Properly explain the Bid-Ask Spread.

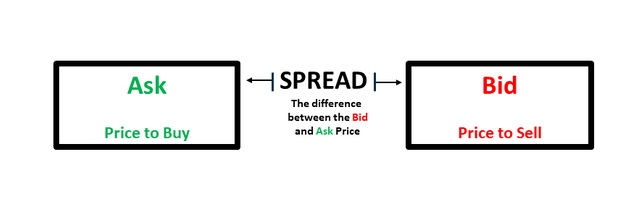

The market is basically about buying and selling. For one to understand the operation of the market, they ought to have some level of insight on the relationship between the Bid and the Ask price.

The Bid price represents the demand. It is the highest, value point or most suitable amount a buyer is willing to pay for an asset or commodity.

The Ask price represents the supply. It is the lowest, value point, or the most suitable amount the seller is willing to sell an asset or commodity.

What then is the Bid-ASk spread?

The Bid-Ask spread is simply the difference between the Bid and the Ask price: It is the amount by which the asking price exceeds the bid price for an asset in the market.

Ideally, when a buyer and a seller decide to take on a trade, having agreed to the prices being offered by both parties, a trade takes place. These prices are the result of the interplay between the market forces of demand and supply, and the gap between these two forces defines the spread between buy-sell prices. The larger the gap, the greater the spread. When the market is highly liquid, spread values can be very small, but when the market is less liquid, they can be large. Bid-Ask Spread can be expressed in absolute as well as percentage terms.

Bid-Ask Spread is typically the difference between the ask (offer/sell) price and bid (purchase/buy) price of a security. Ask price is the value point at which the seller is ready to sell and bid price is the point at which a buyer is ready to buy. When the two value points match in a marketplace, i.e. when a buyer and a seller agree to the prices being offered by each other, a trade takes place. These prices are determined by two market forces -- demand and supply, and the gap between these two forces defines the spread between buy-sell prices. The larger the gap, the greater the spread! Bid-Ask Spread can be expressed in absolute as well as percentage terms. When the market is highly liquid, spread values can be very small, but when the market is illiquid or less liquid, they can be large.

Description: Calculation of Bid-Ask Spread:

Bid-Ask Spread (absolute) = Ask/Offer Price – Bid/Buy Price Bid-Ask Spread (%) = ((Ask/Offer Price- Bid/Buy Price) – Ask/Offer Price)*100

Why is the Bid-Ask Spread important in a market?

Bid-Ask spread is a major indicator of a market's liquidity. This is true because it reflects the relationship between the demand and supply of a particular market. When a market's demand(buyers) and supply(suppliers) is continuously and simultaneously driving towards equilibrium, the Bid-Ask spread narrows - indicating to traders that the market is a high volume market; This is referred to as a liquid market. And where there is continuous and simultaneous uneven interaction or lack of friction between demand and supply in a market, the Bid-Ask spread widens, indicating that it is a low volume market; This is regarded as an Illiquid or less liquid market. The higher the volume of the market (demand and corresponding supply) the lower the discrepancy in price and the lower the volume of the market(demand and corresponding supply) the higher the price discrepancy. Some markets have a more narrow Bid-Ask spread such as currencies because it is a popularly traded market as opposed to a less traded market like futures-market, where the Bid-Ask spread is wider.

Liquidity is an essential concept in the world of financial or exchange markets. liquidity is not dependent on the activities of traders alone but the market makers - primary providers of liquidity. Market makers determine the buy and sell limit order that is open to a trader in a market, therefore they dictate the spread.

The image above shows the spread between the buyers and sellers on the steem market. The gap between both sides shows it is quite a liquid market

If Crypto X has a bid price of $5 and an ask price of $5.20,

a.) Calculate the Bid-Ask spread.

b.) Calculate the Bid-Ask spread in percentage.

Solution

a) To calculate the absolute spread, we use the formula:

Bid-Ask Spread = Ask price - Bid price

Let Ax=Ask price

Let Bx=Bid price

Ax-Bx = spread

$5.20 - $5 = $0.2.

Hence the absolute spread for crypto X is $0.2.

b) To calculate the percentage spread, we use the formula:

%Spread = (Spread/Ask price) x 100

%spread = ($0.2 / $5.20) x 100

= 0.038 x 100

=3.8%.

Hence the percentage spread for crypto X is $3.8.

If Crypto Y has a bid price of $8.40 and an ask price of $8.80,

a.) Calculate the Bid-Ask spread.

b.) Calculate the Bid-Ask spread in percentage

Solution

a) Formula for absolute spread:

Spread = Ask price - Bid price

therefore $8.80 - $8.40

= $0.4.

Crypto Y (absolute) spread = $0.4.

b) %Spread = (Spread/Ask price) x 100

%spread = ($0.4 / $8.80) x 100

= 0.0455 x 100

=4.55%.

Crypto Y (percentage) spread = $4.55%.

- In one statement, which of the assets above has the higher liquidity and why?

Crypto X has higher liquidity than Crypto Y because the spread value of $0.2 is more narrow or lesser than the spread value of $0.4 respectively.

- Explain Slippage.

Slippage is a common occurrence in markets with high volatility or low liquidity. Slippage occurs when the price of a trade implemented is different from the price requested. it can also be said to be a deviation from the initiated price of a trader by some computerized mechanics or the market maker that results in a different outcome in price.

In other words, when you create a market order, an exchange matches your purchase or sale automatically to limit orders on the order book. The order book will match you with the best price, but you will start going further up the order chain if there’s an insufficient volume for your desired price. This process results in the market filling your order at unexpected, different prices.

For example, if a trader place a market order to buy at $220, but the market is short of liquidity to match the initiated price, the trader may have no choice but to take available orders that are above $220 or he may have to set a limit order and risk delay or non-execution of trade. One of the more common ways that slippage occurs is as a result of an abrupt change in the bid/ask spread.

It can also occur when a large order is executed but there isn't enough volume at the chosen price to keep up the current bid/ask spread. Slippage occurs in all market venues, including equities, bonds, currencies, and futures. It can be either positive or negative.

Thanks to smart contract models, which have found a way of curbing slippage in the crypto, financial and decentralized markets by supplying liquidity pools that traders can trade against.

Positive Slippage

Slippage is not always an unfavorable occurrence: It sure has its positive tweaks that can be positive to the trader. When a trader initiates a market bid order and it executes at a lower price, slippage is said to be favorable. Also, when a trader initiates a market sell order and it executes at a higher price, slippage is yet favorable.

For example, when a trader initiates a market buy order to buy an asset at $50 but it executes at the price, $47.5, slippage is favorable.

On the other way round, when a trader initiates a market sell order to sell an asset at $100 but it executes at the price, $100.56, slippage is said to be positive.

Negative Slippage

Traders are well accustomed to negative slippage than positive slippage. It is the opposite of positive slippage. Negative slippage occurs when a trader initiates a market bid order to buy an asset, and it executes at a higher price, or when a trader initiates a market sell order to sell an asset, and it executes at a lower price.

For example, If Mr. A initiates a market buy order to buy an asset at the price, $173.43, but the trade executes at 174.55, then a negative slippage has occurred because he is buying at a higher price than intended. This is the same case where Mr. A initiates a market sell order to sell an asset at $183.50/$183.53, however, micro-second transactions lift the bid/ask spread to $183.54/$183.57 before the order is filled. The order is then filled at $183.57, incurring $0.04 per asset.

Conclusively, a market order may get executed at a less or more favorable price than originally intended when this happens. With negative slippage, the ask has increased in a long trade or the bid has decreased in a short trade. With positive slippage, the ask has decreased in a long trade or the bid has increased in a short trade. Market participants can protect themselves from slippage by placing limit orders and avoiding market orders.

The Crypto market and other financial markets all have their technicalities. Bid-Ask spread, liquidity, and spillage is some of the technicalities or concepts that a trader should understand to be able to keep up with the market. The crypto market, though vast is a combination of simple concepts that build up to a complete roof. The concepts discussed in this article all have some form of relationship with each other, thus comprehension of these parts is necessary for the comprehension of the whole. I can say I learned a whole lot from this course, but sadly, I discovered that I am not eligible to write this course when I was already done. I accept my fate. Funny, it is frustrating though.

Thank you all.

Hello @elvis101,

Thank you for taking interest in this class.

Unfortunately, you do not have the minimum required reputation to participate in this class. The rep is 55.

If you have not, you can complete the Ten Introductory Courses.

Thanks again as we anticipate your participation in the future.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It's all good, thanks.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit