Buddy money, as we all know, a seasoned cryptocurrency trader or investor has several ways of assessing and predicting the cryptocurrency market. One of these is the approach known as technical analysis.

By using technical analysis methods, you can better understand market sentiment and predict important market trends. This analysis can be used to make more accurate forecasts and wiser investment strategies.

Technical analysis looks at the crypto asset's movement history with price and volume charts, as well as everything that has been done for the token. Fundamental analysis, on the other hand, is better prepared for a coin's valuation or value to be high, fair, or low.

Basic Idea of Crypto Asset Technical Analysis

Well, to get a better picture of technical analysis, it is very important to understand the fundamental ideas of Dow Theory that technical analysis is based on:

The market considers everything regarding pricing. All existing, past and future details are integrated into the current asset price calculation.

When it comes to Bitcoin and other cryptocurrencies, this is made up of many variables. For example, such as current, past and future demand, and any regulations that affect the crypto market. Existing prices are in response to all the latest details, which includes expectations and knowledge of every coin traded in the market. Technical analysts interpret prices in relation to market sentiment to make wise and calculated predictions for the future.

Price movements are not random. On the other hand, prices often follow long-term or short-term trends. Once the token forms a trend, it can be continued or reversed. Technical analysts seek to help investors capitalize on trends and profit from them.

The 'what' is more important than the 'why'. Technical analysts focus on the price of a coin rather than the variables that drive price movement. Various aspects can influence the price of a coin to move in a certain direction, but technical analysts tend to look at supply and demand.

History tends to repeat itself.It is can to predict market psychology. Traders may react similarly when experiencing similar sentiments and trends.

Also read: What Are the Determinants of Ethereum Price? Listen Here!

Crypto Asset Technical Analysis Indicators: Trend Lines

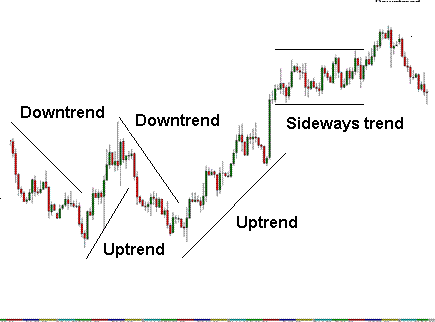

Trendlines, or the typical direction in which a token's price is heading, can be very useful for a cryptocurrency trader or investor. However, use this method is easier said than done. Crypto assets may be very volatile. Observing a chart of the price movement of Bitcoin or another crypto asset may reveal a selection of highs and lows forming a linear pattern.

With that in mind, technical analysts can ignore volatility and spot an uptrend when looking at a series of highs. Vice versa, you can identify a downtrend when you see a series of low price positions.

Moreover, there is a sideways trend, and in this case, the token is not moving significantly in either direction. You should be aware that trends come in a variety of period forms, including mid, long and short term trend lines.

Resistance and Support Levels

In addition to trend lines, there are also horizontal lines that indicate support and resistance levels. By identifying these levels, we can draw inferences about token supply and demand.

At the support level, there appears to be a large number of investors or traders willing to buy the coin (big demand). The investor believes that the currency is undervalued at current levels, and will therefore seek to buy it.

Once the token approaches that level, a buy situation then occurs. Heavy demand usually stops the decline and sometimes even turns the momentum into an uptrend.

Meanwhile, resistance levels are just the opposite, which is an area where many traders wait patiently to sell tokens. This forms a large supply zone. Whenever a coin gets close to that “upper limit”, a crowd of tokens will be sold and a large supply back.

Moving Average

This is another technical analysis tool for cryptocurrencies and other instruments in general to simplify trend prediction. The moving average is based on the average price of the token over a certain period of time. For example, the average price movement on a given day will be calculated according to the token price for every 20 trading days prior to that day. The data is then connected to form a line.

Finding the Exponential Moving Average (EMA) is also important. Where is the average price movement that gives a deeper weight to the price value of the last few days, compared to the previous days. An example is the calculation coefficient of the last five trading days with a 15-day EMA scheme will be double that of the previous ten days.

In the following chart, you can see a practical example: If the 10-day moving average is above the 30-day moving average, it may tell you that a positive trend is coming.

Trading Volume

Trading volume plays an important role in identifying trends in technical analysis. A significant trend is accompanied by high trading volume, while a weak trend is accompanied by low trading volume.

When the coin goes down, it is recommended that you check the volume that accompanies the drop. The long-term healthy growth trend is accompanied by high volume increases and low volume decreases.

It's also important for you to notice that the volume increases over time. If volume decreases during an uptrend, the uptrend is likely to end, and vice versa during a downtrend.

good analysis

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello, @emon19. On Steemit, we value users' identity as such you are expected to have fulfilled a few requirements before you can be eligible to participate in our contests.

One of those things is getting verified in the Newcomers' Community and performing other achievement tasks over there. You can learn more about what is required of you in the newcomers' community through this link. Going through your profile, I realized you have been labelled for some forms of plagiarism at the Newcomers' community, you may need to redeem yourself over there and abide with the rules of the platform.

In addition, subscribe to other communities and publish your content, we would measure the legitimacy of your activities over time and you'd be qualified to participate here. At the moment, you are not eligible.

Remarks

Total| 0/10

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You tried friend but rules are rules so therefore you need to properly identify yourself before making entry in this contest. Please do so in Time you gonna love the platform,

wishing you success

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit