Link

Welcome to my task for professor @cryptokraze, this time I will put into operation and explain what it is and how operations are done with the shark fin pattern, just after reading every detail of his lecture. Welcome.

1 - What is your understanding of Sharkfin Patterns. Give Examples (Clear Charts Needed)

Shark fin patterns are patterns in the shape of an inverted “V” and “V”, which are reflected in diagrams through a technical analysis and with the help of an indicator such as the RSI, likewise, this pattern is very peculiar Since it is reflected by the liquidation of large purchases and large sales quickly, these are also related to points of overselling and over buying on the RSI indicator, the shark fin pattern is something that should be considered for long operations and short as it can be useful for both.

The formation of the shark fin pattern is visualized in 2 presentations, in "V" if the trend is downward until it reaches maximum support points and the trend changes to an upward trend, the RSI indicator line is between measure 30 of the band oversold, and in an inverted “V”, if the direction of the trend comes up and reaches a maximum point of resistance where it plummets, changing the direction of the trend to bearish, at the maximum point generated the RSI indicator line should settle at 70 overbought.

Let's analyze the ADA / USDT diagram, in a 15min temporary frame, we can appreciate the correction or downtrend clearly and quickly, where it reached a point and the price reversed in the opposite direction, changing the direction of the trend and reflecting the Shark fin “V” pattern.

Link

Now let's analyze the ADA / USDT diagram, in a 15min time frame, we can appreciate the direction of the upward trend clearly and quickly, where it reached a point and the price reversed in the opposite direction, changing the direction of the upward trend. trend and reflecting the inverted “V” pattern, of a shark fin.

Link

2 - Implement RSI indicator to spot sharkfin patterns. (Clear Charts Needed)

With the RSI indicator with its default settings, you can see the formation of the shark fin pattern very easily, for a “V” shark fin pattern the trend line has to touch the 30 zone of the RSI band of up down and reversing trend direction, in the same way with the inverted “V” shark fin pattern, if the trend line comes from the bottom up reaching the RSI point 70 and then reversing and changing the trend in the opposite direction, you can see the shark fin “V” pattern.

Let's analyze the ADA / USDT diagram, in a 15-minute time frame, we can see the direction of the upward trend clearly and quickly, where it reached a point and the price reversed in the opposite direction, changing the direction of the trend. and reflecting the pattern in inverted "V", shark fin, this maximum point reached the overbought point 70 of the RSI indicator.

Link

Let's analyze the ADA / USDT diagram, in a 15-minute time frame, we can see the direction of the downward trend clearly and quickly, where it reached a point and the price reversed in the opposite direction, changing the direction of the trend. and reflecting the pattern in "V", shark fin, this maximum point reached the oversold point 30 of the RSI indicator.

Link

3 - Write the trade entry and exit criteria to trade sharkfin pattern (Clear Charts Needed)

Entry criteria for buy position

1. The RSI indicator must be added to the chart and configured by default (14 periods and band width 30-70).

2. We must be patient and wait for the price to touch its maximum and to have a reversal, at this point we will observe the shark fin pattern in a “V” shape.

3. We observe if the RSI line has entered the 30 oversold area and finds a reversal, at this point of the indicator we also observe the shark fin pattern.

4. We wait for the price to move away from the 30 zone of the RSI indicator so that it is a valid reversal, and we will place our buy order.

5. When using the shark fin pattern, it is not advisable to buy right in the area of 30 or below the RSI indicator, because there may be a false reading and the price may continue to fall, so you should expect the price to touch the 30 line and have a bullish reversal.

Link

Entry criteria for the sell position

1. The RSI indicator must be added to the chart and configured by default (14 periods and band width 30-70).

2. We must be patient and wait for the price to touch its maximum and to have a reversal, at this point we will observe the inverted “V” shaped shark fin pattern.

3. We observe if the RSI line has entered the 70 overbought area and finds a reversal, at this point of the indicator we also observe the inverted “V” shark fin pattern.

4. We wait for the price to move away from the 70 zone of the RSI indicator so that it is a valid reversal, and we will place our sell order.

5. When using the shark fin pattern, it is not advisable to sell right in the area of 70 or higher than the RSI indicator, because there may be a false reading and the price can continue to rise, so you should wait for the price to touch the 70's line and have a bearish reversal.

Link

Exit criteria for the buy position

1. We set the stop loss levels just below the shark fin pattern, this allows greater control in case there is a bad reading or the operation goes in another direction of the trend.

2. If the trade opens the stop loss order, the entry point was invalid and a next entry point is awaited.

3. When the operation carried out is heading in the right direction and is being executed correctly, we will open the take Profit level in long operation, to withdraw the benefits.

4. The RR factor of Irrigation / Profit, should be at 1: 1 where the profits and the stop loss should work with the same percentage.

5. We work with the Risk / Benefit factor RR of 1: 1 until mastering the shark fin strategy.

6. With the take profit, the profits are obtained before an exit maneuver of the operation.

Link

Exit criteria for the sell position

1. We set the stop loss levels just above the shark fin pattern, this allows greater control in case there is a bad reading or the operation goes in another direction of the trend.

2. If the trade opens the stop loss order, the entry point was invalid and a next entry point is awaited.

3. When the operation carried out is heading in the right direction and is being executed correctly, we will open the take Profit level in short operation, to withdraw the benefits.

4. The RR factor of Irrigation / Profit, should be at 1: 1 where the profits and the stop loss should work with the same percentage.

5. We work with the Risk / Benefit factor RR of 1: 1 until mastering the shark fin strategy.

6. With the take profit, the profits are obtained before an exit maneuver of the operation.

Link

4 - Place at least 2 trades based on sharkfin pattern strategy (Need to actually place trades in demo account along with Clear Charts)

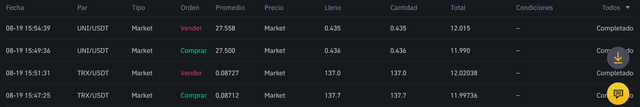

Uni / Usdt chart with a time frame of 1 min, perform the operation on the binance exchange platform with $ 12, we observe that the RSI line reached the oversold level above 30, here I retest and reboot up, making the fin pattern shark in "V", my signal to buy was a candle after breaking higher, I had to wait for it not to give a false signal, my stop loss point was more below the low point of the "V" pattern , and the take profit was with RR 1: 1.

Link

TRX / Usdt chart with a time frame of 1 min, perform the operation on the binance exchange platform with $ 12, we observe that the RSI line reached the oversold level above 30, here I retest and reboot up, making the fin pattern shark in "V", my signal to buy was a candle after breaking higher, I had to wait for it not to give a false signal, my stop loss point was more below the low point of the "V" pattern , and the take profit was with RR 1: 1.

Link

Link

Conclusión

The shark fin pattern can be applied in short and long operations, in addition the RSI indicator provides us with great information to be very clear about the exact entry point, such as the “V” -shaped pattern at the oversold point 30, and the inverted "V" pattern at the overbought point 70, with this we will have a better position when it comes to obtaining benefits as long as we analyze and study very well the direction of the trend and the type of pattern we want to make, it was Very well this week's topic, it is an extremely important pattern for our operations. Thank you God bless you.

I had never heard of this pattern until now, thanks for this post

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit