What are the different dApps in the Tron ecosystem are you familiar with? What are the uses of DeFi applications like Justswap, JustLend, and Sun.io? How can you optimize mining rewards by staking TRX and other TRC20 tokens in Sun.io? Examples?

What are the different dApps in the Tron ecosystem are you familiar with?

Tron Blockchain platform is a smart contract with the aim of creating the lowest possible transactions that has the highest decentralized application. There are 3 different types of Tron that is very useful to me and there are: Steemit, BitTorent and Poloniex. Also the Tron ecosystem which collaborated with TRC20, USDT etc for easy transfers and both systems are very useful in the Cryptocurrency space.

What are the uses of DeFi applications like Justswap, JustLend, and Sun.io?

Justswap:

source

The first decentralized exchange (DEX) is called Justswap of the Tron Network. It enables users to swap a token such as TRX and TRC20 without depending on the liquidity before performing a swap. There is a list of bid and ask values in an Order-book model (CEX) with a Spread as the difference. The Spread gives the best value of exchange in a narrow and competitive and the trader will be affected badly because it will result to losses.

Unlike DEX, CEX does not suffer losses from liquidity.

In contrast, the major problem with DEX is that the liquidity is fragmented as there is no such centralized pool, the liquidity remains in the decentralized wallet of the individual traders.

It is only the AMM mechanism that solves this problem interface of DEX and introduces a constant product market-making mechanism (xy=k) The product of x and y is always constant

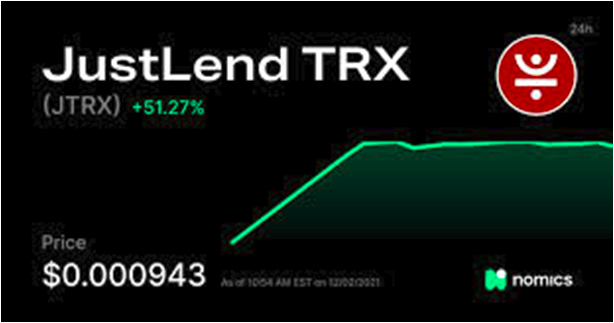

JustLend

source

JustLend is an effective Money Market Protocol with transparent pricing, as a DeFi Application on the Tron Blockchain complying with all the parameters of a DeFi having Low Network Fees and Micro Landing. There are two pools established by JustLend that are based on demand and supply. They are Supply Pool and Borrow Pool. The borrower pays a floating interest rate while the Supplier earns a floating interest rate.

If the liquidity is higher in the supply pool, and the demand for the token (to borrow) is lower, then the interest rate decreases and vice versa. Instead of a daily interest rate, the floating interest rate in JustLend is determined every 3 seconds.

It has a collateral factor from 0 to 1, the loan amount for the borrower is determined by the collateral value. Lower value shows low liquidity and higher value shows better liquidity.

A Borrower will acquire jTokens first by supplying an asset, the borrower will stand as a collateral before he can borrow any listed asset, therefore jTokens worth is the value of the collateral of the Borrower. The interest rate accumulation is every 3 seconds.

JustLend Collateral value has to be greater than the Loan value + Accumulated interest, if not it will become unsafe and cause a liquidation of asset for the borrower.

Sun.io

Sun.io is a dedicated DeFi part in Tron with different projects like Stake mining and self governance. From stake mining and liquidity mining you can earn a premium with this network of Sun.io. Ongoing now is the stable coin pool mining of Sun-TRX LP and SUN pool mining.

If you are holding SUN-TRX in Justswap you can also stake your LP tokens and earn mining rewards. With the highest APY offer of 73.2%, Sun.io has also introduced stable coin swapping.

Also launched is the genesis mining and governance mining with a commitment of 5 billion SUN. Then 30% of the 5 billion SUN is set aside for genesis mining and governance mining within the first three months of introducing it.

How can you optimize mining rewards by staking TRX and other tokens in Sun.io? Examples? .

It is very simple. You can stake TRX and other TRC20 tokens at any time of your choice and withdrawal is at your wish and choice.

- To do this from your device go to: Sun.io and click on STAKE or better still type https://sun.io/#/stake

- Then click on DEPOSIT (SUN staking pool)

- Next is to key in the amount you wish to stake and the period, then click on DEPOSIT and lastly authorize the transaction.

cc:

@sapwood