Anytime I open my web 3.0 wallet and see nearly all the price indicators showing red, I know that bitcoin has probably dumped. And in most cases, this is always true. For an understanding of why that happens, you can check my article (Bitcoin and Market Dominance).

Frankly speaking, the way bitcoin's price action affects the rest of the crypto market is very annoying, and it's that annoyance that has given rise to this article. But before I go into my rant, let's talk about the Ford Model T.

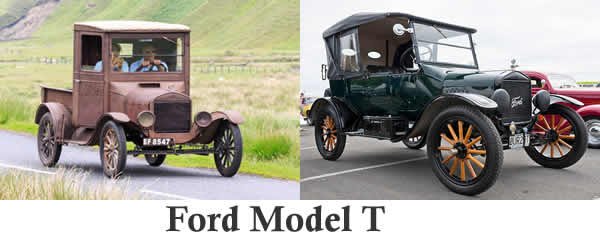

The Ford Model T was a car that ushered in a major revolution in the automobile industry. Based on concepts introduced with that car model and its production, the automobile industry was able to innovate and become more efficient and productive. The automobile industry has since improved and outgrown what the model T introduced. Despite the "greatness" of the Ford model T, I doubt anyone in year 2022 will happily buy one to use as a family car for daily commutes. However, as a priceless collectors item, it is a good investment.

How does this relate to bitcoin, you may ask? Bitcoin is generally recognized as the starting point and foundation of cryptocurrencies. From its humble beginnings, it has grown to become a strong financial asset. Other cryptocurrencies (also called alt-coins) have been developed based on the principles introduced by bitcoin and many of them have gone ahead to add more improvements to overcome the shortcomings of bitcoin.

Despite the "greatness" of bitcoin, just like the Ford model T, I think bitcoin now belongs to the museum. As a collectors item, similar to a priceless work of art, I think bitcoin is a good investment but as a financial instrument for day-to-day transaction, bitcoin is outdated. Even as a basic financial asset for daily payments such as buying coffee or grocery shopping, bitcoin is severely limited both in design and implementation.

Similar to how we can compare our modern cars to the model T, newer and more efficient cryptocurrencies have emerged and the cryptocurrency world is currently doing itself a disservice by hanging so tight to bitcoin.

Looking at what the bitcoin price action does to the entire crypto market is a sign that we need to decouple the alt-coins from bitcoin. There are many alt-coins that would have held their market prices well, even in this bear market, but due to bitcoin's effect, their prices have been pulled down.

Lots of people may not like these assertions because so many believe that bitcoin is the "ultimate" but the truth remains that bitcoin is now an artifact that is pulling down the other cryptocurrencies and needs to be relegated to the museum, together with the cowries and shells which preceded modern money while we should now focus on the other cryptocurrencies that provide real world use cases and innovations that are practical and useful.

This is my argument; Bitcoin has served its purpose and should no longer be used as a yardstick for dealing with cryptocurrencies. The future of crypto now belongs in the hands of alt-coins and that is where we should be focusing our energies.