Hello my friends, How are you? I hope all of my all friends will be fine and happy by the grace of Allah. Let's meet again with me, I am your very own Faran Nabeel. As we know that this is the last week of Steemit Learning Challenge of Season 23 and I am here in Steemit Crypto Academy to participate in the challenge.

Question 1: Why Build a Custom Indicator?

Traditional indicators, such as the MAs, RSI, MACD, and Bollinger Bands, have been the foundation of market analysis. These tools come with some limitations that can constrain the trader ability to effectively capture niche markets like Steem/USDT. One primary limitation is the many indicators are base on historical price and volume data of the market, make it reactive rather than predictive. This lag delays signals, potentially causing to trader or innvestor to miss critical entry and exit points during the rapid market movements.

Traditional indicators also tends to be the one size fits all tools. Develop for broad market conditions, they can not capture the unique characteristics of markets such as the Steem/USDT pair. The cryptocurrency market and particularly pair like Steem/USDT can exhibit volatility, liquidity constraint, and reaction patterns to sudden news and events. Relying solely on conventional indicator can lead to trading decisions.

Difference Table: Traditional vs. Custom Indicators

| Aspect | Traditional Indicators | Custom Indicators |

|---|---|---|

| Data Basis | Rely on historical price and volume data. | Integrate with additional data points like blockchain metric, social sentiment, and custom volatility. |

| Responsiveness | Tends to reactive, with signal often lagging market movement. | Aim to detect early trends and shifts in market dynamics. |

| Flexibility | Offer the one-size-fits-all approach for a market conditions. | Tailore to capture the specific niche markets like Steem/USDT. |

| Signal Clarity | May suffer from delayed responses, potentially lead to false signals. | Design for filter out noise, enhancing the signal clarity and improve decision-making. |

| Market Adaptability | It can struggle to adjust the unique market conditions such as low liquidity and high volatility. | It can be customizable to address specific challenges in volatile markets. |

| Risk Management | Can lead to different trading decisions due to delayed and less precise signal. | Provide improve risk management by offering accurate insights tailore to market trends. |

This comparison highlight the key difference between traditional and custom indicator. A custom indicator overcome conventional limitation by tailoring analysis of markets like Steem/USDT, integrate additional data points and optimizing signal clarity.

Question 2: Your Indicator’s Concept

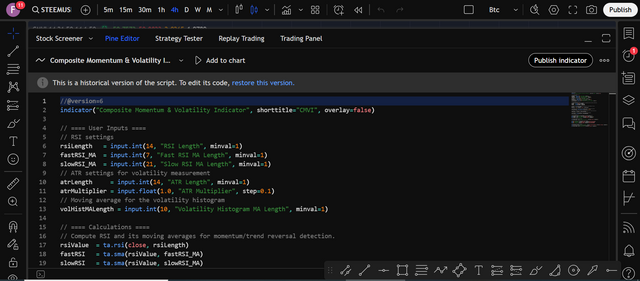

The Composite Momentum & Volatility Indicator (CMVI) is design to provide trader with comprehensive overview of market condition by blend the momentum analysis and volatility measurement into the one cohesive tool. Its purpose is offer a clear signals of potential trend reversal while forecast changes in market volatility. This dual approach support the better risk management and inform decision making.

Purpose:

The main goal of CMVI is capture both momentum and volatility aspects of price movements. It use the Relative Strength Index (RSI) to gauge momentum and the strength of the trend, enhance by moving averages apply to the RSI ranges. This setup provide help to identify key turning points in market sentiment. The indicator measure volatility through the Average True Range (ATR), normalize as the percentage of current price, reflect the market dynamics.

Components:

CMVI has two main sections for getting a trade signal:

Upper Section (Momentum & Trend Reversal):

It calculate the RSI over the user-defined period as default value 14 and smooths it use two simple moving averages a fast MA (default 21) and the slow MA (default 50). This combination create the composite oscillator that blend the momentum and volatility signals.

Lower Section (Volatility Measurement):

It calculate the ATR to market volatility, normalize it as percentage relative to current price, and plots it as the histogram. A moving average is apply to this histogram to smooth out the short term noise. A user-define offset separates the volatility histogram from the momentum section, ensure the clarity even during zoom adjustment.

Logic & Formula

The indicator begin by calculating the RSI on closing price using the standard and unique formula. The snippet code rsiValue = ta.rsi(close, rsiLength) compute the value base on the user define period. Next, to smooth RSI and better capture trend reversal, two moving averages are apply to the RSI range. The fast and slow moving average are compute with code like fastRSI = ta.sma(rsiValue, fastRSI_MA) and slowRSI = ta.sma(rsiValue, slowRSI_MA). This MAs highlight potential reversal when the fast MA cross over and under the slow MA.

To combine momentum with volatility information, the indicator create the composite oscillator. This is achieve by averaging the RSI and volatility value which is derived from the ATR. The composite oscillator is define as compositeOsc = (rsiValue + volatilityScaled) / 2, provide the single metric that reflect both momentum and volatility. User can change the input from the setting of the indivcator according to their trading style.

Volatility itself is measure with the use of ATR, which is normalize as percentage of the current price and adjust by a multiplier. For example, atrValue = ta.atr(atrLength) calculate the ATR value, and then volatility = 100 * atrValue / close * atrMultiplier convert it into percentage. This volatility value is further refine by applying the moving average compute using volatilityMA = ta.sma(volatility, volHistMALength)which help to smooth out short term fluctuation.

To ensure clear visual distinction between the momentum section RSI and it MAs and the volatility section with histogram, a fix offset is applied to volatility values. The offset is define by user for example volOffset = input.int(150, "Volatility Offset", minval=0)), and then the volatility histogram is shift to downward using volatilityOffset = volatility - volOffset and thevolatilityMAOffset = volatilityMA - volOffset. A dash horizontal line (hline(-volOffset, "Separation", color=color.gray, linestyle=hline.style_dashed, linewidth=2)) is draw to mark boundary between this two sections. This separation enhance the clarity by visually distinguishing the oscillator and the momentum data from the volatility histogram.

Unique Value:

By integrate both the momentum and volatility, CMVI provide the holistic and actionable view of market behavior, set it apart from traditional single aspect tools.

Here is the quick review of the indicator code as how am i design and it is perfectly fetch our golas

Question 3: How to Use It

The Composite Momentum and Volatility Indicator generate the signal by analyzing the RSI, its fast and slow moving averages like 21 and 50-period, and the volatility histogram. Signal occur when fast MA crosses above and below the slow MA, particularly from overbought or oversold zone. A rising volatility histogram with it moving average indicate the potential upcoming price movements, while the falling histogram suggest the consolidation. This indicator works best on intraday and daily timeframe, capture timely momentum shift and volatility changes in the market. Example charts show the clear trend reversals and volatility spike, assist traders in well and timed entries and exits for improve market performance.

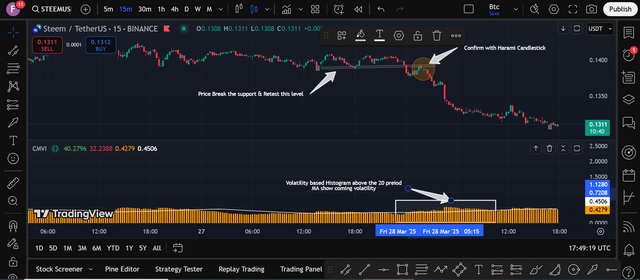

Here is the overview of the indicator as it has two moving averages within the RSI Range and the histogram with the moving average indicate the upcoming spikes in the market. And we can capture profitable reversals from the market.

In the 15 minute time frame as I see price of the steem make a minor support and then break it after a long consolidation range, and after we can see the price retest this same support level and confirm the trend reversal with bearish harami candle.

As I see the indicator which i create it was show the bearish cross over below the midline of the RSI as the value was here is 50, and both moving averages also show the bearish cross over with 21-period with green and 50-period ma with red color. as green cross the red moving average and ready to go below the 50-period moving average and show the bearish momentum will occur.

the another confirmation is that the histogram is appear above the 20-period moving averge or break the moving average shows that the volatility just came and the price up or falls quickly from this perticular level. and it's also confirm the quick price movement.

Here the above a entry setup for a short trade as a example and we can use risk rewrd ratio as 1:3 and it is the best risk reward ratio for getting any profitable trade. by analysing the trend of the market any trader can get benefit from CMV Indicator and capture quick moves from the market.

Question 4: Pros & Cons

The CMV Indicator combine the momentum and volatility to measure a holistic view of market condition. It integrate the RSI with its fast and slow moving averages to get the signal trend reversals and blend the ATR-base volatility histogram to forecast the market swings. This dual approach enhance decision making by providing both trend and the volatility clues. Below I described the quick comparison of pros and cons of this indicator in table form.

| Strengths | Limitations |

|---|---|

| Dual Perspective: Integrate both momentum and volatility for a holistic view. | Lagging Nature: Rely on historical data, and potentially delays the signals in fast markets. |

| Early Trend Reversal Signals: RSI range and its moving averages provide the clear entry and exit cues. | Complexity: Multiple elements can overwhelming for beginners and new users. |

| Volatility Forecasting: ATR histogram and its Moving Average indicate the potential price surges. | Parameter Sensitivity: Require fine tuning such as RSI period, MA length, ATR multiplier for various markets. |

| Visual Clarity: Clear separation between upper RSI, and composite oscillator, and the lower as volatility histogram sections aids analysis. | Market Specificity: Best on the intraday and daily timeframes and can be less effective on the longer term charts. |

| Actionable Signals: Provide help to traders for perfect time entries and exits by identifying the key turning points. | False Signals: In the choppy markets, false signals can occur. |

When Is It Most Effective?

This indicator works in markets with pronounce momentum shifts and volatility surges. It working best and efficiently on intraday and daily charts, where reversals and volatility clues are crucial. However, in highly choppy or sideways markets, its integrate signal may require the additional confirmation.

Question 5: Case Study or Backtest

With three days backtest on the Steem/USDT pair, CMVI demonstrate its capability in captured the trend reversals and forecaste the volatility. During the strong uptrend, the RSI range and its moving averages generate the bullish signal when the fast MA cross to above the slow MA as RSI emerge from oversold and midline levels. and the ATR-base volatility histogram began the trending upward, shows the market’s surge. Trade acted on these signals experienced with profitable entries and exits, aide by the clear visual separation between the momentum and volatility section.

Alternatively, in period of sideways movement, the indicator produce multiple crossover signals that led to the false entries. The volatility histogram lagg behind the sudden price spike, and delay the signal confirmation. Parameter sensitivity necessitate adjustments to optimized the performance for the unique characteristics of Steem/USDT market.

Overally, the backtest underscore CMV Indicator strength in trending markets, while highlight the need for additional filter during the consolidation phases. This case study emphasize the importance of fine tuning and combine the indicator with other tools to manage risk.

Now i invite my friends @suboohi, @sualeha, @ulfatulrahmah, @sdutaskitchen, @chant, @seh-rish, @josepha and @wilmer1988 to participate in this challenge.

Regards,

Faran Nabeel