Good Day Professor

Question No.1 What is the difference between Realized Cap & Market Cap, How do you calculate Realized Cap in UTXO accounting structures? Explain with examples?

Realized cap and Market cap are both on-chain metrics used to analyze the worth of a network or coin.

| Represents that the relative value of the network or coin based on the current supply of shares or coins and the current value of the share of the coin. | Represents the actual worth of the network-based in a given period based on the price of creation of the asset and the UTXO balance. |

| Market is usually greater than the RC | RC is less than the MC and indicates a positive market however when it is greater it indicates a negative market. |

| It is based on both the spent and unspent UTXO balances. | It is based only on unspent UTXO balance. |

| It is relatively more volatile and changes quickly as the price changes | It is relatively more volatile and changes quickly as the price changes It is less volatile and move with less pace as the price changes. |

| It is relatively more volatile and changes quickly as the price changes It is less volatile and move with less pace as the price changes. | It presents an honest evaluation of the market. |

| It is rather easier to measure | Difficult to measure involve complicated calculations. |

| It is directly affected by the buying and selling pressure | It is directly affected by the buying and selling pressure. It is not directly affected by the current buying or selling pressure. |

Calculations:

Market cap: Circulating supply of the coin X current value of the asset

The market cap of ETH at this time with the current price of $2,931.96 and circulating supply of 117,663,894 ETH is $344,986,021,997.

Realized cap: UTXO X price of creation

Let us consider a hypothetical example in which the asset X:

Current price: 42$

UTXO: 8

Price on that date: 38$

Not moved since 1st September

Then RC: UTXO*price of creation: 38 X 8= 304$

Question No. 2: Consider the on-chain metrics-- Realized Cap, Market Cap, MVRV Ratio, etc, from any reliable source(Santiment, Glassnode, etc), and create a fundamental analysis model for any UTXO based crypto, e.g. BTC, LTC [create a model for both short-term(up to 3 months) & long-term(more than a year) & compare] and determine the price trend/predict the market (or correlate the data with the price trend)w.r.t. the on-chain metrics? Examples/Analysis/Screenshot?

Realized cap short-term chart

in the chart above we can appreciate a correlating relationship between the movement of the price and the graph of the Realized cap. It moved parallel to the price moved higher similarly it went flat with the price. We see on July 21 when BTC reached about $29k after its ATH of $65k on April 21, the RC pattern did not show much steep in the downward direction like the price. This is its general pattern that the graph does not move steeply downward with the price in case of a downtrend.

Realized cap long-term chart

In the chart above we can see that RC remained flat however the price dropped to a much appreciable level. The correlation of price changes and RC are clearer in the long term chart.

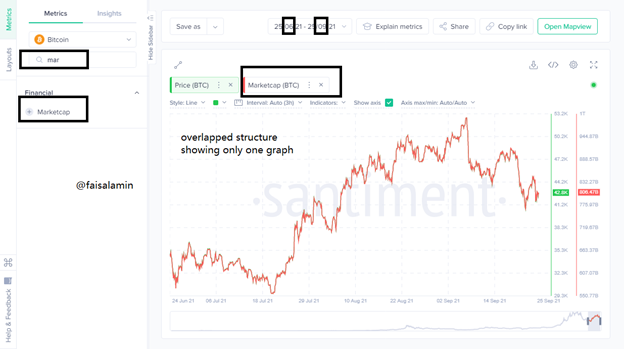

Market Cap short-term chart

When I opened the market cap chart in sentiment I only notice one graph pattern. It is because the market cap overlaps the price action. After all, they move on the same pattern. They are directly related to each other so when the price increases the Market increases at the same pace and vice-versa.

Market Cap long-term chart

In the long term chart to we do not see a price line separate from the Marketcap line since the movement of the price action and market cap are parallel.

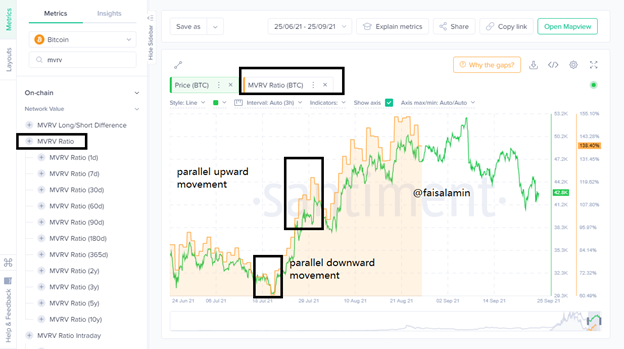

MVRV Ratio short-term chart

It is the ratio of MC to RC. The MVRV ratio too moves parallel to the price line it predicts the movement of the price. If the MVRV ratio is formed of higher highs and higher lows the market is expected to move in the bullish trend. The higher highs are indicated by a black block indicating a parallel upward motion. When the MVRV ratio shows lower lows and lower highs it shows the continuation of the bearish trend of the market.

MVRV Ratio long-term chart

The lower and higher thresholds in a long-term MVRV ratio are chart is often used to predict buying and selling signals. This will be explained in the next question. For this part of the post, we see a corresponding relation between the price action such that when the MVRV ratio shows an upward motion the price is also seen to be exploding in the same direction and vice-versa.

The MVRV ratio rose to 332.06% on the 21st of February 2021 and the BTC price peaked at $57.5k. The chart pattern is such that the highs are followed by slight dips and the dips are followed by slight highs.

Question No. 3: Is the MVRV ratio useful in predict a trend and take a position? How reliable are the upper threshold and lower threshold of the MVRV ratio and what does it signify? Under what condition the Realized cap will produce a steep downtrend? Explain with Examples/Screenshot?

MVRV ratio predicts the movement of the price when used in long-term charts. It is commonly used by investors or traders looking to indicate buying and selling opportunities on the chart. The common fluctuations of the MVRV ratio are between 0 to 100 and 100 to 200. Above 200 to up to 300 the market is said to be overpriced. From 100 to 0 the market enters an underpriced stage.

The percentages of the MVRV above 100 predict an uptrend and the percentages below 100 predict down-trending market trends.

Selling signals:

the upper thresholds are commonly used to set selling signals. These levels are however considered unreliable because the market only makes slight dips after the upper thresh holds as indicated in the chart below.

Buy signals:

The lower thresh holds are used to predict upward movement in the price action. These thresholds are more reliable because historically they precede appreciable dullish peaks and thus safe buy signals can be placed.

RC in a Downtrend

We have seen that RC remained constant even when the price dropped. Practically there is no such condition in which RC produces a steep downtrend because of the wider of crypto assets and increase in trust. In addition to that even when the price falls investors prefer to protect their UTXO balance hence the price remains flat as shown here.

The opposite can only be possible i.e. RC can produce a steep downtrend only and if masses lose their trust in a coin or the buyers start buying it at high prices and start selling it at low.

Conclusion

MVRV is a strategy used by investors for long-term targets. The on-chain metrics represent data like a market cap or realized cap on the charts and comparing them with the price action becomes easy. They represent how the price of an asset is impacted by the change of the on-chain activities. Using them in the analysis before long-term investments are often very helpful.