Source

Through the lecture by professor @kouba01, in relation to the ADX Indicator, I can comment that each point was perfectly explained and clearly understood, it is important to consider the knowledge of these new indicators as they provide an extraordinary functionality for each of our investments, and for our learning. Here is my original presentation for this week, thank you very much for attending.

1. Discuss your understanding of the ADX indicator and how it is calculated? Give an example of a calculation. (Screenshot required)

ADX Indicator

The ADX indicator (Average Directional Index), was created by J Welles Wilder and put into operation in the financial market in 1978, Wilder managed to make a book with his method for the financial market, without a doubt traders need to know the direction of the financial market and observe every detail to know its behavior, this allows us to know the possible reference points to place buy, sell or stay orders, depending on the case of the trend, the trend of a market is the backbone of finances since our investments depend on it.

Carrying out a technical analysis we can know how the market behaves, this is done using already known methods, strategies and using great tools such as indicators that the charts offer us for their study and behavior.

The ADX indicator is an oscillating indicator through a range of values from 0 to 100, which allows to know the strength of a trend, this indicator cannot predict the direction of the trend, if it is bullish or bearish, such as if we are witnessing an uptrend, the indicator will give us data to know its strength, the same happens with the downtrend.

In addition to the ADX indicator, we can find two other moving average lines DI + (Positive Directional Indicator) and DI- (Negative Directional Indicator), these two moving lines are implemented in the ADX indicator to know the directionality of the trend, and it is measured during 14 previous periods, or previous 14 days.

Values and meaning of the oscillation of the ADX indicator:

* 0-25: Little or very weak trend.

* 25-50: There is a clear and concise trend.

* 50-75: There is a strong trend in the market.

* 75-100: We have a strong and decisive trend in the market.

Source

The development of the DI + and DI- lines is very easy to understand since we have to relate them to the ADX line, when the DI + line is oscillating above the ADX line it means that the trend is bullish, and when the DI- line is oscillating below the ADX line means that the trend is bearish, knowing this, we see at what value the ADX line is with a relationship of 0-100 and we will have the strength of the trend witnessed, it is not advisable to execute a trade right in the crossing the DI + and DI- lines, as they are always crossing and can give a false signal of a trend reversal. Later I will explain about false signals.

How it is calculated?

To calculate ADM we carry out the following calculations of its components with reading of 14 previous periods.

The first thing is to calculate DMI + and DMI-

DMI +: High point of the day - Highest previous holding point.

DMI-: Low Holding Point - Minimum maximum point of the previous day.

Second, we calculate the True Range (TR)

Average 1: The highest price of the day (PH) - The lowest price of the day (PB)

Average 2: The highest price of the day (PH) - The price of the day (C)

Average 3: The lowest price of the day (PB) - The price of the day (C)

The highest average will be taken into account as a result.

Third, we calculate DI + and DI-

DI +: DMI + / TR

DI-: DMI- / TR

Fourth, we calculate (DX).

Fourth, we calculate (DX).

Finally, we calculate the go of (ADX).

ADX: Sum of n [((DI +) - (DI-)) / ((DI +) + (DI-))] / n

Example:

The first thing is to calculate DMI + and DMI-

DMI +: 46.1 - 46.7: -0.6

DMI-: 44.1 - 45.4: -1.3

Second, we calculate the True Range (TR)

Average 1: 46.1 - 43.8: 2.3

Average 2: 46.1 - 44.2: 1.9

Average 3: 43.8 - 44.2: 0.4

The highest average will be taken into account as a result, (2.3).

Third, we calculate DI + and DI-

DI +: -0.6 / 2.3: -0.2

DI-: -1.3 /2.3: -0.5

Finally, we calculate the go of (ADX).

ADX: 14 [((-0.2) - (-0.5)) / ((-0.2) + (-0.5))] / 14

ADX: 14 [(-0.3 / 0.7)] / 14

ADX: 0.42 * 100

ADX: 42

2. How to add ADX, DI+ and DI- indicators to the chart, what are its best settings? And why? (Screenshot required)

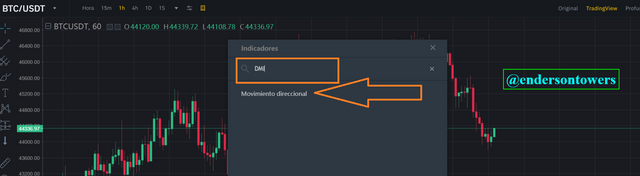

To add the ADX indicator, we go to our favorite analysis platform, in my case I will use Binance, we click on "technical indicator".

Source

Then we write "DMI" or what is the same (average directional index).

Source

We will already have our ADX indicator installed on our chart, to configure it we must enter "settings" in the indicator.

Source

We can see the configurations that our indicator offers us, according to the lengths of the short and long period, the indicator comes by default from 14 periods or 14 previous days.

Source

We can also change the colors of the MA lines, and their thickness, as well as the scale and precision.

Source

What are its best settings? And why?

The indicator comes by default of 14 periods, through this we can mention that the indicator is quite sensitive to the behavior of the market, in the following graph we can see that the ADX line is always located according to the average of DI + and DI-, in addition to the DI + and DI- lines always respect the market behavior, we can also observe a valid break in relation to the last DI- line, crossing from bottom to top both the DI + line and the ADX line, To my personal liking the 14 configuration periods is excellent, since while the reading is in relation to fewer periods, the DI + and DI- lines will be more sensitive to directionality and are more likely to have more false readings, since there is no clear monitoring of the periods and the price.

Source

Another example is taking into account the number of periods of 25, it is visualized that the readings are slower and it may be that when you are making a decision, the market is already taking another course, in this reading we can also see several false signals, remember that By means of the ADX diagram it only reflects the strength of the trend, in addition to that the fewer periods, the more possibility of false readings it has, for them it is necessary to average an intermediate period of 14 to be a better reading.

Source

3. Do you need to add DI+ and DI- indicators to be able to trade with ADX? How can we take advantage of this indicator? (Screenshot required)

Do you need to add DI+ and DI- indicators to be able to trade with ADX?

To operate properly through the market, it is necessary to add the two lines DI + and DI- economically speaking, since these two lines help us to differentiate the possible direction of the trend, and with the ADX line we can see the force it brings, although It is not recommended to use the DI + and DI- lines to operate as reliable lines for the change in trend since many times these two lines cross one above the other and create false alarms of change in trend, since these lines are important data that we must take into consideration, in addition to the fact that these lines also have a special characteristic, that if they are far away the action they are taking is strong and if they are close it is somewhat variable.

Source

How can we take advantage of this indicator?

To take advantage of the ADX indicator, the first thing we must take into consideration is the meaning of each stage from 0-100 of the ADX line, through this we continue to take reading through the DI + and DI- lines, basically these two lines work in the same way of the MA lines to visualize the pattern of the death cross and the golden cross, since if DI + goes from top to bottom DI-, it is a possible downtrend, and if DI + crosses from bottom to top the DI-, It is a possible uptrend, in addition to its spacing also gives us important information about how strong and how weak the trend can be, something very important is not to make hasty decisions since it can throw false alarms in its crossing.

Source

4. What are the different trends detected using the ADX? And how do you filter out the false signals? (Screenshot required)

There are 4 stages of different trends that we can face through the ADX indicator, since each of them according to the behavior of the market is in the range of 0 to 100, below I will describe each of them.

Neutral or weak trend

The ADX line is located in the range of 0 to 25 and is defined as a low or very weak trend, here we can see a scarce presence of trend directionality, since the trend can be in an oscillating range between support and resistance, since the non there is enough supply and demand, or these two are on par.

Using the following BTC-USDT diagram, we appreciate the range that the ADX line has between 0 and 25, between August 10 and 12, where there is little supply and demand.

Source

Strong or well-defined trend

The ADX line is located in the range of 25 to 50, here we can see a clear presence of trend directionality, in addition to the concise trend we can see that little by little it has a very clear directionality.

Through the following BTC-USDT diagram, we appreciate the range that the ADX line has between 25 to 50, in this case there is a greater presence of buyers who predominate the market and therefore it is causing this strength of the trend.

Source

Very strong trend

The ADX line is located in the range of 50 to 75, here we can see a presence of strong trend directionality, we also note that there is strength in the market, where the presence of supply and demand is notable.

Through the following BTC-USDT diagram, we appreciate the value of the ADX line between 50 to 75, we realize that there is a high presence of buyers and sellers but that of sellers predominates more than the market and therefore is causing this force of the trend, this happened in the year 2020.

Source

Extreme volatility

The ADX line is in the range of 75 to 100, here we can see an extreme trend and directionality of the market for a moment. This happened in 2020, in the BTC boom, we also witnessed high market volatility.

Through the following BTC-USDT diagram, we appreciate the value of the ADX line between 75 to 100, we realize that there is a very strong presence of buyers and sellers but that of buyers predominates more in the market and therefore is causing this force of the trend, this happened in 2020 in the btc boom, it is not common to see the ADX line in this area.

Source

How do you filter out the false signals?

We remember that the missing signals depend on the configuration of our indicator, and especially on the hasty of taking a bad reading, I can mention that the false readings are displayed when the configured period of time of the ADX line is below 14, by means of To this, the ADX line is very sensitive to any change in the market and therefore gives many false signals, as when it exceeds the 28 area, since the reading range is greater and therefore the reading of the ADX line and produces false signals, through this it is common to use the ADX line configuration between 14 and 28 periods, less or more than this point would create many false signals.

5. Explain what a breakout is. And How do you use the ADX filter to determine a valid breakout? (Screenshot required).

What a breakout is?.

Breakouts are seen when the market is in an oscillation between the highest zones of 25, in the range of 0 to 100 of the ADX line, if the breakout is below 25, it can be ignored, but if it is done above 25, as I show in the following image, it can be maintained, since breakouts happen when there is an oscillation or a range between supply and demand, where the price of the asset oscillates between support and resistance, here the large entities or Whales can find a point of sale or purchase depending on the case that catches many small investors in low or high points, if the market trend does not change in time to determine if it is a false signal, it can continue and remain , due to the psychological effect that whales exert against the market and thus their view among retailers.

Source

How do you use the ADX filter to determine a valid breakout?.

To determine a breakout through the ADX indicator, one must pay close attention to the area where the swing or range of the ADX line is, since the range must be below the 25 area, and the break must be above the 25 line to be valid, if the breakout is below this line it should be discarded as it is invalid or a very weak breakout.

In the following BTC-USDT diagram, we can see the oscillation through a range below the 25 zone of the ADX line, we also observe the break of this line above the 25 line, which generates a valid breakout , causing a strong upward trend as the DI + line was above DI- and above the ADX line.

Source

6. What is the difference between using the ADX indicator for scalping and for swing trading? What do you prefer between them? And why?

ADX indicator for scalping?

To perform operations through scalping, it is necessary to use very short periods of time of 1 minute, for this reason by studying the ADX indicator, I consider that it is necessary to configure the ADX indicator in short periods of time that conform to the scenario we have, remembering that the scalping trading method is a fast method, for this reason we would have to use short periods of time in the ADX indicator, but this in turn would have consequences with the false crosses of the DI + and DI- lines, thus creating false signals For this reason, I consider that it is advisable to use another additional indicator for a better reading, it can be RSI and the ichimoku cloud in order to take a better reading of the presented scenario.

ADX indicator for swing trading?

Swing Trading on the other hand is a long-term trading method, for this reason we must consider configuring the ADX indicator, through a periodic frame of more time, it could be leaving the default configuration of 14 periods, which provides excellent performance or increasing A little according to our market strategy, it would also be extraordinary to use additional indicators such as RSI, ichimoku cloud or MA 50 and MA 200 lines which provide great long-term qualities to detect signals of entry and exit of operations.

What do you prefer between them? And why.

For scalping it is necessary to be attending to each variation of the market, without a doubt it is the fastest operation in the market, but I adapt even more to long operations, executing long-term operations through strategies and methods that I execute in charts, for this reason my option is Swing Trading, I also loved the ADX indicator to visualize the strength of the market trend, it has already been added to my favorite indicators.

7. Conclusion:

The ADX indicator (Average Directional Index), is undoubtedly one of the best options to visualize the directionality and its strength of the market, this indicator does not predict trend but its strength, I can also mention that trend breaks are not valid breaks if the ADX line is below the 25 zone, I have to mention that for the use of this indicator, several prudent practices should be considered, both in the short and long term to incorporate it into our method and thus achieve the correct time periods according to our market strategy.

Thank you very much, this new indicator was excellent, I will use it from today.