.png)

Introduction

Hello everyone, how are you all doing?

I welcome you all to this week's crypto academy S6W3 course which is about Crypto Trading Using Trix Indicator, this course was taught by professor @kouba01.

Q1. Discuss in your own words Trix as a trading indicator and how it works

The exponential average (TRIX) can be said to be an impetus indicator that is used mostly by technical traders, the TRIX indicator helps the traders to know when they are oversold or overbought in the markets, it also helps traders to discard any unnecessary price movement, with it traders are able to determine the right moves the price pattern is taken. The technical traders implement TRIX to produce signals that are comparable in quality to the moving average convergence divergence(MACD).

The triple exponential average(TRIX) was developed around the early 80s by Jack Hutson, the idea behind developing TRIX then was so that it can help the technical traders to identify the direction and diversions in the stock trading patterns. The TRIX oscillates around zero, whenever TRIX is used as an oscillator when we have a positive value it indicates that they are overbought in the market, while whenever we have a negative value, it shows that they are oversold in the market. While TRIX can also be used as a momentum indicator, when it shows a positive value it indicates that the momentum is increasing while whenever it shows a negative value, it shows that the momentum is decreasing. Also when the TRIX crosses over the zero line, technical traders believe this indicates a good position to make a buy entry and when it falls below the zero line, then it indicates a sell entry position.

How the Trix Indicator Works

The way the TRIX indicator works is closely related to the way the exponential moving average (EMA) operates. And the exponential moving average (EMA) can be said to be a kind of moving average (MA) that helps technical traders to identify and set a more significant weight on the new data, the EMA react exponentially whenever they are recent change in the market price, with the help of the EMA, the traders were able to draw a dynamic line on the chart while trying to identify the direction the market price is taking. The main purpose of developing the EMA is to redraft the lags that normally appear in simple moving averages (SMA).

With the use of the TRIX indicator, most technical traders were able to make accurate calculations in order to know when the market price is within the range of overbought or the range of oversold in the market, also when the TRIX oscillates above zero, it indicates that the market price is trending along with the bullish signal while when the mark is below zero, it shows that the market price is trending along the bear signal line.

Q2. Calculation of Trix Indicator and it's Configuration

The calculation of the TRIX indicator is almost similar to the way the EMA calculation is done, the reason why it's like that is that the TRIX indicator is comprised of three EMAs which means the summation of three EMAs. We will have the calculation of the EMAs as follows;

EMA1(p)=EMA(p,t,1)

where:

(p)= Current price

t= the time period

EMA1(p)=The value of the exponential moving average

Then we calculate for the second EMA which will give us

EMA2(p)=EMA(EMA1,t,p)

Then we also have for the third EMA to be

EMA3(p)=EMA(EMA2,t,p)

our TRIX calculation will be;

TRIX(p)=EMA3(p)−EMA3(p−1)/EMA3(p−1)

The image below shows the TRIX indicator line after it has been added to the trading chart.

How to Configure its settings

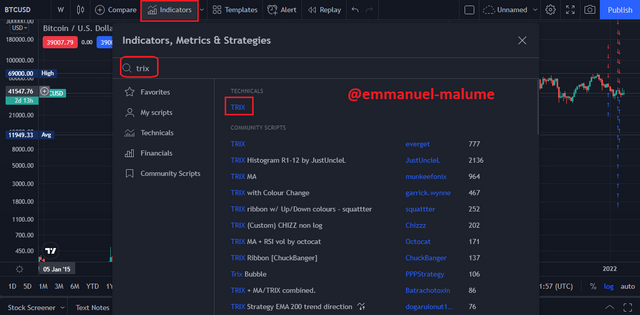

The first step you take when inserting the TRIX indicator into your trading chart if you are making use of the trading view site, you check the top of the site, you will see an icon that shows indicators, when you clicked on that indicator it will show you a space where you can search for any type of indicator you are looking for there when you click on the space, then you search for the name of the indicator you are looking for which will bring it out immediately.

After searching for the indicator, it will bring many similar indicators, all you have to do is to click on the one you want to make use of, in this case, I am searching for TRIX which is the one I clicked on when it pops up.

After clicking on the TRIX indicator, then it will be displayed at the bottom of the chart where the TRIX will be seen as a line that is drawn to showcase the right direction the market price is taking which can be seen from the chart image above.

They are other things we can adjust from the settings, when you clicked on the style side you be able to determine what type of color you want the TRIX indicator to have and in my case, I choose the red color because with that we can see the price pattern which is shown on the TRIX better, after changing the TRIX color you can also change the display of the zero line, in this case, I decided to make use of the dashed line in order to differentiate the zero line from the TRIX line, I also change the color of the zero line to white for a better display, all this can be seen from the chart image below.

Q3. Based on the use of the Trix indicator, how can one predict whether the trend will be bullish or bearish and determine the buy/sell points in the short term and show its limits in the medium and long term?

The idea behind the development of the TRIX indicator is for the technical traders to be able to identify the market trend easily and also for them to be able to pinpoint the right direction the market price will be taking, with that, when the TRIX indicator rises above the zero line, it indicates to the traders that the market price is going to be on the bull side, while when the market price drop below the zero line, it indicates that the market price is on the bear side, with that traders were able to make a better prediction when trading.

I will be showing us some displays on how it works using the ADA/USD market trading chart.

From the chart image above, we can see that before the TRIX indicator line crosses above the zero line, they have been a constant resistance from the market price which makes the price in favors of the sellers before the market has a sudden price reversal which leads to a market fluctuation, then the TRIX indicator starts rising until it rises above the zero line which shows that the market price is going along the bull line, it also indicates the right time for the traders to make their entry which is to buy.

The same thing when we have the Trix indicator trending below the zero line, it also shows that the market price is at the bear signal side, the point where it crosses the zero line going downward, it presents a perfect opportunity for the traders to make their sell entry, the example will be shown on the chart image below.

From the ADA/USD chart above, we can see that for some periods the TRIX indicator is trending above the zero line, after some time the market price meet some resistance from the bull side which causes the market price to fluctuate, and after some time the market meets a reversal in price which causes the market price to fluctuates towards the bear signal side, then the TRIX indicator breakout and move below the zero line which allows the sellers to have a better entry position.

With the help of the TRIX indicator, technical traders were able to filter the movement of price, and with that, they were able to remove the unwanted prices which might cause them to make a wrong assumption when predicting the market price direction.

Limit of TRIX

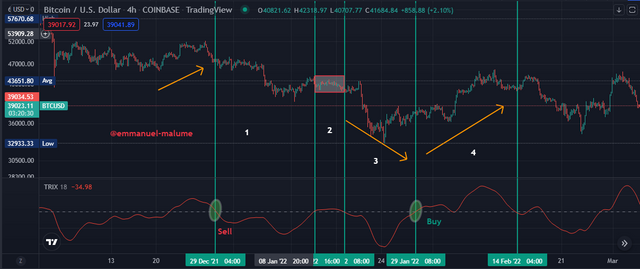

For us to talk about the limitation of the TRIX indicator, then we have to make some little illustration for a better understanding and the chart image below shows little on the limitations of the TRIX indicator.

From the chart image above, we can see that it is divided into different parts, each part shows the movement of the market price pattern. From part 1, we can see that they were a fluctuation in the market price which caused the price not to be stationary, the market price kept on changing from the bull trend to bear trend and at the same time they were a big resistance from the buy signal, after a while, they were a breakout in the price pattern which gives the bear trend an opportunity that allows the TRIX line to fall below the zero line, which also allows the bear traders to be able to have a better sell entry position.

From part 2 we can see that the TRIX indicator shows that the market price is not steady enough to make a better entry and the price kept on fluctuating from bull trend to bear trend which indicates that we tend to have a false signal over there, making a market entry at that moment might turn out to be a loss to the trader, so in such situation, the traders tend t wait till the false signal period passes before determining a good entry point.

After the period of a false signal, part 3 shows a potential short sell entry position where the short time traders will be able to have a good sell entry at that time, while part 4 gives the long period traders a better opportunity to make a buy entry at that period.

With the help of the TRIX indicator, traders were able to filter most of the unnecessary false signals in the market which also helps the traders in making better market predictions.

Q4. Comparing the Trix indicator with the MACD

As I have explained earlier the TRIX indicator is quite similar to the MACD indicator because they both work under the same principle, the little difference that can be noticed between them is that when using the MACD indicator, you will find out that the analysis is a little bit rough and the price movement that is captured is not always precise, compared to the TRIX indicator, where the wave signal it brings is very smooth and detailed, also it helps the traders to filter out any unnecessary signals.

For us to understand the concept of the two indicators, I will be setting up both indicators and by default when setting up the TRIX indicator we will be having the TRIX moving average length be 15 while we have the MA period to be 9, while when setting up the MACD we have our period by default to be (12, 26, 9) which can be seen from the chart image below.

From the above image, we can see that while running the TRIX indicator and the MACD indicator at the same time using the same periods, the TRIX indicator waveform shows to be smooth while the MACD indicator waveform is a little bit rough compared to the TRIX indicator, also the TRIX indicator was able to filter out most of the unnecessary price action compared to the MACD indicator.

Q5. Combination of Trix Zero line Cutoff and Divergences

The combination of the TRIX indicator and the zero line allows the technical traders to be able to make a better price prediction, because, with the help of the zero line, the technical traders were able to determine the right time it is for them to make a market entry and also for them to avoid making any unnecessary loss while trading, with that they were able to recognize when the market price is in favor of the bull side or when it is in favor of the bear side when the TRIX indicator crosses the zero line and moving above the zero line, it indicates that the market price is in favor of the bull side, the same thing when the TRIX indicator line crosses the zero line to move below the zero line, it also shows that the market is in favors of the sellers.

The signal from the TRIX cutoff can also be used because they are also some other analysis tools that also help the trader to determine the right direction the market price will be taking so that they won't be any mistake when making an entry and also for the trader not to fall for the false signal alert, an example of the analysis tools that I am talking about is like having the resistance line drawn, the support line, etc.

From the chart above, we can see that they are divergence in the price pattern because the market price makes lower lows while at the same time we can see that the TRIX indicator line shows an upward movement which indicates that the TRIX line is moving above the zero line which is a bullish sign and also creates a better buying opportunity for the traders.

Q6. Pairing Trix Indicator with another Indicator to filter False signals

Though it is not possible for every trader to have a perfect market prediction, also sometimes depending on one indicator might not be reliable because sometimes the information gotten from the indicator might not be 100% precise so in order not to lose out too much, most traders tend to add more indicators so that they will be able to make a better and more accurate prediction when trading.

I will be making use of the TRIX and Aroon indicators for my market analysis which will be shown in the chart image below.

From the BTC/USD chart image above, we can see that the TRIX indicator, as well as the Aroon indicator, were added in order to make a better analysis before making a market entry, with the help of the two indicators I was able to identify the period when the market price fluctuates which also leads to the price pattern forming a false signal, with the help of the indicators I was able to avoid choosing a wrong position for my buy entry because when observing the TRIX indicator we can see that it indicates a position which shows the market price moving above the zero line while when observing the Aroon indicator, it shows that the market price is yet to reach a saturation point which means the trader has to hold for a while before making an entry, from that we can see some little contradiction between the two indicators, after observing the market price movement for a while we were able to choose a better position for the buy entry.

Also looking at the second point when taking a position for the cell entry, we can see that they were a breakout in the market price which caused the price to fluctuate, and looking at the TRIX indicator where the price fell below the zero line which indicates that the trader can make his sell entry while that position indicates a false signal when observing from the Aroon indicator, this shows that if the trader makes his sell entry at that point then they are the possibility of having a reversal in the market price which will turn to a loss to the trader.

While using the two indicators, it shows that the technical traders will be able to make a better judgment when taking any entry point, it will save them from making any unnecessary loss in the market.

Q7. Pros and Cons of Trix Indicator

In every trading indicator, they are surely an advantage and also a disadvantage to it, in terms of the TRIX indicator the pros and cons will be listed below.

Pros

With the help of The TRIX indicator, technical traders are able to filter out any unnecessary noise which might cause the indicator to be lagging

With the help of the TRIX indicator, traders were able to determine the right position to make an entry either when buying or selling in the market, they were also able to determine the direction the market price will be taken at any period of time.

The TRIX indicator is also displayed with either upward or downward movement, when the TRIX line moves upward, it indicates that the direction of the market price at the period is bullish while when moving towards the downward direction, it indicates that the market price at that period is bearish.

Cons

Sometimes the traders tend to notice that the TRIX indicator lag, at that period the prediction the traders do will be inaccurate because the entry position they take at that time was a false signal.

The TRIX indicator is not an indicator that can be used alone when trading because it lags behind sometimes and in such situation the traders meet a huge loss, so when using the TRIX indicator, traders tend to add other indicators in order to cover for the deficiency

Conclusion

From all the explanations given, it can be seen that the TRIX indicator helps the technical traders a lot in order to make a better prediction and know the right direction the price will be taken in the market, with the help of the TRIX indicator traders were able to filter out any unnecessary noise and also the TRIX indicator has a zero line which helps the trader in knowing which direction the price will be taking when the TRIX indicator line moves below the zero line, it indicates that the price pattern is moving along the bearish line while when the indicator line moves above the zero line, it indicates that the price pattern is moving along the bull trend.