Hello everyone, welcome to the crypto academy, on today's task I will be shedding more light on CandleStick Pattern and as well how to analyze its bullish and bearish candlestick.

Homework Question

1a) Explain the Japanese candlestick chart? (Original screenshot required).

b) In your own words, explain why the Japanese Candlestick chart is the most used in the financial market.

c) Describe a bullish and a bearish candle. Also, explain its anatomy. (Original screenshot required)

1a) Explain the Japanese candlestick chart? (Original screenshot required).

Japanese Candlesticks can be referred to as a technical analysis tool that traders use to investigate the price development of an asset on a chart and dissect the value development of an asset, and as well make a trading decision on the movement been depicted on the chart with the help of the Japanese Candlestick. The idea of the Japanese candlestick was created by "Munehisa Homma", a Japanese rice trader. During routine exchanging, "Munehisa Homma" found that the rice market was impacted by the feelings of traders, while as yet recognizing the impact of interest and supply on the cost of rice.

Japanese Candlesticks give more point-by-point and precise data about value developments when compared to other analysis tools like bar charts and others. They give a graphical portrayal of the market buy and sell signals behind each time-frame's value activity.

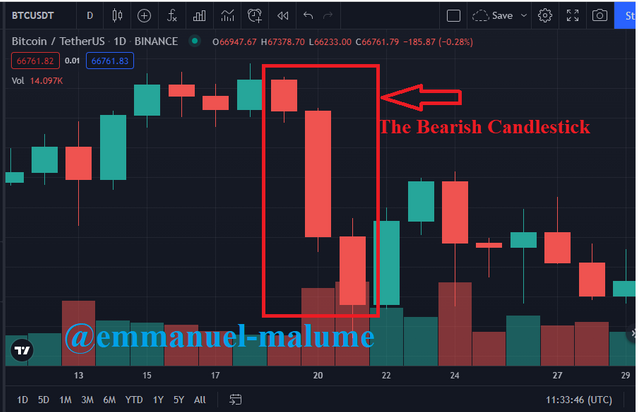

Image showing a chart with the analysis of the Japanese Candlestick

Just as seen from the image shown above from tradingview, the chart was been analyzed with the Japanese candlestick, where the green candle represents the Bullish Candle and likewise the Red Candle represented a bearish candle which I will be analyzing later as the task move on.

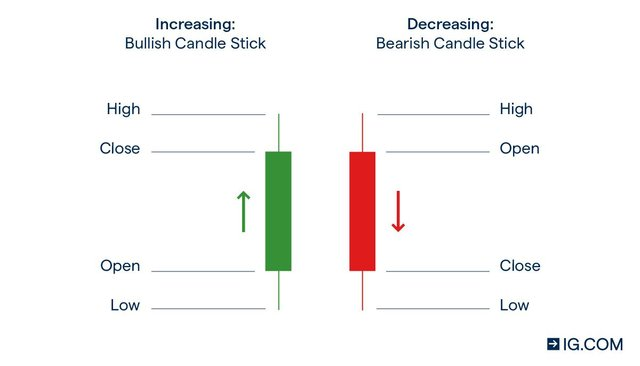

The Japanese candlestick compromises four major points which are High, close, Open, and Low respectively, which this individual point has a major part they took in the candle analyses, which I will be explaining more explanation on them later on.

b) In your own words, explain why the Japanese Candlestick chart is the most used in the financial market.

The whole idea of trading is to make a profit which is not possible without making losses as well, which then brought in the use of Trading analysis tools such as Japanese Candlestick, Bar chart, Doji Stick, and others. But as a beginner's people tend to a candle pattern which will be less easy, straightforward and much easier to work with, and Japanese CandleStick possesses all these aforementioned Features as it portrays a pattern in a way that an ordinary layman can as well understand and as well someone who is just working on trading or someone who just started learning the trade can easily familiarize with the Japanese Candlestick.

The Japanese candlesticks are as well easy to read and it gives first time signal of market movement without any bogus and it's most trustworthy in the crypto trading analyses. The Japanese Candlestick well has been generally acceptable on all trading analysis websites and it's the first technical tool that is always depicted on a trade, this made it much more convenient and comfortable for anyone to work with.

The Japanese candlestick is as well more than enough as a trading indicator due to its pattern of display, and most indicators can be analyzed with the help of the Japanese candlestick which brought it to the general attention of traders and has been widely accepted on all exchanges at large.

Describe a bullish and a bearish candle. Also, explain its anatomy. (Original screenshot required)

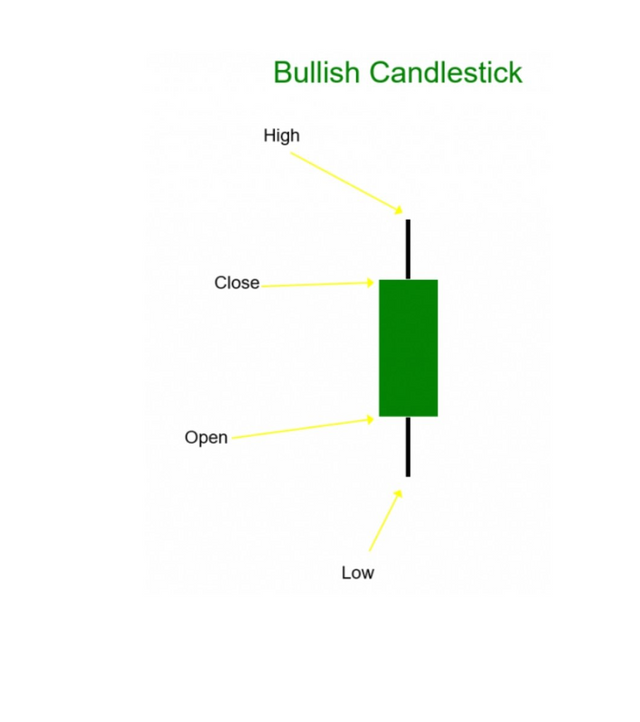

The Bullish Candle and its Anatomy

The Bullish candle is the candlestick found on the trading chart and is widely depicted in green color. The Bullish Candlestick is mostly found when the price of an asset is developing to an uptrend positioning, i.e when the market is showing profit and well traders can decide to buy/sell when the market is in the bullish signal.

The Bullish candlestick comprises of four major anatomy which are High, close , open and low respectively.

The High: This is the maximum point on the candlestick and these is the point where the asset was mostly bought or mostly sold .

The Close: This is the point on the candle where the price movement of an asset finish off the bar before taking another positiioning at that particular time.

The Open: The open point is the point on the candlestick which shows the point at which the market movement of an asset started showing a fortune movement at the particular time.

The Low: The low point is the minimum point on the candlestick and this is the point at which the market was being bought at the lowest price or the lowest price at which the market was being sold.

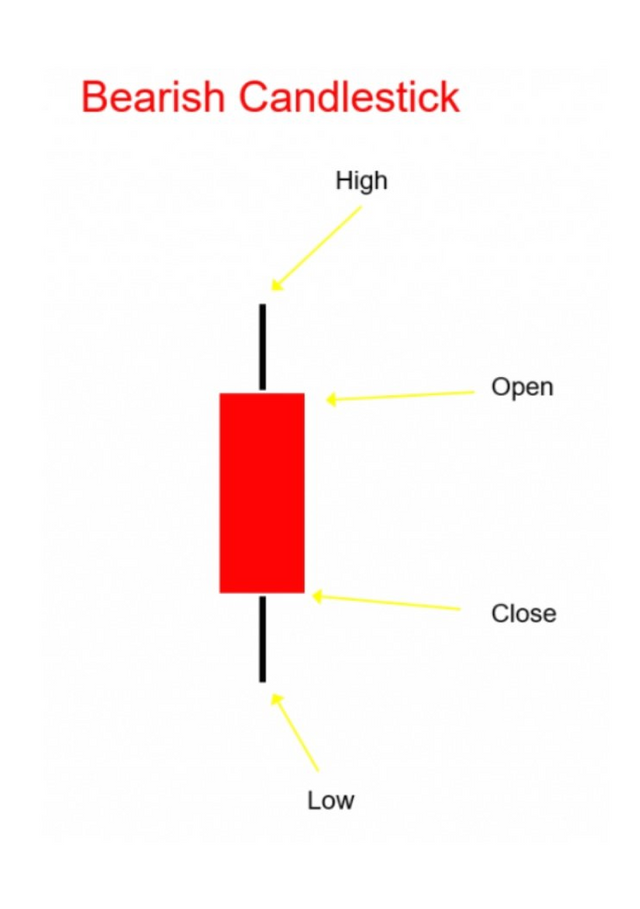

The Bearish Candle and its Anatomy

The Bearish candle is the candlestick found on the trading chart and is widely depicted in Red color. The Bearish Candlestick is mostly found when the price of an asset is downgrading to a downtrend positioning, i.e when the market is showing misfortune and as well traders can decide to buy/sell when the market is in the bearish signal.

The Bearish candlestick also comprises of four major anatomy which are High, open , close and low respectively.

The High: This is the maximum point on the candlestick and these is the point where the asset was mostly bought or mostly sold.

The Open: The open point is the point on the candlestick which shows the point at which the market movement of an asset started showing misfortune movement at the particular time.

The Close: This is the point on the candle where the price movement of an asset finish off the bar before taking another positiioning at that particular time.

- The Low: The low point is the minimum point on the candlestick and this is the point at which the market was being bought at the lowest price or the lowest price at which the market was being sold.

Conclusion

The Japanese candle was an old invention of a trading analysis tool which was widely encouraged on most exchanges, the Japanese candle was an invention of a popular rice farmer named "Munehisa Homma" in the 18th century, The Japanese candle has gained more popularity in the market due to its simplicity and straightforwardness and the candlestick as well is easy to work with as it portrays the current market movement and can be used to analyze and predict the next market movement.

cc:

@dilchamo