Trading with cryptocurrency is not supposed to be a big deal given that you can start trading with at least 100 USD. Investment capital is not much of a problem. Before going into looking into CFD, what is the cryptocurrency itself?

What is cryptocurrency?

Cryptocurrencies are digital currencies used to carry out financial transactions on a decentralized network. These transactions are very secure given it takes place on a decentralized network.

What is cryptocurrency CFD?

Contract for difference (CFD) is a type of financial transaction between a trader and a brokerage. It's a contract between an investor and a broker, where you either end up gaining or losing your investment. You do not own the asset or the cryptocurrency you about to trade. How it works, you there to using the price-changing nature of cryptocurrency to predict if it raise or falls. The result of your prediction is how you gain or lose in CFD trading. What you gain or lose will determine the value change of the asset at the moment of prediction.

Benefits

- Online base, meaning available all round the clock.

- Prediction is both directions (Buying or Selling)

- You don't need a special wallet.

- Broker charges are reasonable

- Easy to start

How do I know if cryptocurrency CFDs are suitable for my trading strategy?

After seeing a few benefits of CFD trade, here is my strategy to know if cryptocurrency CFDs are suitable

- Trading platform: the many platforms that you fine brokers using. I will be looking at options for a simple, and friendly platform.

- Trading teams: I look at the sweet table team to take advantage of, short team is always preferable since you can easily end the contract if the desired result is going in the wrong direction.

- Broker reputation: this is an important aspect to check out. If the broker ensures that my fund is safe and secure. I check if the broker gives his client the financial account details.

- Payments option: I need to find out about the payment options offered by my broker. This is to know if payment and withdrawal are done on time.

- Leverage: I need to make sure I'm comfortable with the leverage offered by the broker. This is an important aspect of CFDs trading.

Are CFDs risky financial products?

As in any other financial market, CFD is not different. As you may want to gain in the CFD trade, I will love to make it clear that the risk is very high. So I will highlight out some risks involved in CFD.

- Gapping, this when they a fast change in price without stopping at any price point. If this happens, you may not have the chance to close your trade if you had plans to close at a particular price.

- Since the CFD trade is base on predictions, and given that CFDs are highly leveraged, the market conditions can influence the movement of prices of financial assets. Most of the time external facts (political elections) play a part in the stability of the market.

- Most of the time, we don't take the time to read the details of the terms of the contract. It is easy to miss out on an important clause in the contract between you and your broker, which can later affect the contract.

- CFD is not as easy as it looks, and the smallest misunderstanding due to the complexity of the products can get you into trading errors.

Do all brokers offer cryptocurrency CFDs?

Well, I say that simple answer because not all brokers are into cryptocurrency CFD. We have particular brokers which I will be demonstrating his to trade with one below.

Explain how you can trade with cryptocurrency CFDs on one of the brokers (Using a demo account).

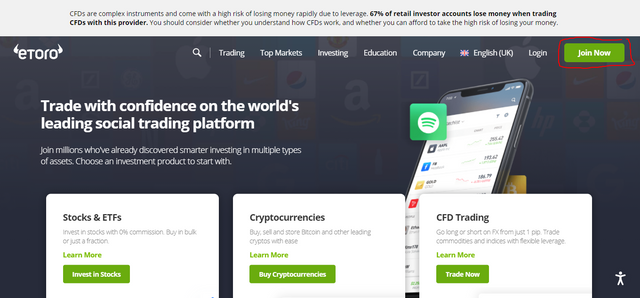

eToro

Visit the website etoro.com

Screenshot Home page

Screenshot Home page

- Click the joining Join Now call to action on the top right hand

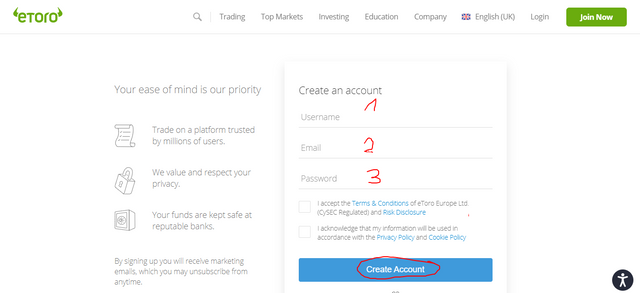

Screenshot Sign Page pop up

Screenshot Sign Page pop up

Sign up form

- user name (more than six characters)

- Email address (valid email address)

- Strong password (I used the option that was given to me)

- Make sure to click the check box to accept the terms and conditions.

Click the create account button

Note: you also have the option to sign up with your Facebook or Google account.Email sent for verification, log into the email you used in creating your account.

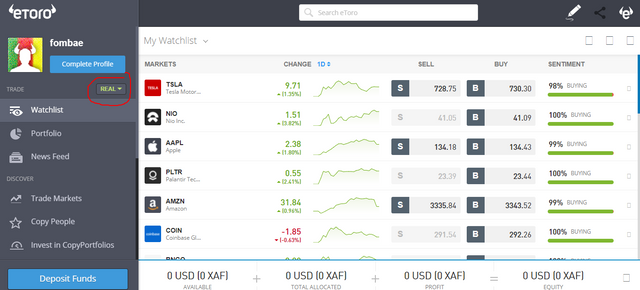

Log in

Screenshot Dashboard

Screenshot Dashboard

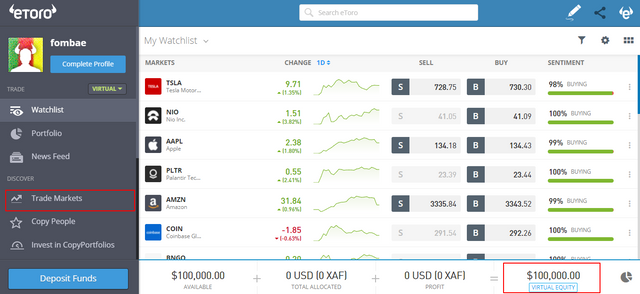

Log in as a real investment, to move to demo. Click the drop-down below the profile on the left hand of your screen of the laptop. You seen virtue portfolio, click and the pop screen comes up. Click go to virtual portfolio.

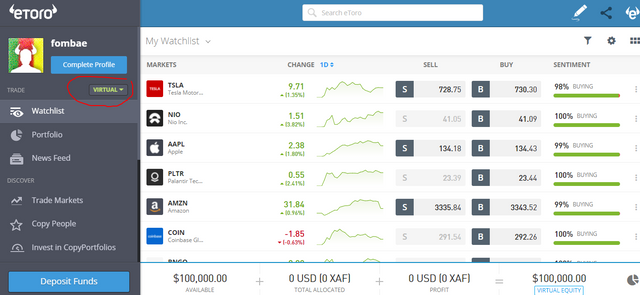

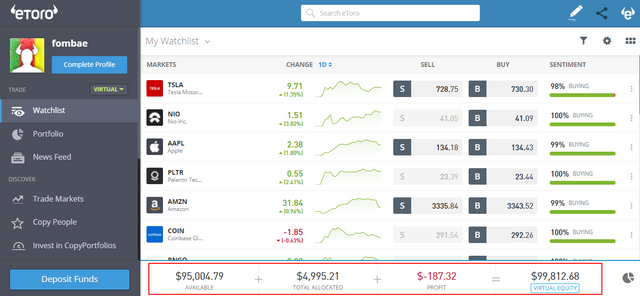

Screenshot Dashboard (virtual portfolio)

Screenshot Dashboard (virtual portfolio)

Click Trade Markets.

100 000 USD virtual deposit

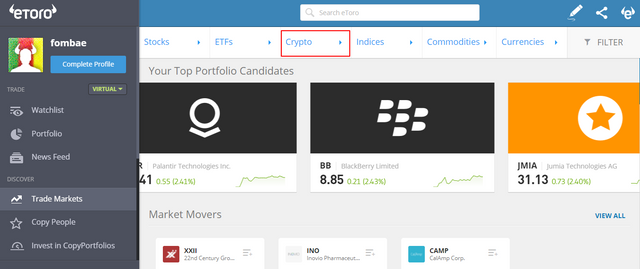

Select crypto from the top of the page.

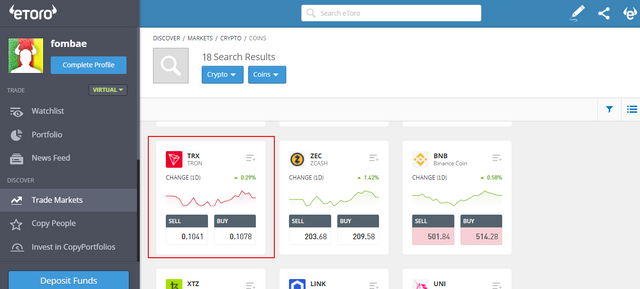

I click TRON to invest in.

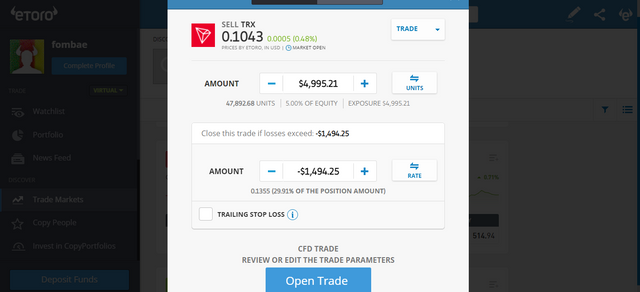

I entered a Sell position.

I'm selling at an amount of 4 995.21 USD.

For fear of losing my money, I enter a negative amount to close the trade if it gets to that price

Then click Open Trade.

Conclusion

This is still new as compared to Forex, So putting more effort into understanding CFDs trading will be required. the so many benefits are just the right reasons to start trading. Check out guides about creating an account on the eToro platformWebsite and start benefiting from the price changes of cryptocurrencies as of the date.

Thank @kouba01 for this opportunity

Hello @fombae,

Thank you for participating in the 2nd Week Crypto Course in its second season and for your efforts to complete the suggested tasks, you deserve a 5/10 rating, according to the following scale:

My review :

Medium content, in which you relied on editing information only from websites without expressing your opinion, which made the article lose the analytical dimension of the ideas. Try to find one idea in each question and analyze it to find a straightforward answer.

Thanks again for your effort, and we look forward to reading your next work.

Sincerely,@kouba01

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks, Prof @kouba01 for taking the time to review my work.

Hope to do much better in the next homework task

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit