Hello professor @imagen, this lesson was very useful for me, I learned a lot, thank you very much.

1.) How many times has "halving" been made in Bitcoin? When is the next expected? What is the current amount that Bitcoin miners receive? Mention at least 2 cryptocurrencies that are or have been "halving".

In short, Halving refers to reduce by half. In mining cryptocurrencies, the reward per block in mining production is halved at certain intervals. In all cryptocurrencies produced by mining such as Bitcoin (BTC), the number of units to be produced is determined. The specified amount is not exceeded. In this way, the supply-demand balance of crypto money is preserved. In this way, inflation is prevented.

Bitcoin (BTC) mining founder Satoshi Nakamoto launched it on October 31, 2008 with the Genesis Block. All subsequent confirmations are written on this block. In 2008, when BTC first came out, it was rewarding 50 BTC per block. Since the number of miners will increase and transactions will slow down, the developers have developed a halving system which will automatically reduce the reward given per block.

Number of halvings in Bitcoin / Date of next halving / Amount BTC miners receive current

There are 3 halvings in BTC. The first halving on the Bitcoin network was made in 2012. Thus, the reward per block was 25 BTC. Halving, which takes place approximately every 4 years, made its next halving in 2016 and the reward per block was 12.5 BTC. The third halving was held in 2020. Thus, the reward per block was 6.25 BTC. Since halving is done automatically every 4 years, the next one will be in 2024. So it will be 3.125 BTC.

- Tomochain (TOMO)

TomoChain PTE. LTD created the TomoChain blockchain platform in early 2018. The halving in the Tomochain (TOMO) network occurred on February 7, 2021, with the number of TOMO coins mined each year being reduced from 2 million to 1 million.

I took this screenshot here

17 million TOMO has been implemented an 8-year halving program.

1st and 2nd year: 4 million TOMO annually

3rd, 4th and 5th year: 2 million TOMO annually

6th, 7th and 8th year: 1 million TOMO annually

The Tomochain blockchain generates blocks at intervals of two seconds. For every 900 blocks, a total of 250 coins are currently issued to miners. This amount will be reduced by half to 125.

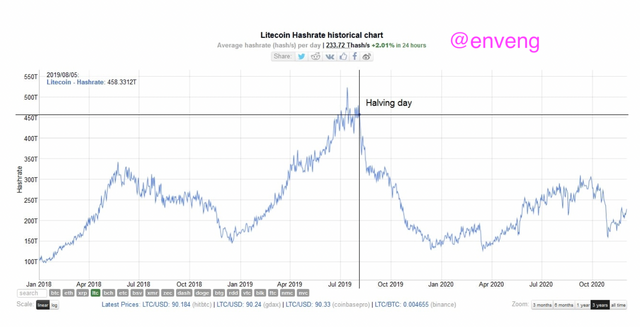

- Litecoin (LTC)

Litecoin (LTC) is the first cryptocurrency to leave the Bitcoin blockchain network. It was launched in 2011. It is the first altcoin. Thanks to its fast block generation, it enables transactions to occur faster than the Bitcoin blockchain network. The halving takes place on the Litecoin (LTC) network every four years. In 2011, when LTC was first launched, the reward per block was set to 50 LTC. In 2015, with the halving transaction, the reward per block decreased to 25 LTC. The last halving took place on August 5, 2019. Miners will be paid 12.5 LTC per block.

I took this screenshot here

2.) What are consensus mechanisms? How do Proof-of-Work and Proof-of-Staking differ?

The Consensus Mechanism is the establishment of a decision based on general acceptance by taking a certain number of steps within the framework of certain rules among a group of people. Consensus algorithms are a very important part of blockchain technology. A network rules by which the order of events is defined. The consensus algorithm is applied to ensure that a group of people make sure that all transactions are authentic and authentic.

Proof of Work (PoW): PoW is a way to verify current and past transactions. PoW requires members of a community to solve challenging blocks. This is also based on the resolution of previous blocks. In PoW, cryptocurrency transactions are encrypted and stored in a data block, which fills the block and miners can decrypt it. These blocks are not easy to solve. However, once solved, they are mathematical equations that are not difficult to verify by the rest of the network.

The disadvantage of PoW is that the energy consumption required to maintain its network grows with the network. This means an important environmental problem. Small miners may not be able to compete with the big ones.

A low throughput must be implemented to secure the PoW mechanism. This makes PoW slower than blockchains with other consensus algorithms.

I took this screenshot here

- Proof of Stake (PoS): It is an algorithm that enables PoW to achieve distributed consensus without relying on the massive computation required. Blocks are not created by miners. It is created by coin generators betting their tokens on which blocks are valid.

PoS algorithm has Nothing to Stake problem. The problem is, validators can vote on both of the forks that took place. Thus, in a fork that will occur in each chain, validators can earn two different cryptocurrencies and spend double.

Continuous forks can be issued to win more. This situation could damage the reputation of the cryptocurrency.

PoS has more energy savings than PoW. Instead of large computers like PoW, the PoS protocol selects users to validate the next block of transactions and receives transaction fees. It is more resistant to centralization.

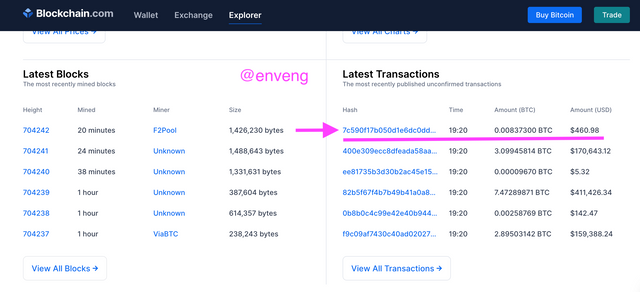

3.) Enter the Bitcoin explorer and indicate the hash corresponding to the last transaction. Show Screenshot.

I selected https://www.blockchain.com/explorer. Firstly, I looked at the last transactions of Bitcoin. Then, I entered the hash of the last transaction. In this way, I could see the details of it.

I took this screenshot https://www.blockchain.com/explorer

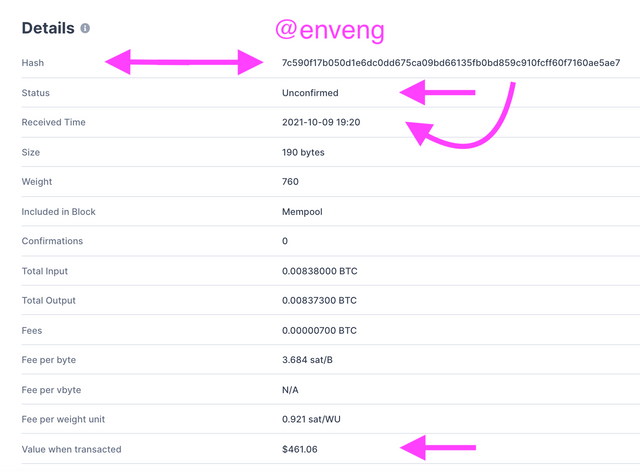

You can see the hash of the last transaction in the photo that is 7c590f17b050d1e6dc0dd675ca09bd66135fb0bd859c910fcff60f7160ae5ae7

Th received time is 2021-10-09 at 19:20. The value when transacted is $461.06. The amount of BTC is 0.00837300 BTC (total output).

I took this screenshot https://www.blockchain.com/explorer

4.) What is meant by Altcoin Season? Are we currently in Altcoin Season? When was the last Altcoin Season? Mention and show 2 charts of Altcoins followed by their growth in the most recent Season. Give reasons for your answer.

Altcoin, short for Alternative Coin, means all cryptocurrencies other than Bitcoin such as DOGECOIN, Ripple (XRP), etc. Altcoin season is a period when cryptocurrencies other than Bitcoin, namely Altcoins, start to make big gains. Astronomical rises may occur in a short time during the altcoin season.

How can we tell if we are in altcoin season? If we are not in the altcoin season, how can we detect the latest season?

An Index has been created to decide whether it is altcoin season or not. If 75% of the top 50 coins outperformed Bitcoin in the last season (90 days), it is called Altcoin Season.

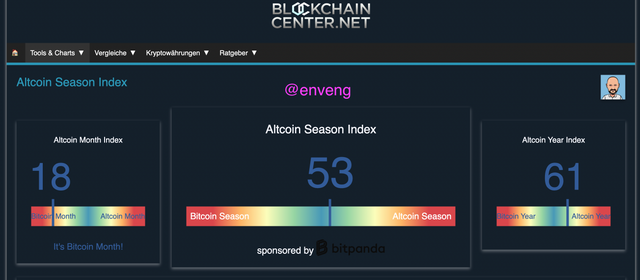

When we looked at Altcoin Season Index in https://www.blockchaincenter.net/, we can understand that we are not in the Altcoin Season, currently.

I took this screenshot https://www.blockchaincenter.net/altcoin-season-index/

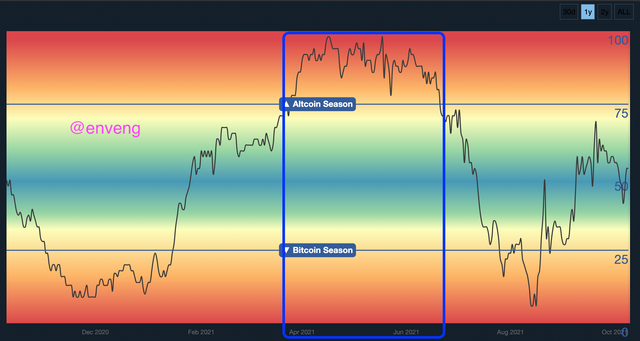

So, when did the last time altcoin season happen? To see this clearly, we need to look at this graph. The date range when 75% of altcoins are above 50 seems to be in this range, end of March and end of June in 2021.

I took this screenshot https://www.blockchaincenter.net/altcoin-season-index/

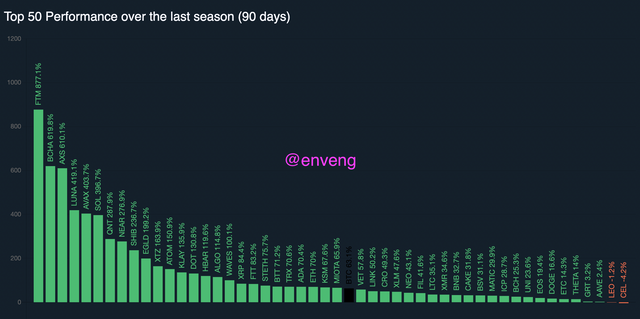

When I looked at the top 50 altcoins over the last season in 90 days, I saw that FTM and BCHA have the best performance.

I took this screenshot https://www.blockchaincenter.net/altcoin-season-index/

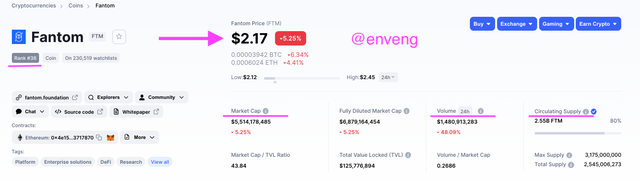

- Fantom (FTM)

I looked at https://coinmarketcap.com to review detailed data on Fantom. I have reached the data I marked below and more. The price of Fantom today is $2.17. Its rank is 36. Market capacity is also $5,514,178,485. FTM's 24-hour market volume also seems to be $1,480,913,283.

I took this screenshot https://coinmarketcap.com/

FTM has been in an uptrend since August. After a large increase in September, it peaked in October. When we look at it as of September, it increased from 0.4 to 2.15 in 1 month.

I took this screenshot https://www.tradingview.com/

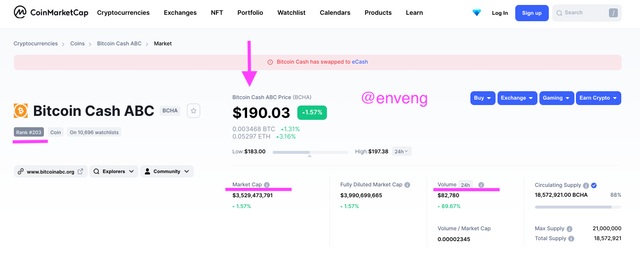

- Bitcoin Cash (BCHA)

I looked for BCHA at https://coinmarketcap.com. I have reached the data I marked below. The price of BCHA is $190.03, currently. Its rank is 203. The market capacity of BCHA is $3,529,473,791. BCHA's 24-hour market volume appears $82,780.

I took this screenshot https://coinmarketcap.com/

While BCHA moves in the 25-50 band for about 8 months, it starts to rise in August and peaks at 400 in September. It continues in the band from 190 to 275 in October. When we look at the year in general, its performance in the last two months seems quite good.

I took this screenshot https://www.tradingview.com/

5.) Make a purchase from your verified account of the exchange of your choice of at least 15 USD in a currency that is not in the top 25 of Coinmarket (SBD, tron or steem are not allowed). Why did you choose this coin? What is the goal or purpose behind this project? Who are its founders / developers? Indicate the currency's ATH and its current price. Reason for your answers. Show Screenshots.

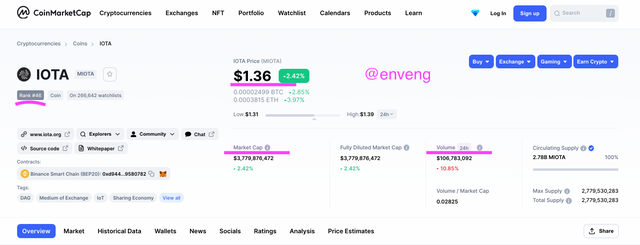

My preference for altcoins is IOTA (MIOTA). I searched IOTA in https://coinmarketcap.com to get more detailed data. The price of IOTA is $1.36 currently. Its rank is 46. Its market capacity is $3,779,876,472. IOTA's 24-hour market volume is $106,783,092.

I took this screenshot https://coinmarketcap.com/

I made the purchase on my Binance account. In order to make my transaction quickly, I created order with close values where the transaction will take place. Therefore, I could not capture the image of the order moment. I also showed what I did from my transaction history. First of all, I transferred 30 Steem from my Steemit account to my Binance account. I bought BTC on all of Steem. I have obtained 0.0003369 BTC. I got 15,37088 USDT from BTC as I will trade 15 USD. I created an order to buy 15 USDT IOTA. When the transaction took place, I saw that 10 IOTA were received for 13.6782 USDT.

I took this screenshot https://www.binance.com/

I chose IOTA because it operates in the internet of things (IoT) industry. This subject interests me. Decentralized and no transaction fees are incentives. In addition, IOTA made a big move in 2019, creating an accessible data market open to everyone, including big brands such as Microsoft, Samsung, and Fujitsu, and many companies. I did research on it when I found out about it. The idea of making money from all kinds of data is very interesting to me.

IOTA does not use blockchain technology like Bitcoin or Ethereum. It uses another technology called Tangle. Tangle is theoretically superior to blockchain technology for several reasons. Because Tangle removes the mining and transaction fees issues in the blockchain.

IOTA was founded in Germany in 2014 with four founding partners. The names of the founders are Sergey Ivancheglo, Serguei Popov, David Sønstebø and Dominik Schiener.

While IOTA was at 0.40 for a long time, it increased to $2.5322 by peaking in 1 year on April 16, 2021. It progresses in the range of 1.05 to 1.99 in September.

I took this screenshot https://coinmarketcap.com/

6.) Conclusions

Under the title of Bitcoin's Trajectory, we first learned about the halving system. In mining cryptocurrencies, supply-demand balance is maintained by deliberately lowering the reward at certain intervals. By choosing 2 different cryptocurrencies where the halving takes place, we got an idea of how often they do it and how much reward they get per miner.

We learned that consensus mechanisms are a method for making decisions within a group. In PoW, the mining of a block is determined by how much computational work the miner has done, while in PoS, the probability of validating a new block is determined by how large a stake a person has.

We learned that Altcoin Season is a time when cryptocurrencies other than Bitcoin (altcoins) are on the rise. With the Altcoin Season Index, we learned to determine whether the season is altcoin season or bitcoin season.

CC: @imagen

Gracias por participar en la Cuarta Temporada de la Steemit Crypto Academy.

Continua esforzandote, espero seguir corrigiendo tus asignaciones.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Muchas gracias 🌸

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit