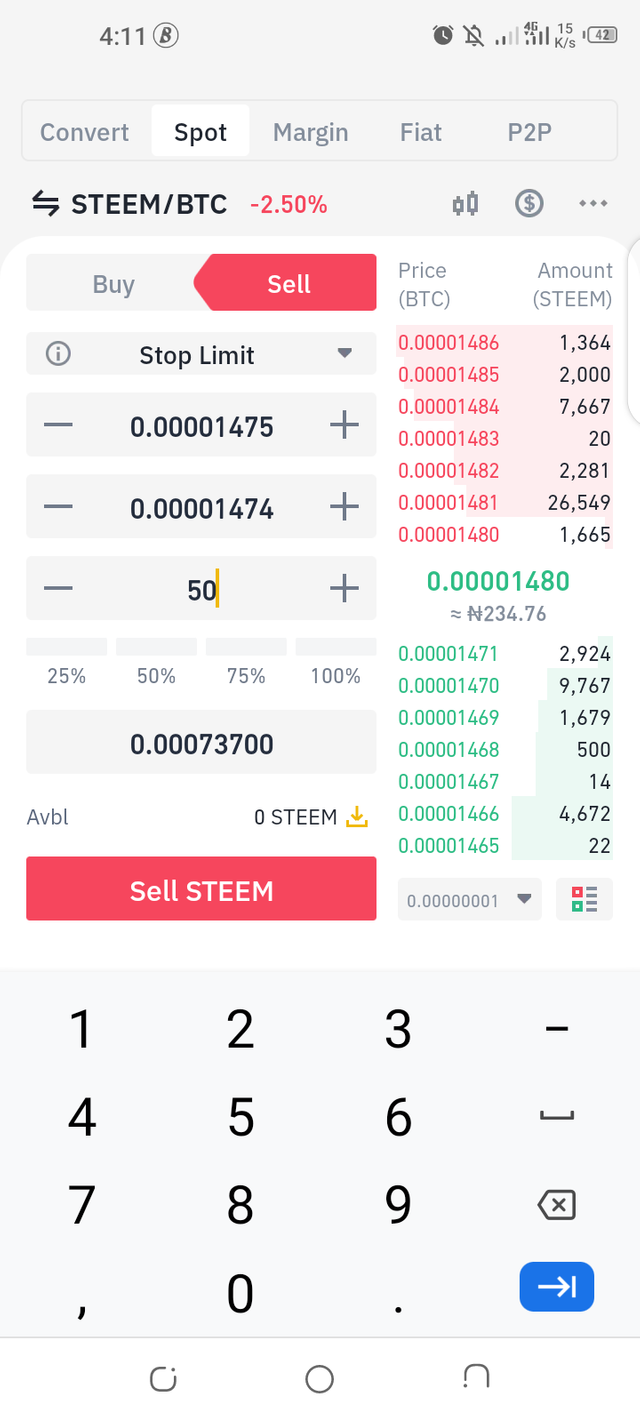

Now ,in the screenshot above ,I made a stop limit of 0.00001475 and the sell price of 0.00001474 .If the price goes below 0.00001475, a sell order will be created for 0.00001474.

This option is very profitable for traders that won't open their accounts for long periods of time.It is advisable to set a stop limit order when you're leaving for a long time.

This can also be done when buying a coin just that in this case when the price hits your stop limit,your coin would be bought at the price you placed.

- OCO

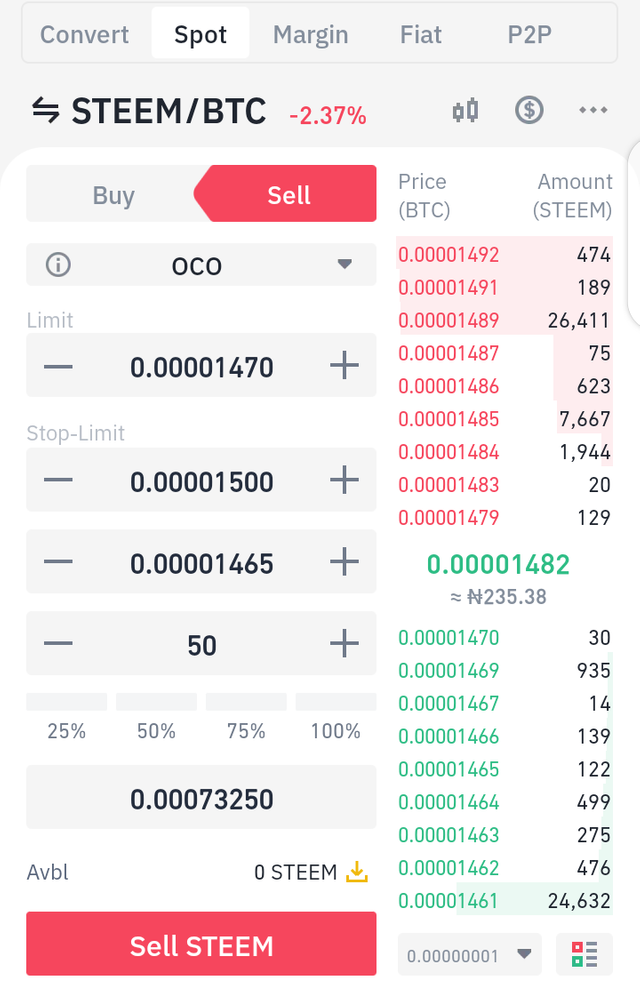

OCO means one cancels the other. When placing an OCO,the stop price should be greater than the market price and the limit order should be lower than the market price.This is done simultaneously, if one order has gone through, the other cancels.

In the screenshot above ,I set my stop limit to be 0.00001500 and my limit at 0.00001470 and my price at 0.00001465. So if my price order goes through,the other order is cancelled.So if my upper limit (0.00001500) is reached the other order of my lower limit is cancelled.

5. How order book help in trading to gain profit and protect from loss?share technical view point, that help to explore the answer.

Due to the information supplied by the order book about the market trend of the pair,the prices at which people are buying and selling the pairs.If you have proper knowledge on how to set prices for the stop limit and the OCO is it really beneficial because if a stop limit is set in certain trades and there's a long dip,you won't be overly affected as the stop limit would have sold your coin at the set price.

Taking the recent market dip if Bitcoin for example.The market dropped by 51% ,if a stop limit had been set at a loss of just about 10% ,the trader won't be affected by the overall dip of the market .

CONCLUSION;

If the order book is properly understood,it would assist in trading .Options like the stop limit for example help prevent losses and also allow traders leave a trade with profit overtime.

Over the course of this lecture I have learnt a lot and I have learnt new things and features like the OCO,I've always seen it but never really understood it.

Thank you professor @yousafharoonkhan for the great lecture.

#yousafharoonkhan-s2week7 #cryptoacademy #nigeria #orderbook #cryptotrading

Thank you for joining The Steemit Crypto Academy Courses and participated in the Homework Task season 2 week 7.

If you look at feature in the order book, you will see a lot of technical and simple advance feature. You have not searched for futures in detail. it is very much important to explore the order book to use the feature that will help you in trade

How an order book can help a trader make a profit ,your answer was very much short , need more detail to explore this question۔

Thank you very much for participating in this class. I hope you have benefited from this class.

Grade : 6.5

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for your review sir

I'll make more research next time

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit