Good day all, in this assignment by @allbert we will be talking a lot on fundamental analysis in crypto and how to create good trading portfolios.

1-Select two Crypto, perform fundamental analysis, and based on your fundamental analysis explain why you chose them. Exclude BTC, ETH, RUNE. Develop and justify your answer. Be original.

Fundamental analysis is the use of news events and non-technical tools in investing in a token. There are many criteria for choosing a token based on fundamental analysis.

They include :

• Looking at their white paper: that is the aim, goals, and problem-solving benefits that the token would provide. This would help separate real projects from garbage tokens

• Accountability of Team behind the project; not to insult my dear country Nigeria but Nigerian govt presenting a project to you and Ghana govt presenting the Same project to you. You will defiantly go for the project from the Ghanian govt cause they are more trusted and keep to their words more

• Aspirations of the team and the project: having a trusted and accountable team is okay but for the project what is the long term target, which future projects will come from the token

These three criteria, I listed above, led to me picking two particular tokens. Tatcoin and Siacoin

TATCOIN

A token produced by a Nigerian crypto guru known as bitcoin chief, Gaius chibueze. The token was created in 2017 to solve the problems of the great continent of Africa.

It was created to solve a lot of African problems from the education of the new and to improve the economy of the African continent. The aim is to make tatcoin which is the native token of the Abit network a mode of payment for services around the world.

The problems that tatcoin aimed to solve were :

• Means of payment: the traditional paper money has always had its own problems and tatcoin was created to Remove the problems that traditional money came with

• Owing to properties through abit crowd: the token could be used to co-own properties with people by using it as a means of payment

• Traveling: just like I mentioned that tatcoin is aimed to become a worldwide payment method, one can use the token to pay for his traveling services meaning that you don’t need physical cash to pay for vacations and holdings

• Farming; tatcoin is a token that could be farmed to earn others tokens.

Sc(siacoin)

A coin for decentralized storage. Yes, a token that allows one to access storage from a noncentralized source. The token was created by developers David Vorick and Luke Champine in 2013 when they were students(Vorick has contributed to Bitcoin Core, the main software used by nodes on the Bitcoin network)Sia’s public beta first launched in March 2015, with the live network finally launching to the public in June of that year.

How does the token work

The token is used in the sia network where Renters pay hosts in Siacoin to utilize their hard drive space, and hosts are paid out only after they’ve proven they are storing the file in question.

The problems that the token is aimed at solving storage problems

2.Through your verified Exchange account (screenshot needed), make a real purchase of one of the cryptocurrencies selected in the first assignment and explain the process. The minimum investment must be 5USD (mandatory) and must present screenshots of the verified account and the whole operation.

We will be going through the process of purchasing siacoin from finance. we will first open the finance app. I have a verified account which I will be showing proof too.

1.click on the Binance app

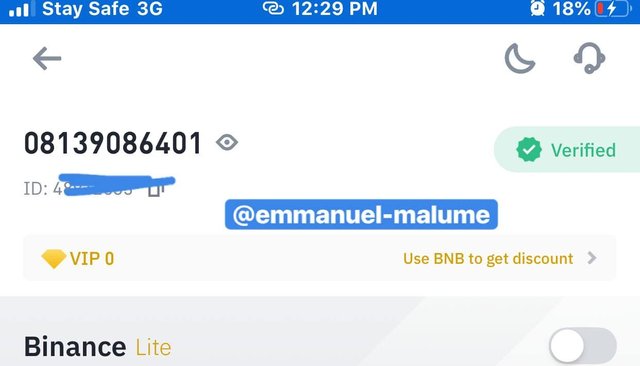

2.We will first show that the account I am about to use is verified.

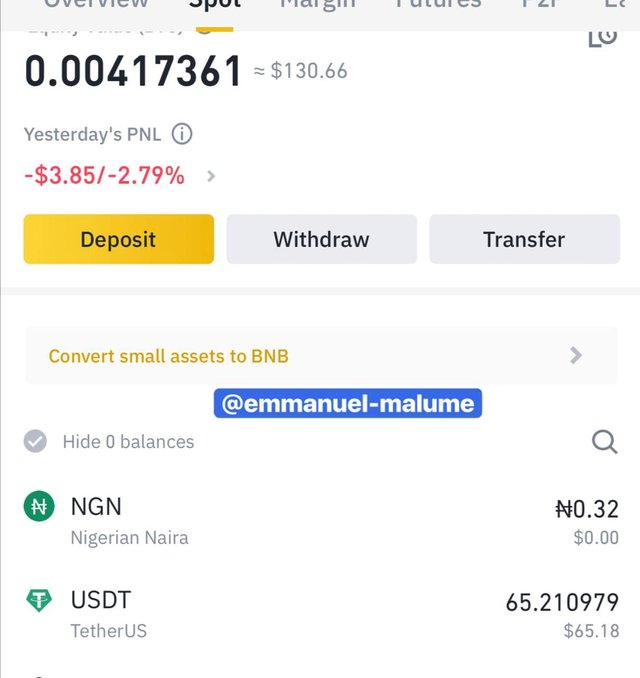

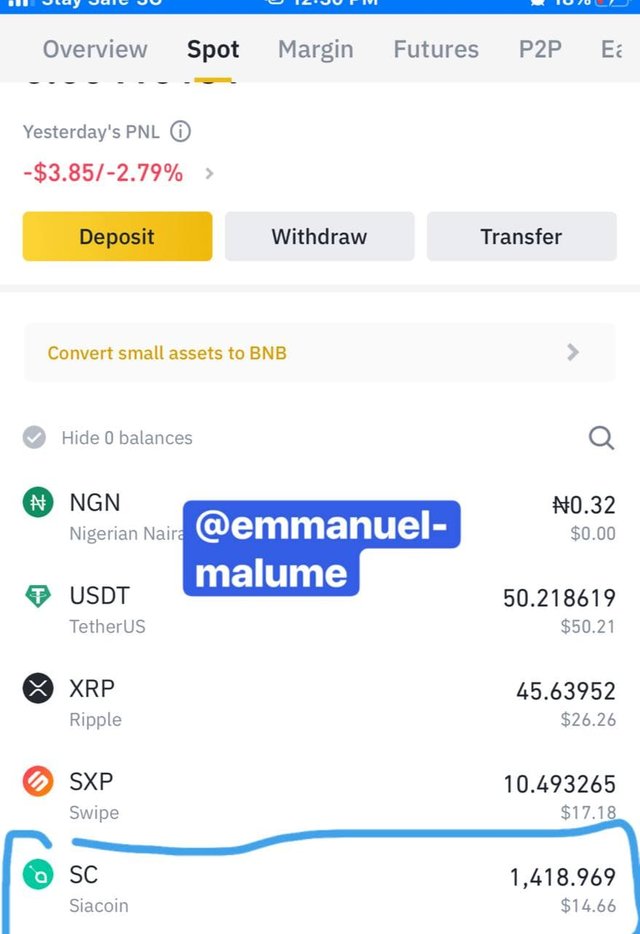

- Then we move to the wallet and I initially had 65$ in my usdt account and I will be buying 15$ worth of siacoin

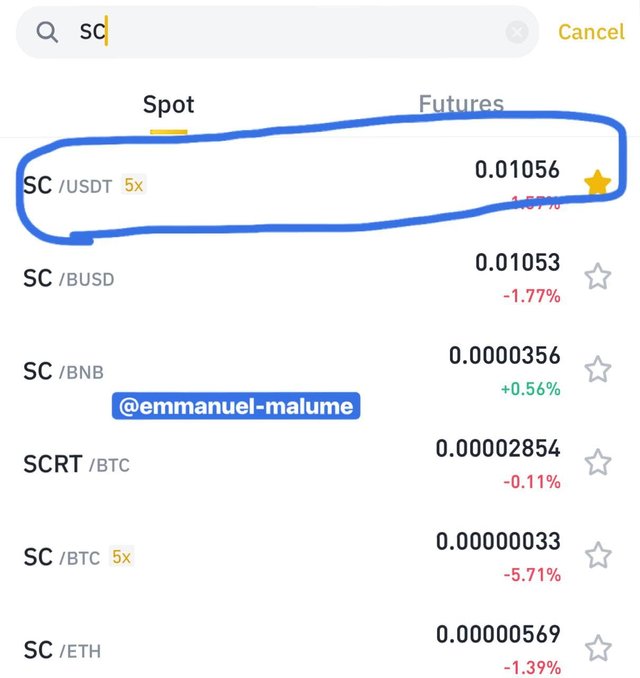

4.Then we move to market and type sc which is the abbreviation for siacoin and click on scusdt since its usdt I have

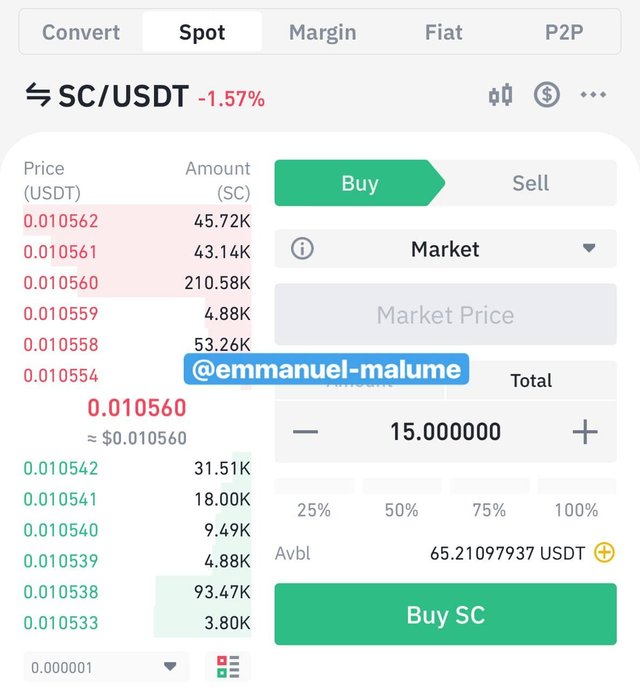

5.Then we are taken to the trading section where have the buy and sell option then we click on buy and from the 65$ we have, I keyed in the 15$ I plan to buy siacoin. The current price of sia coin is at 0.0105 so 15$ worth is about 1418 pieces of the token. After the transaction was confirmed, the token was transferred to my wallet which we can see below

As we can see below, I successfully made purchased the siacoin token

3- Finally, make a simulated exercise, using the DCA method to perform the purchase of two assets and present charts showing the data of days in which the operation was performed, price of purchases, average price, sell point, percentage of profit or loss. (include screenshots)

There are different trading strategies used in crypto trading and one of them is DAC(Dollar-cost averaging) This technique is a technique especially for new traders. From its name we can say is a technique aimed at getting an average of an amount of money. This technique involves spreading one's capital over a long term when investing in a token rather than investing once.

To show off how this trading strategy is used I would use two tokens for the example and I would be using a 1000$ investment for this example. I bought the first amount of the token on 19th June and I will be buying new tokens every 7 days. The final date I bought the last one would be on 13th June

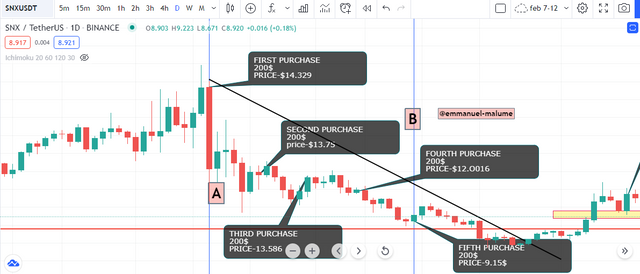

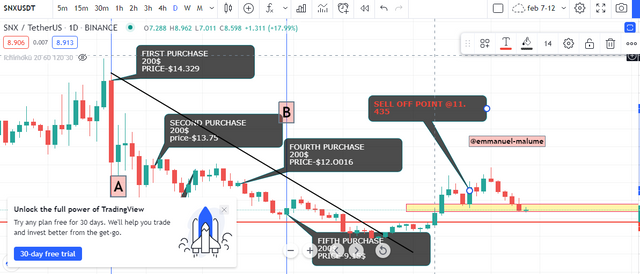

Like I said above, the capital of 1000$ will be spread to buy new snx tokens every 6 days. The first-day gap will be full 6 days after the first buy while next buys would be buying exactly on the th day after previous buy. so the transactions went like this

IMAGE FROM TRADING VIEW

IMAGE FROM TRADING VIEWDetails of each operation:

• First purchase (19/05/2021):

Investment:

$200 Price: $14.329

Amount of Coins: 13.9 tokens

• Second purchase (25/05/2021):

Investment:

$200 Price: $13.75

Amount of Coins: 14.54 tokens

• Third purchase (31/05/2021):

Investment:

$200 Price: $13.586

Amount of Coins: 14.72 tokens

• Fourth purchase (07/06/2021):

Investment:

$200 Price: $12.0016

Amount of Coins: 16.66 tokens

• Fifth purchase (13/06/2021):

Investment:

$200 Price: $9.15

Amount of Coins: 21.86 tokens

TOTAL AMOUNT OF TOKENS OBTAINED :81.68

I ended up with 81.68 snx tokens which had I bought with all my cash once, I would have had 69.78 tokens giving me 11 tokens less at the same price. so this strategy helps one earn more with the same price

Average cost price here is =(9.15+12.0016+13.586+13.75+14.329)/5=62.81/5=12.5

In trading, the aim is to make a profit, so I look for a selling point to incur profit. The market is on a downtrend, so we wait for when the price starts moving up again by breaking out of that downtrend line, and upon the break, we follow the market accordingly. since we are in a very shaky market, it would be ideal to take profit at a point above the first buy after a retracement so our selling-off point would be @11.43$.

IMAGE FROM TRADING VIEW

IMAGE FROM TRADING VIEWSo when we check the number of tokens we have now by multiplying that price with the number of tokens we have which is 81.68 tokens. we end up with 933$ as our balance. we did suffer a loss but this loss is actually negligible compared to the loss had we bought all at once. with 69.78 tokens, even if we sold at this price, we would be having 797.58$ as a balance.

So you see, we suffered only a 7% loss with DCA but had we bought once, the loss would have been about 20.3%. so DCA helps with reducing losses

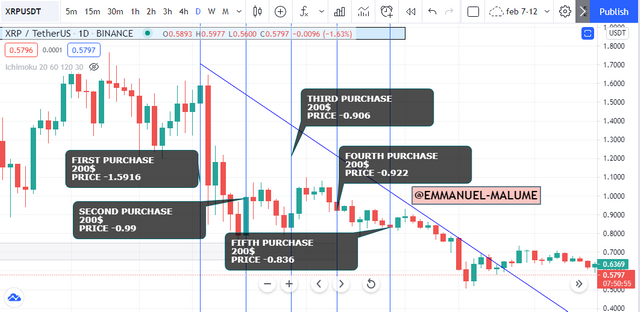

Like in the example above, we are going to be using 1000$ and buying 200$ worth every 7 days. Starting from 18th May to 12th June.

IMAGE FROM TRADING VIEW

IMAGE FROM TRADING VIEWDetails of each operation:

• First purchase (18/05/2021):

Investment:

$200 Price: $1.5916

Amount of Coins:125.65tokens

• Second purchase (24/05/2021):

Investment:

$200 Price: $0.99

Amount of Coins: 202 tokens

• Third purchase (30/05/2021):

Investment:

$200 Price: $0.906

Amount of Coins: 220 tokens

• Fourth purchase (05/06/2021):

Investment:

$200 Price: $0.922

Amount of Coins: 216.91 tokens

• Fifth purchase (12/06/2021):

Investment:

$200 Price: $0.836

Amount of Coins: 239tokens

TOTAL AMOUNT OF TOKENS OBTAINED :1002 PIECES OF XRP

When we compare this amount of token I would have bought if I bought once with all my capital, I would have had 628.29 pieces. A far cry from the 10002 tokens we got from DCA. Here DCA displays another of its features, helps in acquiring more of a token at lower prices

Average cost price we got here =(1.5916+0.99+0.906+0.922+0.836)/5=1.04912

Like I said above, the aim is to leave the trade-in profit or at a minimal loss. The market has been moving down so we find a good point to sell off without more downtrend. so we see as the price is looking to be in a range, we wait for the price to return to the resistance point in the range and exit so we can exit with minimal loss.

But how do we know how much loss we are exiting with?

Our selling point target is 0.709$ at the price we sell our 1002 tokens for (1002 x 0.709)=710$. we suffer a 30% loss but this could have been worse without DCA.

With DCA we would had have 628.29 pieces of the token. When we multiply this with our selling point target, we would be having 445$. Almost 60% loss was suffered.

DCA as a technique makes sure our losses don't exceed 40% and this has been proven right with these examples as we can see.

CONCLUSION

In this class, we learned how to pick tokens to invest in through fundamental analysis and also learned about a very unique strategy known as the dollar cost average. Honestly, this is my first time hearing this. I wish I knew this since. I would not have been in a serious trading loss. THANK YOU FOR THE KNOWLEDGE @allbert

Hello, @emmanuel-malume Thank you for participating in Steemit Crypto Academy season 3 week 3.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit