INTRODUCTION:

Hi guys , welcome to my assignment post on lecture given by professor @fendit . Before I start,I want to thank the professor for giving a great lecture on "making your cryptocurrencies work for you". Without further ado, I'll get on with the assignment.

MY AVERSION TO RISK

Ever since I started trading cryptocurrencies,my aversion to risk has mostly been that of a conservative trader meaning I use the "conservative tolerance to risk". Sometimes I often glide into the "moderate tolerance to risk" but not often as I often prefer markets with low volatility.

When I enter a particular trade,I don't plan staying too long,I make my quick profit and leave.If I buy a coin,I have the habit of selling it back within the week.I can attribute this to me being kind of a newbie to the crypto market as I only started trading last year.

Within the few months I've been trading,like I said before I've glided between moderate and conservation aversion to risk so u guess with time I'll move more into the moderate aversion to risk and then when I have capital that I can afford to lose I might trade with the aggressive tolerance.

FIXED & FLEXIBLE SAVINGS, HIGH RISK PRODUCTS,LAUNCH POOLS

FLEXIBLE SAVINGS

In this type of savings, you stake your cryto assets to earn interest from it.In this type of staked savings ,you can pull out your cryptocurrency at any time you want ,that's why it's called flexible savings.There is no staking period!!!

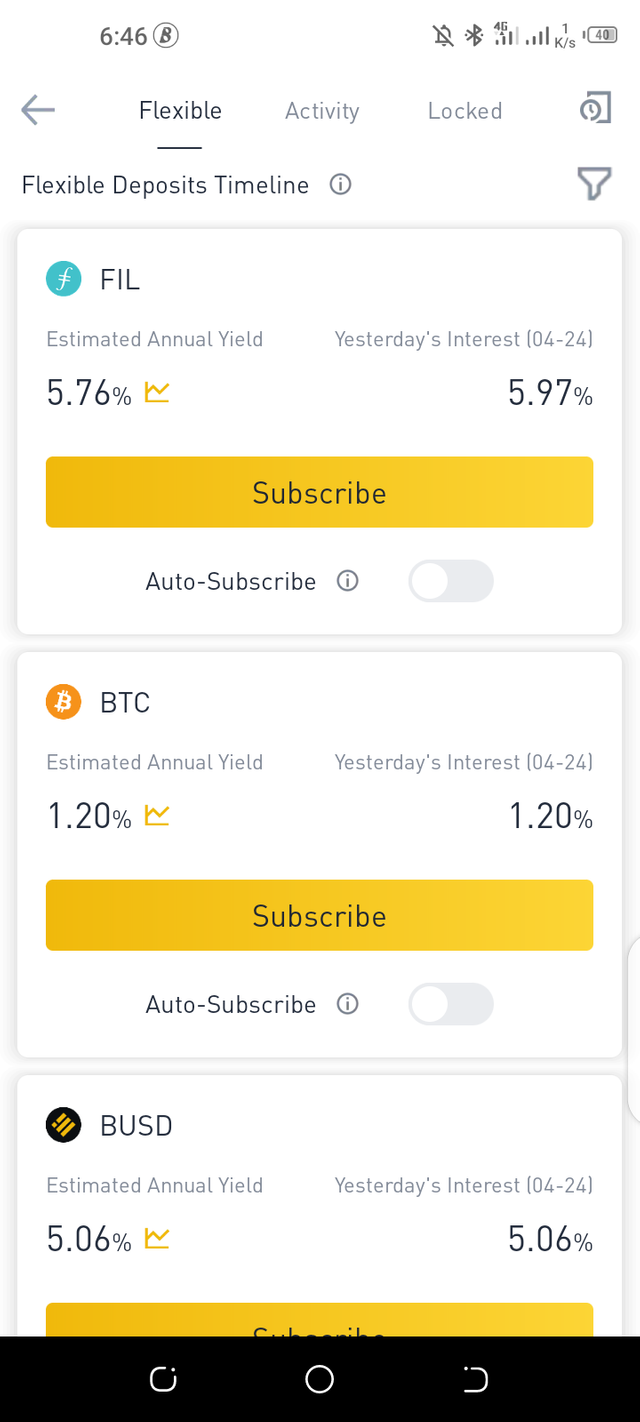

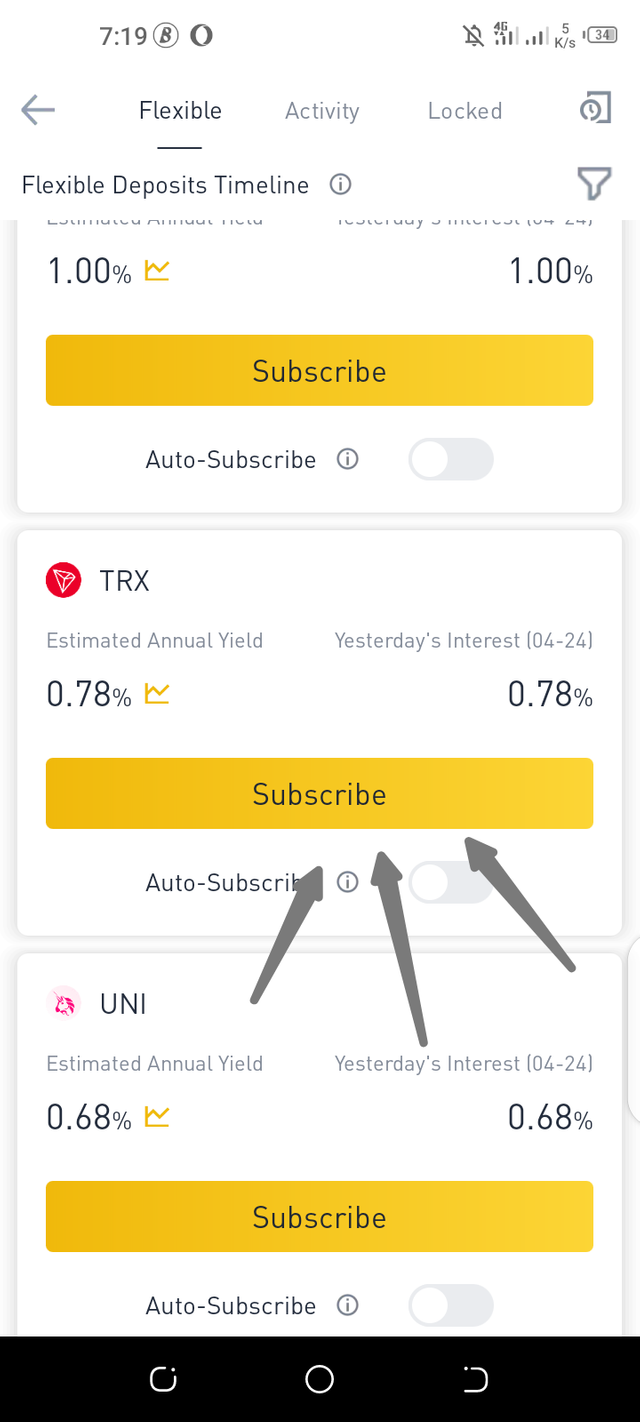

This is a screenshot of how the flexible savings page looks in the binance exchange platform.

FIXED SAVINGS

Unlike flexible savings ,in fixed savings you can't withdraw your staked crypto assets until the end of the staking period.When you're about to stake your crypto assets ,you pick a plan that suits you,it could be 7 days ,14 days,30 days etc.Some people often prefer fixed savings over flexible savings as the percentage interest in fixed savings are higher than that of flexible savings.

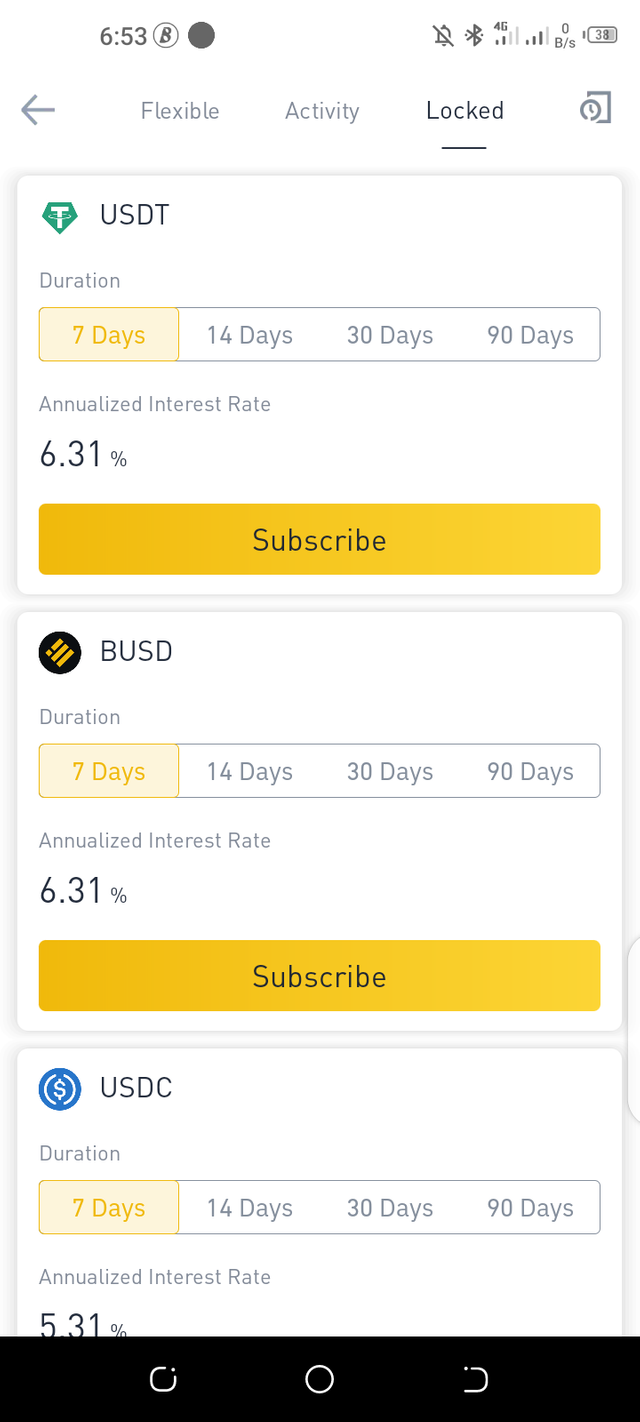

This is a screenshot of the fixed savings page in the binance exchange platform.You can clearly see the different staking periods you can choose from .

HIGH RISK PRODUCTS

These type of cryptocurrencies are best suited for traders with aggressive risk tolerance.The markets of these cryptocurrencies are very volatile and can either yield great profits or great losses.I don't invest in high risk products because I am a conservative trader.

LAUNCHPOOLS

When a new cryptocurrency is about to be listed on an exchange platform,the exchange uses a launchpool to create awareness about the crypto currency.

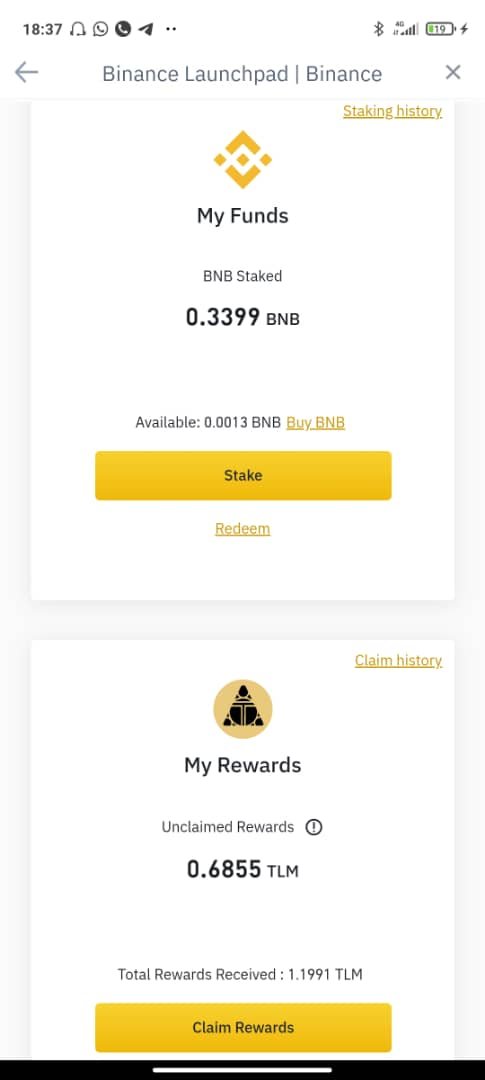

In a launch pool ,you are able to stake your assets to mine the new cryto currency about to be listed.I shall site an example on this launchpool; Earlier this month,the binance exchange platform campaigned for the launching of the alien worlds token TLM on its exchange.They allowed users to stake BNB to mine this TLM.

As you can see in the screenshot above,staked BNB was used to mine TLM.

HOW TO INVEST YOUR CRYPTO ASSETS USING THE FLEXIBLE SAVINGS

Staking your crypto assets is really easy on binance exchange.I shall explain how to stake your crypto with a couple of screenshots below:-

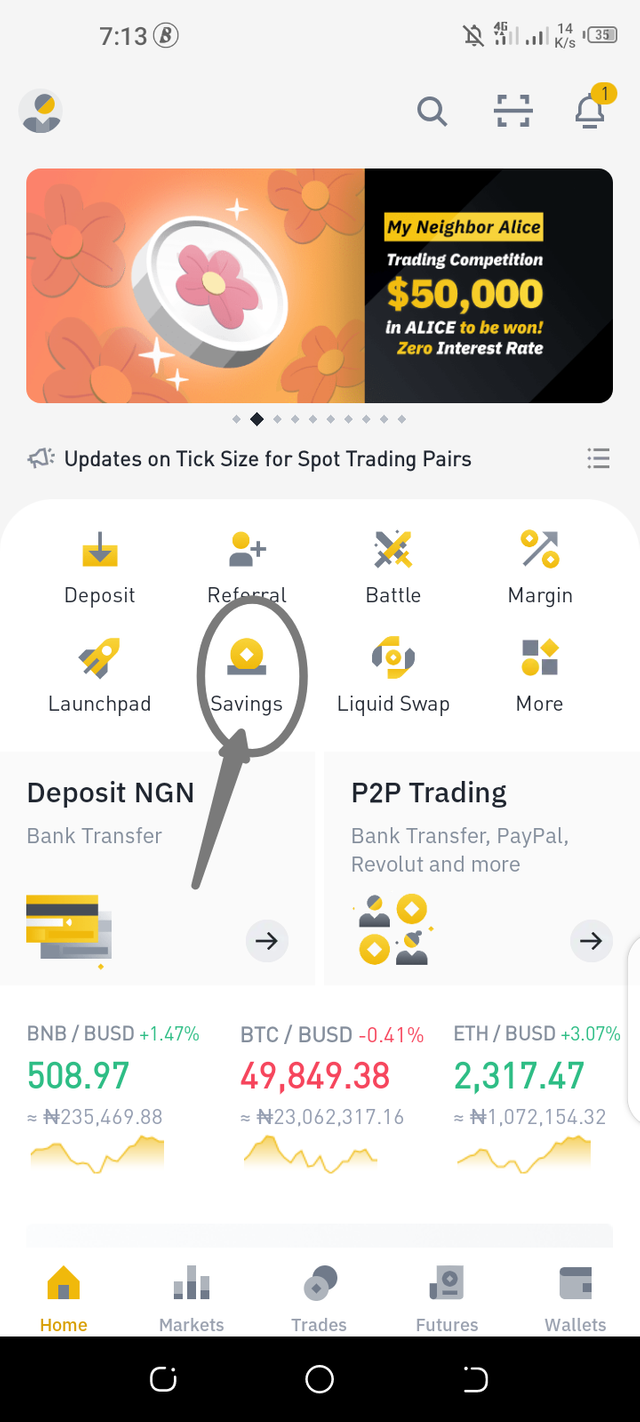

On the binance homepage ,you'll see a "savings" tab.(follow the arrow)

Click on it and you'll be led to a new page.

On this new page, you'll see different crypto currencies.Here ,you'll pick a crypto of your choice and then proceed to stake it.This is done by clicking on the subscribe tab.

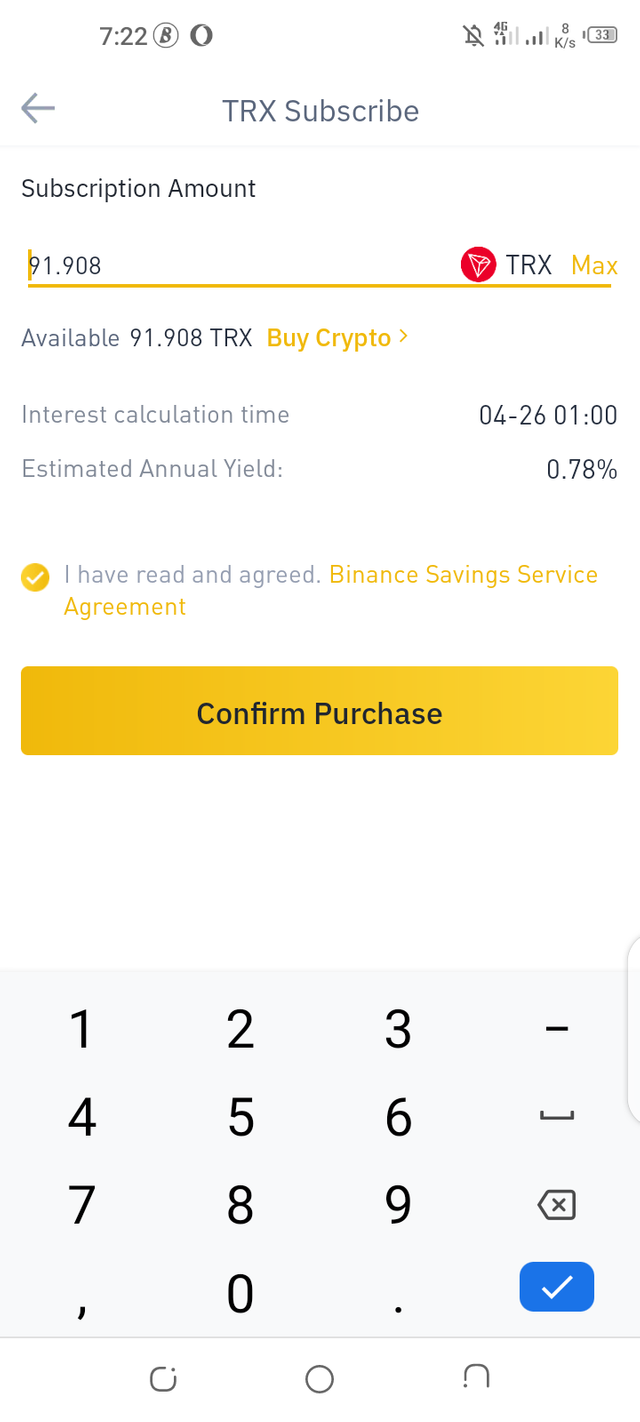

Here,I'll be staking my tron.Click on the subscribe tab and you'll be moved to a new page where you'll enter the amount of cryto you want to stake.

Proceed to read the terms and conditions before agreeing then you can move forward to stake your crypto.

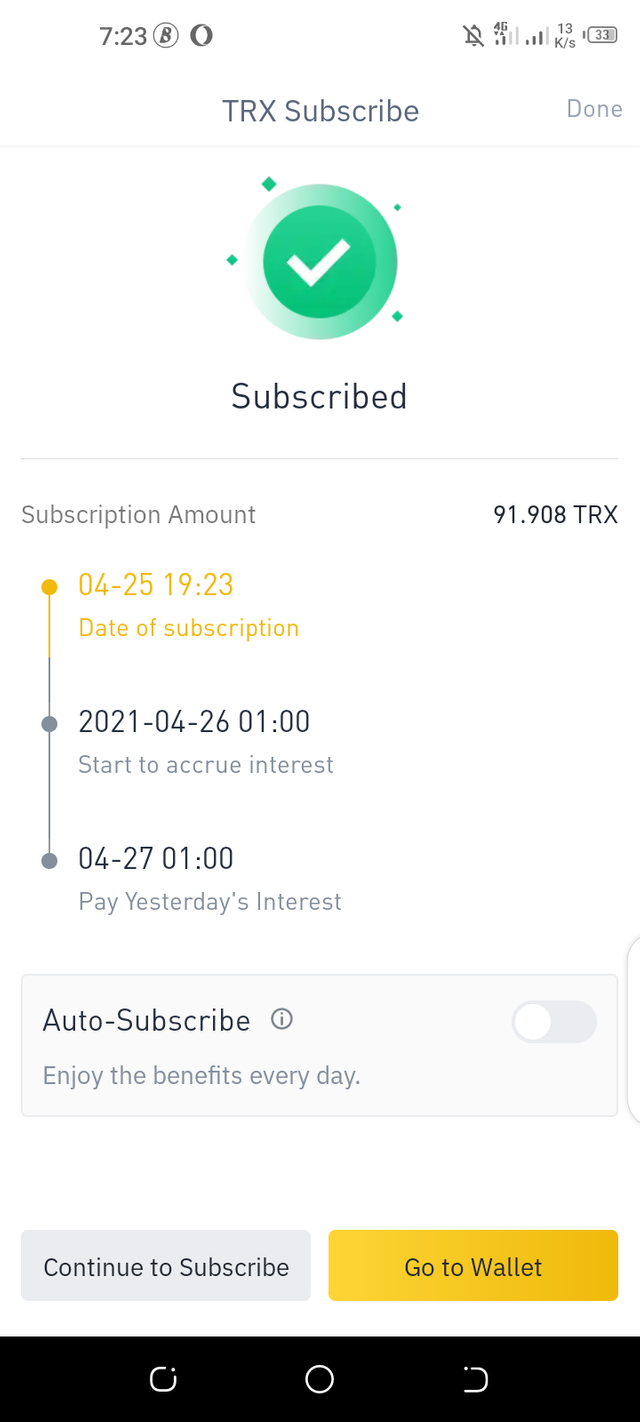

After subscribing/staking, you'll be moved to a page that shows you when you staked,when you'll start to accumulate interest and when your first interest would be able to be claimed.

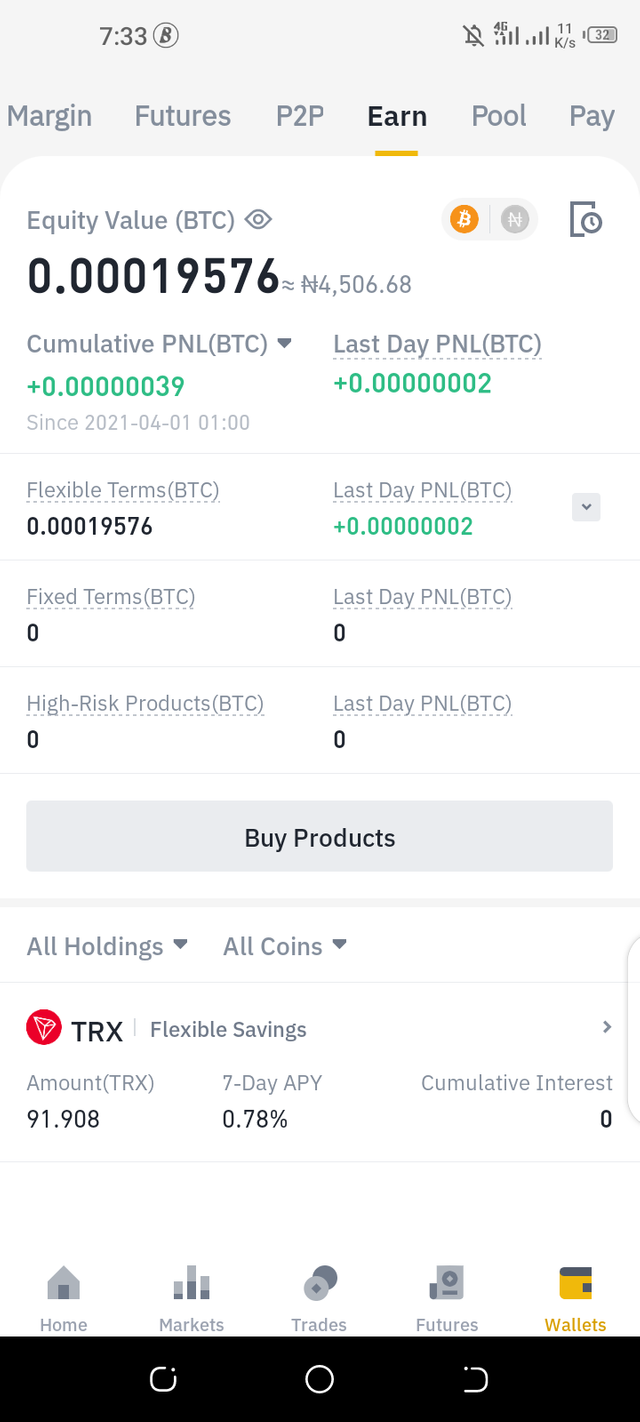

From this page ,you can go to your wallet directly to see more information about your staked assets.

That's all on how to stake your assets.

CONCLUSION;

I feel it's best to leave your crypto assets in savings especially flexible savings as you can pull out anytime you want and you also get interest for staking them.

Thank you for reading my assignment post and I also want to say thank you professor @fendit for this assignment.

CC: @fendit

CC: @steemalive

#fendit-s2week2 #cryptoacademy #staking #nigeria #steemexclusive

Thank you for being part of my lecture and completing the task!

My comments:

All tasks have been a bit too vague and I believe you could have done better at defining every product.

Also, focus on applying markdowns next time, as that helps a lot on overall score.

Overall score:

4/10

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit