.png)

1- Explain in your own words what the A/D Indicator is and how and why it relates to volume. (Screenshots needed).

Created by Marc Chaikin. As the indicator name implies, this indicator serves its purpose as and an indicator that helps one to identify accumulation and distribution zones, and then we can trade these zones when identified as signals. To identify these zones, the volume flow is measured and compared to the price of the asset.

In a situation when we see the volume of moving in or out is large, with comparison to the price of the asset, the indicator can determine if the market is accumulating or distributing. When talking about accumulation we are talking of the phase when the volume flowing into the market is using d to buy up more assets leading to an increase in price while when the market enters distribution we are seeing volume moving out of the asset.

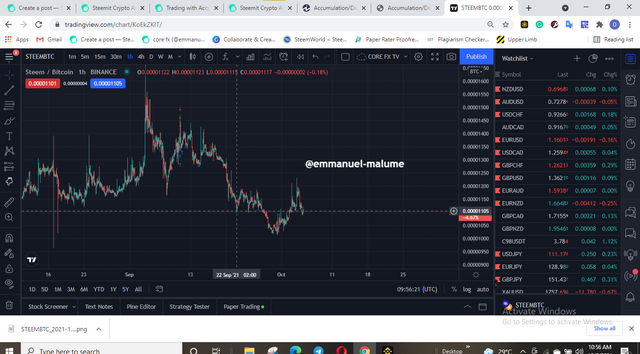

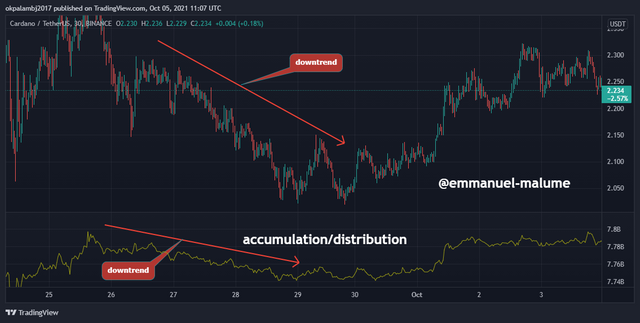

The volume flow of an asset when identified by the moving indicator can be compared to the price and depending on the movement of price, this creates a divergence in the indicator which can be identified as a good reversal level. We can look at an example of the indicator below:

2- Through some platforms, show the process of how to place the A/D Indicator (Screenshots needed).

I am going to be using the trading view platform. so going to the platform website www.tradingview.comand then we go to the chart section as seen below:

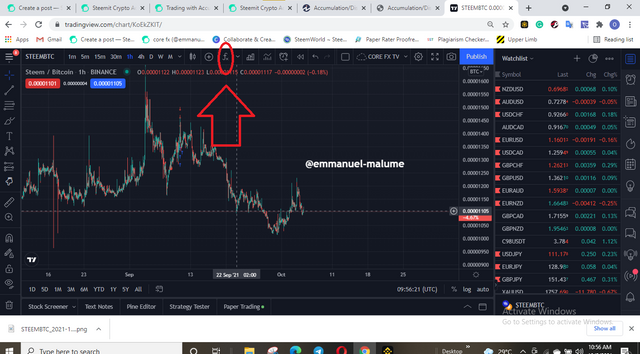

Then we click on the indicator sign as seen below

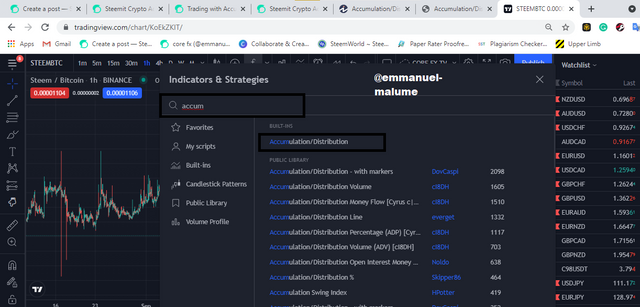

Then we search for accumulation and distribution indicators as seen below then we load it on the chart :

We can edit the setting of the indicator by clicking the setting icon and seeing this below where one can change the visibility, style, and inputs

3- Explain through an example the formula of the A/D Indicator. (Originality will be taken into account).

The general formular for the indicator is seen below as:

For Current Period’s Money Flow Volume calculation:

this is calculated by money flow multiplier(MFM) multiplied by PERIOD VOLUME

CPMFV=MFM X PERIOD VOLUME

MFM=[(Closing Price – Low) – (High Price – Closing Price)] / (High Price – Low Price)

EXAMPLE

Close=50$

low=49$

high=54$

period volume=70

previous A/D=30

We first calculate MFM

MFM=[(50 – 49) – (54 – 50)] / (54 – 49)=0.6

CPMFV=MFM X PERIOD VOLUME=0.6 X 30=18

4- How is it possible to detect and confirm a trend through the A/D indicator? (Screenshots needed)

Here we see price moving in the same direction as the indicator and using this we can identify two types of trend using the indicator:

BULLISH TREND

Here we see pricer rising and the indicator rising, seeing this we can say that the volume inflow in price and price of an asset is moving very well and we can comfortably say we are in an uptrend and that the market is in a bullish phase and the bulls are in control and the market is in a high demand phase where lots of volumes are in the market to buy up the asset more asset in the market. An example can be seen below:

In this BTC/chart above, the A/D line keeps increasing with the price increasing too and this shows how we confirm a bullish trend using this indicator

BEARISH TREND

Here we see price moving downwards and price moving downward too and here we can interpret that the volume in the asset is reducing as people keep selling off their asset and we see the indicator showing off this with a downtrend in the price. The reason for this sell-off may be due to fear of a fall in price may be due to news or for different reasons

in the chart above, we can see price falling and we see the same with the accumulation and distribution indicator and this confirms a downtrend.

USING DIVERGENCE

Divergence trading with the accumulation and distribution indicator is a good way to trade and if used well would yield good returns. In divergence we see indicators moving in the opposite direction to price and this signifies exhaustion of the current trend which can lead to an accumulation or distribution zone before a new trend begins and using this method one can identify trends that are coming to an end in anticipation for a new trend. There are two types of divergence: bullish and bearish divergence

Bullish divergence

Here we see a fall in price but we are seeing the indicator line rising and this shows that the bearish trend is coming to an end due to exhaustion in the number of sellers in the market and this can help us identify that a new trend is about to begin

Bearish divergence

Here we see the opposite of what happens in the bullish divergence where we see the price rising but the indicator line is falling and this shows us a loss in steem and amount of buyers in the market leading to an imminent price reversal where the market now turns bearish. To trade this, we wait for a break of the trend of the initial bullish trend and then we take a sell trade and then using proper risk management in managing the trade

5- Through a DEMO account, perform one trading operation (BUY or SELL) using the A/D Indicator only. (Screenshots needed).

For this demo trade, I would be combining this indicator with the moving average indicator. Below, we can see that the A/D line is going downwards and then we see the price below the moving average we see a confirmed downtrend and

then I took a sell trade based on this condition and then using proper risk management putting my stop loss abovenxt high and targeting a 1;1 R;R.

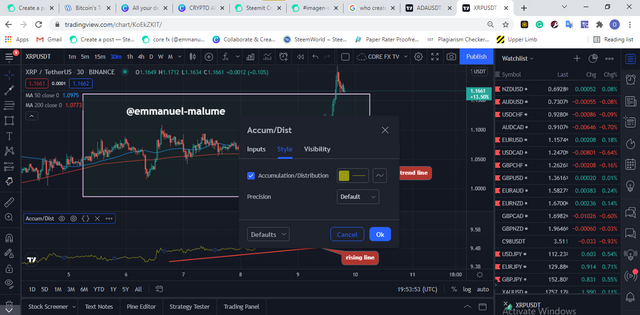

Question 6- What other indicator can be used in conjunction with the A/D Indicator. Justify, explain and test. (Screenshots needed).

For this particular question, we will be using the accumulation and distribution indicator in addition to the moving average indicators(50 ema and 200 ema). To use this indicator together we will use the fact that a rising A/D indicator indicates an uptrend so in conjunction with when we see the 50 ema above 200 ema we wait for a return to the trendlines in form of retracement and then we wait for the formation of a good entry candlestick we can intake entries and this can be seen below

With the xrpusdt chart above, seeing a rising A/D indicator rising and then we see the 50 ema (blue line) above 200 ema and we saw the price after retracing to the moving average we saw price react from them strongly and move up from there

For a sell trade, we would see the reverse of this when we see the indicator moving downwards and we see price below the below-moving average, we look for a retracement of price to the moving average then we take the sell trade as seen below

This indicator is a fantastic indicator that uses the information on the amount of volume entering or leaving the market to identify key accumulation and distribution zones in the market and help us take trades in the market especially applying divergence in taking trades using the indicator and one with an easy formula to calculate.

Thanks @allbert