It’s another wonderful edition at the crypto academy and it is

awesome attending the first lecture by professor

@kouba01. The professor gave a lecture on

Cryptocurrency CFDs and I will be solving the task given with this post.

What is a cryptocurrency CFD?

Before talking about cryptocurrency CFD, it is important to have the

basic meaning of CFD itself. CFD is an abbreviation for the phrase Contract for

Difference which clearly state the word contract in it. Now, Cryptocurrency Contracts for

Difference simply means the practice by an investor entering a cryptocurrency investment based on contracts which means assets traded by such trader isn’t his but rather enter a contract of buy/sell offered by a broker. The contract involves an agreement between a trader and the broker.

.jpeg)

Source

In cryptocurrency CFD, the investor is given a contract opportunity of buy/sell by the broker on any cryptocurrency asset and as such, the investor would purchase a position contract on the particular asset which could be a position for buy (long position) or a sell position (short position). And the decision of buy or sell is based on the investor’s choice by

hoping the price of the asset would rise or drop, as such, cryptocurrency CFD allow users to take

benefit from the bear or bull of the crypto asset market which means your contract can be based

on the uptrend or downtrend price behavior of the asset.

Highlights of Cryptocurrency CFD

It’s an investment/trade type that is based on contracts.

It involved the trader and broker offering the contract.

The trader chooses a position either buy or sell position.

The trader can choose to base the contract on bullish tendency of the asset or bearish tendency as well.

The trader would reach an agreement with the broker by placing position and at the end of the

contract, profit will be taken or loss if things went the other way of the initial position.

Merits of Cryptocurrency CFD

- Investors have access to larger market that can't be accessed with their initial low capital.

- This type of investment is characterized with high profitability.

- It allows investors to take advantage of both the bull or bear of the asset market.

- Allows investors to take advantage of the short term position especially when it's clear the market is bearish.

I will talk about the demerits of cryptocurrency CFD in its risk later in this context.

How do I know if cryptocurrency CFDs are suitable for my trading strategy?

Suitability for CFD would be determined by the trading features

exhibited by me and that tends to become my trading strategy. Below is a list of how to

determine that;

Provided that:

- I don’t have enough capital to participate in high profitability trades.

- I want to take profit from a crypto asset no matter what the price trend is, uptrend or downtrend.

- I exhibited a short term trading feature to take advantage of the slightest bear.

- I am determined to maximize my chances of gaining quickly from the crypto market after my analysis has shown me a definite trend.

- I realized I don’t have the capacity of possessing large amount of crypto for good profitability.

- I exhibited an aggressive tolerance to risk in crypto trading.

Are CFDs risky financial products?

CFDs are very risky and as such, I can say it is mostly suitable for the

aggressive tolerance to risk traders who have the initial thought of win or loss no matter how profitability the trade is. The risk involved will be shown below in the list;

- The risk of investment in CFD is greater compared to normal crypto trading as they are leveraged financial products.

- General market volatility and the change in price of the asset you are trading on can affect your position and tend to make you lose money.

- You bear the losses if your entry position goes wrong at the end of the contract.

- The cost of holding your position while you are away for a long period of hours is high.

- You could face account liquidation if your loss is exorbitant as compared to your trading account balance.

Do all brokers offer cryptocurrency CFDs?

In this case, the answer is that not all brokers offer cryptocurrency CFDs and a few list of some that offers it will be given below;

HYCM: This is the abbreviation for the name Henyep

Capital Markets Limited which is a UK based broker and according to research, it offers up

to 60 cryptocurrency CFDs. On the website, it is clearly stated that CFDs trading is highly risky

and according to research, HYCM has been in operation in other financial realm for over 40

years.

Swissquote: This is another broker that came into limelight

in the year 2000 and which is actually an online bank located at Switzerland that offers

cryptocurrency CFDs and provide access to most financial markets.

City Index: City Index is another broker that offers different

access to financial markets and cryptocurrency CFD is not an exception. City Index is a UK

based broker. City index has been operating in other financial realm since the year 1963 when it

was founded.

eToro: eToro is a trading platform that offers trading in the

stock market and also in cryptocurrency. In addition to the cryptocurrency trading, they offers cryptocurrency CFD. eToro was founded in the year 2006 and has their headquarters in Tel Aviv-Yafo. Israel.

Above are a few list of brokers that offers cryptocurrency CFD.

Explain how you can trade with cryptocurrency CFDs on one of the brokers (Using a demo account).

I will be using eToro for this purpose and I will start from account creation to the stage of trading Demo.

Steps on how to create an account on eToro

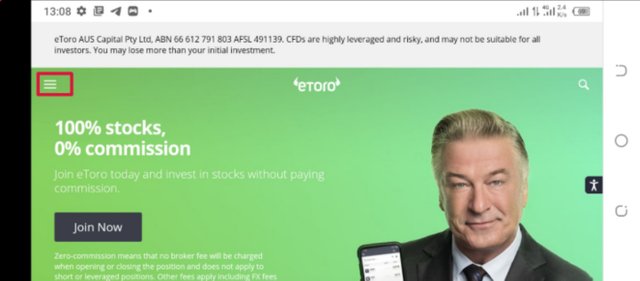

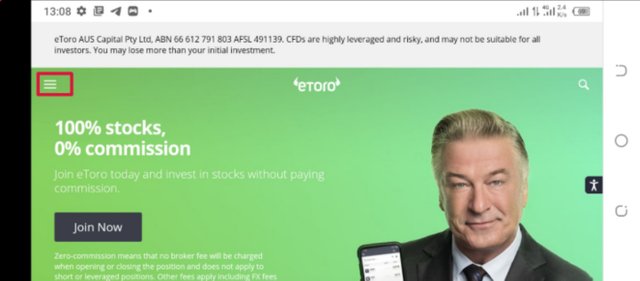

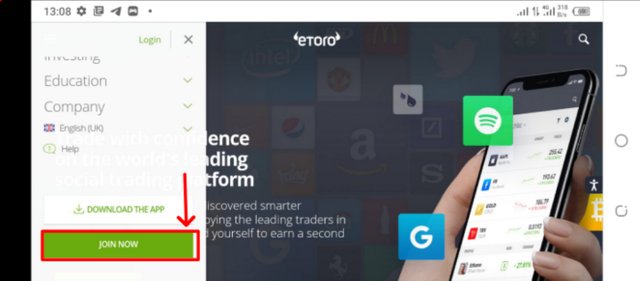

- Visit etoro.com

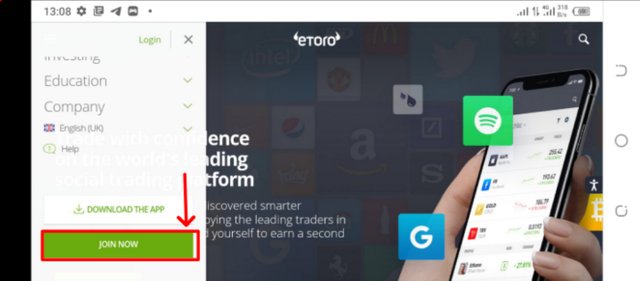

- Select the three parallel lines icon by the top left of the page and click JOIN NOW.

eToro Homepage

Join Now

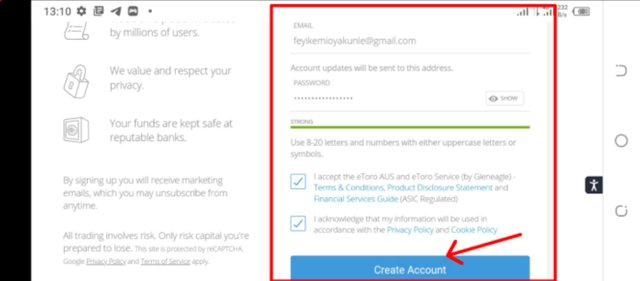

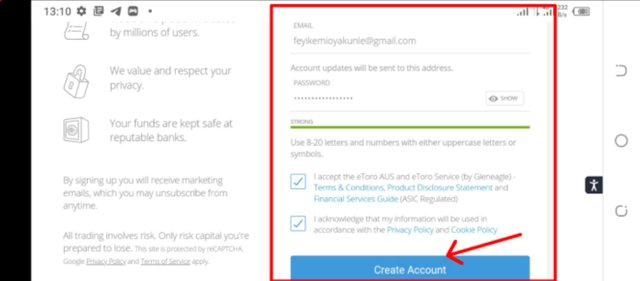

- Input your username, email address and a strong password.

- Click Create Account.

Create Account

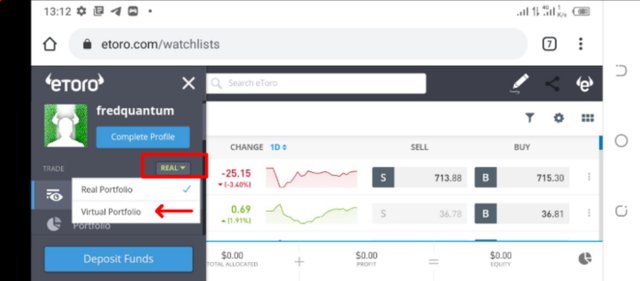

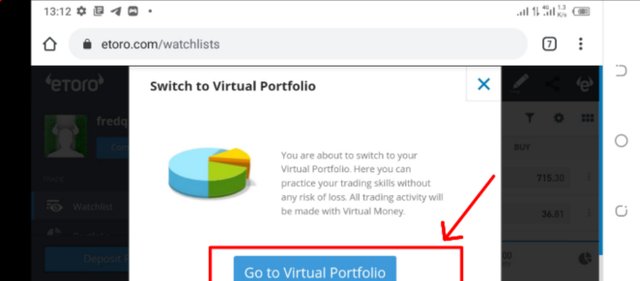

How to carry out a Demo Trade

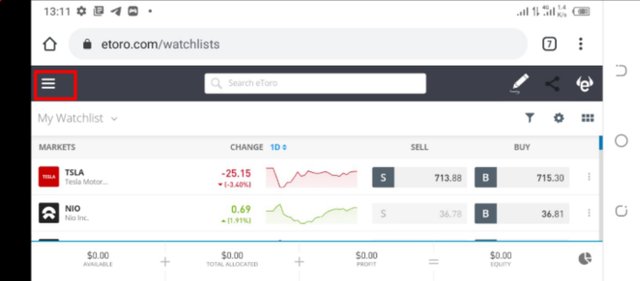

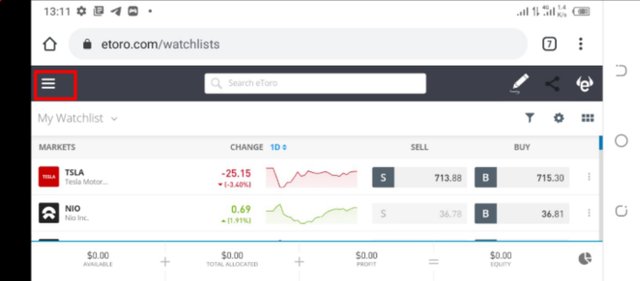

- Account created and you have a new page.

- Select the three horizontal lines icon.

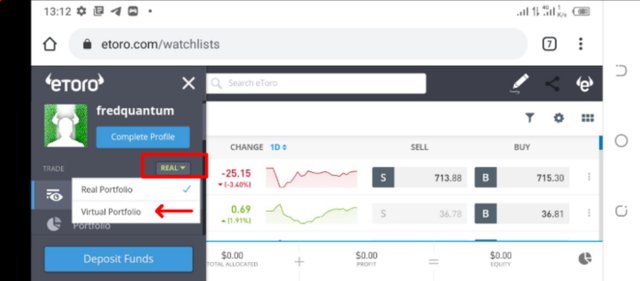

- Select the drop-down in front of Real, and select virtual portfolio.

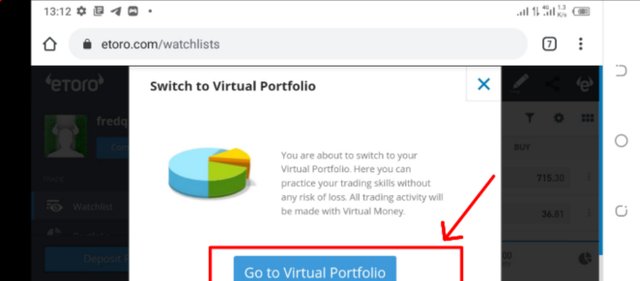

- Click on Go To Virtual Portfolio to switch to virtual account.

Homepage

Select Virtual Portfolio

Go Virtual

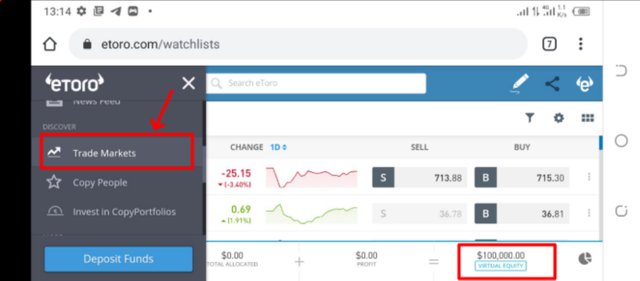

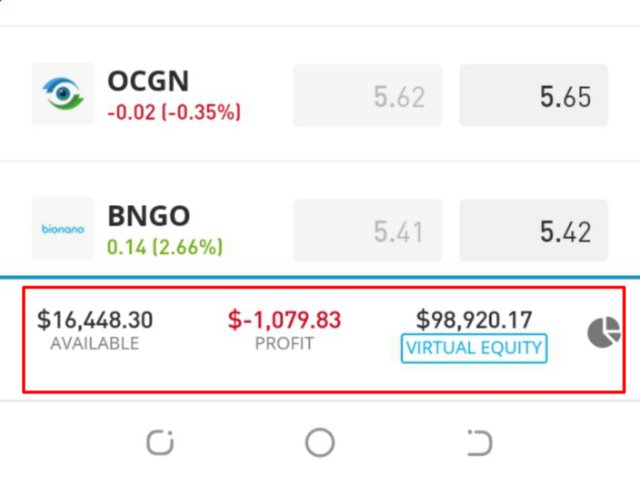

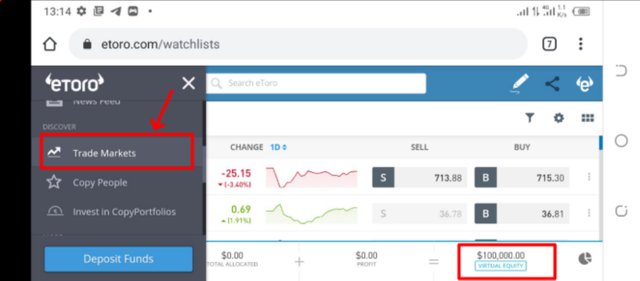

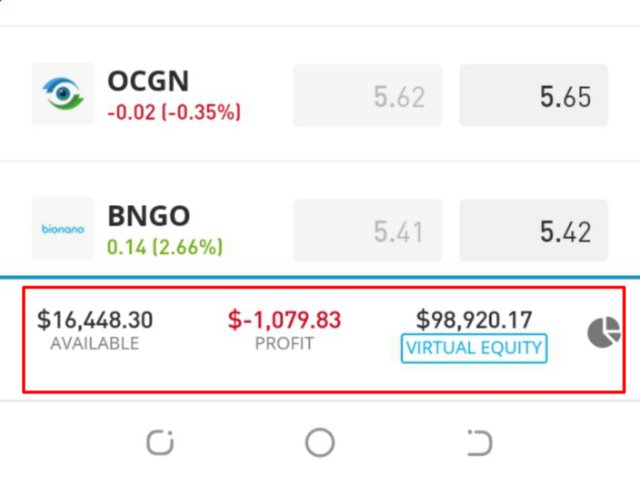

- Now you have the Demo account.

- Click Trade Markets.

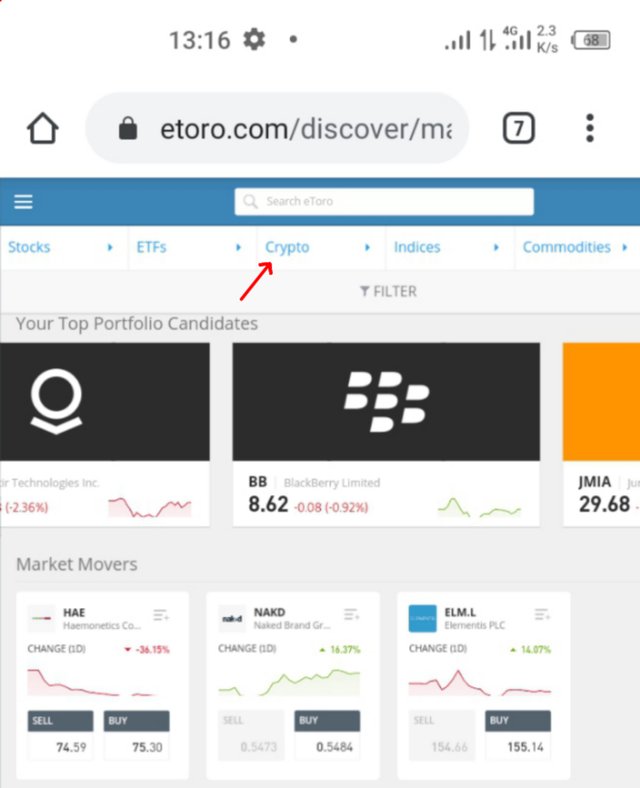

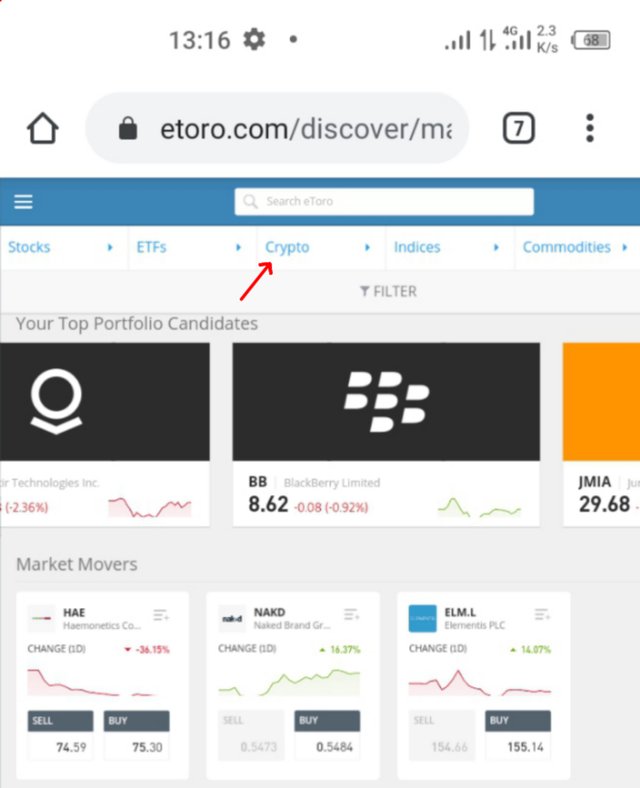

- Select crypto from the top of the page.

Demo Account

Crypto Navigation

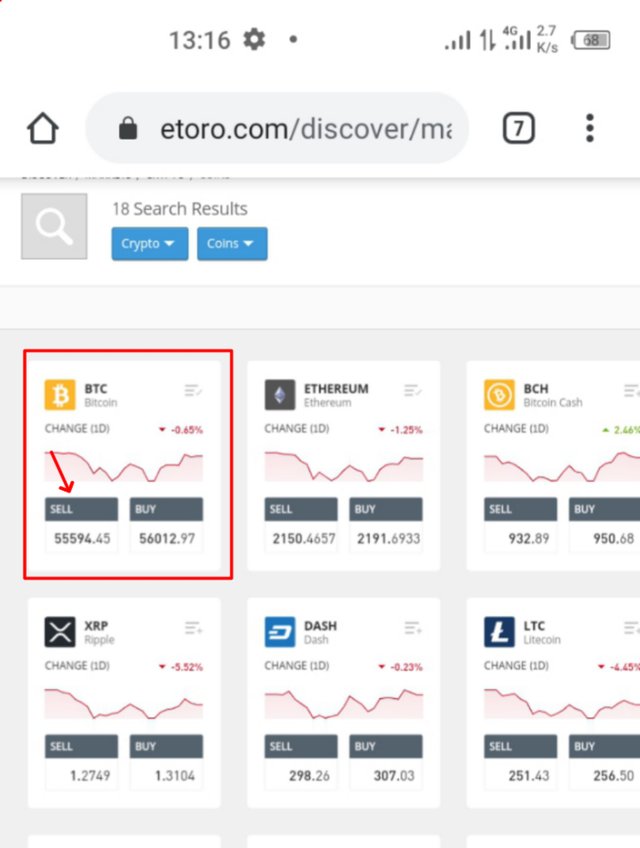

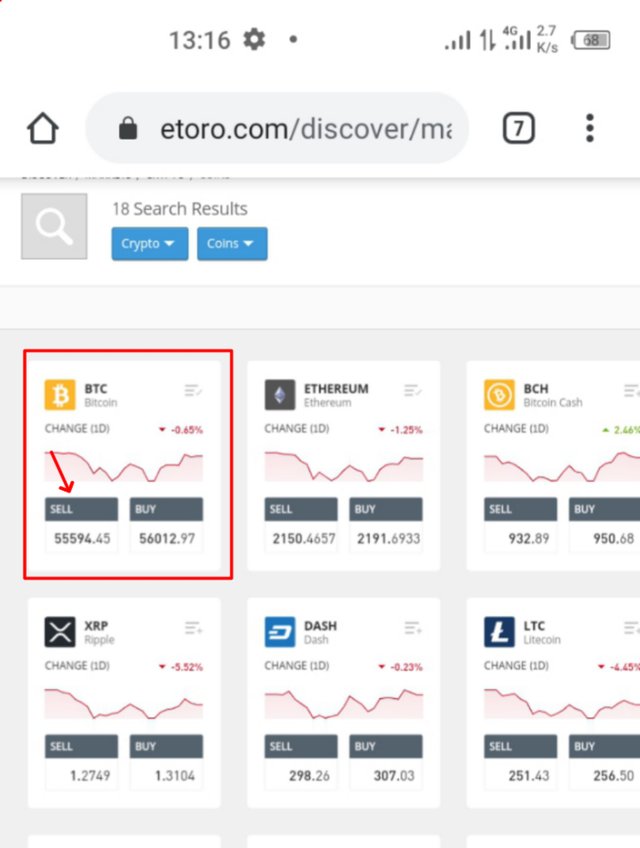

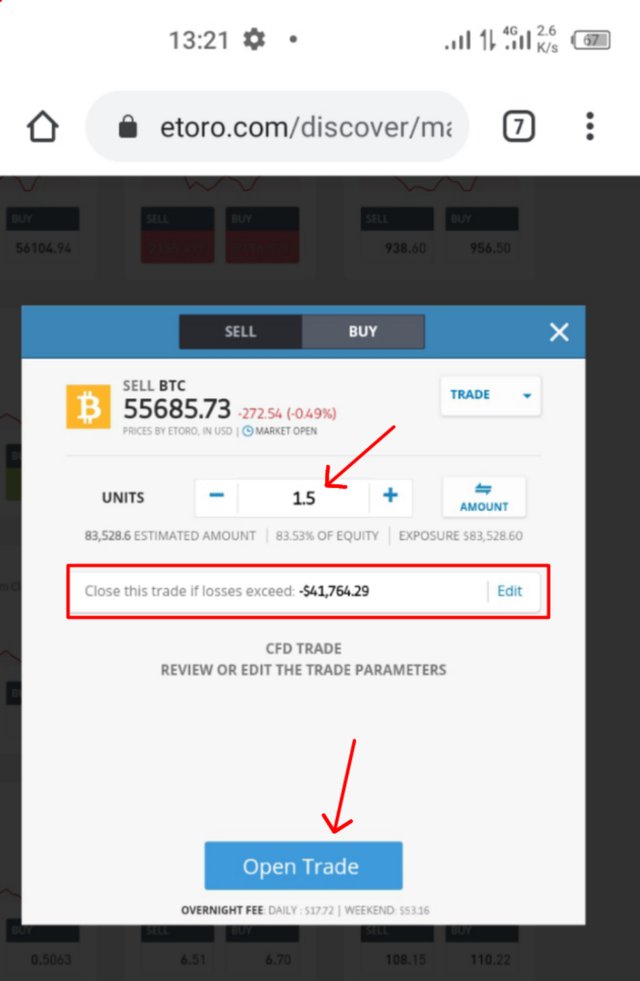

- I selected Bitcoin as an asset I wanted to invest in, on the CFD.

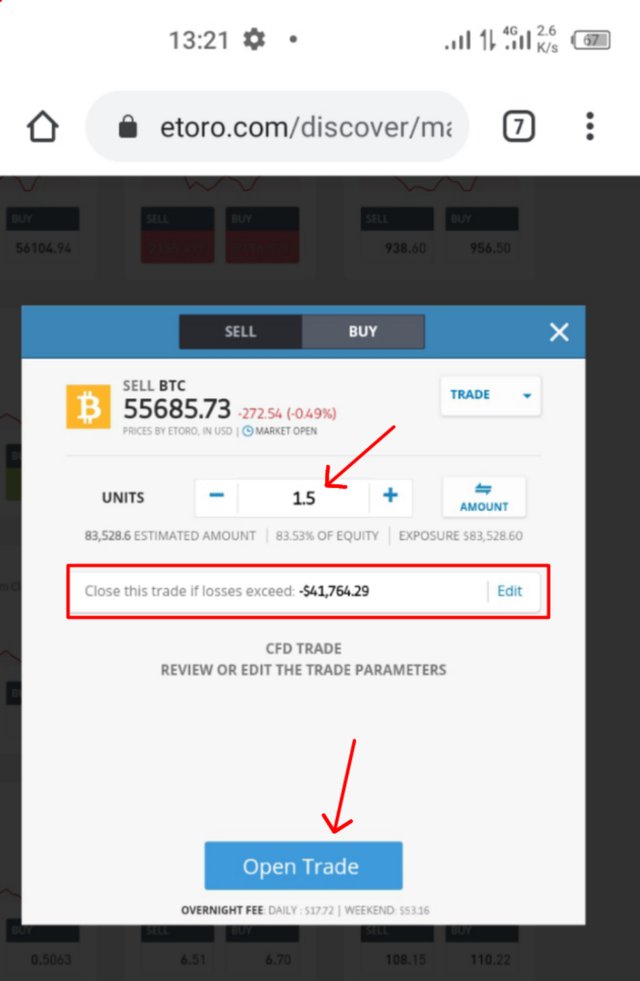

- And I entered a Sell position.

- I'm selling 1.5 unit.

- There is a field where I can close a trade when I feel I am loss and I can input a value in there.

- Then click Open Trade.

Asset

Input Amount, Loss Control and Open Trade

Demo Account- After opening a Sell position for Bitcoin

In conclusion, cryptocurrency CFDs is an contract investment that helps traders/investors to have access to larger market which their capital initially isn't capable to access and thereby expose them to earn massive profits if the position goes well as planned and it is also a high-risk investment which could drain up an investor's portfolio if anything goes wrong. Thanks to professor

@kouba01 for this great lecture. Thank you all for reading.

Cc: @kouba01

.jpeg)

Hello @fredquantum,

Thank you for participating in the 2nd Week Crypto Course in its second season and for your efforts to complete the suggested tasks, you deserve a 10/10 rating, according to the following scale:

My review :

An excellent article in form and content, a clear understanding of the topic, which gives you a clear methodology for answering questions, a great way to analyze information, and to create ideas to achieve the goal. I wanted you to try another broker so that we can share a new experience with you.

Thanks again for your effort, and we look forward to reading your next great work.

Sincerely,@kouba01

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for the review professor @kouba01. It's really wonderful attending your lecture and participating in the task given. How I wish I can explore another broker at leisure in my post's comment section, if it won't be regarded as spamming. Thanks for the review once again, sir.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It is not worth it, just an opinion that does not spoil anything.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Okay, sir. Thanks for the response.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit