Greetings everyone, I am much delighted to be part of this week's lesson of our noble professor in the person of @kouba01. I, therefore, hope to put out my best in this lesson and hope to be reviewed. I will therefore go-ahead to submit my solutions based on the questions asked by our professor.

Question1

In your own words, give a simplified explanation of the CMF indicator with an example of how to calculate its value

The CMF indicator is a technical indicator that we have in circulation in the crypto market which is of great help to investors and traders. It was brought to the limelight by Mr. Marc Chaikin a technician in the crypto market. The CMF is a technical based indicator that indicates the strength of the market. It helps traders to know the directions as to which the market is moving towards.

The Chaikin in indicator is an oscillating indicator as it is part of the family.

This indicator works in a sense that, the last price of a crypto asset is been compared to the high and low price of the crypto asset for a period of time in order to know how the funds of the crypto assets are moving towards. It is been used for a 20 days period.

The CMF indicator moves with levels between 1 and that of -1. The indicator helps traders to know when a crypt asset is in a bullish or bearish trend movement. In a sense that, when it is above the 0 points it is in a bullish trend movement and when it is below the zero point it is in a bearish trend movement.

How to calculation the CMF indicator.

From development, there has been a mathematical formula that you can use for this. But I will be doing the calculation using the MFM. Money Flow Multiplier etc.

MFM= [(Close price - Low price) - (High price - Close price)] / (High - Low)

You will then find the MFM by multiplying the MFM to its associated volume

MFV = MFM × Volume Period

We can now find our MFM, the math equation is

MFM = [(Cprice - Lprice) - (Hprice - Cprice)] / (Hprice - Lprice)

Where we can define the parameters:

Lprice = Low price for the day

Cprice = Close price for the day

Hprice = High Price for the day

Let’s see how to do our calculation after writing the formula to be used

Say under a period of 21 days, a crypto pair of BTC/USDT chart has the following readings as stated below.

Closeprice = $60599.58

Highprice = $60918.21

Lowprice = $60545.95

Period Volume (VP) = $152,000

Total period volume = $35,220,086,450

In other to find the CMF, we first find the MFM

MFM = [$60599.58 - $60545.95] – [$60918.21 - $60599.58] / [$60918.21 - $60545.95]

MFM = 52.7740

We now find the MFV

Which is:

52.7740 x $ 152,000

MFV = $ 8,021,648

We can now calculate our CMF value

CMF indicator = 8,021,648 / 35,220,086,450

CMF = 0.00022775776

Question 2

Demonstrate how to add the indicator to the chart on a platform other than the tradingview, highlighting how to modify the settings of the period(best setting).(screenshot required)

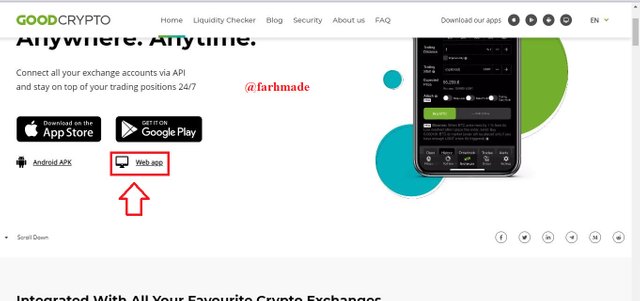

I will be demonstrating how to add the CMF indicator to a chart using the Goodcrypto platform. Let’s see how this is done.

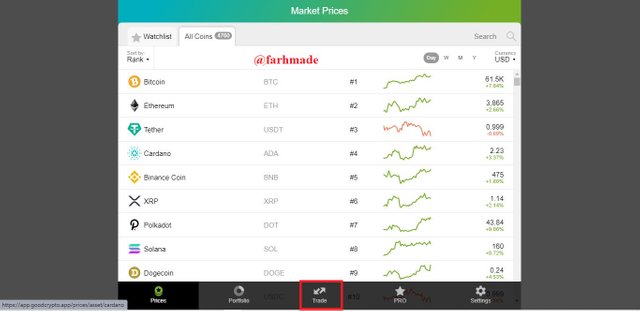

You will first of all have to visit the website through GoodCrypto and select the web version. Its other versions but I am using the web.

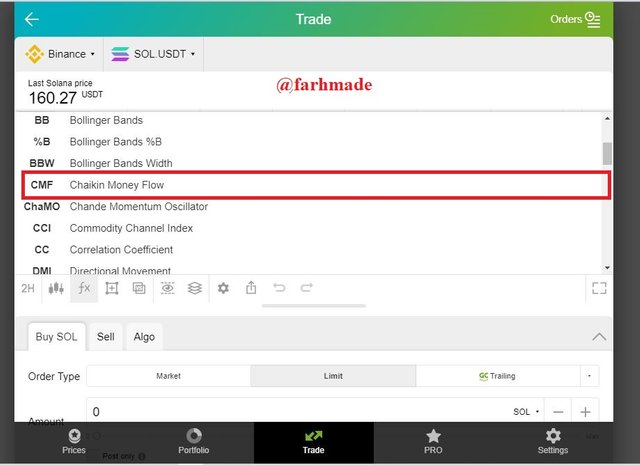

Once you are on the site, you will have to select trading to have access to the trading platform. Locate and click on FX where you can see a list of the indicators

Through the list, you will search and find the CMF indicator

The indicator has been successfully added to our chart

Changing the settings of CMF on Goodcrypto

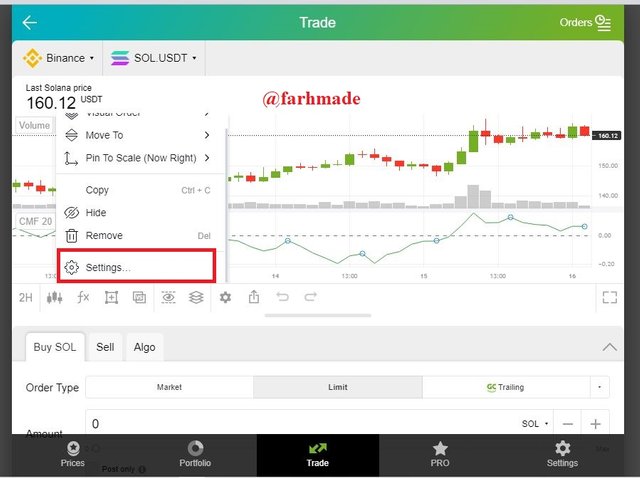

To change or modify the indicator, you have to click or select the indicator on the chart and then select settings.

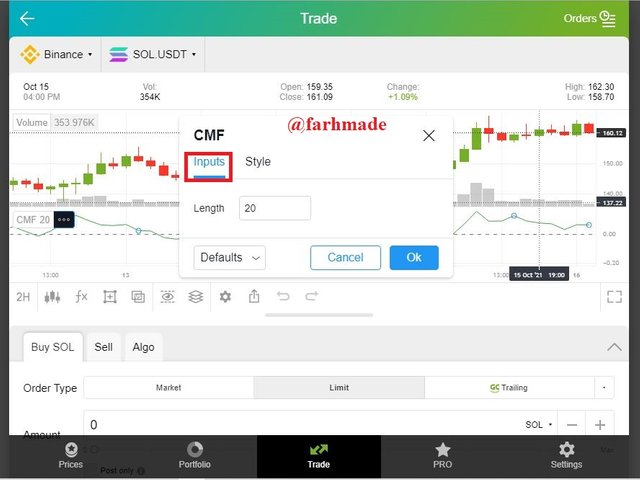

Now you can see the settings panel where you can set your length which is also the period.

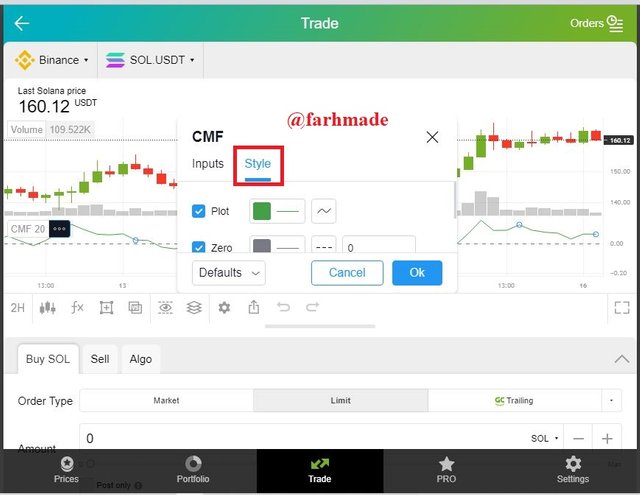

Another modification you can do is the styling of the indicator.

Best CMF Indicator Settings

The indicator from development has gone through series of testing and it has specific or default settings that best suits it for trading.

The indicator has a default period observation of 20 or 21 days and that is the period chosen by the developer of it.

The default settings, that is the 20 or 21 days will conform perfectly to the trading month and of course, will cause a reduction in volatilities in the market. So to enjoy the indicator, we better live it to its default settings in other acquire what we want.

Question 3

What is the indicator’s role in confirming the direction of the trend and determining entry and exit points (buy/sell)؟(screenshot required)

Every indicator we come across is always to give a better view of how prices move. Thus, getting very good trends while signaling out the false ones.

Trading along with the price can give you great loss most at times, so there is always a need to use indicators to have a perfect trade. So basically, I would say that indicators play a major role in trading.

Most at times, you could see that there is an increase in a price of an asset, but looking at the price you wouldn’t know how to classify it. Indicators then help you know if the price is hitting an oversold or an overbought. Also, trend confirmation, trend reversals, and breakouts are other roles indicators play.

Using the CMF, its indication is +/- 0.1 or 0.2. Of course, whenever we see the negatives, then we should be expecting a downtrend or a bearish trend and whenever the non-negative values are seen, then clearly that would be a bullish trend or an uptrend.

Let’s see some illustrations

In a bullish movement, we will see the CMF indicator confirming the movement by moving above the 0-midpoint and as well you see it going towards the non-negative values. That is how the indicator confirms an upward movement of the price of the asset.

In a downtrend where you see the price falling, the indicator again will confirm the movement by going down the 0-midpoint. Thus, you will see it moving towards the negative values

1. Buy Entry and Exit Points

To successfully be a trader who wants to earn more than you lose, then you should always know the right time to make a buy and when to exit.

I am going to illustrate when to make a buy entry with SOL/USDT chart with a 2H timeframe as well as the CMF indicator giving me all my confirmations.

From the chart, you saw that on September 6th, the line of the indicator had gone above the 0-midpoint upwards. This gave a bullish trend meaning prices were going up.

So, you quickly place your buy entry and then you saw at the latter part, there was a quick fall and this should tell you that price will also fall. So, at that point, you will have to exit the trade.

2. Sell Entry and Exit Points

I still used the same timeframe and the same crypto pair for my sell entry and exit points.

You can see in the chart below, on July 19 there was a massive fall in the market so a trader must be willing to live a trade then. Cause holding your asset will literally give you a loss.

Now you saw again in the chart, there was a spike in the price of the asset towards the positive values which means that there was going to be an uptrend. So a trader must again exit from the sale and then prepare to buy.

Question 4

Trade with a crossover signal between the CMF and wider lines such as +/- 0.1 or +/- 0.15 or it can also be +/- 0.2, identify the most important signals that can be extracted using several examples. (screenshot required)

In this chapter, I will be making a crossover with regard to signal lines of the CMF indicator. We can use lines like +/- 0.1, +/- 0.15 and +/- 0.2.

Crossing over strategy is just another form of trading and it also gives you or helps you locate trend movement. Based on this and the tax is given, I will use the +/- 0.1 and then +/- 0.2 to make a crossover on a chart.

For instance, using the crossover strategy with the values chosen for our signal line will mean that, when there is a cross above the positive values of the indicator, it will mean that the price is in a bullish season or in an upward trend and when we see the line going towards the negative values, it will give us a bearish trend.

Let’s take charts below using the +/-0.1 and +/- 0.2 levels

Using +/- 0.1 on ETH/USDT wit a timeframe of 1h

In the chart above, I made a sell and a buy trade using the crossover strategy as stated in the tax by the professor.

PartA

The first portion that has been labeled PartA is a sell as can be seen in the chart above. We can observe that the line of the CMF indicator has gone below the -0.1-set point which is a total sell, and a bearish price movement. So here a trader will place a sell entry since you will be losing more than you will gain. You can see that I placed my sell trade in the chart shown above.

PartB

In part is another trade I placed, but here it is a buy trade. My indicator gave a confirmation to place a buy trade as the line went above the +0.1-point stated in the chart. This was a clear bullish trend and a trader willing to make some profit will definitely place a buy as I have then in my chart above.

Using +/- 0.2 on DOGE/USDT on 1h timeframe

As in the case of the first, it is the same in this one as well. But in this one, we will be looking at the point to be +/- 0.2. We then use a crossover strategy to make our buy and sell entries.

PartA

Just like I have done in the first part, I will be using the same strategy here. But here, I will be using +/- 0.2. So for part A in the chart, you can see I placed sell trade because the CMF indicator confirmed a sell as the line went below the -0.2 line and so there was a need to place a sell trade. So a trader who wants to make a profit at this point must sell his assets.

PartB

Just like in the previous part I have done, I will do my crossover with the same technique. As the CMF line was seen going above the positive 0.2 line was the best place to place my buy entry. A trader who is willing to make a profit at this point should place a buy trade since it is in a bullish season.

OBSERVATION

It was great using the crossover strategy as it gives the best way to either know when to exit a trade or go into a trade.

I would conclude by saying that, the +/-0.1 was a bit good to use as the price went in and out through the positive and negative values. But it was so close as there was not enough space to see actually how the price forms. Visibility was a major cause here but in the ++/-0.2, it was okay as there was enough spread, visibility was not really a problem here.

Question 5

How to trade with a divergence between the CMF and the price line? Does this trading strategy produce false signals?(screenshot required)

Trading Trend Divergence and CMF Indicator

Bullish divergence sets in the market when the price of the assets does not conform to the indicators that are being used. In this case, I am using the CMF indicator. So, a divergence can occur in the market when the price of the asset that is used does not move in line with the indicator that is the CMF. Divergence is always caused by quick trend reversals in the market. I will be talking next about what a bullish and a bearish divergence are.

Bullish Divergence with CMF Indicator

Upside reversals occur in a bullish divergence along with the CMF indicator. We mostly see that the price of an asset falls in price to the low but the CMF indicator does not go in line with it. So, what happens is, the indicator might be found going up and the price going down.

In the above chart, we can confirm a bullish divergence as I have indicated how it occurs on the chart. We can see that; the indicator line is moving up while the price is going down. So, this is not what we most want when trading.

Bearish Divergence of CMF Indicator

Bearish divergence mostly occurs when the price of an asset goes up whiles the CMF indicator goes down. The price goes to the high point but the indicator produces a downtrend.

So, when this happens in the market then we can confirm a bearish divergence since both of them do not follow as expected.

In the chart above, I have been able to confirm a bearish divergence as the price of the asset was found going up and the indicator going down giving a downtrend. But the price of the asset is going upwards.

False CMF Indicator Signals

I can state that upon all the indicators we have studied with the professor, there hasn’t been one that has a full working ability. All indicators produce false signals sometimes as a result of price volatilities and also liquidity providers in the market. This mostly causes the false signal we come across in the market.

What I can say about this indicator is that it is a great one and really makes clear trend reversals by its midpoint values. O through to +/-0.1 or +/-0.2.

The indicator can be paired with other great indicators like that of the RSI and also the EMA. This will help resolve the issues of false signals a little in the price of an asset.

CMF with EMA Indicator

We have experienced the case of bullish and bearish divergence. These are a result of false signals in the market.

CONCLUSION

I will like to conclude by saying that, it was really great investigating this indicator. I really enjoyed this week’s topic with our hardworking professor @kouba01.

The CMF indicator like I said is a great one to use but I will advise that it should always be used in line with other performing indicators to get the best result needed when trading.

Above all, I am happy I have been able to make my submission, and thanks to all and sundry.

Hello @farhmade,

Thank you for participating in the 6th Week Crypto Course in its 4th season and for your efforts to complete the suggested tasks, you deserve a Total|6.75/10 rating, according to the following scale:

My review :

Work with acceptable content. It was possible to go deeper into the ideas presented and provide several examples. Here are some notes that I bring to you.

Good explanation of the CMF indicator with all its features and method of calculating it. You have given an obvious example but it is not correct since you have to provide the results of 20 previous periods to get the result of period 21. It was possible to add an interepting to the result obtained.

You didn't delve into how to choose the right settings for the periods.

You haven't clearly shown how the divergence strategy is capable of bypassing or not false signals for the CMF indicator.

Thanks again for your effort, and we look forward to reading your next work.

Sincerely,@kouba01

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit