Source: pixabay.com Modified by@emimoron

Source: pixabay.com Modified by @emimoron

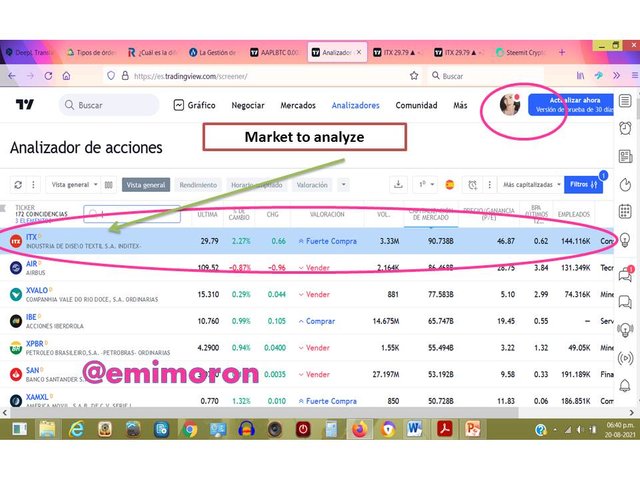

The terms that we are going to define correspond to the trading orders that can be generated, these are given by the client to the broker to buy or sell a financial instrument, the result of the action is translated into the transaction of buying and selling. The price of the share will always be determined by the type of transaction according to the clauses of the order, usually the purchase is made at Ask price or what is equal to the lowest price and the sale is executed at Bid, i.e. the highest price that the buyer is willing to pay.

Source: pixabay.com Modified by @emimoron

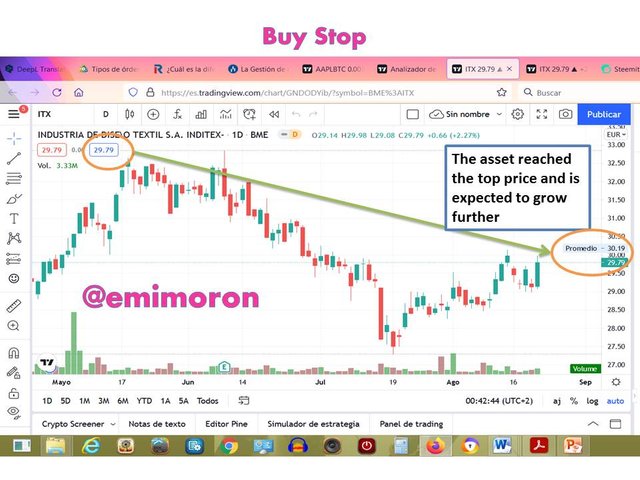

This is an order that executes the purchase of an asset when it has reached a higher price than it currently has, in this case the purchase is executed at the "ASK" price equal or higher as indicated in the order. It is assumed that the price value is lower than the value established in the order, usually these orders are placed on hold until the price of the symbol reaches a certain level and continues to grow. Sell stop: This commercial order is executed to sell at the "BID" price which is equal to or lower than the one indicated in the order. This is contrary to the buy sptop, because the price is much lower than the one indicated in the order. Orders of this type are also placed on hold until the price of the asset reaches a level and begins its decline. This is an indicator of a strong downtrend.

Source: pixabay.com

This is a trade order to buy an asset at "Ask" price value when it is equal to or lower than the one indicated in the order, i.e. a buy limit is set and as soon as the price touches that limit the order is executed. In the case of these orders the price level is higher, again they are orders that are placed waiting for the price of the asset symbol to reach a certain level and begin to grow.

Source: pixabay.com Modified by @emimoron

This is a trade to sell at a bid price equal to or higher than the price indicated in the order. This is used when there is an assumption that once the asset has reached a high average value it will begin to decline.

Source: pixabay.com Modified by @emimoron

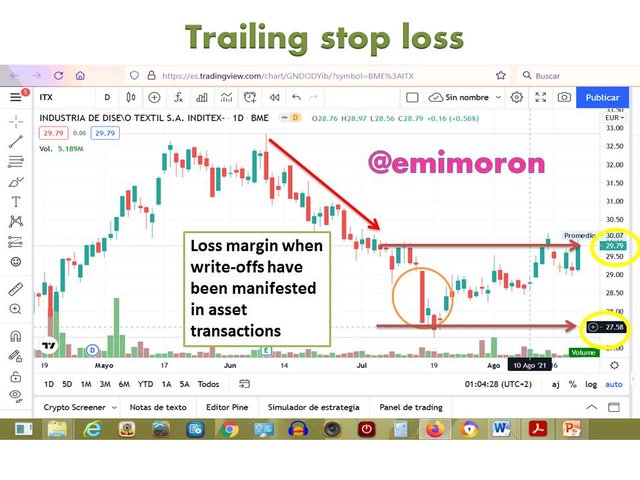

This is an order that indicates a trading loss limit. In this case it indicates a protection to the too fast oscillations, generally in the markets this Trailing stop loss is established for all the assets, however in the same way there is a margin of loss when the downward tendencies have been manifested in the transactions. Its importance lies in the protection of the client's investment because its purpose is to maximize profits and minimize losses.

Source: pixabay.com

This margin call is the name given to the action taken by the broker when he tells the investor to allocate more money to the open positions in the market because he considers them a very good option, this call can only be carried out in markets that accept leverage, because it is a technique by which the operator uses a mechanism to inject more capital to an investment, usually this mechanism is a debt for the realization of a loan. This concept appears when the free margin, which is the money that the investor has in his account, is below the minimum margin that the broker tells him to place for that option to remain open, to make this transaction the investor must close other positions and withdraw money from other investments to inject more money to the option that the broker tells him to keep open. This is very common in the equity markets.

Source: pixabay.com Modified by @emimoron

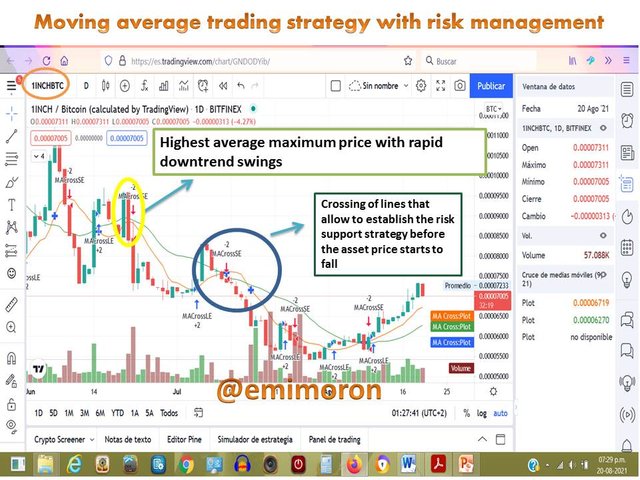

Regarding risk management in trading, this is constituted as the different strategies that the trader uses to know and minimize the risks that can be generated in the operations he performs according to the market and the asset with which he works. The greater the risk control the trader will have more flexibility when performing operations. As far as risk management is concerned, the following principles should be considered:

-Limit the lot size of the operations to establish loss control.

-Establish the hours of the day in which you will be performing the operations.

-Identify where losses and gains can occur.

-Apply hedging strategies where possible.

Design by @emimoron

Source: pixabay.com Modified by @emimoron

1INCH BTC was analyzed in which it was observed that in the month of July presented a higher and lower price limit with which the cryptoasset began its decline in rapid oscillations that caused several points of losses from 00009500 to 0000600 this in turn caused a support action to be performed which is The oscillation at its lowest point led to 0000550 but then began to recover the value of the asset during the month of August to exceed the average of its value that was at the time of the task at 00006998 achieving a price above 00007000. Through the crossing of mobile measures it is possible to analyze the oscillations of the average of the value of the asset and to be able to establish in function of the rapidity that these oscillations occur a limit of loss, remembering that there are always risks in any transaction the ideal is to minimize it through the suitable analysis of the market.

Source: pixabay.com Modified by @emimoron

In the work of trading should not always use automated options to establish investment movements or predict market actions with respect to an asset, it is also desirable to analyze the markets with different analytical techniques.

The importance of risk management in trading is that learning to minimize risk makes the difference between success and failure in trading. Generally the quick death of a trader in the market occurs because of excessive losses caused by bad decisions made in operations. An excellent trader in addition to having a good strategy to make money must manage strategies to minimize the risks of their decisions in operations and these are obtained through the analysis of the risks in the study of the market.

By limiting the risks, the trader assures his operations and his permanence in the market, a good risk management allows him to assume the possible losses in a smaller margin and to take advantage of the opportunities when they appear.

Hi

Thanks for participating in the Steemit Crypto Academy

Feedback

You missed out on the very important aspect involved in Risk management and that is setting the Stop Loss and Take Profit. I expected to see that on the final chart under risk management.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit