Good Day All, Today I am talking about my assignment for Professor @redileep in the Steemit crypto academy intermediate course program.

1- Define TD Sequential Indicator in your own words.

The TD Sequential indicator is a technical indicator created by Tom Demark, a technical analyst. This indicator is used to determine if a price trend is up or down. It makes transactions & available to the user. This TD process seems to be a tendency to buy indicators that identify a defining moment during a commodity's trading price.

The series indicator is made of special symbols, calculating from 1 to 9 again for the initialization process to Thirteen again for the reduction stage. which appear under the candles inside a trend and just above the candles inside a bearish trend

2-Explain the Psychology behind TD Sequential. (Screenshots required)

TD Sequential is divided into two phases: TD Setup and TD Countdown. The first calculates basic impulses that construct the pattern upon a graph, while the second displays a trend's trend or role.

The requirements for a TD Countdown reversal signal are provided by the TD-Setup pattern. Furthermore, these TD Companies setup helps us to determine if the market can advance inside the manner of a pattern or be restricted inside its progress.

The TD sequential indicator helps in detecting market trend completion of market flip. There are two types of setup for the setup phase: purchase setup and sale setup. The price must move up for the sell setup to happen, and down for the buy setup to happen, understanding also that actual sale that makes a lot of money is at a higher cost, expensive cost, as well as the purchase which makes money is at a discount price.

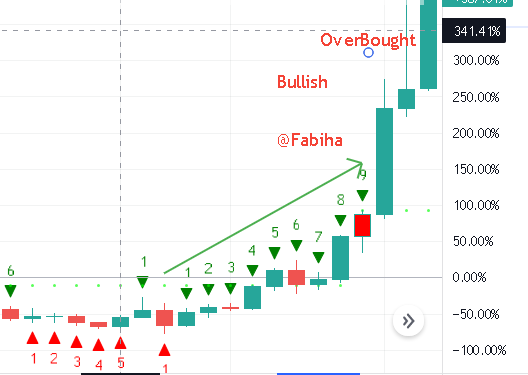

In the above picture, we see that the count is moving in an uptrend.

When the market is trending downward and the numbers are below the Candles, there may be a correction or reversal after 9 numbers, at which point we can begin a Buy position.

3-Explain the TD Setup during a bullish and a bearish market. (Screenshots required)

Bullish Market

When the market moves in the other direction, a Bullish Market Point or Buy Setup develops. When the market is trending downward, we may use TD Setups to determine the reversal point and hence indicate a bullish market.

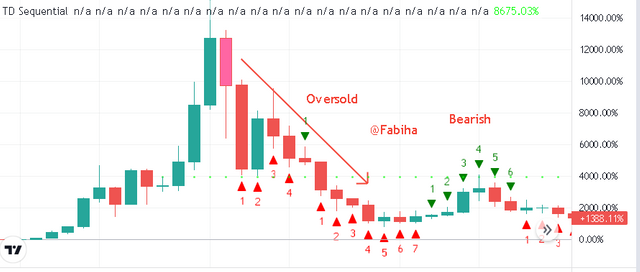

Bearish Market

The Market is bearish so the TD sell setup is in the market, TD Sell Setup happens when the market is moving upward. For a Bearish Market as well as Setup, several conditions must be satisfied.

In TD Setup, there are amounts generated up or down candlesticks. Therefore, now may examine that TD No.1 Candles, which has to be bullish, and the purchase of the TD No.1 Candle must be higher than the final of both the other 4 Candles, each of which had to be in a bullish direction, indicating that the market is oversold.

4- Graphically explain how to identify a trend reversal using TD Sequential Indicator in a chart. (Screenshots required)

The TD Sequential Indicator is used to identify commodity changes of direction and collapses.

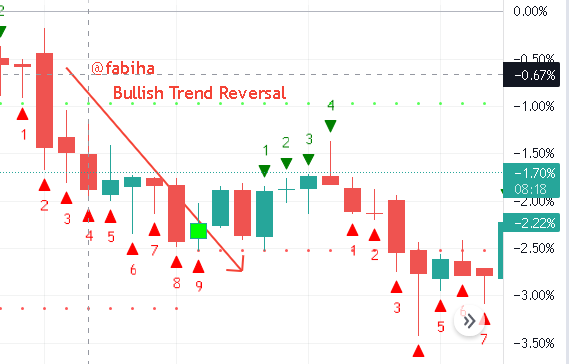

The TD sequential indicator should give a count on a continuous bearish candlestick to signal that there is a downtrend to identify a positive trend reversal. A bullish market, on the other hand, arises when there has been a significant bearish tendency, as we all know. As a result, we let the downtrend numbers fall within eight to nine numbers to determine that whether the bearish trend is strong. There is no doubt that the Bullish market will have a bullish trend reversal.

DOWNTREND REVERSAL

The market should be trending downward, — in other words, its price should be falling.

We will search for Candles to identify the trend reversal if there is a continued downward trend. We need to look at the TD Number 1 Candle, and its closure must be lower than the closing of the preceding 4 Candles. As a result, the TD Number 1 Candle will move downward, It will move downward until it reaches TD Number Eight, nine, then after its development of TD Number 8 or 9 Candle, there will be Trend Reversal.

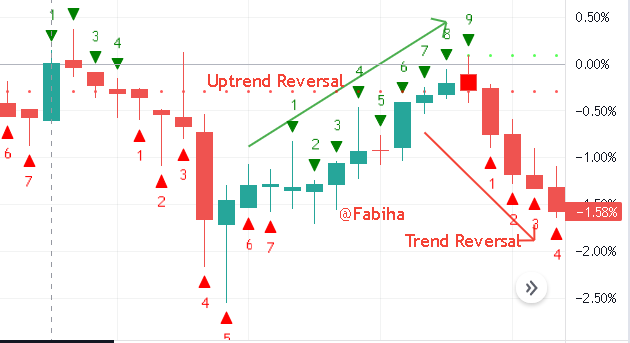

Uptrend Reversal

We will start examining the TD Number 1 Candle, as well as the TD Number 1 Candle's close must be greater than the closing of the last 4 Candles.

As a result, the TD Number 1 Candle will move upward and will continue that until it approaches TD Number 8 or 9, at which point there will be a Trend Reversal, and the market will go downward.

5-Using the knowledge gained from previous lessons, do a better Technical Analysis combining TD Sequential Indicator and make a real purchase of a coin at a point in which TD 9 or 8 count occurs. Then sell it before the next resistance line. (You should demonstrate all the relevant details including entry point, exit point, resistance lines, support lines, or any other trading pattern such as Double bottom, Falling wedge, and Inverse Head and Shoulders patterns.)

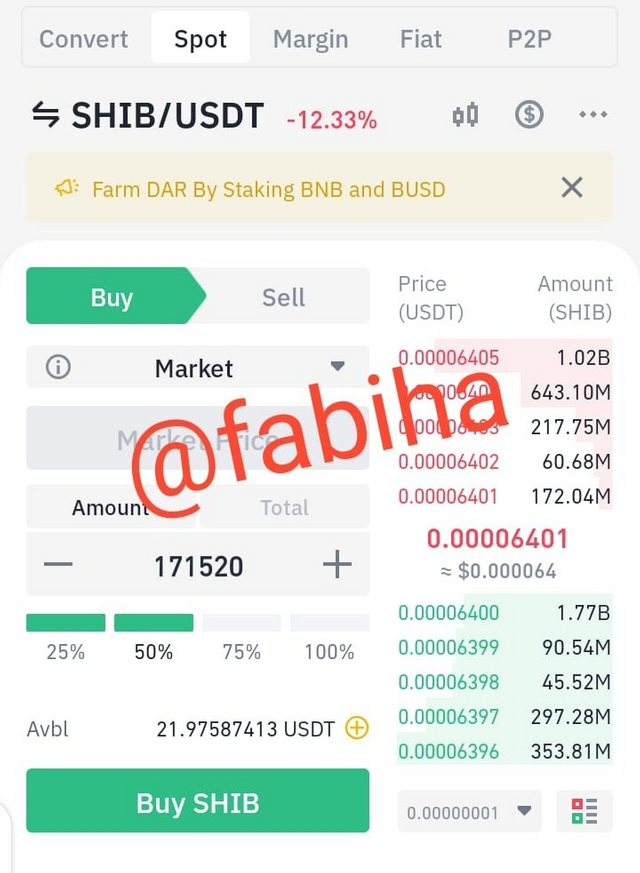

I will be using Shiba/USDT Pair.

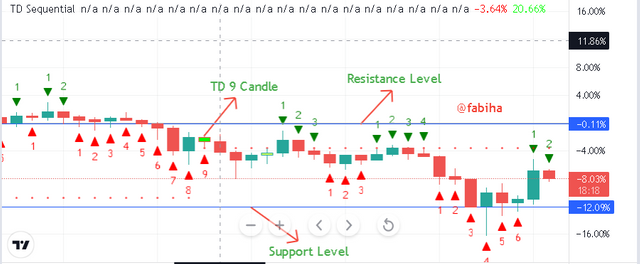

In the above image, there is an entry point also a resistance level and a Td 9 Candle which is downward. and at the bottom, there is a point that was moving downward get a stop loss which is support level.

I purchased SHIBA/USDT

STEP 1:

Search Shiba

I purchased it at a market price.

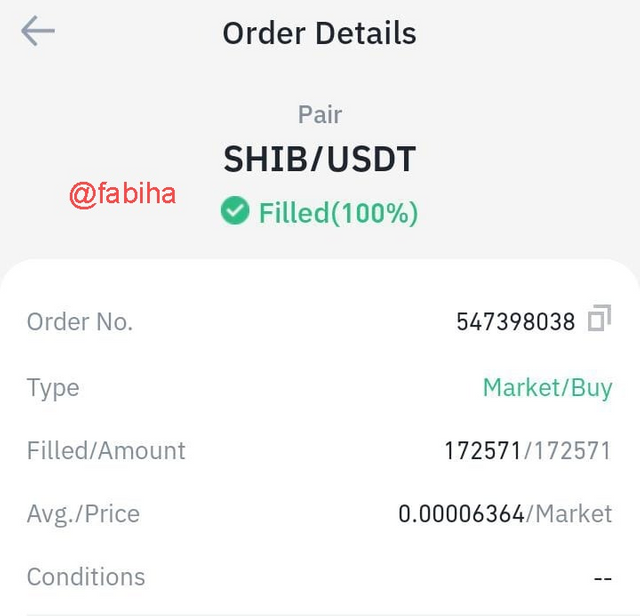

I purchased that coin at a market price of 0.0000634. and sell it after some time at a price of 0.00006343.

From the screenshot above you can easily able to see that I have gotten a few loss in this meme coin Shiba.

REGARDS,

RESPECTED MENTION,

PROF.@reddileep

Congratulations, your post has been upvoted by @dsc-r2cornell, which is the curating account for @R2cornell's Discord Community.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

#club5050 😀

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit