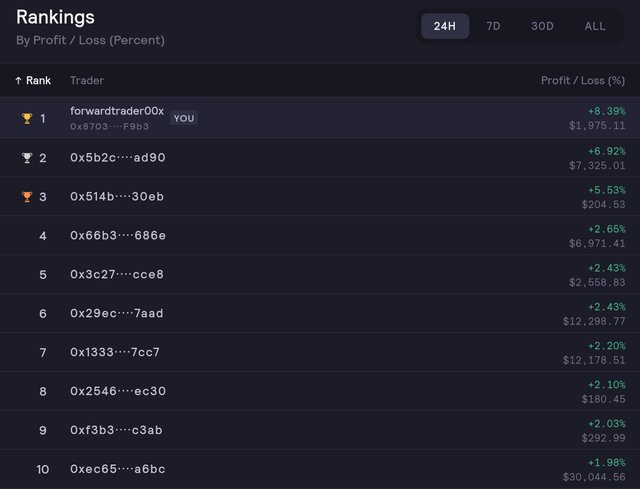

Ranked 1st out of 100+ traders in the intense daily dydx exchange competition. Join my $5/month mentorship program to master the art of crypto trading.

Dydx Trading Competition: https://trade.stage.dydx.exchange/rankings/competition

Forward Traders Mentorship Group: https://signal.group/#CjQKILZqZhzmXQrXE8YfYHN4CrImzNkOapmcha2hmH_tqyCHEhAjU9Bqg9HLjzKDKFSZHPKD

Breakout trading is a popular strategy employed by technical analysts to capitalize on significant price movements and market momentum. By identifying key levels of support and resistance, traders aim to enter positions as prices break out of established trading ranges. In this article, we will explore different breakout trading strategies, techniques for identifying breakouts, and essential considerations for successful implementation.

I. Understanding Breakouts:

Definition of Breakouts: Breakouts occur when price surpasses a well-defined level of support or resistance, signaling a shift in market sentiment and potentially leading to substantial price movements.

Types of Breakouts: Breakouts can be categorized as bullish (upward breakout) or bearish (downward breakout), depending on the direction of the price movement.

II. Identifying Breakout Candidates:

Support and Resistance Levels: Identify key levels of support and resistance using tools such as trend lines, horizontal levels, and moving averages.

Chart Patterns: Look for breakout signals within chart patterns like triangles, rectangles, and wedges.

Volatility Expansion: Monitor volatility indicators, such as Bollinger Bands or Average True Range (ATR), to spot periods of low volatility that often precede breakouts.

III. Breakout Trading Strategies:

Classic Breakout Strategy: Enter a trade when price breaks above resistance (bullish breakout) or below support (bearish breakout), accompanied by an increase in volume.

Pullback Breakout Strategy: Wait for a brief pullback or retest of the breakout level before entering the trade, which provides a more favorable risk-to-reward ratio.

Breakout with Retracement Strategy: Enter the trade after a breakout and subsequent retracement, aiming to catch the continuation of the trend.

Breakout with Price Patterns Strategy: Utilize specific price patterns, such as flags, pennants, or cup and handle formations, in conjunction with breakouts to identify high-probability trades.

IV. Risk Management and Trade Execution:

Setting Stop-Loss Orders: Place stop-loss orders below the breakout level for bullish trades and above the breakout level for bearish trades to limit potential losses.

Profit Targets and Trailing Stops: Determine profit targets based on measured moves, previous price swings, or key technical levels. Consider trailing stop-loss orders to protect profits as the price continues to move favorably.

Trade Volume and Position Sizing: Adjust position sizes based on the volatility and risk of the breakout trade. Higher volatility may warrant smaller positions to manage risk effectively.

V. Refining Breakout Trading Strategies:

Confirmation Indicators: Use additional technical indicators like momentum oscillators (e.g., RSI or Stochastic) or volume indicators to confirm the strength of a breakout signal.

Backtesting and Analysis: Validate the effectiveness of breakout strategies by backtesting historical price data and conducting thorough analysis of past breakouts.

Market Conditions and News: Consider the overall market conditions, upcoming economic announcements, and news events that may impact the success of breakout trades.

Conclusion:

Breakout trading strategies offer technical analysts a dynamic approach to profit from strong market movements and capitalize on shifts in market sentiment. By identifying key support and resistance levels, employing appropriate risk management techniques, and staying vigilant for confirmation signals, traders can increase their chances of successfully riding the waves of market momentum. However, it is important to remember that breakout trading carries inherent risks, and continuous learning, practice, and adaptability are crucial for achieving consistent profitability in this strategy.

If you enjoy my works, please consider donating Ethereum to 0x870319E96690e65fcB97aeacc6d1AB585d1FF9b3. Thank you!

Start trading on Dydx Exchange: https://trade.stage.dydx.exchange/r/LFECSJTO