.png)

image source

Hello steemians, am glad once again to participate in this week’s lecture and homework task. I read through the lecture and have learnt a lot through it. Thanks Prof @yohan2on for this great lecture on Risk Management in Trading. To this, I will be answering based on the professor’s task.

Define the following Trading terminologies;

Buy stop

This is a buy order that is placed in a crypto market on a particular asset when the current price of the asset is in a bullish direction in a long term. The order is always placed above the current price of the asset in the market. When the price of the asset gets to the order that was placed above the current market price of the asset, the order is accomplished thus a buy stop order is executed. But if the price of the asset does not get to the buy stop order, the order remains pending.

Sell stop

This is also another type of order which is carried out in the reverse case of the buy stop order. It is an order that is placed in a crypto market on a particular asset when the current price of the asset is in a bearish direction. The order is always placed below the current price of the asset in the market. When the price of the asset gets to the point of the order that was placed below the current market price of the asset, the order is accomplished but if the market price of the asset does not get to the order placed, the order remains pending.

Buy limit

This type of buy order is used by traders when there is swings in prices of asset. It is placed below the current price of the asset in the market in an uptrend. It is used by traders when there is a retest in the market price of an asset.

For instance, if the current trend of a particular asset is moving in the uptrend direction and suddenly there is a swings low caused by sellers of the asset, the support point at which the price retest is where this type of order is placed.

Sell limit

This type of order is the reverse case of the buy limit. It is a type of sell order that is placed in a bearish direction of an asset. Here, the order is placed above the current price of the asset in the market in a bearish. It is also used by traders when there is a retest in the market price of an asset.

For instance, if the current trend of a particular asset is moving in the bearish direction and suddenly there is a swing high caused by buyers of the asset, the resistant point at which the price retest is where this type of order is placed.

Trailing stop loss

This is a type of order which enables traders or investors to make profit in both a bearish or bullish trend. It is a type of order that is placed at a distance percentage away from the market price of the asset. Just as the name implies, if a trader places an order using the trailing stop loss in a bullish trend, as the price keeps moving in the bullish trend, the percentage of the trailing stop loss keeps moving in that same direction allowing the trader to make more profit. But if it is in a bearish trend, as the price keeps dropping, the percentage of the trailing stop loss keeps moving in that same direction as well.

Margin call

Margin call just as the name implies indicates the trader that their margin trader fund is below the rate of fund required by the broker. This might be as a result of the trader running loss in subsequent trade orders. As the margin call indicates a trader, the trader has to fund his/her account to be able to continue trading with his broker.

Practically demonstrate your understanding of Risk management in Trading

Briefly talk about Risk management

Risk management is on one of the strategies deployed by traders in averting huge losses during trading. It is a step taken by traders on the type of brokers to choose as well as the carrying out proper analysis on the trade they want to enter. Risk management helps traders to consider the one percent rule in any trade to be carried out as well as placing a stop loss so as to maximize and also take profit.

Use a Moving averages trading strategy on any of the crypto trading charts to demonstrate your understanding of Risk management. (Screenshots needed)

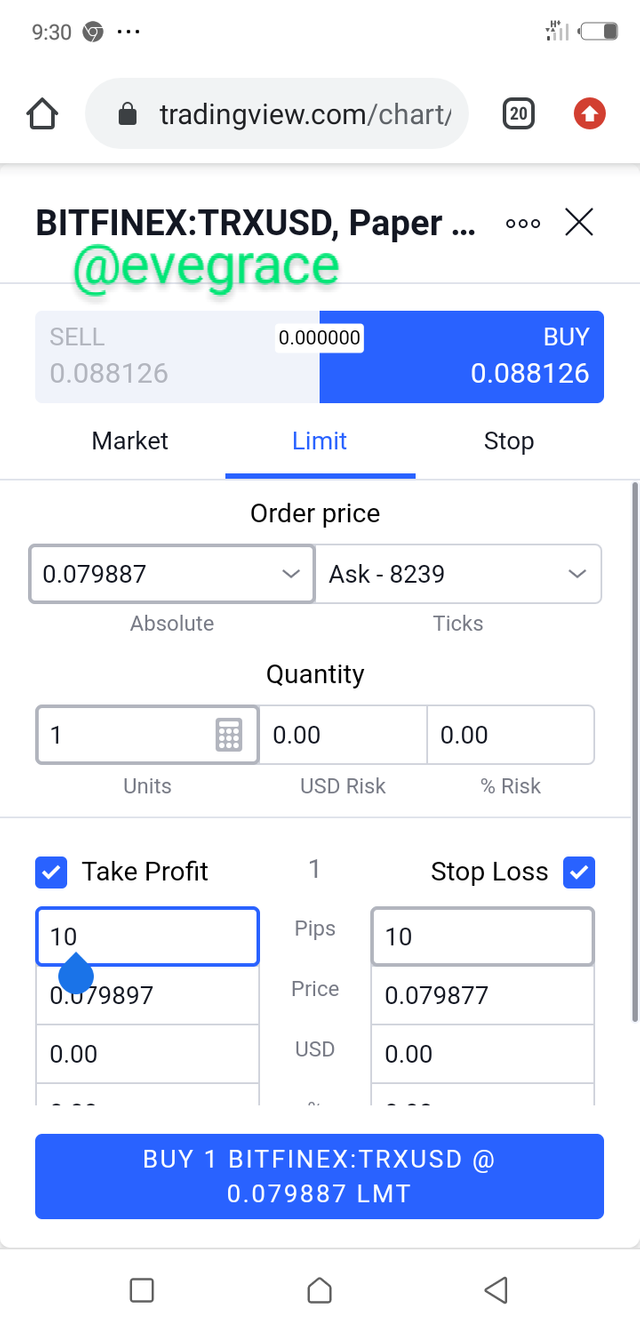

Trade Entry

Looking at the screenshot below, I made a trade entry when the moving average with 50 length crosses over the moving average with 200 length. A sell signal is identified as the 50 moving average crosses above the 200 moving average but a sell signal is identified when the 50 moving average crosses below the 200 moving average

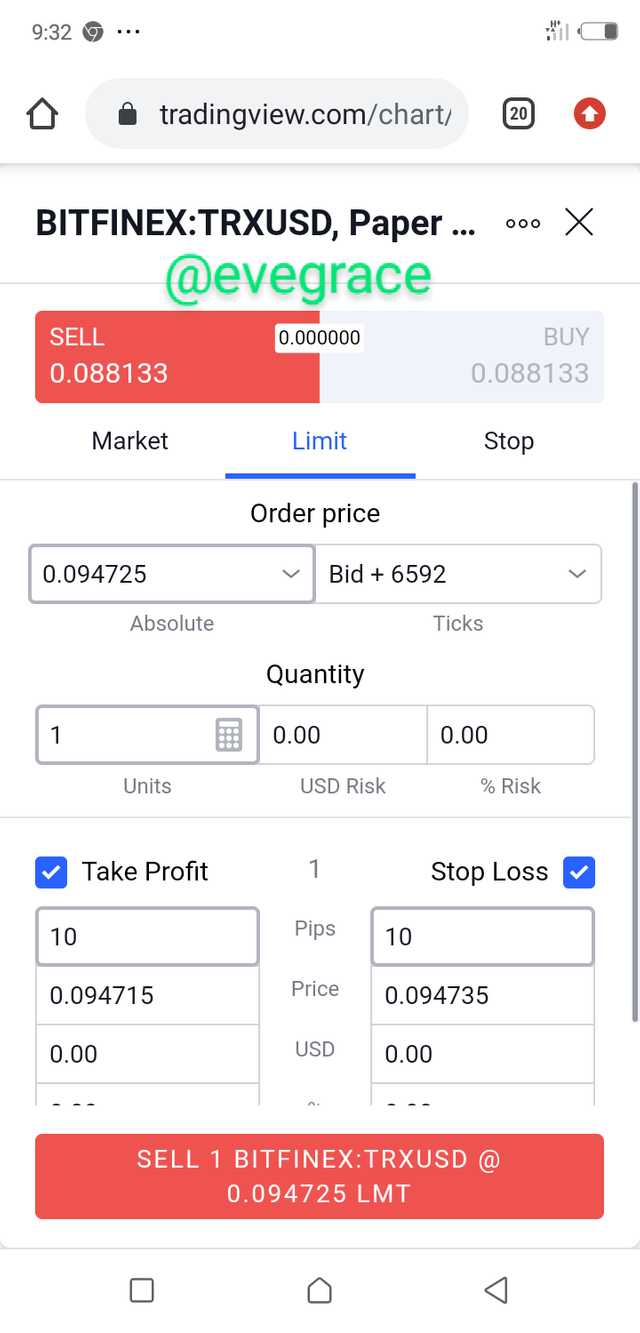

Trade Exit

Looking at the screenshot below, I had set a stop loss below the 200 moving average. so when the asset is in a bearish trend, whenever the current price of the asset reaches the stop loss limit, there will be an automatic exit of the trade so as not to incure huge loss.

Conclusion

As a trader, it is necessary to carry out a good trade management practice before trading or opening a trade as well as using the necessary tools like the stop loss, buy and sell stops and buy and sell limit. This will help traders to be able to avert possible loss while trading.

CC: @yohan2on

Hi

Thanks for participating in the Steemit Crypto Academy

Feedback

This is good content. Well done with your practical study on Risk management.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit