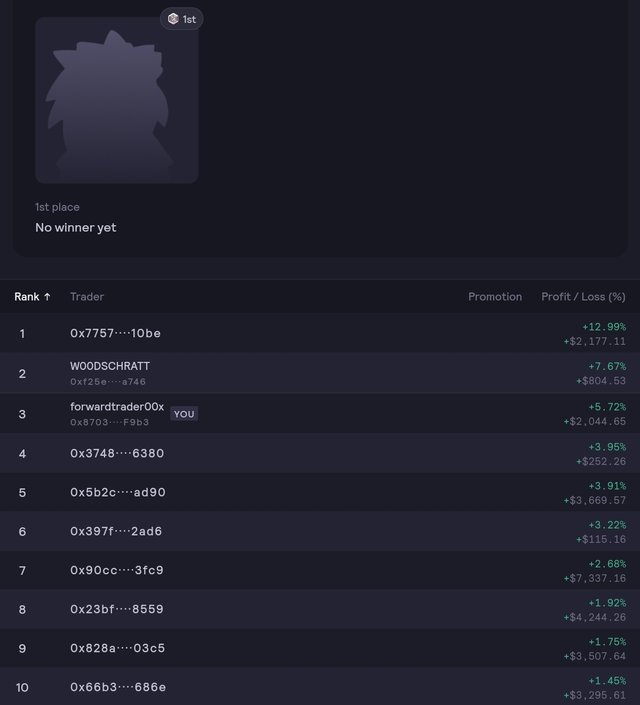

Ranked 3rd out of 100+ traders in the intense daily silver dydx exchange competition. Join my $5/month mentorship program to master the art of crypto trading.

Image Source: https://trade.stage.dydx.exchange/rankings/silver

Dydx Trading Competition: https://trade.stage.dydx.exchange/rankings/competition

Forward Traders Mentorship Group: https://signal.group/#CjQKILZqZhzmXQrXE8YfYHN4CrImzNkOapmcha2hmH_tqyCHEhAjU9Bqg9HLjzKDKFSZHPKD

Cryptocurrencies have revolutionized the financial landscape, offering investors a unique opportunity to participate in the digital asset revolution. While short-term trading can be enticing, long-term investing in cryptocurrencies has proven to be a fruitful strategy for many investors. In this article, we will explore the benefits and considerations of long-term investing in cryptocurrencies, highlighting the potential for significant returns and the importance of strategic decision-making.

Understanding the Volatility:

Cryptocurrencies are known for their volatility, with prices experiencing wild swings in relatively short periods. However, adopting a long-term investment approach allows you to ride out short-term price fluctuations and focus on the overall growth potential of the market. While volatility can be unnerving for some, it also presents opportunities for patient and disciplined investors.

Building a Diversified Portfolio:

Diversification is a fundamental principle in any investment strategy, and it holds true for cryptocurrencies as well. By spreading your investment across multiple cryptocurrencies, you can mitigate risk and capture potential gains from different sectors of the market. Consider investing in established cryptocurrencies like Bitcoin and Ethereum, as well as promising altcoins with innovative technologies and strong development teams.

Research and Due Diligence:

Before making any long-term investment, thorough research and due diligence are essential. Explore the fundamentals of each cryptocurrency, including its underlying technology, use cases, market adoption, and development roadmap. Stay informed about industry trends, regulatory developments, and market sentiment to make well-informed investment decisions.

Dollar-Cost Averaging (DCA):

One effective strategy for long-term investors is dollar-cost averaging. This approach involves investing a fixed amount of money at regular intervals, regardless of the cryptocurrency's price. By consistently buying over time, you can reduce the impact of short-term price volatility and potentially achieve a lower average purchase price.

Setting Realistic Expectations:

While cryptocurrencies have delivered impressive returns in the past, it is crucial to set realistic expectations for long-term investing. Understand that the market can experience prolonged periods of volatility, and it may take time for your investments to appreciate significantly. Patience and a long-term perspective are key to success in this space.

Secure Storage Solutions:

Proper security measures are paramount when investing in cryptocurrencies for the long term. Consider using hardware wallets, such as Ledger or Trezor, to store your digital assets securely offline. Implement strong passwords and enable two-factor authentication on your exchange and wallet accounts. Protecting your investments from potential cyber threats is crucial for long-term asset preservation.

Regular Portfolio Review:

Although long-term investing implies a more hands-off approach, periodic portfolio reviews are still necessary. Evaluate the performance of your investments, assess market conditions, and make adjustments to your portfolio if needed. Stay informed about any developments related to the cryptocurrencies you hold and adapt your strategy accordingly.

Conclusion:

Long-term investing in cryptocurrencies can be a rewarding strategy for those willing to embrace the inherent volatility and focus on the potential of this emerging asset class. By building a diversified portfolio, conducting thorough research, and adopting a patient mindset, investors can position themselves to benefit from the long-term growth and innovation within the cryptocurrency market. Remember, successful long-term investing requires discipline, resilience, and a commitment to ongoing learning in this rapidly evolving space.

If you enjoy my works, please consider donating Ether to 0x870319E96690e65fcB97aeacc6d1AB585d1FF9b3. Thank you!

Start trading on Dydx Exchange: https://trade.stage.dydx.exchange/r/LFECSJTO

You've got a free upvote from witness fuli.

Peace & Love!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit