Hello Steemians

You are welcome to my post. How are you doing today. I am very much sure that you are fine. In this post I have shared my understanding about DeFi as regarded to the questions that was asked in the Season 2 Week 2 contest challenge that is organized in SteemitCryptoAcademy Community.

Explain in your own words the DeFi world Why is it important? Let's talk about it.

DeFi is a very popular financial terms that is use in the crypto world. DeFi is a financial system that is totally created to give everyone access to the use of financial services of which it goal is to make sure that there is an efficient, transparent and trustworthy financial system that is totally independent from any form of intermediaries.

DeFi is an abbreviation of Decentralized finance which is a financial system that is available for everyone to access on a public blockchain most precisely Ethereum. In a number, DeFi means a self custody of finance in the cryptocurrency world. Unlike Centralized Finance where bank is the one responsible for your money, but in DeFi you are the one that is responsible for your money.

DeFi was first introduced by a group of Ethereum developers in 2019 who wanted to open up finance applications from centralized systems. The aim of DeFi is to takes out the middleman in the financial transactions and make everything transparent.

Important of DeFi

DeFi is important in the following ways;

There are no third parties in DeFi, which means that everyone is in control of his or her funds.

There is a high level of transparency, since DeFi code is available for everyone to see.

The network is open and transcend graphic borders .

It provide users with several application to access.

DeFi Vs Centralized Finance. Advantages and disadvantages, let's talk about them.

DeFi is quite different from a centralized finance. Centralized Finance are financial institutions that makes use of third parties in carryout transactions and also the controlling of users funds. In a centralized finance the management of users funds are done by the financial institutions and some intermediaries, whereas in a DeFi users are in control of their funds. However, below are the difference between DeFi and Centralized Finance.

DeFi vs Centralized Finance

| DeFi | Centralized Finance |

|---|---|

| DeFi allows users to have control over their funds of which users enjoy an autonomy when making transaction | Centralized finance are the ones in control of users funds, of which there is no autonomy that is enjoy by users |

| Users funds are not accountable for should in case of a bridge of security | Funds are provided to users should incase a bridge of security |

| DeFi functions and services include; Borrowing, lending, trading and payments | Centralized finance services include;Fiat transactions, leading, buying, selling, payments and even trading |

The both are good financial, but in terms of security and transparency DeFi is leading Centralized finance. However, in the case of services Centralized finance provides external services over DeFi

Advantages and disadvantages of DeFi

| Advantages | Disadvantages |

|---|---|

| There is no third party between transactions | If you loss or forget your password,automatically you have lose all your assets in the exchange since there is not central authority |

| There are a lot of accessibility for insurance and loan without collaterals | Lack of protection of users funds. |

| High Interest rate is available | It us very risky since cryptocurrency is associated with high volatility |

Have you used decentralized Exchange? Tell your experience and explain a Decentralized Exchange. Show screenshots.

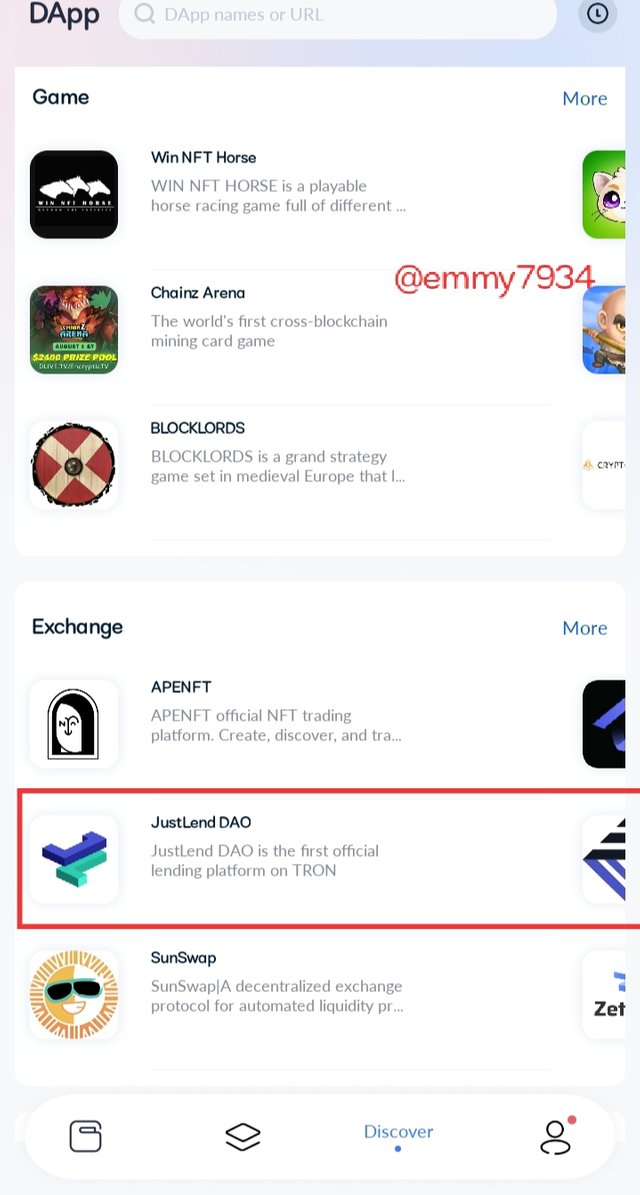

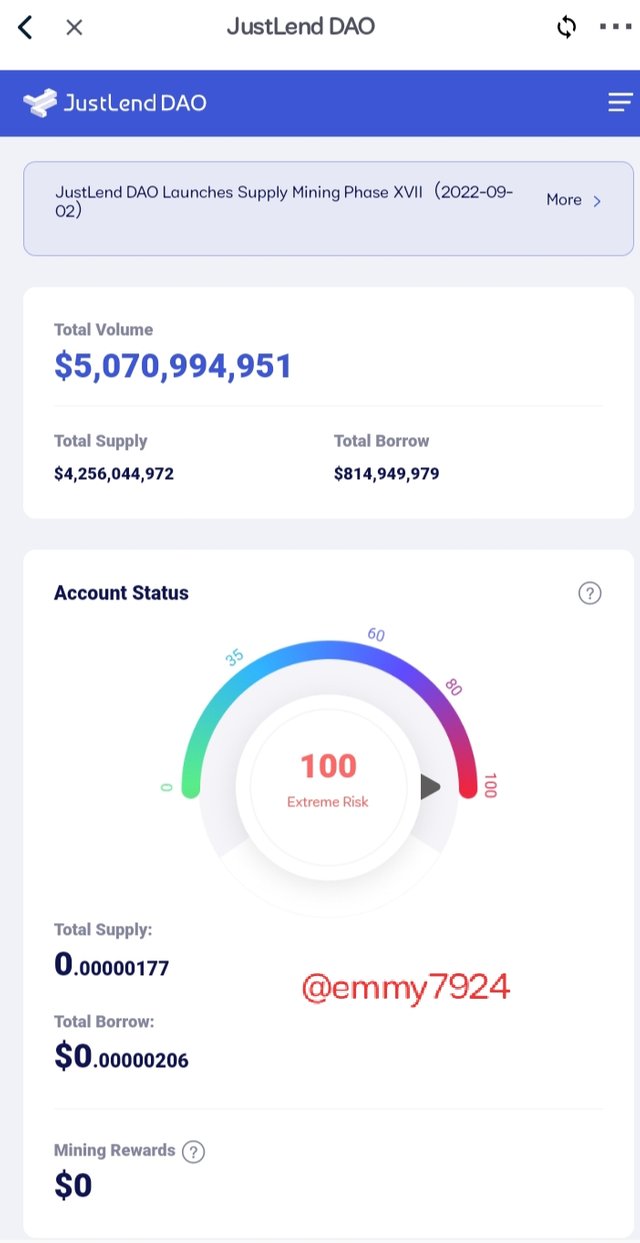

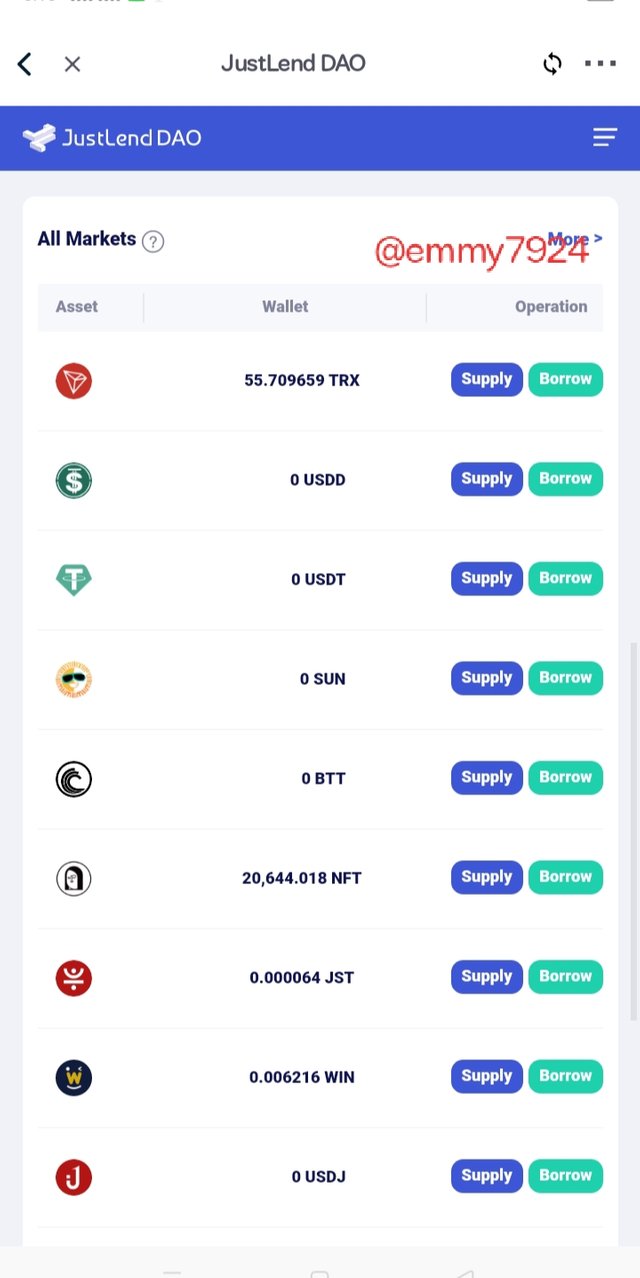

Justland was the Decentralized Exchange that is have used and experienced before. I used Uniswap via TronLink wallet. Justland is a decentralized exchanges for lending and borrowing of money. At the time that I used the exchanges I didn't experienced any negative issues with the exchnges. However, at first when u make used of the exchange I was confused about how it work.

|  |

|---|

In the exchange I used my TRX and borrowed USDT and after I had borrowed the USDT, I later I found it difficult to convert it back to TRX because it was showing USDT-TRX whereas in other exchange, I didn't see such a pair that looks like what was showing me in my TronLink Wallet. The experienced I had was great because I learn a lot from using the Decentralized Exchange.

Give us your opinion about the future of DeFi.

DeFI is indeed the future of finance because everyone is looking for a quick access to loan. DeFi has make it possible for people to borrow and also lend money, without the use of third party involment.

DeFi has also sharp the way financial institutions operate by creating a trustworthy platform where everyone can access. Looking at how DeFi is fast growing it is of no doubt to me that it is the future of finance because there are now hundreds of smart contracts and DApp that are built.

Thank you friend for reading my post......

I am inviting

@preye2

@rubilu123

@badmus-official

Hello friend you have indeed written so well about your understanding on DeFi. However, your experience with Justland has broaden your understanding so well. Best of luck to you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

No doubt DeFi has been making more ways than CeFi and alot of investors will more likely DeFi over CeFi. Justland is indeed a nice decentralized exchange for trading. You have shared a nice post here. Thanks for sharing and goodluck in this contest.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your explanation about DeFi and its importance is good, just as you said in DeFi, one has to be very careful when dealing with DeFi because once the private key is lost, which implies a loss of the total asset.

I don't totally accept this, there are cases of fraud that even the user ran to the bank while the transaction was still going on yet they couldn't do anything to it even when the scammer debited almost x10 of what the bank permitted for the user. But some centralized exchanges make provision for their customer's losses.

Thank you for sharing.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit