.png)

Hello everyone, it's yet another great week in the steemit crypto academy.

I welcome you all once again to the last week of the fifth season in the crypto academy, which I could say I have had an amazing season so far, today I will be taking a course offered by professor @fredquantum on the topic: dark pools in cryptocurrency.

The Dark Pool in cryptocurrency can be referred to as a different request book that is not apparent to the remainder of the market, in a sense that Every broker just knows their requests where others don't get to know the amount at which others execute the exchange not until the transaction has been done, which this permits brokers to namelessly submit huge trade requests without uncovering their advantage to different merchants.

Dark Pool is an exceptionally imaginative name given to a private financial exchange like banks. They can also be referred to as legitimate private protection commercial centers.

The real motivation behind the Dark Pool in exchanging is to give the financial backers/brokers the capacity to get their orders filled without others knowing the order price at which their market was being filled.

Now, let me run you through A short history of DarkPool: - Dark Pools appeared in the light of the institutional financial backers needing to approach their exchanges secretly without the association of trades. This was so nice since dark pools offer the chance to exchange without taking a chance with their speculation with potentially unfavorable value developments in the business sectors. Besides, every one of the exchanges stays unknown until and except if some legitimate prerequisites need the dealers to share any subtleties.

The Dark pool as well came to fruition as a way for huge scope financial backers to make manage each other exchange that would not bring about an unfavorable value move against them.

Just as we know that to sell a significant piece of crypto assets on a public trade, traders would pronounce their market price at first and run the danger that the worth of the stock will drop on account of the swell in supply. with this, Dark pools eliminate this danger by reporting bargains solely after they have occurred and enclosing admittance to bargains.

So in this sense, these get to put a limit to the rate at which exchange or stock of an asset could fall, as we know that the market price is affected with the sum of demand and supply or a crypto exchange, so with dark pools, users get to fill exchange and execute a transaction without others knowing the value or rate at which it was being bought.

The Dark pool works in the format of Limit Order while other exchanges use the Market Order.

Limit Order: - Limit orders get to be created on the Dark Pool exchange in a sense whereby, traders who wish to trade in the market can choose the amount to execute a trade Buy/Sell, this is done without considering the amount at which others already executed their order, it is executed as a result of the value you tend to create for the order.

Market Order: - Market orders are as well as the normal exchange whereas traders execute based on the current price which might be buying/selling trade, this is a little bit less productive, as these is like making execution at the current market price which might as well go against what the trader is willing to trade or sell at the present amount.

I will be discussing one of the popular exchanges listed as one of the best and as well offers the dark pool features which are the Kraken Exchange.

The Kraken exchange is been known to be an interesting exchange in the crypto trade space. The exchange was founded by Jesse Powell in 2011.

The Kraken exchange is notable for its modest exchange expenses, smooth Interface, and importantly, its security. Kraken's general mission is to do all that they can to advance and push the reception of digital forms of money so we would all be able to profit from its monetarily freeing highlights. which is what comes in the introduction of the dark pool on the Kraken exchange

The Kraken exchange offers A dim pool whereby the request book on the exchange of the market can not be seen. Only Each trader can know the orders they have made. That way, you can put in huge sell or purchase requests namelessly and without presenting their advantage to other people. Typically, when different brokers notice outsized orders, the market starts to move ominously which confuses the most common way of filling your request at a decent cost.

How does its dark pool work?

The Kraken dark pool work in a similar way as mentioned whereby the orders are only created at a limit order unlike other exchange where orders are created at the market price, so the Kraken exchange executes its order keeping the request safe by which other traders don't get to know the amount or cost of an asset that is currently been purchased without putting the fear of doubt or the fear of missing out to others.

[1]What are the supported assets on the dark pool mentioned in (2) above?

The crypto pairs assets supported in the Kraken dark pools are the following listed,

ATOM/USD

ETH/BTC

ETH/USD

ETH/EUR

EUR/GPB

LUNA/USD

BTC/USD

BTC/EUR

BTC/GPB and others

As we can see from the listed pairs, we get to see that BTC, ETH, and USDT that are the main crypto assets on the Kraken Dark Pool and there are as well other coins such as luna, ATOM and others provided its exchange is available.

[2] - What are the requirements for getting involved in dark pool trading on the platform?

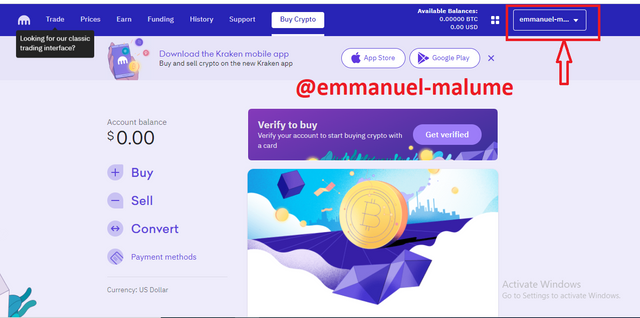

Before we could get to participate in the platform, we needed to firstly Sign up on the platform which I will show in the illustration below.

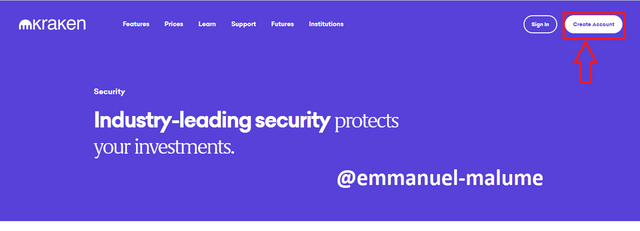

- Log on to the exchange https://www.kraken.com, then click Create Account.

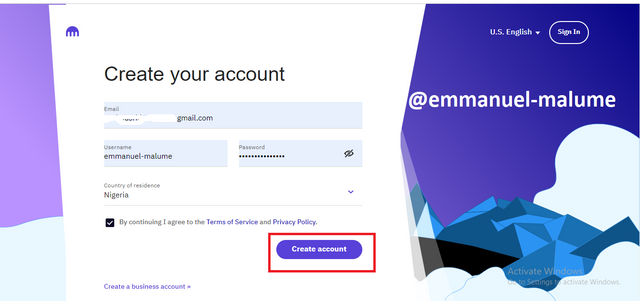

- Then Supply your information below such as the email, then type in a password and as well provide a username for your account, then click Create Account.

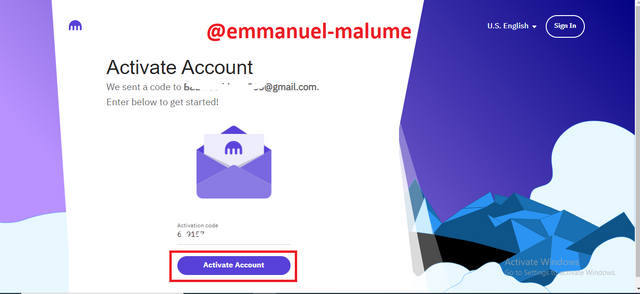

- Then an activation code is being sent to the email which you thus provide in the activation space from the exchange then you click "Activate Account" to continue.

- Account successfully created.

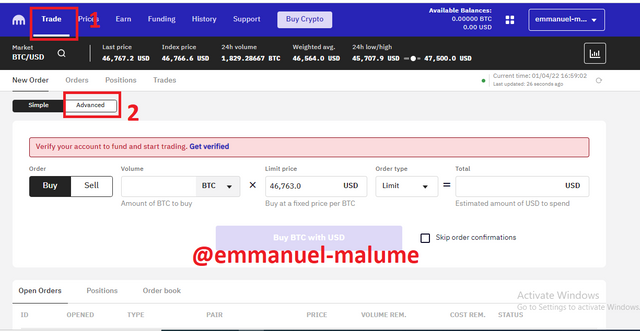

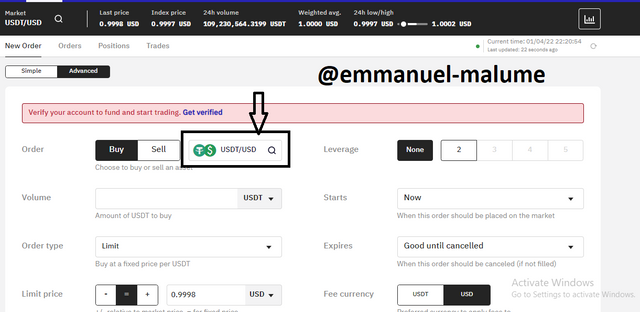

Now, to access the Dark Pool of the exchange, you click on trade[1], then next you click advanced[2],

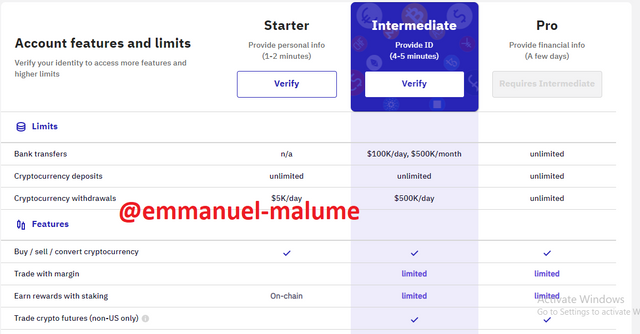

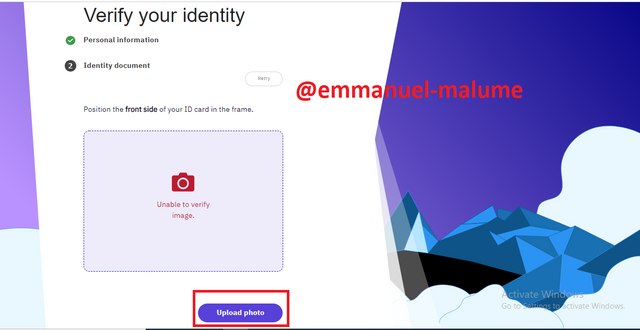

To get involved in the Kraken dark pool, users are required to be verified at least at the intermediate level,

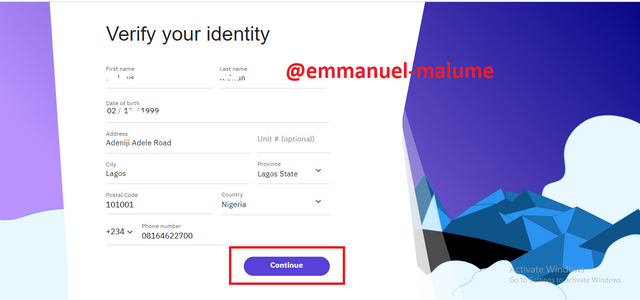

Then users are required to fill in the form as shown in the image below, then click Continue.

Afterward, users are to go through personal verification by presenting an identity card then click Upload to proceed.

[3]Is there any fee attracted?

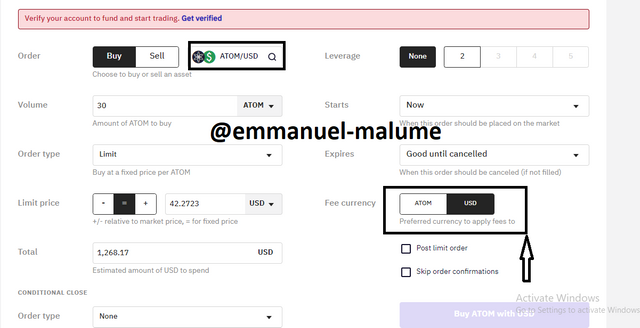

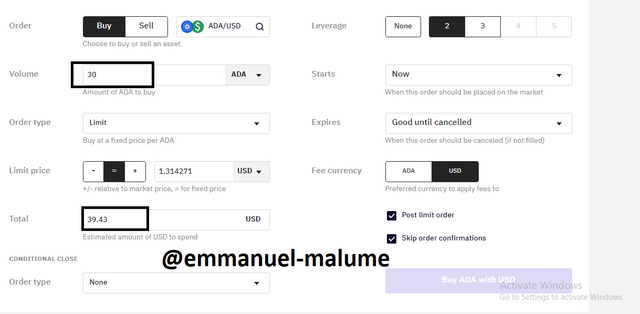

Yes, there is a fee attracted when making an exchange on the Kraken dark pool, for instance, if a trader is trying to make an exchange of the ATOM/USD pairs, he/she can then decide which between the two he had like to make the gas fee on, for example, the image is shown below;

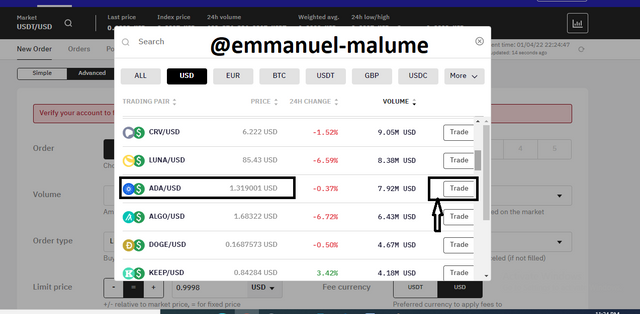

After coming to the advance trading page, we click on the search option to pick the crypto pairs we trading on.

Then we choose the pairs we would like to carry our trading on, just as I picked the ADA/USDT as I get to see the crypto asset worth in USD and click trade.

Then to create a block order on the Kraken dark pool, we input the volume of the assets we are willing to trade either buy/sell, then choose the leverage amount and as well we get to set the limit order at which we want the order executed, as we could see that with this, we get to eliminate the chance of misleading other traders since the order book is not visible, afterward, you click to "Buy ADA with USD".

Decentralized dark Pool can be explained way back to the introduction of cryptocurrency as the whole idea of blockchain and cryptocurrency is to remain anonymous and as well as there is not supposed to be a third party managing users exchange.

But are all exchanges decentralized? The answer is NO since in the previous days we have gotten to see the involvement of users participating in scamming and as well as a mode of embezzlement which was what brought in the introduction of centralized exchange like BINANCE, KRAKEN, and others managing users assets.

So the decentralized dark Pool as well work in a sense whereby to carry out an exchange you don't need to provide any data or any additional information such as personal identities or home address before you get to participate in trades on the exchange unlike the Kraken dark pool where users are required to provide identity, the decentralized dark pool did not require users to provide information before participating.

What do you understand by Zero-Knowledge Proofs?

The Zero Knowlege Proof acronyms as ZKP is a concept in trading whereby trades are encrypted in a format that only traders who have made execution get to let you know the outcome of the trade, this is done as a situation whereby the past users only attest to the proof with the TRUE or FALSE replies in a sense that no additional information is provided as users are only required to attest to the proof.

The decentralized dark pool I would give insight on is the Republic Protocol also known as REN.

The Ren exchange is a decentralized exchange which means the exchange requires no third party to users assets, the exchange uses decentralized dark pool meaning traders don't need to provide any information before partaking in the dark pool.

How does it work

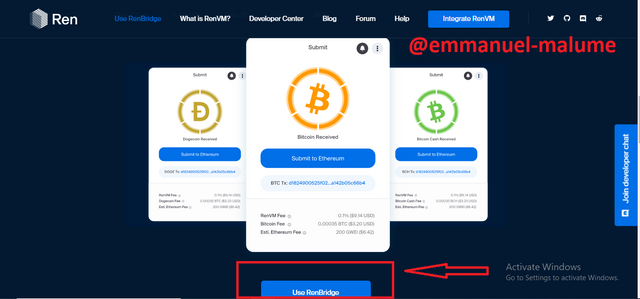

The Ren exchange works in a sense that it allows interoperations between several blockchains, then this blockchain token can be interchanged on the Ren dark pool through the Ren Bridges, for example, users firstly gets to transfer their dogecoin to RenDoge before making the exchange possible.

The image below shows the illustration of how assets are moved on the ren exchange as we get to see the listed Asset and we could see that the assets can only be moved to Ethereun or BSc.

| S/N | Centralized dark pool | Decentralized dark pool |

|---|---|---|

| 1 | Requires third-party | No third-party involvement. |

| 2 | Verification is needed before engaging. | No verification is needed. |

| 3 | Orders are executed using Stop Limit order | Orders are executed when an address is confirmed. |

| 4 | Has access to users' wallets. | users' assets are inaccessible by the exchange. |

| 5 | Require fees for the exchange. | Only bridges fees are paid. |

The Recent huge sale I will be discussing is the large Bitcoin sales which did occur on December 4, 2021, which this occur because large investors decided to take profit on the Bitcoin causing sales of nearly a billion-dollar this thus causes other investors too to have the fear of doubt making them as well to sell most of there assets using the Bitcoin to be down 22% on that day, the price of bitcoin fell from $57,495 to $45,967 that same day.

From the image above, we could see how the sales affect the bitcoin market movement which is even clear for a fact that ever seen the last big sales, the bitcoin market has been unable to adjust to the level ever since then.

What difference would it have made if the dark pool was utilized for such sales?

Hardly been the bitcoin big sales which occurred on Dec 4 was utilized on a dark pool, this wouldn't have caused panic or fear to other investors as the sales wouldn't have been visible to anyone and nobody would have known the volume of sales or the rate at which the market was executed.

In my own opinion, the impact of trades executed on the dark pool exchange wouldn't have been visible, though this will surely be known from the market analysis, the main thing is that no users will know the number of sales or buy orders in the market, only that the candle bar might be increased a little bit or decreased in a case of sell, these have a great advantage and as well as it has disadvantages to market movement.

Also, these as well doesn't cause much impact on trade since the orders are executed at a limit order meaning they were executed at traders choice, not at the instant market price which might not cause many effects on the market as the market get to shift to the law of supply and demand. in a case where the trade was executed on the dark pool, everyone gets to trade safely without causing effects much on the market price as the market continues to trend safely.

Advantages

Trading Volume is inaccessible eliminating others seeing the number of assets traded at a time.

Eliminate fear from other investors, which thus removes the fear of missing out or FUD from others.

Orders are picked at traders' choice.

Transaction fees are not as large when compared to other trades as there is not much liquidity involvement.

Provides Law of Privacy to investors.

Disadvantages

Risky at some point which is why some dark pools warn traders to trade only what they can afford to lose.

Annonymous trading causing some fraudulent act to be moved around the exchange.

No identity, mostly the decentralized dark pool as the exchange offers decentralization meaning large embezzlement could be carried on without other taking awareness of.

The progressions in crypto business sectors somewhat recently have had numerous positive perspectives such as quicker transactions, more rivalry in the market, and more prominent functional productivity. Notwithstanding, this article has momentarily examined how dark pools can likewise possibly prompt decay of market quality

Dark pools were at first used generally by institutional financial backers who didn't need public openness to the positions they were moving into which the growth has now moved to crypto exchange as well so exchanges could be made without putting fear on other investors as these pose to be private trading without others looking into how or the amount traded.

Here comes the submission to the assignment on the topic dark Pools in cryptocurrency, special thanks to professor @fredquantum, it's a privilege to participate with you this season.

Task Written by @emmanuel-malume