Good day everyone and Asallamualaikum professor,

I am very delighted to be part of this wonderful lecture and on the topic about exchange order book, how to place stop limit order and OCO and how order book help in trading to gain profit. I will like to thank our noble professor @yousafharoonkhan for that wonderful lecture.I really enjoyed and learnt a lot so am kindly here to present to you my work.

Question 1

What is meant by order book and how crypto order book differs from our local market. Explain with examples (answers must be written in own words, copy paste or from other source will not be accepted)

ORDER BOOK

Order book is the total addition or bringing together of records of traders in the crypto market which involves those buying and selling. This simply means that records involving crypto sets are been stored especially when such crypto currencies has a lot of value so therefore when sold one day profit will be made because all eyes of traders will be on them to also trade and get something. It also helps traders to know the price of crypto asset pairs because they will be made known in the market.

There is also a platform for traders in which traders can agree on how their crypto asset will be traded. So the seller will tell you this or her price, if it’s good for you the buyer the agreement will be made and the crypto asset will be bought.

DIFFERENCES BETWEEN CRYPTO ORDER BOOK AND THE LOCAL MARKET

There is a lot of differences between crypto order book and the local market. Below are some of them :

1.In the crypto order book, prices are not nailed they always change as times goes on let’s take bitcoin for example : Yesterday it was around $40,000 but today as we speak it has reduced to a price of 37,000.

But in terms of the local market, prices usually stay at one place for a long time before it will increase or decrease.Example here to like a went to a store to ask of a price of a phone, I can go back to the same store in the next two weeks or even more and the price will still be the same.

2.In a crypto order book for a trader to buy or sell any crypto asset, pairing of crypto currencies will be done before trading will be done successful.

But with the local market things are not done so. You can buy anything of your choice using your country’s approved currency.

3.In a crypto asset book, prices of crypto assets can either be increased or decreased by the seller or the buyer. Price limits can also be set by a trader so that anytime it reaches the price you want to purchase then you do so.

But as for the local market, you the one buying need to interact well with the seller before price will be reduced for you and sometimes they will still be on their price.

Question 2

Explain how to find order book in any exchange through screenshot and also describe every step with step with text and also explain the words that are given below. (Answers must be written in own words)

Pairs

Support and Resistance

Limit order

market order

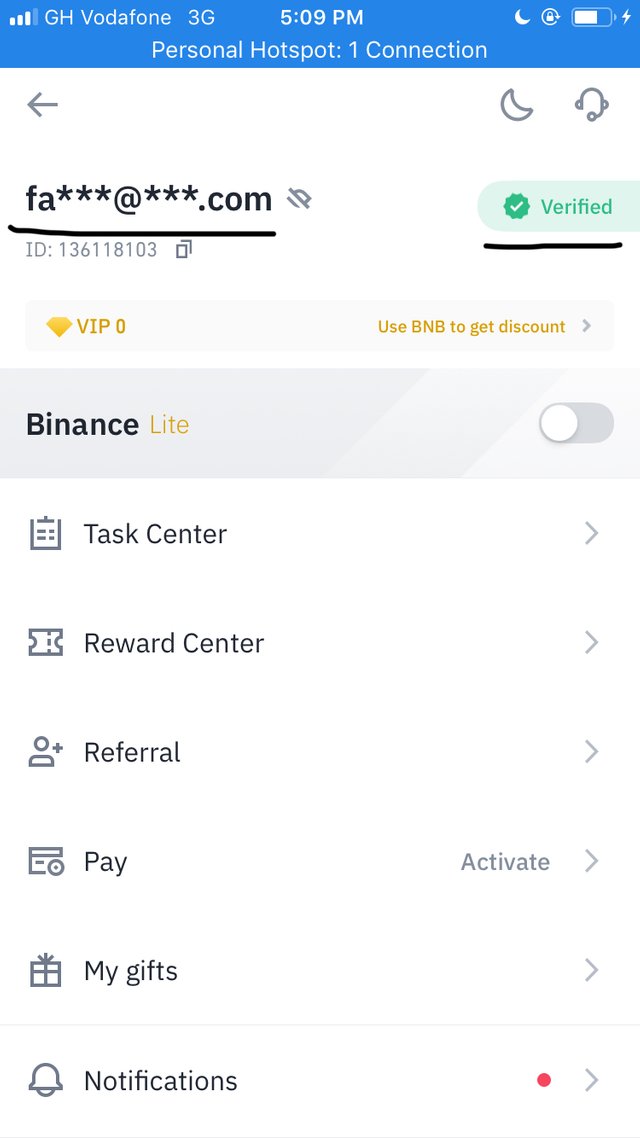

The process in which you can follow to get a an order book exchange is not difficult at all, and for me I will be using my verified Binance account to take you through all those processes.

Below are the steps and some clear screenshots involved :

STEP 1

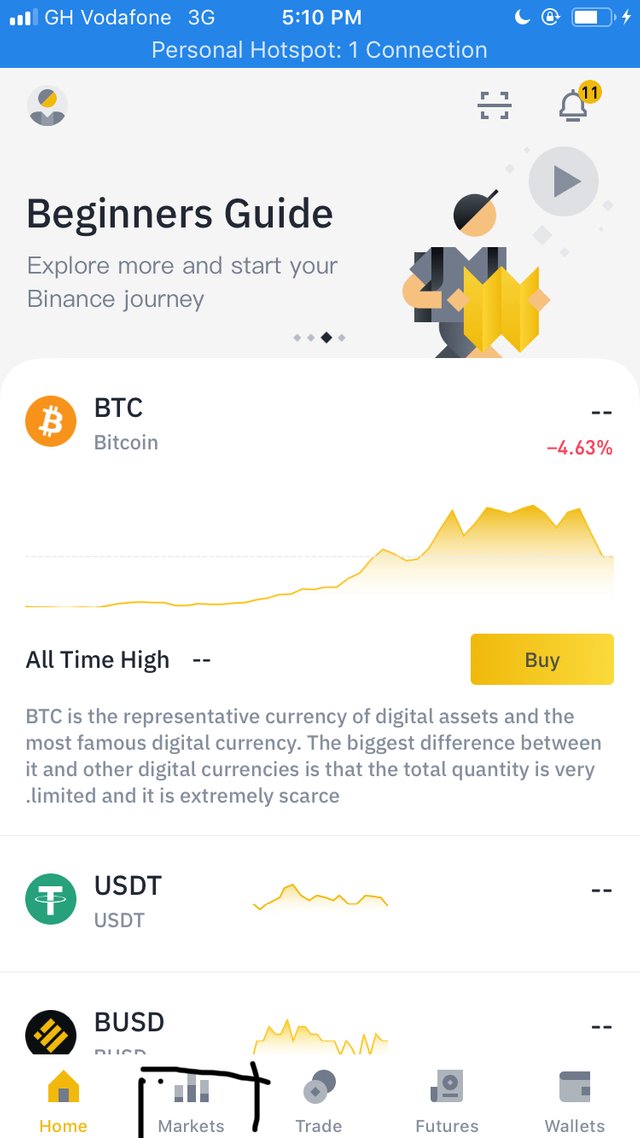

I first open my Binance exchange wallet page and then click on market which you can find down there.

STEP 2

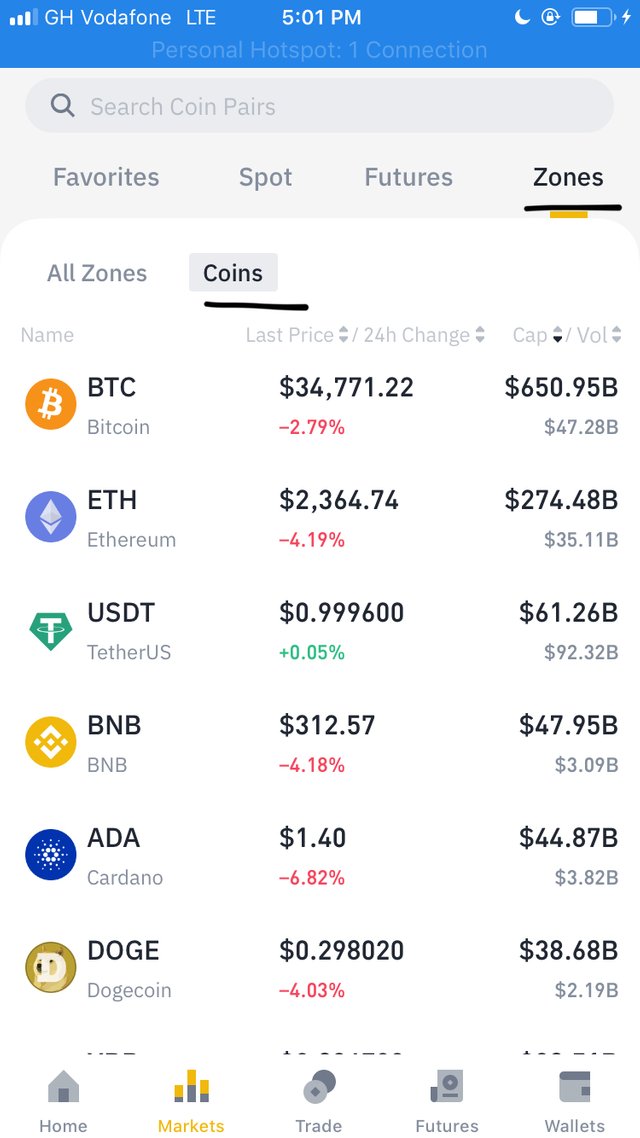

A pop up menu will appear which you will click on coins. When you click you will see all the coins listed according to their value in the market.

STEP 3

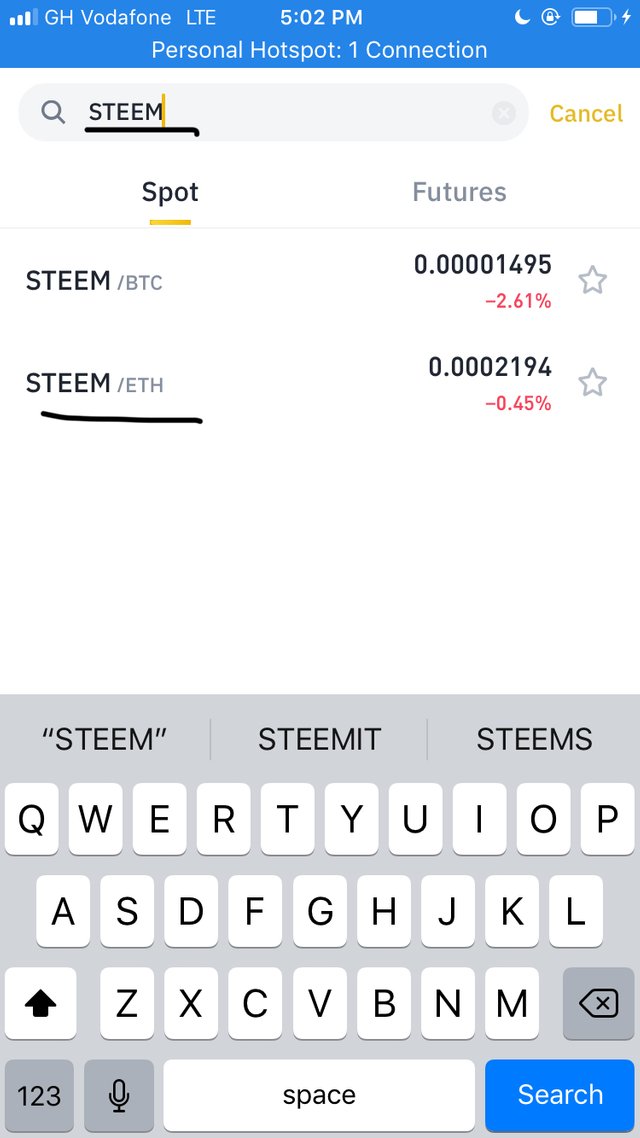

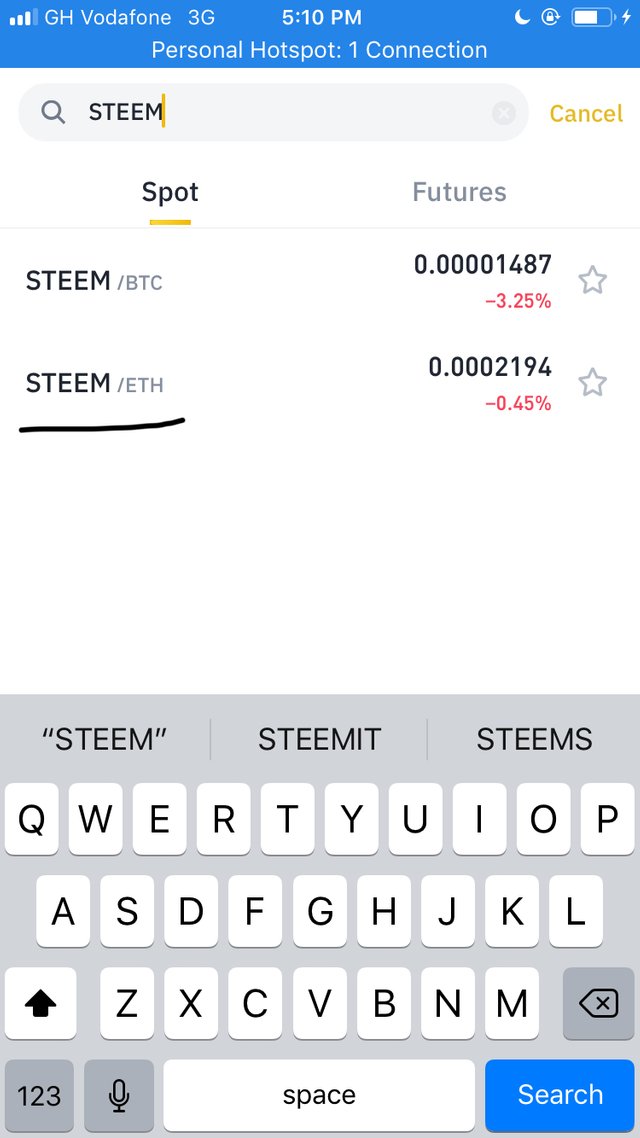

Which the help of the search engine at the top, you can search for any cryptocurrency and get to know it’s order book.

STEP 4

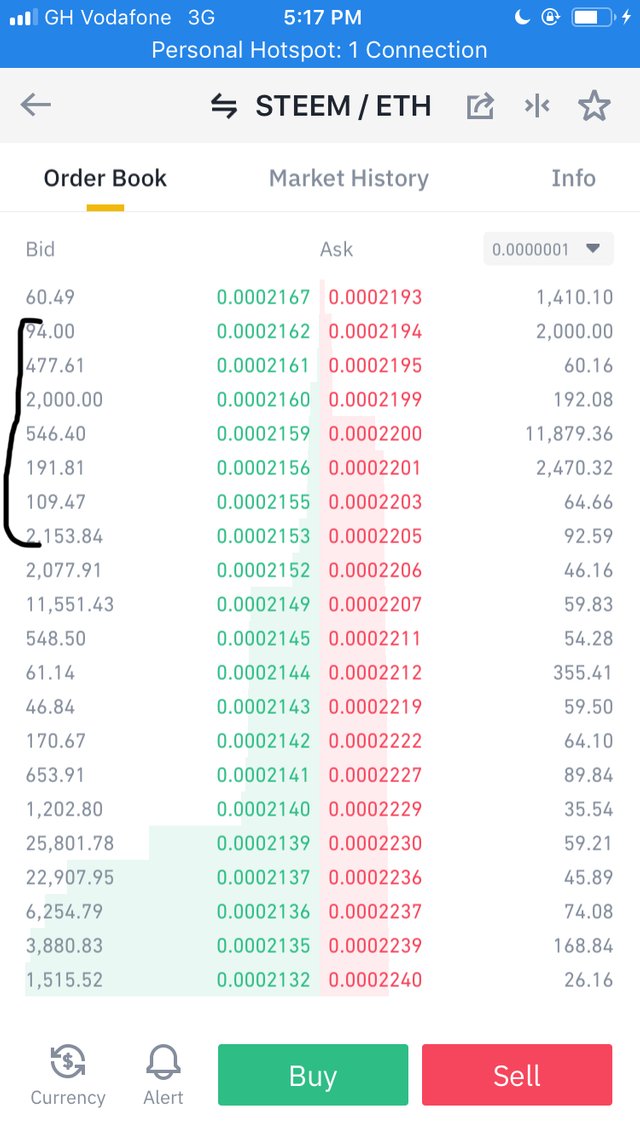

I decided to search for steem and chose Steem/ETH to get to know it’s order book.

STEP 5

As you can see below the order book shows and a number of buyers and sellers have been listed according to their trades.

PAIR

This is the process whereby a trader traded on a certain crypto currency for another crypto currency. The last crypto currency he or she is trading for is what we call pair. Example like I have steem and am trading for ETH in that process is what is termed as steem.

SUPPORT AND RESISTANCE

Support level is level whereby when crypto currencies get to that level they mistly stop dropping. In that level of time, a lot of trades buy those kind of cryptocurrencies a lot because they know that the end of it dropping and when that crypto currency finally rise they make a lot of profit.

Resistance level is simply a level when crypto currencies reach they stop rising. At this point to that is when a lot of investors sell their crypto asset and waits till it falls then they buy another one.When prices of cryptocurrencies get to this level they decrease in price again.

Below is a well shown graph of support and resistance level of ETH and USD.

LIMIT ORDER

Limit order is a level in which you can set for yourself in a matter that when crypto’s sets get to that level you will be alerted to either sell or buy. In this process it helps you the trader to get more profit when trading.Let me give you an example like I had $1,000 and I wanted to buy bitcoin which currently mid $1,200, in this case I will quickly enter a price limit for myself and wait till it gets to that level before I purchase my bitcoin.

MARKET ORDER

Market order refers to the price of cryptocurrencies we have currently in the market. In any crypto market platform you can see that there a selling and buying price attach to each cryptocurrency. Sometimes to a lot of investors take risks to buy crypto assets with their current price especially when they hear a rumor that it might fall and especially when money is needed urgently.

QUESTION 3

Explain the important feature of order book with the help of screenshots. In the meantime, a screenshot of your exchange account verified profile should appear( Answer must be written in your own words)

The features involved in an order book are many but I will be emphasizing on the key ones and the keys ones are the indicators.

Below are some of the indicators and they are:

1.RSI

2.VOLUME(VOL)

3.KDJ

4.MACD

RSI

The RSI indicator is a type of indicator which helps an investor to know the price level of each and every crypto assets. It can also be known in different ways especially when the crypto set is around 70 that’s the turn investors make more profit because that type of crypto asset will be valued on the market and the reason behind is that a lot of people will buy them. Also when the TSI shows a number less than 30 then it means investors have sold that type of crypto asset a lot and at this time I will advise you not to buy that kind of crypto asset because it can fall at any moment.

Below shows a clear screenshot of a RSI indicator

VOLUME

With this kind of indicator, it helps investors to determine a risen or fallen crypto asset in the market. They are thereby shown by green and red. When ever it shows the green color it means there is hope because that crypto currency is risen. The green color mostly appears to when that crypto asset type is valued in the market.Also when ever the red color shows, you need to start bleeding because the price of that particular crypto asset is decreasing in price slowly and at that point I will advise to buy if you can.

Below shows a clear screenshot of a volume indicator

KDJ

This is a type of indicator which helps one to know what is going to happen to a crypto asset in the near future and they do so by using values. When ever it is sold a lot on the market it shows a number of 20 and whenever it is bought on the market it again shows a number of 80 so take note.

Below shows a clear screenshot of a KDJ indicator

MACD

This type of indicator is more unless like the KDJ because it also let you get to know what is going to happen to a crypto asset in the near future. This one goes to to do with a line. When ever the signal line is is below the MACD line ii is called Bearish reversal but when ever the signal line is above the MACD line then it is also known as a Bullish reversal.

Below is a clear screenshot of a MACD indicator

QUESTION 4

How to place Buy or Sell orders in Stop-limit trade and OCO,? Explain through screenshots with verified exchange account. You can use any verified account. ( Answer must be written in your own words)

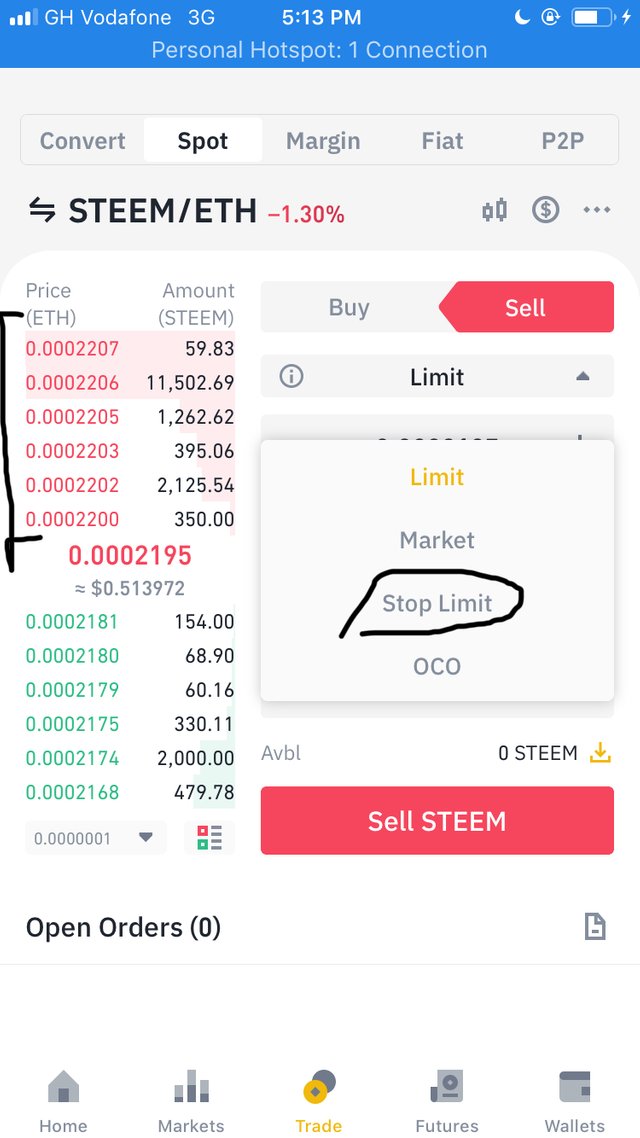

These are some steps involved when placing a stop limit and an OCO to buy and sell. I will kindly list steps down with the help of clear screenshots below:

But before that I will actually let you to have some knowledge about Stop limit.

STOP LIMIT

Stop limit is the act by which investors decide as to go into the market trade to either buy or sell and with the help of the sop point you will actually know when amount will get the limit you want and then you can proceed with your trade.

Below are the steps you are to go through :

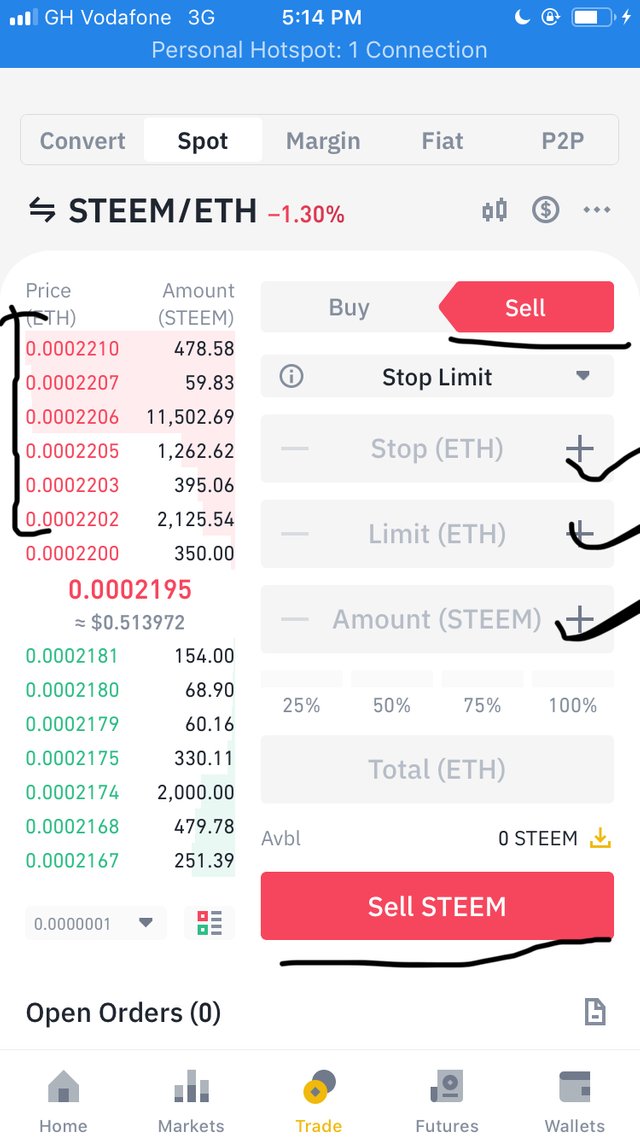

STEP 1

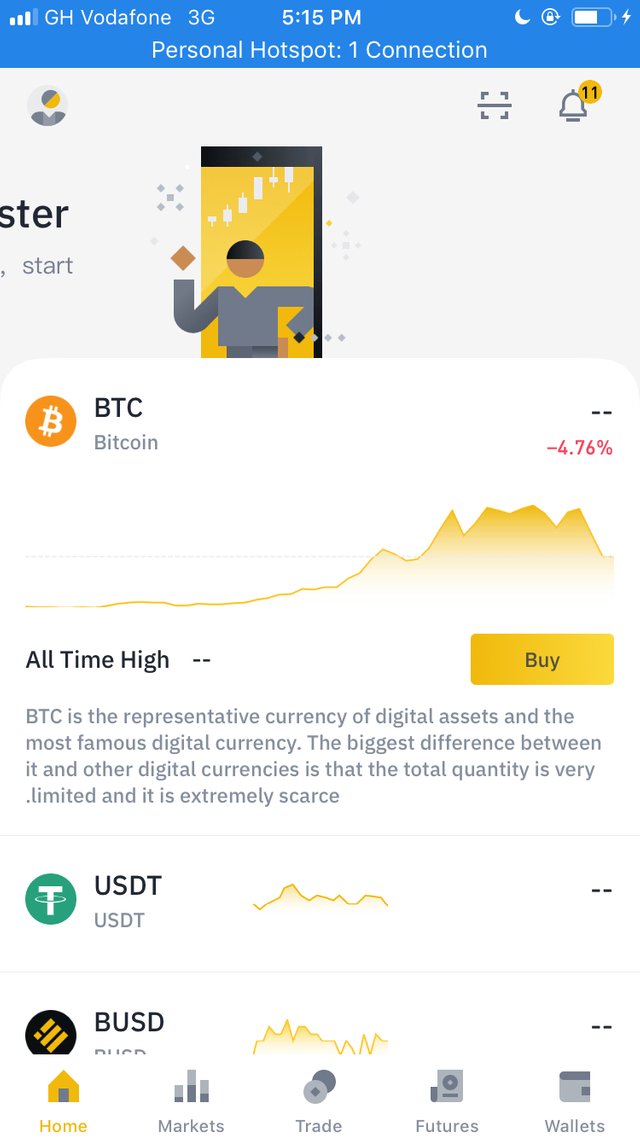

Here is the view of my verified account, on the same page click on Market.

STEP 2

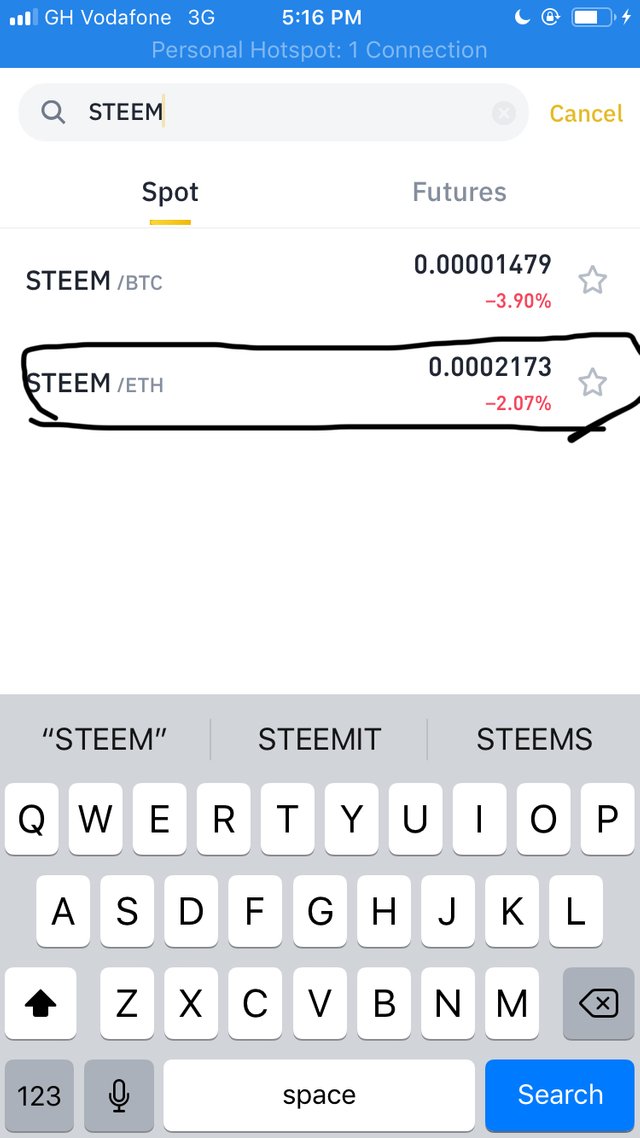

With the help of the search engine type the name of any crypto asset of your choice. I will search for steem and choose my STEEM/ETH.

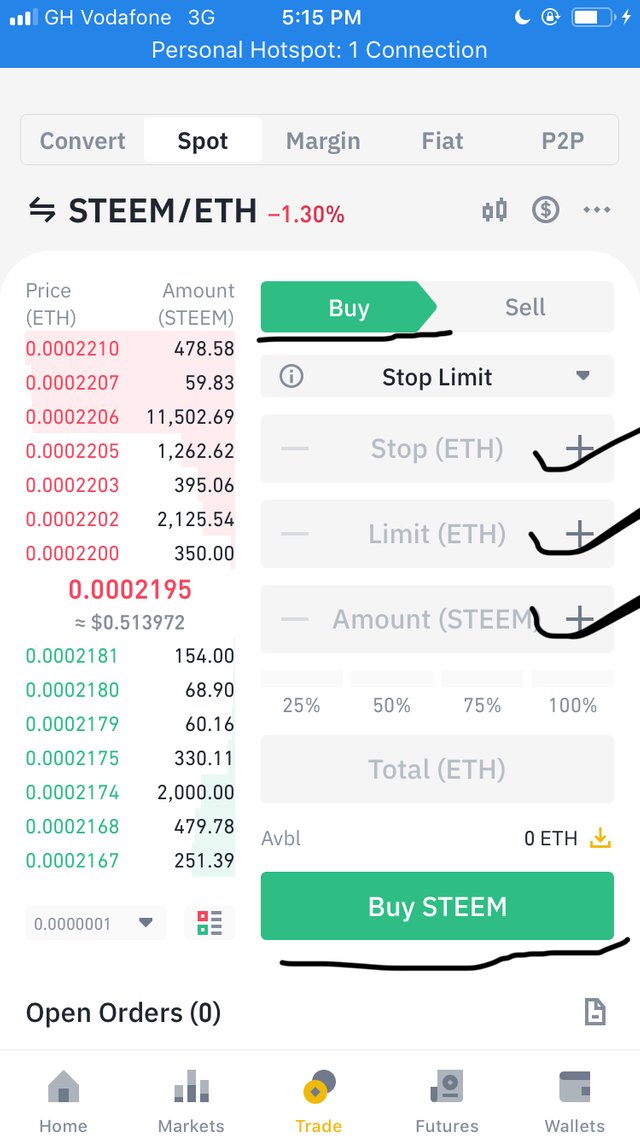

STEP 3

If I want to buy you choose the buy option and if you want to sell to you choose the sell option.

STEP 4

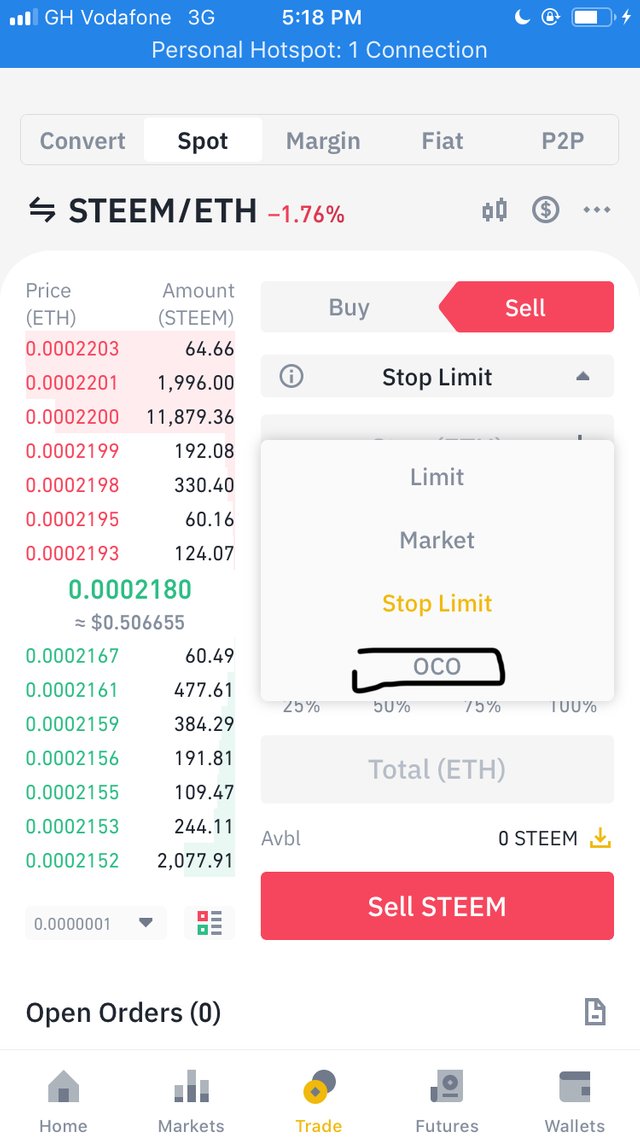

You will now click on Stop Limit Trading and now proceed to either buy or sell.

OCO LIMIT

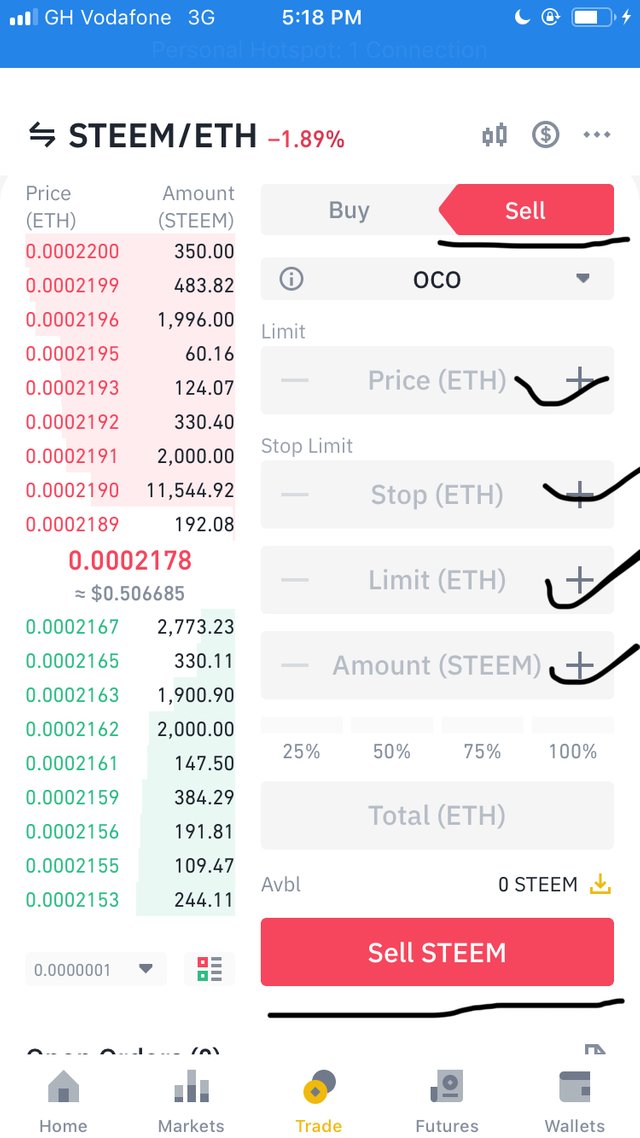

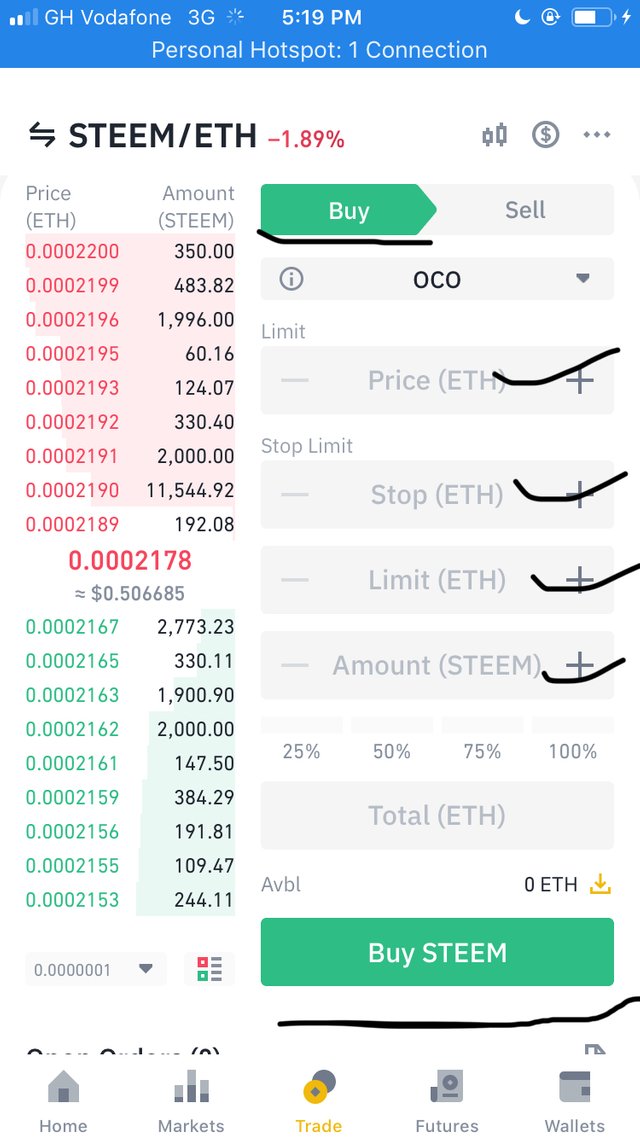

OCO limit is simply an investor choose for himself as to enter the market or the point he wants to leave the market. So with this type to we have what we call the stop point and it shows when an a trader will get into the crypto market, when ever the selling or buying or buying price reaches that level that’s the same amount to can buy to.

Below are some of the steps with clear screenshots you can follow :

STEP 1

You open again your Binance account and click on the market option

STEP 2

With the help of the search engine search for any crypto asset you prefer. As usual I will choose STEEM/ETH

STEP 3

Click on buy option if you are to buy or click on sell option if you are to sell

STEP 4

Click on OCO from the trading section and proceed to either buy or sell.

QUESTION 5

How order book help in trading to gain profit and protect from loss? Share technical view point, that help to explore the answer ( answer should be written in your own words that show your experience and understanding)

When it comes to crypto market trading, order book is a key factor you need to understand because when you know this you enjoy trading in crypto just because your gaining experiences will be more than the loss.

When one also know the limit order in an order book you are free from making loss even when price decreases for a long time. Am saying this because in most occasions Crypto assets increase without one knowing just because we don’t mostly most on them. But when this limits are set to the preferred amount you want, it will automatically sell when price gets to that level and more profit will be made.

We should know what stop limit is so that the way we make loses day in and day out cwill be reduced. Because it can get get to a time where no one can tell the future of a crypto coin, and when that happens you are made known to set up a stop price and a limit price.

There are some features which makes up an order book and they include : trade history, open orders and order history which shows up all exchange transaction history. This keeps records of the type of crypto asset you traded for, the amount you used in purchase, the day and the time you did the trading.

As for the resistance and support it prevents an investor from making loss and when you even get to know it better you can actually tell what is going to happen to a particular coin in the near future.

With the OCO which is a feature on the order book as said earlier it helps one to gain a lot when it comes to profit making because with this you will be given the chance to set prices as to how you think as at that prices you will make profit so that you will be alerted if any of those prices hits the target.

CONCLUSION

In brief, I will like to say I really enjoyed the lecture a lot and I can say this lecture was one of the great lectures for this week. I also learnt a lot especially on ‘Exchange order books, it’s uses and how to place the different orders’

Thank you very much professor @yousafharoonkhan for that wonderful lecture and May the Almighty Allah be with us and bless us all.

Thank you for joining The Steemit Crypto Academy Courses and participated in the Homework Task season 2 week 7.

Thank you very much for participating in this class. I hope you have benefited from this class.

Grade : 7, .

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you my one and only professor

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit