Good day everyone, today, I will be answering the questions stated below about trading strategy with RSI + ICHIMOKU from wonderful lectures from Prof @abdu.navi03.

1-Put your understanding into words about the RSI+ichimoku strategy

2-Explain the flaws of RSI and Ichimoku cloud when worked individually

3-Explain trend identification by using this strategy (screenshots are required)

4-Explain the usage of MA with this strategy and what lengths can be good regarding this strategy (screenshots required)

5-Explain support and resistancet with this strategy (screenshots required)

6-In your opinion, can this strategy be a good strategy for intraday traders?

7-Open two demo trades, one of buying and another one of selling, by using this strategy

Firstly, No indicator is 100% Reliable. So indicators can not be used alone. In the unpredictable cryptocurrency market, the RSI (Relative Strength Indicator) and Ichimoku clouds indicators are applied with each other to carry out effective buying and selling choices. When we used this indicator separately so, they can give inaccurate signals and When We used signals collectively, these indicators are quite useful. let's talk about that one by one.

RSI is also known as the Relative Strength Indicator, is a market level indicator that uses a sine wave output to display market levels, — in other words this same indicator spins among both support or resistance levels. The RSI indicator indicates whether the market is overbought or oversold. Then it indicates whether the buyers or the sellers are in command. The oscillations bar fluctuates for both the 0-100. When the line is above 70 then it means that the market is in Bullish Trend means the region is Overbought and when the line is below 30 it means that the market is down which means that the Oversold Region occurs, Hear the market is in Bearish Trend.

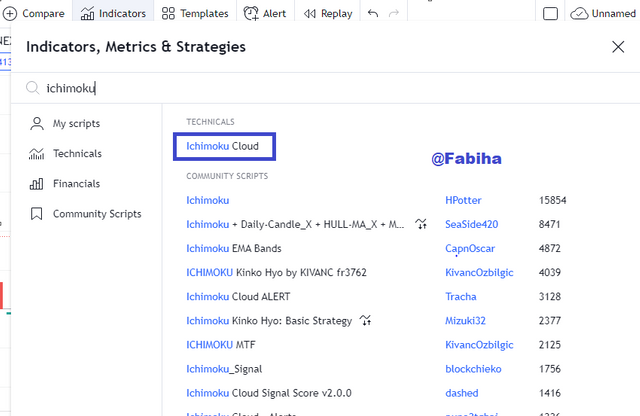

ADDING ICHIMOKU INDICATOR TO THE CHART:

STEP 1 :

Go to TradingViewchart

STEP 2:

Click on indicators.

STEP 3:

Search Ichimoku.

STEP 4:

Click on Ichimoku Cloud After that Ichimoku indicator is Successfully Added to the chart.

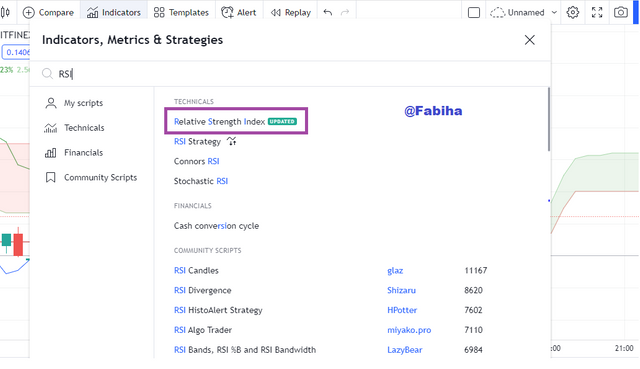

Now I am going to add an RSI indicator means relative strength index.

Same Steps on Step 3: Search RSI

STEP 4:

Click Relative Strength index. Then the indicator is successfully added to the chart.

In the above picture, we can see that the RSI line is Above 70 Which means that the market is in Bullish Trend and the trend is Overbought, which means that the buyer is in control.

2 - Explain the flaws of RSI and Ichimoku cloud when worked individually

RSI FLAW:

In the above picture, I Highlight the Flaw. As we see that it provides false signals. It shows that the market is in Bearish Trend but it was not, Market is not in a Bearish Trend market will be in a Bullish trend which means that It gives False Signals. Many traders lose money due to that signals, Currently, the market is in Bullish trends that market is Moving up but due to False Signals traders doesn't know where to go.

One more flaw I have seen in RSI is that it is still not indicated for scalp strategy because it fluctuates for quite a long period between bullish or bearish situations, stopping investors from making better price action.

Ichimoku cloud Flaw

It is composed of the following lines that are stretched out on the chart to form a cloud. Such indicators are quite valuable for technical analysis, although they do have certain disadvantages.

The most prominent and significant downside of the Ichimoku Clouds indicator would be that it generates trades recommendations very late than some other signals. As we know it is a lagging indicator, users maybe capture the trend late if you rely alone on it also this indicator does not indicate momentum.

In the above picture, we can see that the current market is in a bullish trend the ICHIMOKU Cloud indicator's biggest problem is that it delivers up indications extremely late. For example, if the market seems to be bullish however the indication sends the signal late, a trader would face a collapse at that time.

Q3. Explain trend identification by using this strategy?

BEARISH TREND

For Every Aspect to identify a trend is very important, We Need to keep an eye on Both Indicators and then we check what is the current trend. When the line is above 80 then it means that the current trend is Bullish and for below 30 The trend is Bearish. Let's Determine the trend, do this by adding both indicators at the same time.

In the above picture, we easily determine the trend, currently, our both indicator is in Bullish Trend. and it means that they both are in Overbought Region.

BEARISH TREND

The Trend is Bearish we see in the image below because the line in RSI is below 30 which means that the indicator is in the oversold region means that the trend is Bearish Trend.

Q 4 - Explain the usage of MA with this strategy and what lengths can be good regarding this strategy (screenshots required)

Moving Average Lines are often used to develop a sequence of means to assess various pieces of data. Another indicator considered for technical indicators is indeed the moving average (MA). This improves you quickly identifying current, simple variations, is a lagging indicator it works to find the effective points of markets over a given period, to filter overall price data volatility.

I will be using the Weighted Moving Average (WMA).

In the above image, the trend is bearish, Weighted moving average indicator helps to find the current trend of the market so, the current market was in the overbought region. In the chart of DOGE/USDT, It can not give false signals, it gives true signals on both indicators. In the chart, the WMA length is 20. It helps to confirm the trend changes for RSI and Ichimoku.

5 - Explain support and resistance with this strategy (screenshots required)

The Support and Resistance are different. At the support level, we can see that the trend is a reversal and the price of the asset is moving in a downward direction. Means in support level the trend is Bearish. Whereas, resistance is the level or point from which the price normally falls; even so, if a market candlesticks cross through the resistance level, the market enters an uptrend. This means the price of the asset is moving in an upward direction. and the trend is bullish.

Support and Resistance Strategy

When trading in the support and resistance levels with the RSI + Ichimoku technique in a trending market, people should first look for Ichimoku, because it will perform a vital part in our trades. We observe the Support and Resistance levels on the chart, therefore users firstly check at the Ichimoku clouds, which assist us in identifying both Support and Resistance levels in the chart.

We can observe that the ICHIMOKU clouds will be below the price movement to find the support level. When the Ichimoku Clouds are above the price movement as well as the clouds are Red, then consider it just a Resistance level, and once the cloud is Green, we consider it a support level.

In the Above Picture when the price is moving up then the support level occurs and when the price is moving down then the support level break. and after moving forward we shall see that the price is moving down and up when the price is moving down then the trend is bearish. and in bearish trend resistance level occurred.

The above picture clearly shows that the cloud is green so this is a bullish trend and the price is moving up and here, the support level occurs.

The above picture clearly shows that the cloud is Red so this is a Bearish trend and the price is moving down and here, the Resistance level occurs.

6 - In your opinion, can this strategy be a good strategy for intraday traders?

Yes, this can be a good strategy, Because, We understand that just by combining the RSI and the Ichimoku Cloud indicator, users can make the maximum potential outcomes. Because the RSI indicator alone reveals the market's overbought and oversold levels, the Ichimoku clouds indicate the trading market's direction, momentum, and period.

Every buying and selling approach is suitable if it is implemented correctly. To use a trading strategy properly, the trader must-have skill and concentration. Intraday traders might use the approach for identifying market entry and exit points. that is the most significant aspect for such traders to know when to enter and quit the market. The most important thing to know is that if you have the best indicators but you don't know how to work on them then you are not becoming a great trader. Taking full advantage of that too, we should understand how these indicators work.

7 - Open two demo trades, one of buying and another one of selling, by using this strategy

BUYING

In the above picture, I see that the support level has occurred on both indicators RSI as well as Ichimoku and they both are in Overbought Region, which means they both are in Bullish Trend so, I make the Buy trade and take the profit of 1:2.

SELLING XRP/USDT

In the above picture, I see that the resistance level occurred on both indicators RSI as well as Ichimoku and they both are in Oversold Region Here, the trend is Bearish, then I make the sell trade with stop loss and take profit.

Conclusion

In the unpredictable cryptocurrency market, the RSI (Relative Strength Indicator) and Ichimoku clouds indicators are applied with each other to carry out effective buying and selling choices. When we used this indicator separately so, they can give inaccurate signals and When We used signals collectively, these indicators are quite useful.

I'm grateful for helping me in learning through this. Thank you for reading and thanks to Prof. @abdu.navi03 for this insightful Lesson I can learn a lot from this lecture and I will try My best to Explain this in My own Words. Once again Thank You so much for reading my post professor.

Regards,

@fabiha

Respectfully Mentioned,

All the Screen Shots are taken from Trading View. and Grammar check from Grammarly