Greetings, and welcome to dropping on my publication this week on DeFi. DeFi which is the acronym of Decentralized Finance, is gaining ground for its top secure, transparent, and efficient method of implementing financial services. When an operation becomes decentralized, the great transparency, and trustworthiness of the system eventually take off the need for a centralized system. With the use of blockchain technology, the DeFi system reduces the risk of fraud, is cost-effective, and boosts efficiency.

Explain in your own words the DeFi world Why is it important? Let's talk about it.

The Defi world is a financial system that functions on its own without any intermediaries between transactions. As I mentioned above, it is backed by blockchain technology, it is applicable online, and all its transactions are executed online. DeFi systems permit us to do a huge number of transactions within a very limited time. DeFi systems can execute applications for insurance, exchanging, borrowing, and more in a more efficient manner. DeFi used technology alongside public blockchain to facilitate its financial transactions. DeFi needs two important components, that is the infrastructure (technology) and the currency(cryptocurrency).

DeFi is important in the financial sector to offer another level of financial services. I will break down the importance in different domains and services.

- Infrastructure

Defi with blockchain technology (e.g. Ethereum) offers the possibility of creating decentralized programs and smart contracts. These smart contracts can automate financial operations, which can not be altered after deployment. Most DApps that execute financial services are built on the Ethereum network.

- Currency

To have a fully functioning DeFi system, you need a stable currency, this is to have a system that will be secured and reliable. Note here that any programmable currency will not be compatible be it Ether or Bitcoin. Most compatible are stable crypto coins whose values match a fiat currency, making them the ideal currency for DeFi systems.

- Decentralized financial services

As I mentioned above, DeFi cut through every financial operation beyond financial transactions online. Meaning, that it is just not about online payment but exchanging, borrowing, lending, saving, etc. the ability to host smart contracts allows the system to operate transparently and securely.

- Decentralized exchange

Exchange platforms allow its users to buy and sell cryptocurrencies. The DeFi system operates decentralized exchange platforms on the Ethereum network, which permit users to trade cryptocurrencies. These decentralized exchanges do not force users to sign up, require an id, or require any initial deposit or fees for withdrawing funds.

- Decentralized borrowing and lending

DeFi systems offer secure loads without any restriction or complicated processes in the shortest possible time. An example is Compound, which is a decentralized peer-to-peer Borrowing and lending platform on the Ethereum network. The compound platform has the possibility for its users to deposit cryptocurrency and burrows fiat currency.

DeFi Vs Centralized Finance. Advantages and disadvantages, let's talk about them.

Be it DeFi or CeFi, both are covering large cyberspace within a very short time in the crypto ecosystem. While CeFi is most used, DeFi is showing authority.

DeFi runs on blockchain technology which gives the possibility to take control of its transactions. DeFi is permissionless, Trustless, and has capabilities to continue innovations. DeFi transactions do not need the approval of any third parties, the user can check if their transaction was completed without reaching out to any parties. DeFi has the dynamic ability for innovation, as new smart contracts are being developed and tested to execute financial services. Examples: PancakeSwap, MakerDAo, etc.

CeFi is the opposite of DeFi. Here we have a centralized company to hold and manage the financial services for us. CeFi has the Know your Customer (KYC) policy, in which they hold the user's personal information. CeFi knows where your funds are coming from and where you are sending the funds to. CeFi takes off the management of your crypto making you vulnerable on the platform with no control of your crypto. With this limitation, CeFi offers seamless customer support, Flexible conversion, interoperability, cross-chain swap, and centralized exchange. Example Coinbase, BlockFi, etc.

| Parameters | DeFi | CeFi |

|---|---|---|

| Services | Borrowing, Lending, Trading, Payments | Payments, Lending, Trading, Borrowing, Fiat-to-crypto |

| Public verification | Execution should be publicly verifiable | Execution Not mandatory to verify publicly |

| Atomicity element | Present | Not present |

| Anonymous development | More anonymity | Less anonymity |

| Custody | Customers give complete control over assets | Acts as custodians |

| Transaction cost | Charges transaction fee | Offers transactions at no extra cost |

| Cross-chain services | Delay in completing cross-chain exchange | Majority of cryptocurrencies are traded frequently |

| Fiat conversion flexibility | No fiat conversion flexibility | Fiat currency is involved in the exchange |

| Security | More secure | Less secure |

- CeFi

| Advantage | Disadvantage |

|---|---|

| - CeFi system has a clean chain of operation, that transactions have particular objectives. Uses most have an account, most deposit to be able to trade or borrow, etc. | - the level of innovation is limited as the system already has a particular operation to follow. |

| - The CeFi system has autonomy over the user's fund, holding details of the user's information. | - The level of data security is limited as the system holds personal information belonging to the user. |

| - CeFi system help to hold the user's keys, they don't have to border private keys since the transaction is validated by the system | - The users don't have authority over their funds, since they do not hold private keys for their wallet. |

| CeFi systems are user-friendly, which is more comfortable for the user to navigate. | - |

- DeFi

| Advantage | Disadvantage |

|---|---|

| - DeFi takes care of Human Error in a financial transaction, unless the algorithm of the smart contract is poor. | - The instability of a blockchain host can make a project unstable, as the technology is still undergoing updates. |

| - DeFi takes off the necessity of the third party in a transaction, making the process faster. | - Sometimes transactions charge a high fee due to congestion or a long time to be confirmed. |

| DeFi is time-saving, as you do not need to move around to get a load. you can just deposit crypto and borrow fiat currency. | - The system suffers over-collateralization as the value of the stake asset is always higher than the amount to be borrowed. |

| - DeFi operations are permissionless, you do need the approval of any intermediary body to carry out your financial operations. | - They are always afraid of the smart contract, as it is vulnerable to a major flaw in the code. This can eventually lead to a loss of funds if the Defi project failed at one point. |

Well, I will not be forcing any user to pick which system to work. It all depends on where you feel safe in cyberspace. If you don't want to worry about the security of your funds, then the CeFi system is the best option. But if you have the time to follow your transaction, then DeFi is the best option. So as you can see it will all depend on your objectives.

Have you used decentralized Exchange? Tell your experience and explain a Decentralized Exchange. Show screenshots.

No, I don't remember using a decentralized exchange. My experience has been on learning proposed so I will just be sharing what I know about the PancakeSwap.

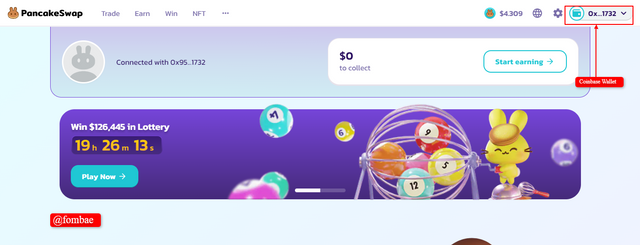

PancakeSwap is a DEX platform that focuses on BEP20 tokens, which are developed by Binance. With PancakeSwap, you don't need to create an account, all you need is to connect your wallet to the platform. PancakeSwap can be used to change particular BEP20-base tokens to BNB by just jumping into the pool with sufficient liquidity.

Navigating the PancakeSwap, you need to create a wallet that is compatible with the BNB Chain. Examples are Trust Wallet, BNB Chain Wallet, Coinbase Wallet, MetaMask, etc.

So you need to connect to any of the wallets, before you can add liquidity to any of the pools on the platform. Like I said above, you just need to connect your wallet by clicking the connect at the top right of the homepage.

Apart from adding liquidity to one of the pools, you can also farm on pancakeSawp. Here you can deposit your LP tokens to earn a CAKE token which is a native cryptocurrency for PancakeSawp. If you are interested, you can click on Earn and select the Farms option. Another feature of the PancakeSwap is Staking. I have not used any of the features, but from my reading, the platform is safe and interesting.

Many opinions in general when it comes to the future of blockchain technology, so DeFi is not different from it. While we will see a lot of advantages over the traditional financial system. Forbes reported the increase in the worth of the market capitalization in the Defi industries in gaining wide ground. DeFi's ability to secure huge investments, reshape the traditional financial sector. With all is, I can deny that DeFi is driving the financial industry to another level.

So my optimism about DeFi comes due to the volatile nature of cryptocurrencies. DeFi makes use of Stablecoins, but I have seen stable coins fall over 500% down from their $1 peg, and some have moved over 200% from their $1 peg. So Defi is something to be very informed about before finally making up your mind to invest in or make use of its unique business models.

Cheers

Thanks for dropping by

@fombae

Your explanation of decentralized finance, its importance, and its difference from CeFi are good.

However, I don't accept this because to me CeFi transaction charges are sometimes more when compared to DeFi, they charge on each transaction and also we pay maintenance and alert fee.

Yes, DeFi is not something you can just go into without acquiring knowledge about it, unlike CeFi which anyone can use. Thank you for sharing and Good luck with the contest.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

#letscomment

Curated By - @lavanyalakshman

Curation Team - Team 3

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You have this post in a very excellent manner and I appreciate your knowledge of the decentralised financial system. The decentralized finance is actually the modern form of the financial system.

There are lot of innovations and benefits that are introduced by the decentralized financial system and one of them is the high security. It is really a very good thing that most of the people are satisfied with the decentralized finance as their funds are under their own control.

Good luck man 🤞

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You are perfectly right, user will always feel safe when they hold complete control of their funds. Thanks, @steemdoctor1 for dropping on my post.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello friend!

I'm @steem.history, who is steem witness.

Thank you for witnessvoting for me.

please click it!

(Go to https://steemit.com/~witnesses and type fbslo at the bottom of the page)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your post was upvoted and reshared on @crypto.defrag

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This post was selected for Curación Manual (Manual Curation)

@tipu curate

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted 👌 (Mana: 1/7) Get profit votes with @tipU :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You have really written so well about DeFi, indeed DeFi has the potential to change our financial institutions more better. Best of luck to you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks, @jasminemary. As I mention volatile nature of the currency is a big setback.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your post is upvoted using the @steemcurator08 account by @chant. Continue making quality content for more support.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit