Good day everyone, today, I will be answering the questions stated below about Zig-Zag Trading from wonderful lectures from Prof @kouba01.

1. Show your understanding of the Zig Zag as a trading indicator and how it is calculated?

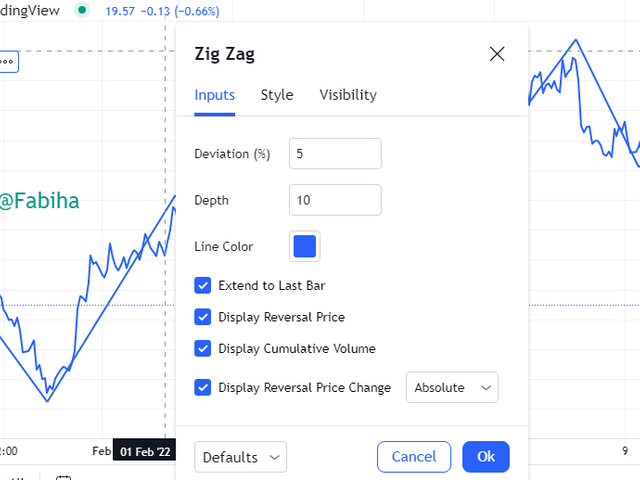

2. What are the main parameters of the Zig Zag indicator and How to configure them and is it advisable to change its default settings? (Screenshot required)

3. Based on the use of the Zig Zag indicator, how can one predict whether the trend will be bullish or bearish and determine the buy/sell points (screenshot required)

4. Explain how the Zig Zag indicator is also used to understand support/resistance levels, by analyzing its different movements. (screenshot required)

5. How can we determine different points using Zig Zag and CCI indicators in Intraday Trading Strategy? Explain this based on clear examples. (Screenshot required))

6. Is there a need to pair another indicator to make this indicator work better as a filter and help get rid of false signals? Give more than one example (indicator) to support your answer. (screenshot required)

7. List the advantages and disadvantages of the Zig Zag indicator:

8. Conclusion:

The Zig Zag indicator is a momentum indicator that can be designed to identify changes in price trends, that can show the weakest and strongest points on the chart, and then draw a line to connect them.

The Zigzag indicator joins different points on a chart, contains points via price movements. Compared to other indicators is very easy to interpret because it will deliver a clear and visible signal. It can also be used to eliminate market noise and short-term swings.

The Zig Zag Indicator could well try to concentrate on fast movements or Macro Separates when creating a line that joins the highs and lows of a chart. It'll also affect the Zig Zag Indicator to reject a mini motion that takes place on the cryptocurrency market, which is known for its fluctuations, and with this, the Zig Zag Indicator will be able to “ reduce noise or false signals.

Calculation of Zig Zag indicator:

The Calculation of any indicator Depends on the type of chart. The Zig-Zag indicator is a price movement indicator that focuses on historical price movements, It will be able to make rational decisions from the market's highest and lowest points. It depends on the maximum or minimum prices on the trading chart.

To Calculate the Zigzag indicator we have to use the Given Formula.

Zigzag = HL,% change = X, Retrace = False, Lastextreme = true

If the percent change is more than X, then draw a zig-zag graph.

Where, HL = Closing Price.

% change = Min Price movement (Percentage), new price-old price / old price x 100

Q 2. What are the main parameters of the Zig Zag indicator and How to configure them, and is it advisable to change its default settings? (Screenshot required)

The main parameters of the Zig-Zag indicators are as follows:

- Deviation.

- Depth.

Deviation

The deviation is a parameter that can be used by zig-zag to identify a new peak. It is in the kind of a minimum price change required for the ZigZag to detect a new peak is a maximum/minimum from the previous maximum/minimum. It usually denotes a percentage.

Depth

It is the parameter that is determined for a minimum distance (in candles), It could not be plotted by the zig-zag indicator when representing the new maximum or minimum value. In Short, The Depth parameter determines how many periods the zigzag indicator will take to plot a swing high or swing low.

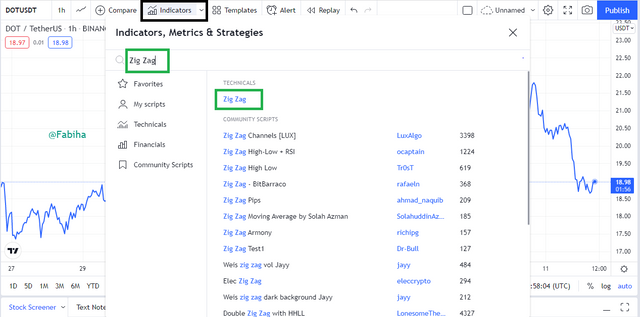

Now, I am going to add the Zig-Zag indicator to the chart.

In the image above First click on the indicators and then search Zig-Zag.

On the image above Click on Zig Zag.

In the image above we can easily see that the zig-zag indicator is successfully added to the chart.

Configuration

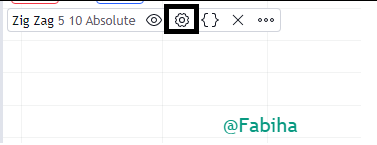

- First Click on Setting.

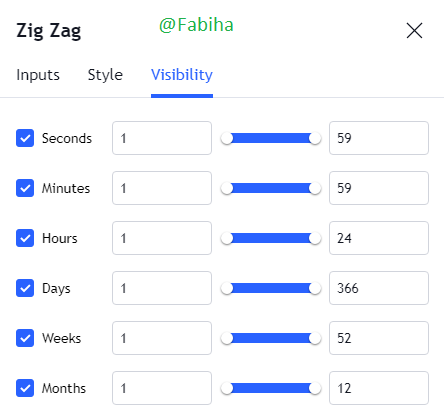

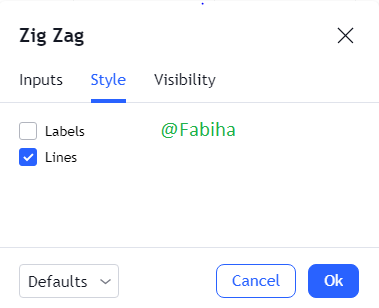

After this, the Popup will open which shows the visibility, style, and inputs As we will see in the zig-zag chart we will see many labels so I don't want to see these labels, So I click on style. After this, I will uncheck the labels.

Let's see what effects are on the chart.

Now, All the labels are Hide.

The input menu has deviation and depth which is the Main parameter.

Already the deviation % is set to 5 and depth is set to 10.

These are the parameters that can be set but there will be a risk chance if you are not an experienced trader so make sure first learn about trading then change the parameter and enjoy these trading.

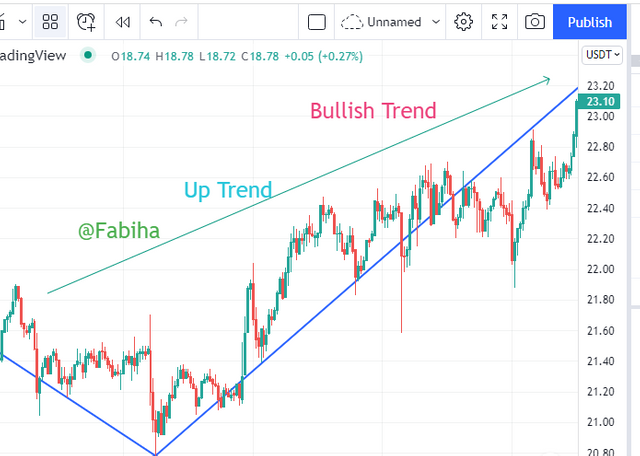

3. Based on the use of the Zig Zag indicator, how can one predict whether the trend will be bullish or bearish and determine the buy/sell points (screenshot required)

To Predict the trend is very important in trading, Mostly Professional Traders use Zig-Zag Indicator to determine the trend of the market. If we need to see if the trend is bullish, we need to look at the minimum and maximum values and minimums of the candles, because the maximums must be greater than the previous ones, and the minimums must also be higher than the previous ones. To see that the trend is bearish, we must look at the maximums and minimums of the candles, because the maximums must be lower than the previous ones, and the minimums must also be lower.

In the above picture, we will see that market is going down which means that the market is in a Downtrend and it will be a bearish Trend.

In the above picture, the trend is in Bullish Trend, the price is going up means it is an uptrend.

We will make the buy point if the market is in uptrend.

In the image above this is a Bullish trend.

We will make the Sell point if the market is in a Downtrend.

In the image above this is a bearish trend.

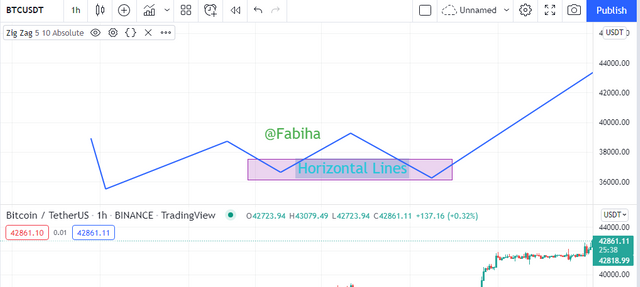

4. Explain how the Zig Zag indicator is also used to understand support/resistance levels, by analyzing its different movements. (screenshot required)

The Resistance and Support levels are price zones that provide traders with strong signals for trade positions that rely on them.

A resistance level is a point on a trend where the market continues to decline or Resistance levels are places where the market reacts to move downwards, On the peaks of the Resistance Level, there are Zig Zag horizontal lines visible with at least two linked swing high points. There are more odds of a trend reversal in the opposite direction at this level, where we saw severe resistance.

On the Lows, there are Zig Zag horizontal lines with at least two linked swing low points that lines are known as the support levels, In the opposite direction there are more possibilities of something like a trend reversal at this level, where we noticed strong support.

5. How can we determine different points using Zig Zag and CCI indicators in Intraday Trading Strategy? Explain this based on clear examples. (Screenshot required))

The CCI is an oscillator that clarifies market frustration, was designed to detect long-term trend changes, but sometimes investors are linked into swing trading strategies, finding everything just beneficial including all times. Such a tool represents the actual value over a given timeframe and generates signals.

I will ad the CCI indicator to the chart.

In the CCI indicator, the Market is overbought when the market is above +100 and the market is oversold if the market is below -100.

The data is crucial because when the zig-zag indicator forms swing lows and highs, we can validate a buy or sell entry using both regions of Buying and selling. This data is essential because when the zig-zag indicator forms swing lows and highs, we can validate a buy or sell entry using the overbought and oversold regions. Our objective to using these signals is all about being capable of recognizing inputs with zigzag zag as well enhancing the quality and reducing mistakes

BUYING POINT:

The market is on an uptrend, in a bullish trend and this was a perfect time for a buy entry. In the image Below I make a buy entry.

In the image above there is a break out in the last maximum value of the zig-zag and the CCI indicator is above 100 bands.

SELLING POINT

The market is in a Downtrend there is a bearish trend in the market and there is a breakout in the last minimum value of the zig-zag indicator and the CCI is below -100.

6. Is there a need to pair another indicator to make this indicator work better as a filter and help get rid of false signals? Give more than one example (indicator) to support your answer. (screenshot required)

Yes, this is very important to pair another indicator because as we know no indicator is 100% Reliable so we need to add more than one indicator to get a good output. If every indicator gives different results so somehow this is not good means some indicators give the false signal, results. or If I talk about Zig zag indicator It can not give an accurate result, it gives false signals.

Let's take an example. I will use another Indicator with Zig Zag.

- KDJ indicator

- Simple Moving Average (SMA)

KDJ indicator

The KDJ indicator is also known as a random index, and random index is another term for it. It's a type of technical indicator that shows the trends of an asset and identifies entry and exit opportunities.

This indicator indicates if a region is overbought or oversold. When the lines are above 80%, it is considered to be an Over-Bought region, and when the lines are above 20%, it is said to be an Over-Sold region. While some traders use a range of 75 to 100 for overbought and 0 to 30 for oversold, others use a range of 75 to 100 for oversold. It also tells us about the current market trend. When the indicator is in an overbought region. It looks for a purchasing opportunity when the indicator enters the oversold region, which is defined as a fall of 20% in a year.

7. List the advantages and disadvantages of the Zig Zag indicator:

- It can be designed to identify changes in price trends so, By the Zig Zag indicator, we can easily identify the trends.

- When compared to other indicators, it is quite simple to understand because it provides a clear and visible signal.

- The Zig Zag Indicator will be able to reduce noise or false signals.

- It will be used to easily spot large market changes and therefore can be linked with other indicators to make a trading unit.

- All leading indicator signals are required. in order to choose the necessary signals to enter a trade. A Zig Zag Signal is the indication just because it totally depends upon signals for interpreting market movements.

- The Zig Zag Line is not Permanent due to which it provides false signals.

- All signals outside of the range are hidden because they are depending on the indicator settings.

- The biggest disadvantage of this indicator is that the line chart appears after the momentum has formed.

8. Conclusion

Zig Zag indicator is a momentum indicator that can be designed to identify changes in price trends, that can show the weakest and strongest points on the chart, it will deliver a clear and visible signal. It can also be used to eliminate market noise and short-term swings.

I'm grateful for helping me in learning through this. Thank you for reading and thanks to Prof. @kouba01 for this insightful Lesson I can learn a lot from this lecture and I try My best to Explain this in My own Words. Once again Thank You so much for reading my post.

Regards,

Respectfully Mentioned,

All the Screen Shots are taken from Trading View. and Grammar check from Grammarly