1.) Discuss Dark Pools in Cryptocurrency in your own words. How does dark pool works?

Dark Pool

Dark Pool refers to a private exchange that operates outside of the traditional exchange, which enables traders to trade large volumes of assets discreetly and anonymously. With Dark pool, there is no visible order book, and traders are not visible to the public market. Dark pools help to avoid slippage when a large volume of an asset is intended to be bought or sold.

The benefit of using a Dark Pool

- Less impact on market sentiment, as traders trading in large volume, can conceal their intention from the public.

- The price of an asset is picked depending on the average of the best available bid. Price gets to be improved as buyers and sellers get a better trade than in the open market.

- No slippage, as an entire trade can be executed at the intended prices.

Dark Pool is beginning to get into the crypto market, as several exchanges are now offering the set services to customers for a fee. In crypto, the Dark Pool is not different from how it works in the traditional exchange. As I mentioned, the Dark Pool is the place for large-volume traders.

2.) Discuss any crypto exchange that offers a dark pool. How does its dark pool work?

Kraken

Kraken is one of the cryptocurrency exchanges and banks based in the most unit state, offering buying and selling. Kraken was founded in 2011 by Jesse Powell with the plan to give readers a secured space to invest. Kraken exchange is a platform for both advance and beginners in crypto trading. It is a home of a good number of cryptocurrency pairs and a tool for leverages.

How it works

On the Kraken exchange, only the dark pool orders are matched to each other. That will mean a trader can match a standard order with a Dark Pool pair. As we mentioned above, Dark Pool is an invisible order book. Here the orders are limited to the market, so the dark pool orders are not placed where traders can see the order book.

Since the orders are limited, Dark Pool only executes when they cross each other. For this reason, dark pol minimums are large making it difficult for traders to find the other side of the book.

Dark Pool does not execute margin trading as a large minimum need to be met by the trader's balances. Here a fee is placed on everyone no matter if you are a maker or a taker.

3.)What are the supported assets on the dark pool mentioned in (2) above? What are the requirements for getting involved in dark pool trading on the platform? Is there any fee attracted? Explain.

So far from the official website of Kraken link, only Bitcoin, and Ethereum currency pairs are available on the Dark Pool.

Ethereum pairs:

- ETH/CAD

- ETH/EUR

- ETH/GBP

- ETH/JPY

- ETH/USD

Bitcoin pairs:

- BTC/CAD

- BTC/EUR

- BTC/GBP

- BTC/JPY

- BTC/USD

Bitcoin ↔ Ethereum:

What are the requirements for getting involved in dark pool trading on the platform?

- You need to be a Pro Level (personal or Business) verified account holder.

- 100K USD minimum order size for BTC pair

- 50K USD minimum order size for ETH pairs

- Support only limit orders.

Is there any fee attracted? Explain.

Sure. As I mentioned above a fee is placed on both the taker and makers. The fees on the Kraken Dark Pool range from 0.20% to 0.36% which is higher than the normal limit order rates (0.0% to 0.16%). That means an extra 0.20% increase in fees from the normal limit.

On the Kraken exchange, a trader's contribution in a 30 days trade volume can influence the fees, the more trades on the dark pool, the lower the fees on the execution.

4.) For the chosen dark pool, give a brief illustration of how to perform block trading on the platform. (Screenshots required).

I will demonstrate how to perform block trading on the kraken exchange web platform. Following the requirement above, I had created and verified my account to achieve a pro-level. So no need for me to create another account, but for a new user on the platform. you need to create and verify with your email.

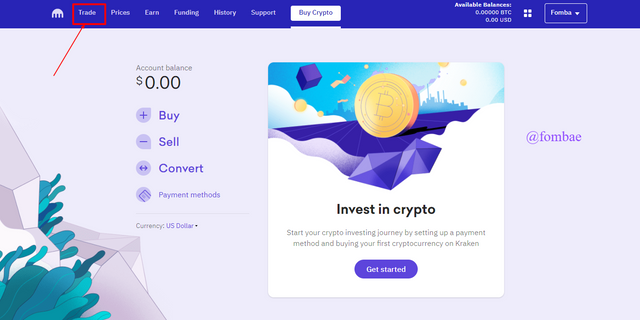

Click Trade

Screenshot kraken web platform

Screenshot kraken web platform

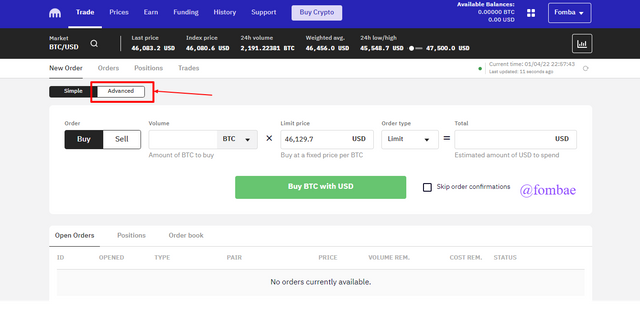

Click advance to switch from simple to advance

Screenshot kraken web platform

Screenshot kraken web platform

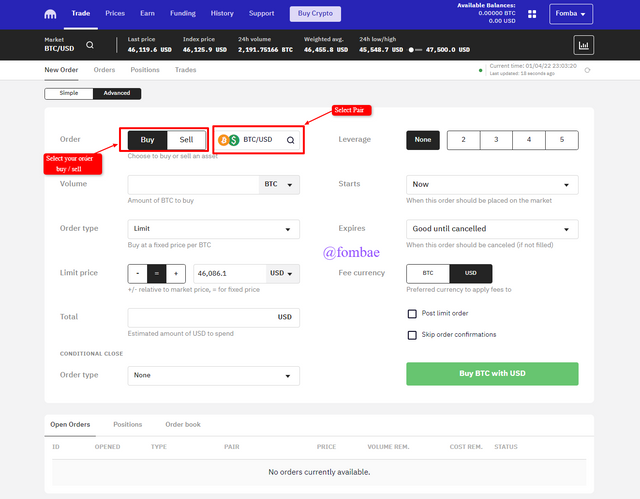

here you can select the order type(buy or sell)and click the pairing bar to select dark pool.

Screenshot kraken web platform

Screenshot kraken web platform

Which I did not find, because my account doesn't hold the large volume equivalent to execute such orders.

5.) What's your understanding of the Decentralized dark pool? What do you understand by Zero-Knowledge Proofs?

Decentralized dark pool

Decentralized dark pool as the name is a separate manner of placing an order without the interference of any third party. The concept is not that different from the centralized exchange dark pool as both Dark Pool place orders and executes which are not public. A decentralized Dark Pool is just a high level of placing more private orders.

A decentralized dark pool is more digitally secure when it comes to the verification method and maintains a fair market price for all participants without manipulating the current market price.

The concept of Atomic swap (peer-to-peer transfer) has been applied in the decentralized dark pool, which aids a trade to be involved in multiple blockchains without any intermediary.

Zero-knowledge-Proof is a technology involved in the decentralized Dark Pool to verify the authenticity of transactions of the Dark Pool. It is in two steps, the prover, and the verifier. The proven step is level when the transaction information needs to be proven to be verified in the second step.

6.) State one decentralized dark pool in cryptocurrency and discuss it. How does it work?

RenEx

RenEx is a decentralized dark pool officially launched by the Republic Protocol. The order book at its core is entirely hidden and invisible to any parties. It is a fair platform that enables traders a verifiable exchange were conducting large volume asset trade. Front-running is not practiced on the platform as trades are not vulnerable to predator trade.

As I mentioned above, the dark pool is a private exchange common on-wall stress and operated by institutional investors. Here assets are traded and matched by a hidden order book. RenEX permits large volumes to be placed on a hidden order book as a decentralized dark pool. Here the engine permits a secure multi-party computation protocol whose trade details will only be made public after the trade has been fulfilled. RenEX gives large volume traders the opportunity for a safely decentralized, atomic cross-chain trading method for the digital asset.

RenEx offers the tool for an institutional investor to trade a large volume of digital assets with high security, which is not publicly available in the market but with the strong support of funds and investors for trading large volumes.

7.) Compare a crypto centralized exchange dark pool with a decentralized dark pool. What are the distinctive differences?

I will be comparing Kraken (centralized) with RenEX (decentralized) dark pool platforms.

Kraken exchange orders are crossed while RenEx implements the concept of atomic swap (peer to peer) during trading.

A centralized dark pool can't make use of a smart contract to facilitate trades, while a decentralized dark pool makes use of a smart contract.

Centralized dark pool orders are not broken down, while decentralized is broken in to identify small fragments

With the centralized dark pool, the exchange platform has access to the order. The decentralized dark pool is completely free from any third party having access to the order.

8.) Research any recent huge sale in any market in the crypto ecosystem and how it has affected the market. What difference would it have made if the dark pool was utilized for such sales?

The 60K BTC sell order on coinbase could be considered a scam wick which is one of the huge sales done during the end of the last year 2021. Scam wicks can be momentum triggers in price, to either increased volume in buy or sell to affect the thickness of the order book.

Due to the 60K sell, the price of BTC still stood to continue the bullish trend to ~63k before collapsing below 61K.

If this transaction was done under the dark pool concept, the market wouldn't have been affected and the order book will not show any sign of change.

9.) In your own opinion, qualitatively discuss the impacts of trades carried out in the dark pool on the market price of an asset. (At least 150 words).

The dark pool has a safer cryptographic verification method for the transaction while maintaining the same rule for all participants. Its illiquid features is been used in the cryptocurrency market to permit traders to execute large volumes without fear of slippage. As we saw above, were a huge transaction affected the public order book, here it is not as the order book is hidden and given that it is an illiquid market. The slippage does not tamper in the public market.

Darl poot can be of benefits but can also be a means of generating an increase in volatility, and which is a disadvantage to lower trades. Dark pool feature and requirements is a place for heavy institutional investors.

10.) What are the advantages and disadvantages of Dark pool in Cryptocurrency?

Advantages

- The order book is hidden from the public making transactions private

- Slippage features help to avoid interference between dark pool transactions and traditional transactions.

- It is a more secure level for institutional investors during trading.

Disadvantages.

- They are lack transparency as the order book is hidden

- The final price pick for trading might not be the best price for trading.

- Small traders do have a place in dark pool trading

Conclusion

The dark pool can be safer but the need for large volume will slow the speed of traders joining. Its lack of transparency is a problem as many traders will love to know what is happening to their assets.

cc: @fredquantum