.png)

1: Explain Crypto Assets Diversification.

As the name indicates Crypto asset diversification is an asset diversification strategy. In this strategy, the portfolio is so designed that a total sum of your investment is invested into a number of assets rather than in a single asset. This technique is applied to filter the effects of volatile changes in the market.

The CAD is the talk of the town with major benefits of reduced overall risk and a better approach to understanding the crypto markets. It is basically an allocation of your investment sum in different types of assets to mitigate the losses and increase gains.

The investors proceed with the selection of assets after proper evaluation of each asset achieved through the risk management ratios fundamental and technical analysis, and the historical performance of the asset. The investors through this strategy also broaden the scope of their portfolio.

Some major factors to be considered while selecting a coin may be checking that the assets may belong from different regions thus not all are affected by similar policies of a region, should have different use cases, and should not be correlated in terms of price changes such altcoins are related with BTC etc.

2: What are the Benefits/effects of Diversifying one's assets? Some major benefits of diversifying your portfolio are:

Broadens your portfolio:

Diversifying your portfolio and investing in different projects gives you an insight into their performance and periodic behaviour and you know which asset is beneficial at what time and situation of the market. this broadens your trading horizons and brings long-term gains.

However, investing in more than assets require more effort, analytical study, regular monitoring of all assets, increased transaction costs in terms of buying and selling of different coins and hence require more time and energy.

A trader should always analyze his input to output and design a strategy that suits his style of trading and investment options

3: Construct Crypto Assets Diversification according to the 1 - 4 Rule - Choose 4 crypto-assets (State the reasons for choosing them), discuss each of the assets, and perform a detailed fundamental/technical analysis on them. Invest a part of at least 15 USD into each of the assets based on the diversification constructed earlier, proper stop loss and take profit levels must be put into place. A real trade on a centralized exchange is expected here. (Graphics/Screenshots/Charts are required). Note that: You are expected to show your verified account screenshot, your reservoir and the steps involved while investing (For example, if you are investing a part of 15 USD at a time, then, the reservoir must have been 60 USD clearly shown, you can use Fiat or Stablecoin for construction). Kindly take note.

Bitcoin

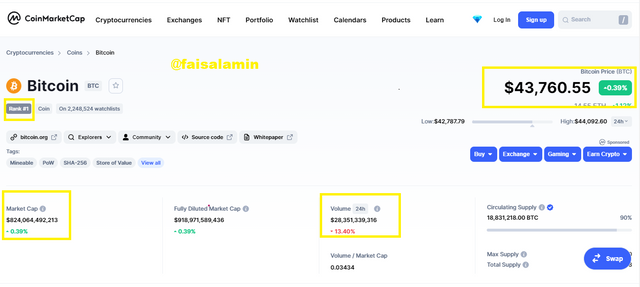

Bitcoin is the number 1 cryptocurrency due to its current market cap ranked on coinmarketap.com. It is the predecessor of all the cryptocurrency as it was the first coin launched at the price of 1$ a decade ago. Bitcoin is based on proof-of-work consensus. It was Bitcoin who later gave the idea of blockchain technology which is now widely applied in many other fields.

I think when choosing 4 currencies Bitcoin should be the part of the portfolio because it has stayed up for more than a decade. It is at number 1 and it dominates the market by more than 42% so the activity of the Bitcoin market largely affects other coins. In the screenshot below I indicated large sums of its market cap, traded volume and diluted market cap.

Ethereum

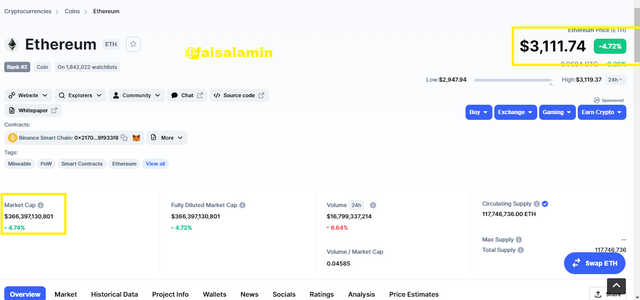

Ethereum is ranked second on coinmarketcap.com. it was launched in 2015 and focuses primarily on providing an ecosystem for building smart contracts and decentralized apps. It was previously using the same consensus as Bitcoin but shifted to proof of stake after the launch of its hard fork. It dominates the market by more than 18%.

Its current price as listed on coinmarketcap.com is $3,116.84. the native token is also used for trading and for networking fees and transaction costs.

Ripple

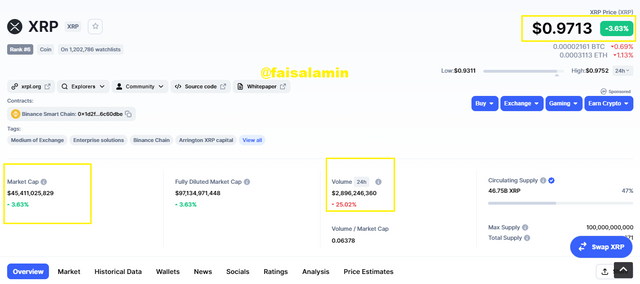

Ripple was launched as a solution to late transfers or high transfer costs of funds globally. It is therefore known as the payment transfer solution. It was brain-child introduced by Ryan Fugger in 2004 and was developed by Jed McCaleb and Chris Larson in 2012.

The platform was kept as light as possible to process its core function of fast transfer, low-cost transfers and sustainable transfers a practical thing. At the source, the currency to be transferred is converted to XRP which at the destination is again converted to the parent currency.

It works of proof of work consensus to process transactions. The current price of the token is $0.9706 and its market cap is $45,374,497,493.

Cardano

Cardano is the largest decentralized proof-of-stake consensus blockchain. It is built to address the issues of scalability, high networking cost, and sustainability. It supports the construction of decentralized apps and automated contracts or smart contracts. The developer of the Cardano is one of the finest leaders of the Ethereum project.

It is a 3rd generation blockchain platform that has a market dominance of about 3.6%. ADA is currently trading at 2.16$. from a technical point of view, it is currently trading around a key support level in case the support is respected we can see its price peaking to last high 2.7$ and that is why I chose It to be a part of my portfolio.

Now buying all these assets according to the 1-4 rule.

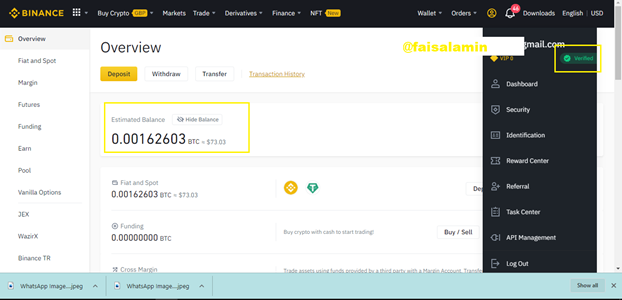

I made these purchases through my Binance account. A total of 60% investment was divided among the 4 assets as 15$ each.

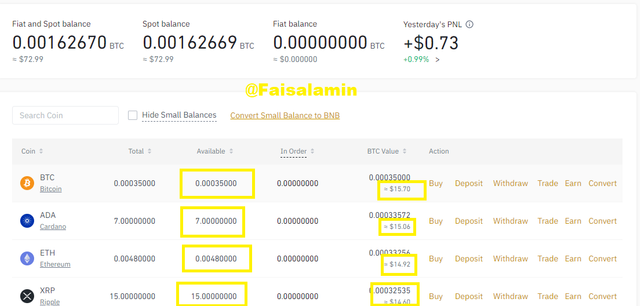

Verified account and sum of investment

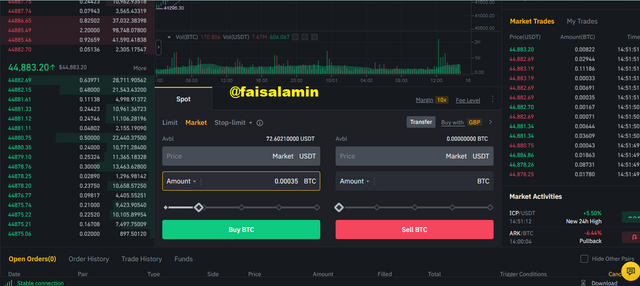

Bitcoin

The BTC was added to my portfolio which I will show at the end.

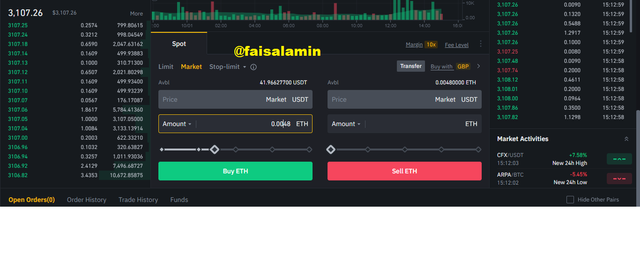

Ethereum

I selected ETH/USDT pair and bought 0.0048 ETH

The stop loss was set to 3000$ and the take profit was set to 3600$.

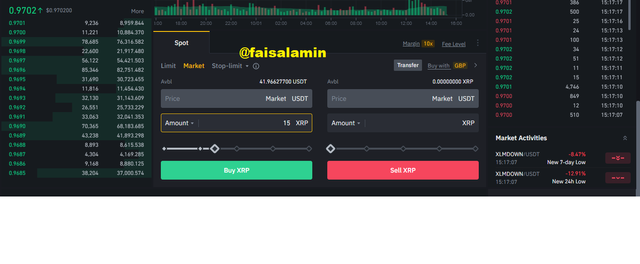

Ripple

15$ were invested in XRP/USDT

The stop loss was set to 0.5$ and the take profit was set to 1.3$

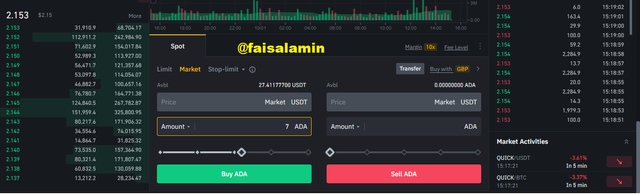

Cardano

The last investment was in ADA

The stop loss was set to 2$ and the take profit was set to 2.5$.

The final portfolio was

4: Explain Arbitrage Trading in Cryptocurrency and its benefits.

Different crypto exchanges may have different prices for an asset or an asset pair and Arbitrage traders make use of that price differences to take leverage. During Arbitrage trading, a trader buys from a cheaper exchange and sells on a and exchange with higher prices. The risk and profit levels in most cases are minutes but it is a better alternative to buying and selling on the same exchange.

Such difference also exists among pairs which means an asset is cheaper when bought in one specific pair as compared to another

The arbitrage trading that takes place making use of the price difference among different exchanges is called exchange arbitrage trading and arbitrage trading involving taking benefits from the price difference between different currency pairs is called Triangular Arbitrage trading.

The basic benefit of arbitrage trading is to earn minimal profits or protect yourself from buying at a high price and selling at a low. The difference in the price of two exchanges or crypto pairs is used to earn profit.

Other than that, there is automated software that pinpoints the differences in the price and notifies the traders thus this can be easily handled.

5: Discuss with illustration how to take advantage of Exchange Arbitrage.

An illustration of how to take advantage of Exchange Arbitrage is as under.

BNB/USD is trading on Binance at $380.1 and on Bybit it's trading at $379.25. An arbitrage trader will notice the difference will go to the Bybit exchange to buy the BNB/USD pair at $379.25 and sell it on Binance making a profit of about $0.85 per coin. The trader will continue to make a profit as long as the price difference exists. This instance is just for illustration and the profit recorded is minimal but in some other cases, traders can make more than 40 to 50 dollars per coin.

This is an example of Exchange Arbitrage as the trader utilized the price difference between two exchanges to make a profit.

6: Creatively discuss Triangular Arbitrage in Cryptocurrency. How to identify Triangular Arbitrage opportunities and the risks involved.

BTC/NGN

The price of Bitcoin is given as 25,685,191 NGNBTC/USDT

The price of Bitcoin in USDT is given as 42,038.58NGN/USDT

1 USDT is equal to 608 NGN

Now if the trader buys 1 BTC using the BTC/USDT pair and then sell this BTC with the BTC/NGN pair at 25,685,191 and then convert it back to USDT at the rate of 608.

At the end of the whole trade, he will have 42,245 USDT as

608 X 25,685,191=42,245

His initial investment equals to 1 BTC was= 42,038.58 USDT

Now he has 42,245 USDT his profit will be approximately 206 USDT

This is a clear indication of triangular arbitrage in which an asset is bought and sold through different pairs due to differences in price.

The sudden fluctuations in the price during and buying and selling is one of the major risks involved in arbitrage trading.