Arbitrage occurs when the trader takes advantage of the price differences that exist between several exchanges, exchanging the assets simultaneously to benefit from the slowness in updating prices.

It consists of taking an asset and selling it in a market where the exchange of that asset has a slightly high price if we intend to sell it or lower if we intend to buy it.

for instance:

If asset A against pair B, has a value of $ 50 in market 1 and that same Asset A in market 2, against pair C has a value of $ 53, said discrepancy between the two markets is used to benefit of the.

That is, if we have the AXS token in EXCHANGE # 1 at $ 100 against the BNB pair and in EXCHANGE # 2 we have the AXS pair against USDT at $ 99, this difference is what we call arbitrage.

2- Do your own research and define the types of Arbitration (Define at least 3 types of Arbitration)

There are many types of arbitration among them we find:

- Pure arbitration.

This arbitrage is what we normally know, it happens when I have an asset and I try to change in another market that has a slightly lower or higher price depending on the case.

- Risk arbitration.

This type of arbitrage is carried out by obtaining an asset seconds before the price changes, knowing in advance what the change will be that will be made soon, the risk of this arbitrage is that the price does not move as we have predicted!

- Exchange arbitration.

This arbitrage is carried out by buying any asset on one exchange and selling it on another exchange, previously checking the prices and taking into account that there is a discrepancy between them.

- Financing rate arbitration.

This type of arbitrage occurs when you buy a currency and try to cover the cost and the variation in the price of the currency by trading futures based on the market trend.

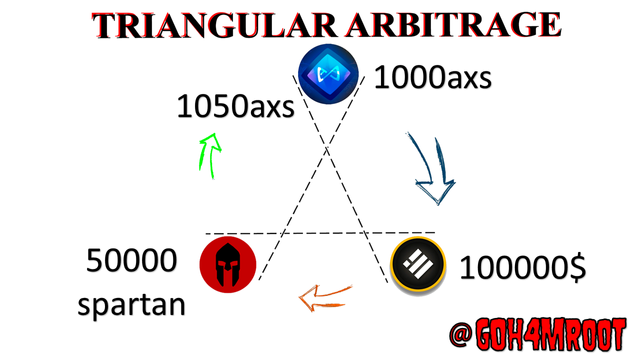

3- Explain the triangular refereeing strategy in your own words. (You must demonstrate it through your own illustration)

Triangular arbitrage occurs when there is a difference between the value of one currency within the market compared to the price of the same currency within the other market, and to obtain profit the asset is exchanged 3 times returning to the same currency in the last exchange, with this we can increase the amount of coins we had at the beginning.

it is done as follows:

Example:

We have 1000 AXS tokens, these tokens we change to BNB receiving 100000 BUSD tokens in exchange, then we change the BUSD to SPARTAN token, we receive 50000 Spartan, then we change the doge again to AXS but now we receive 1050AXS, in theory, what you should do is to change the currency a few times while the market price fluctuates to make a profit with minimal risk.

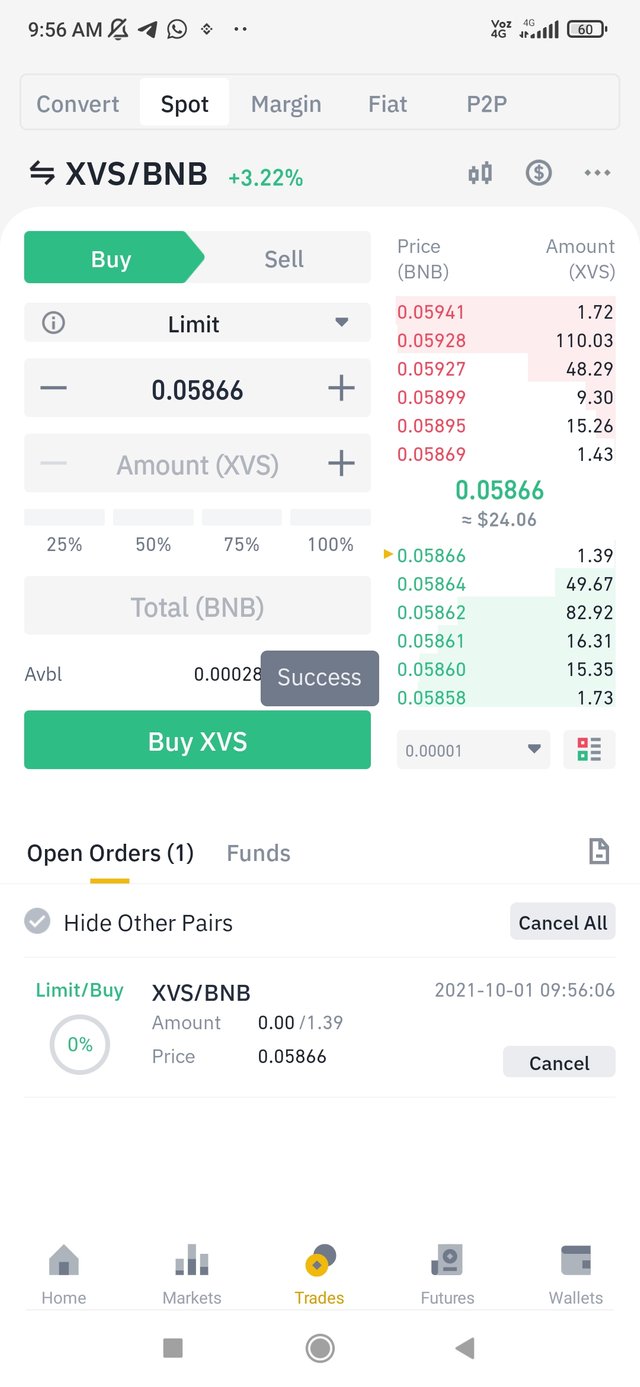

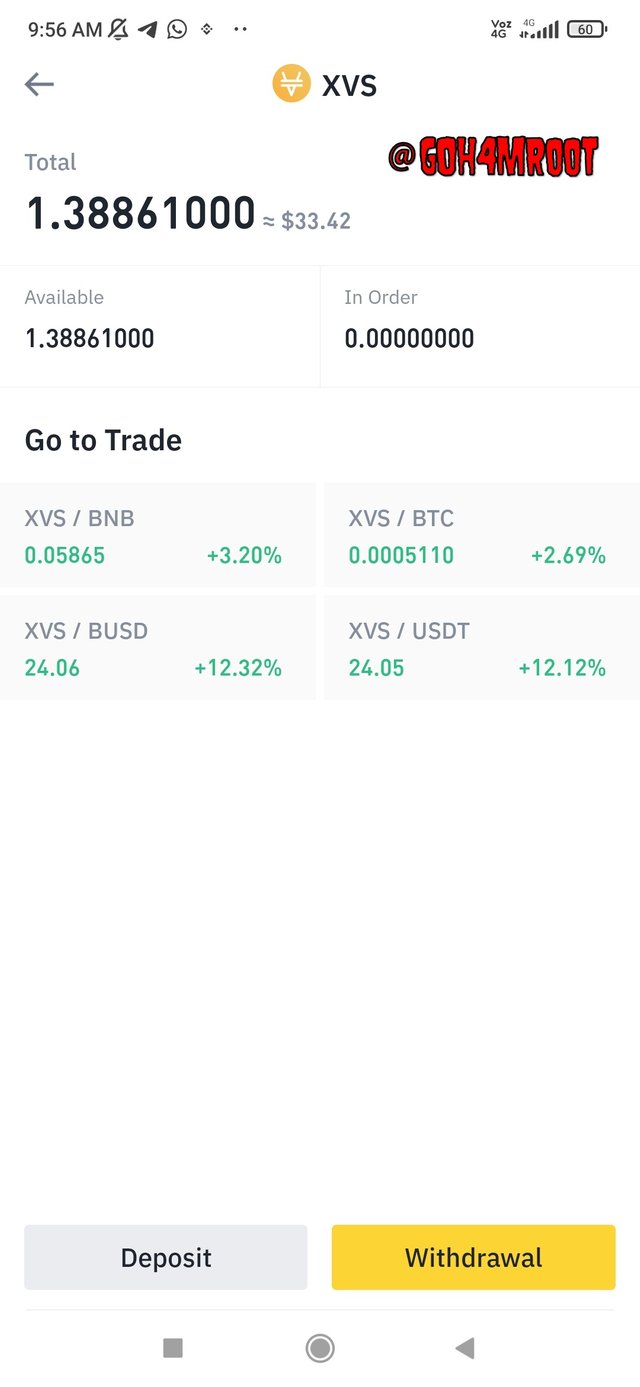

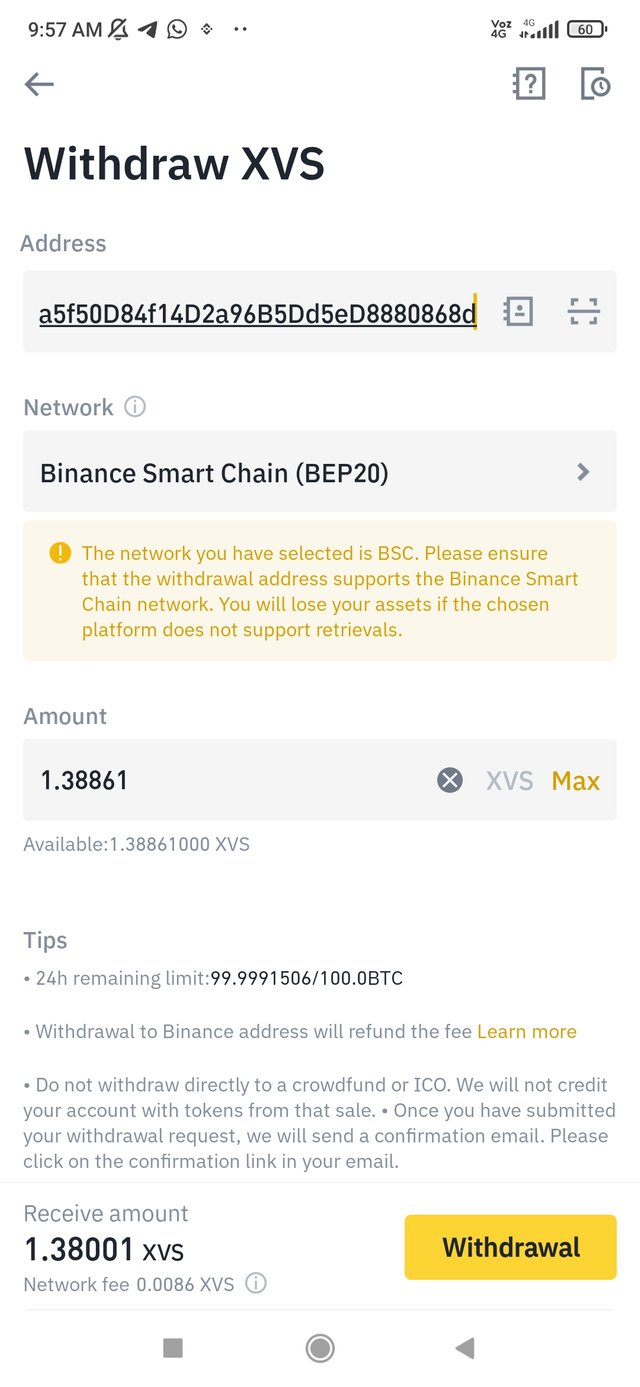

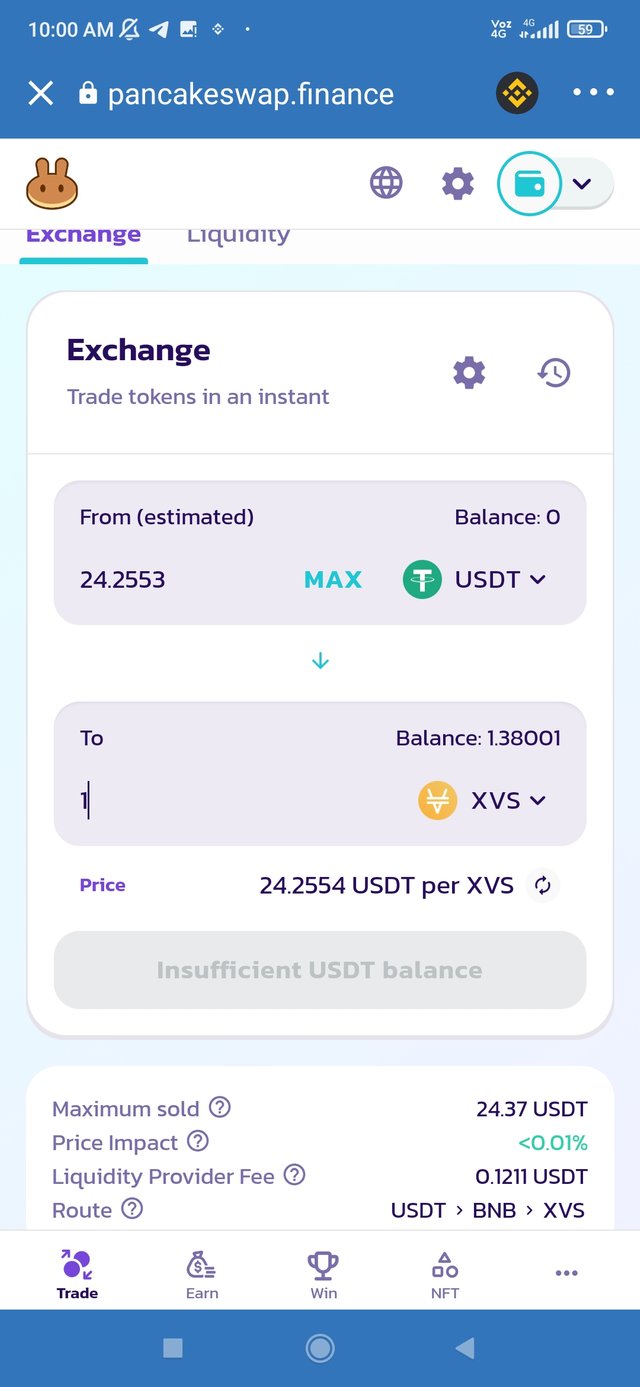

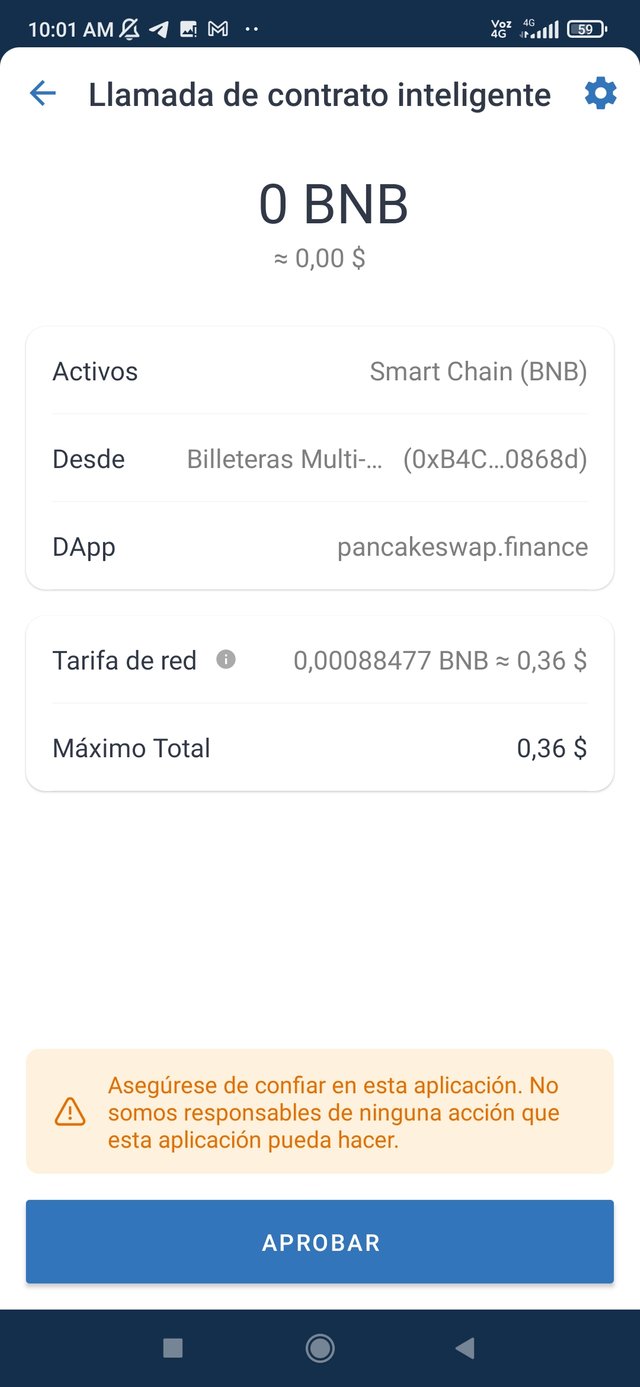

For this activity I have bought the VENUS (XVS) token, first in binance exchange BNB for XVS at a price of $24.06 and I have obtained the amount of 1.39XVS for 0.08146BNB.

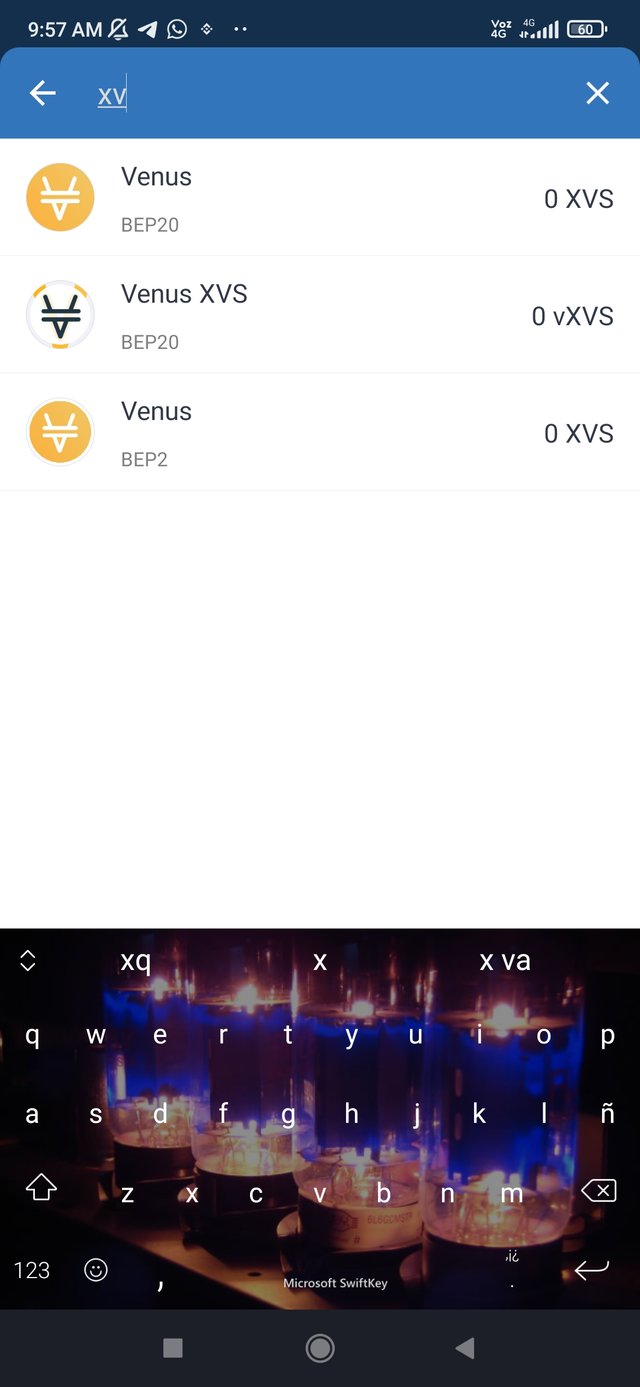

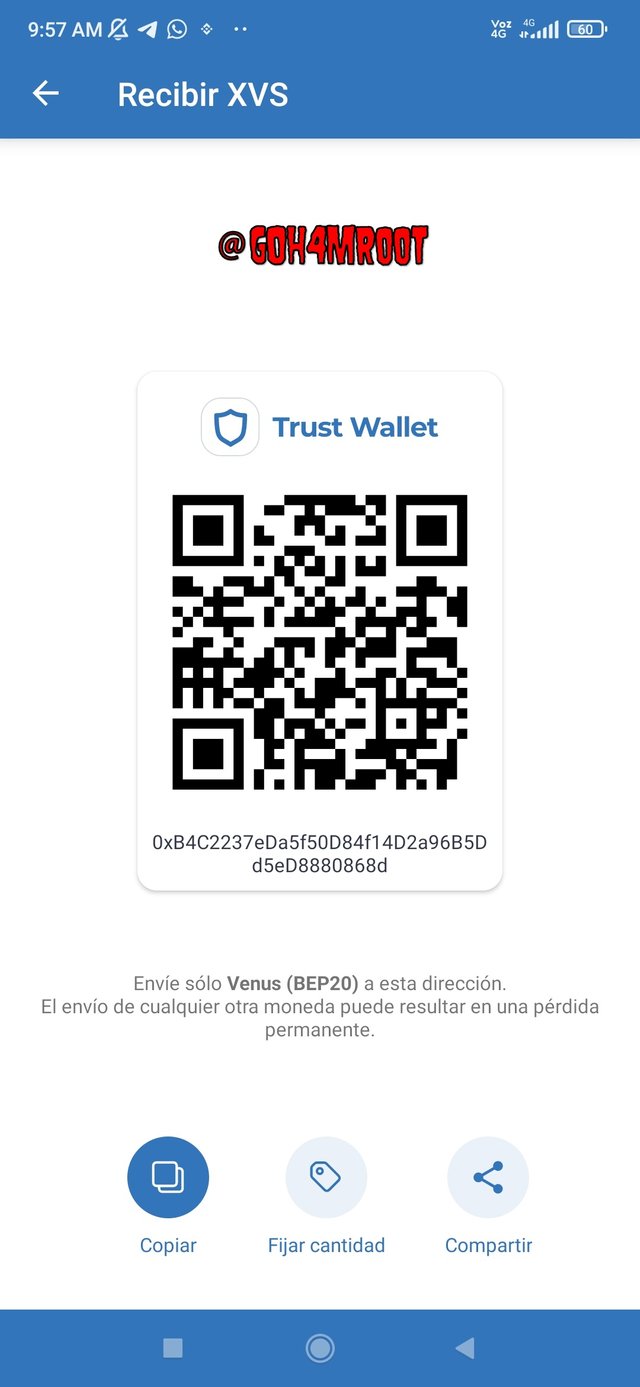

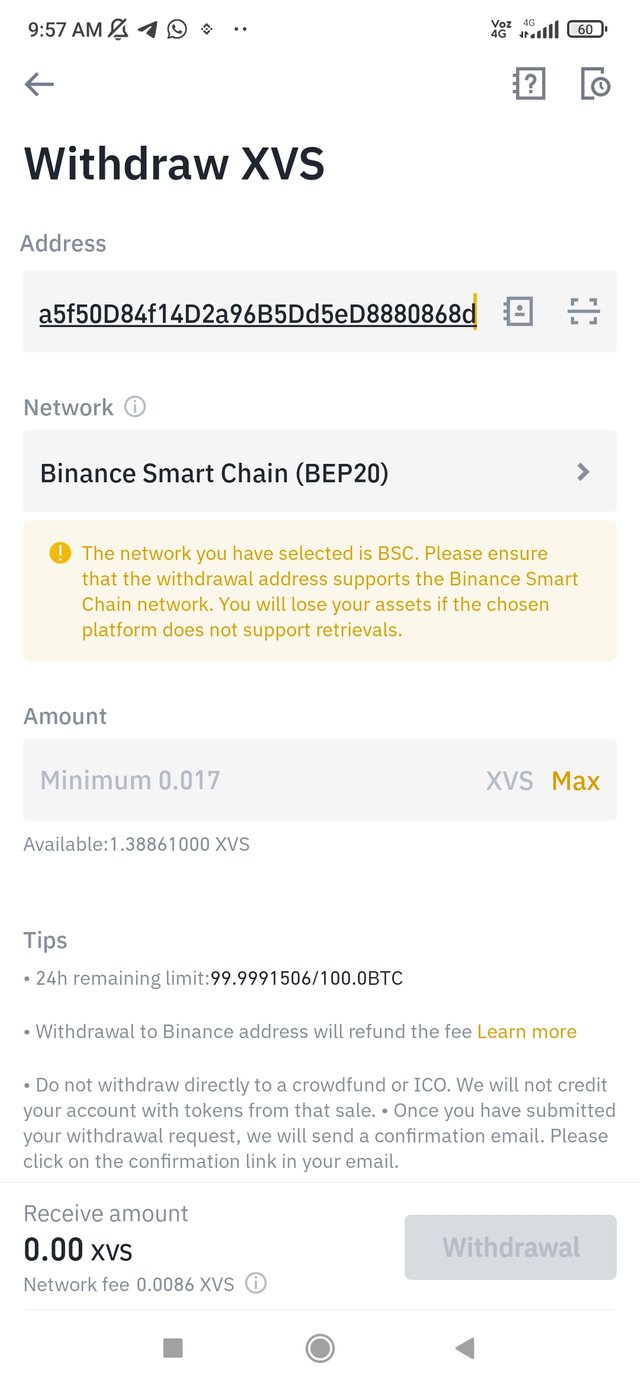

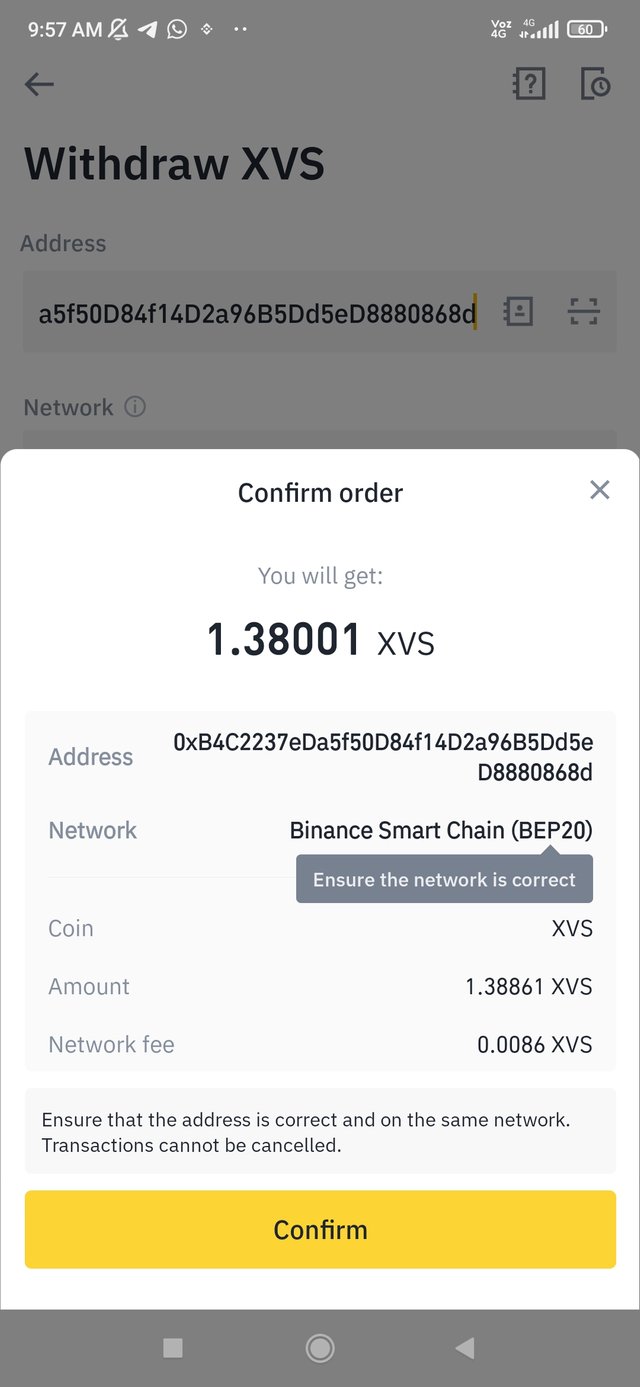

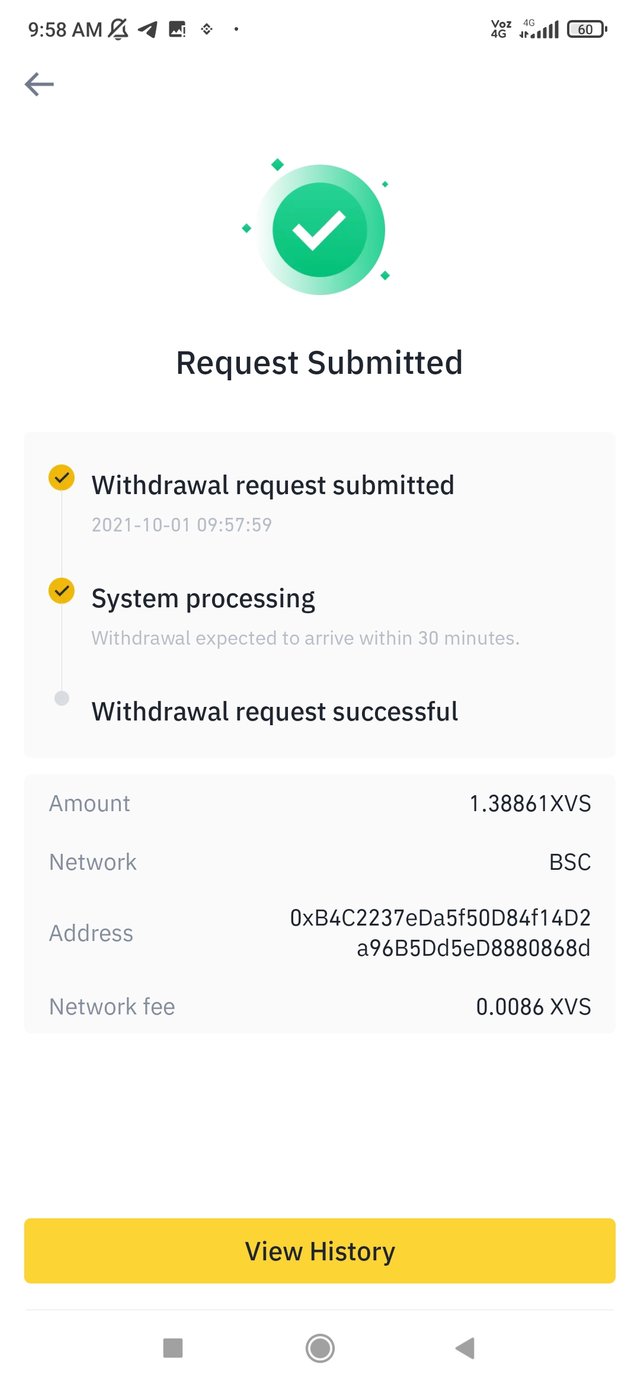

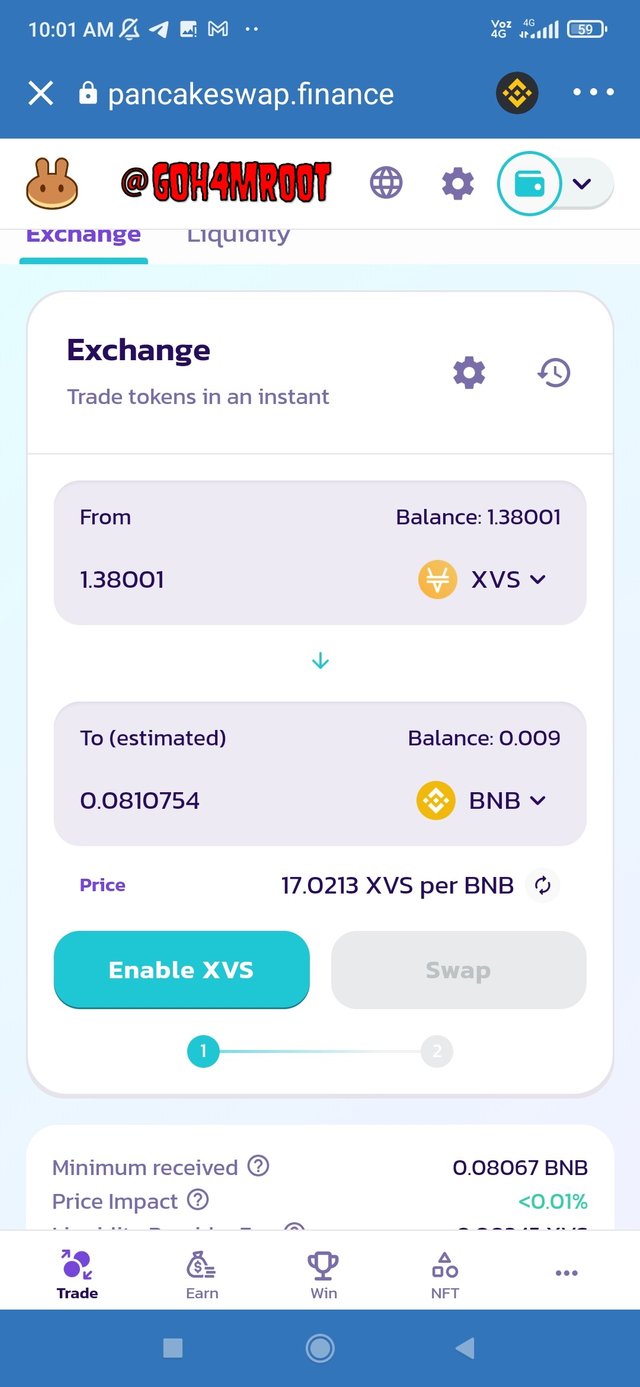

I have sent my XVS to Pancakeswap so that I can sell them at another price.

In the shipping process I have lost 0.01 XVS due to commission expenses.

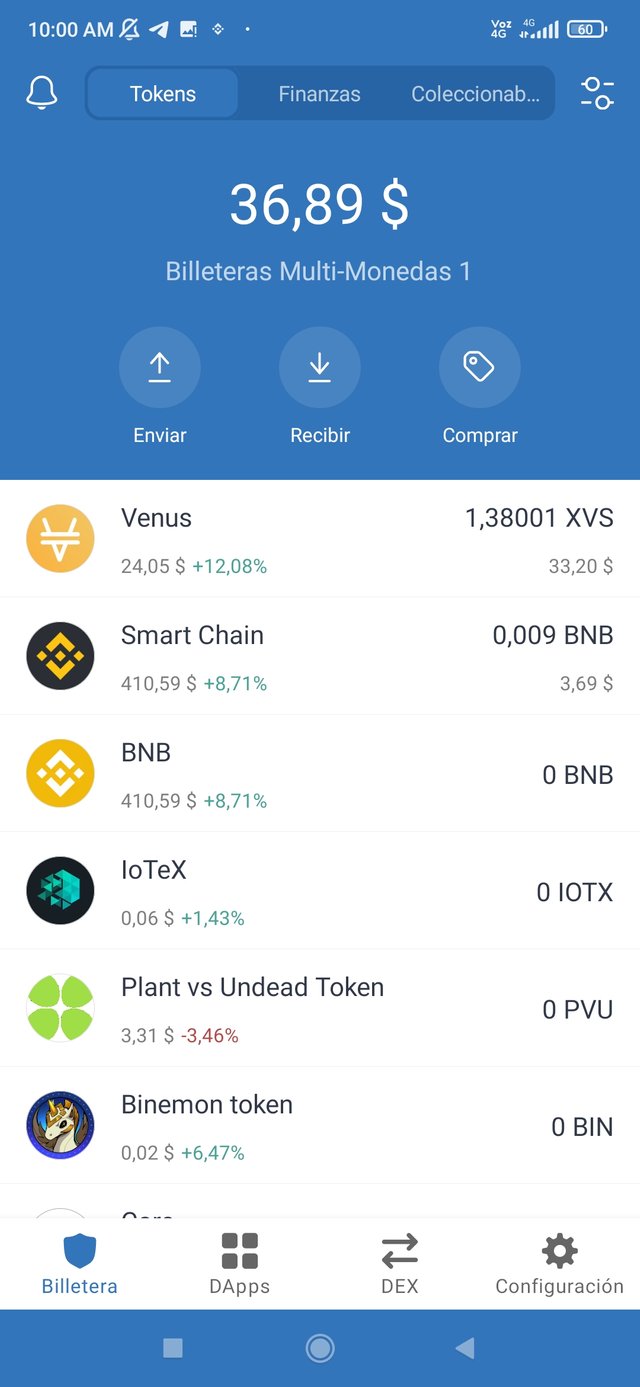

and in my trustwallet wallet I have received 1.38XVS.

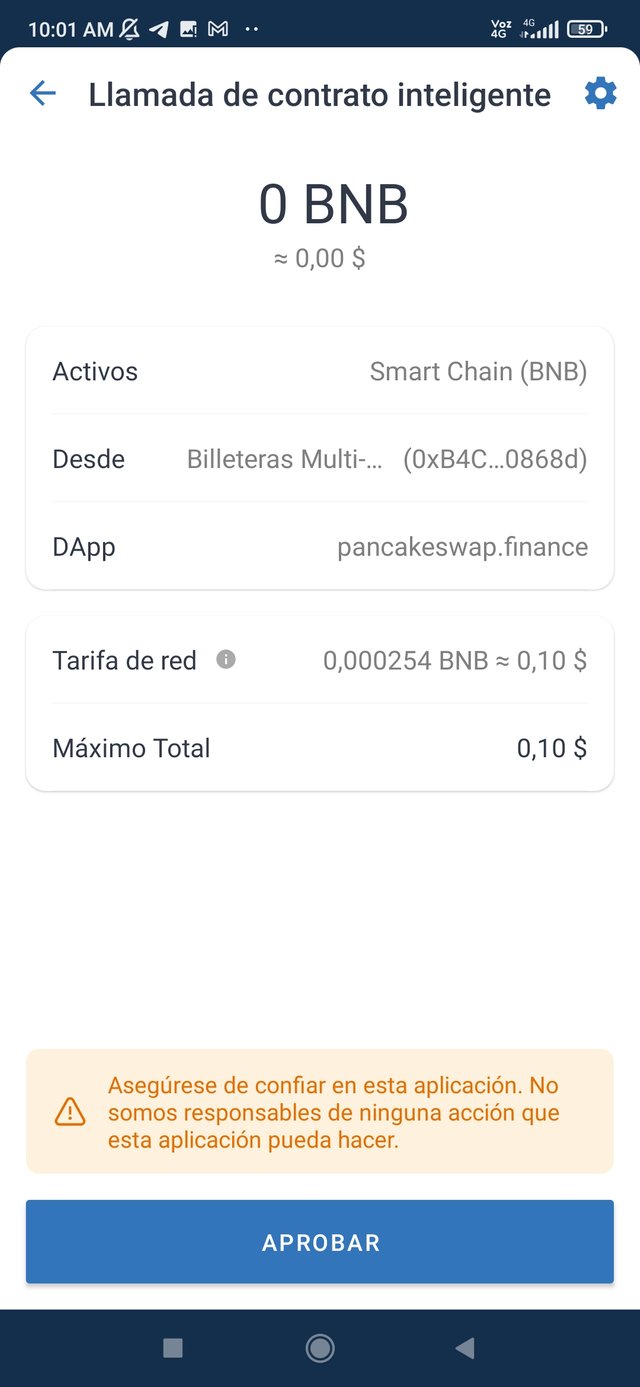

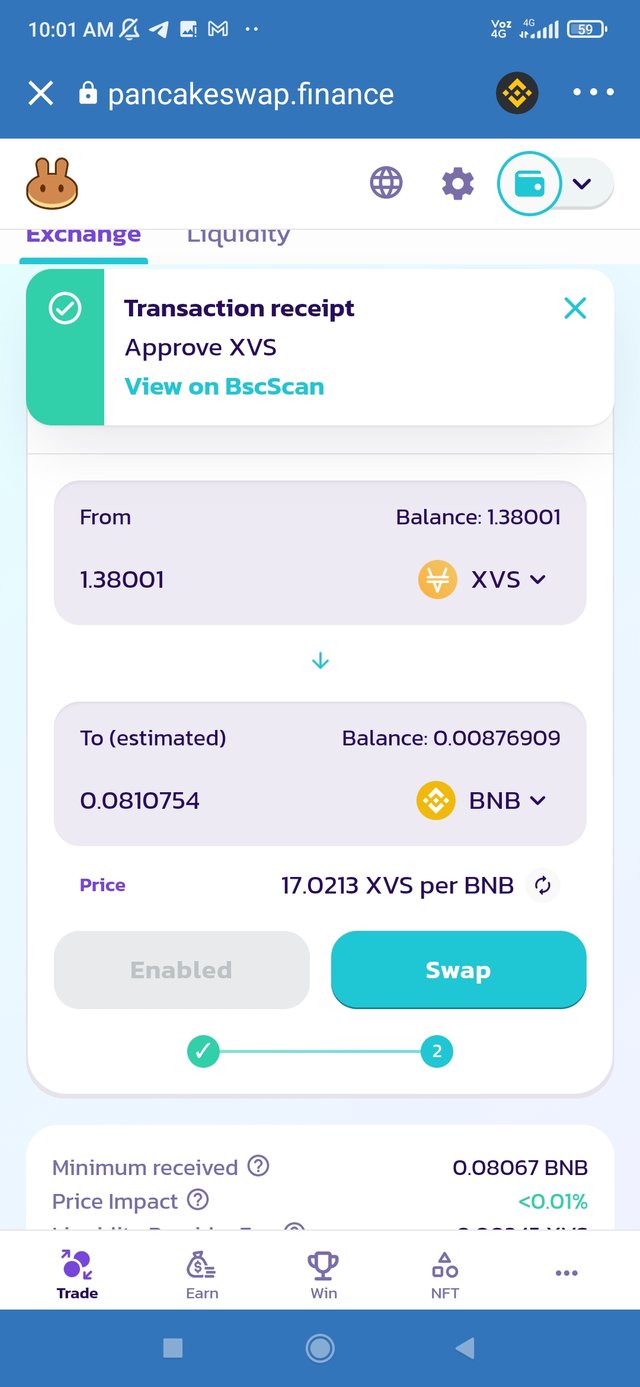

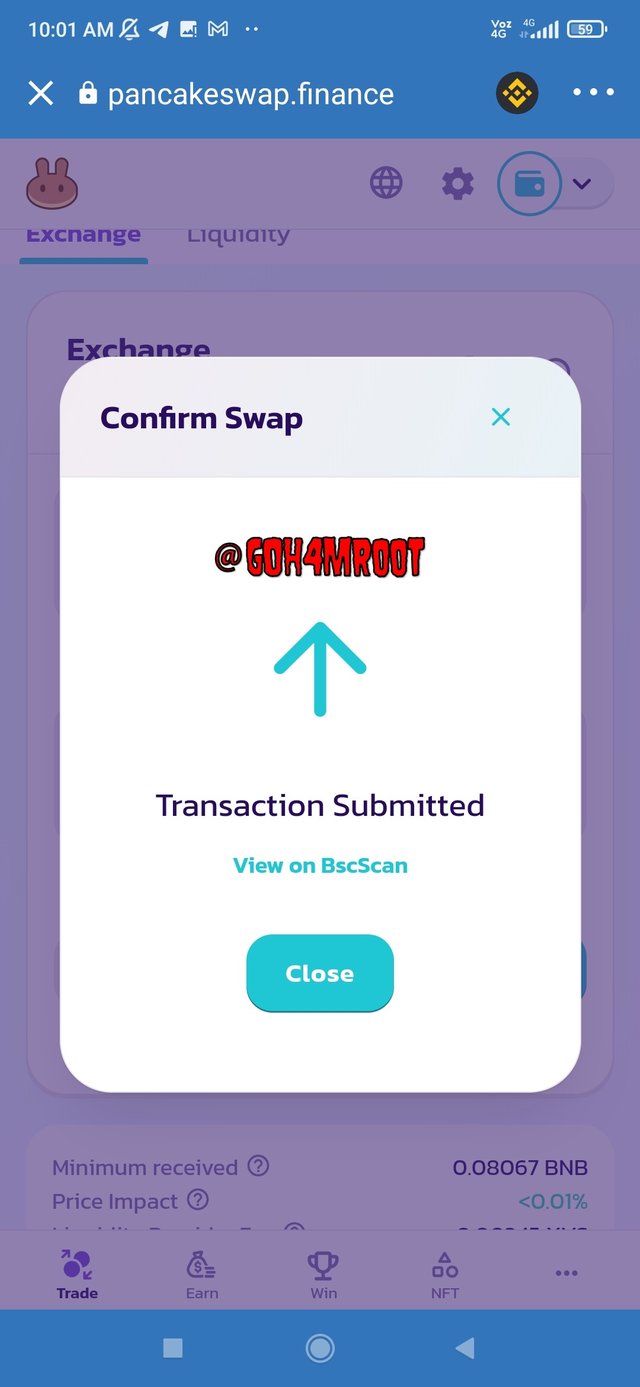

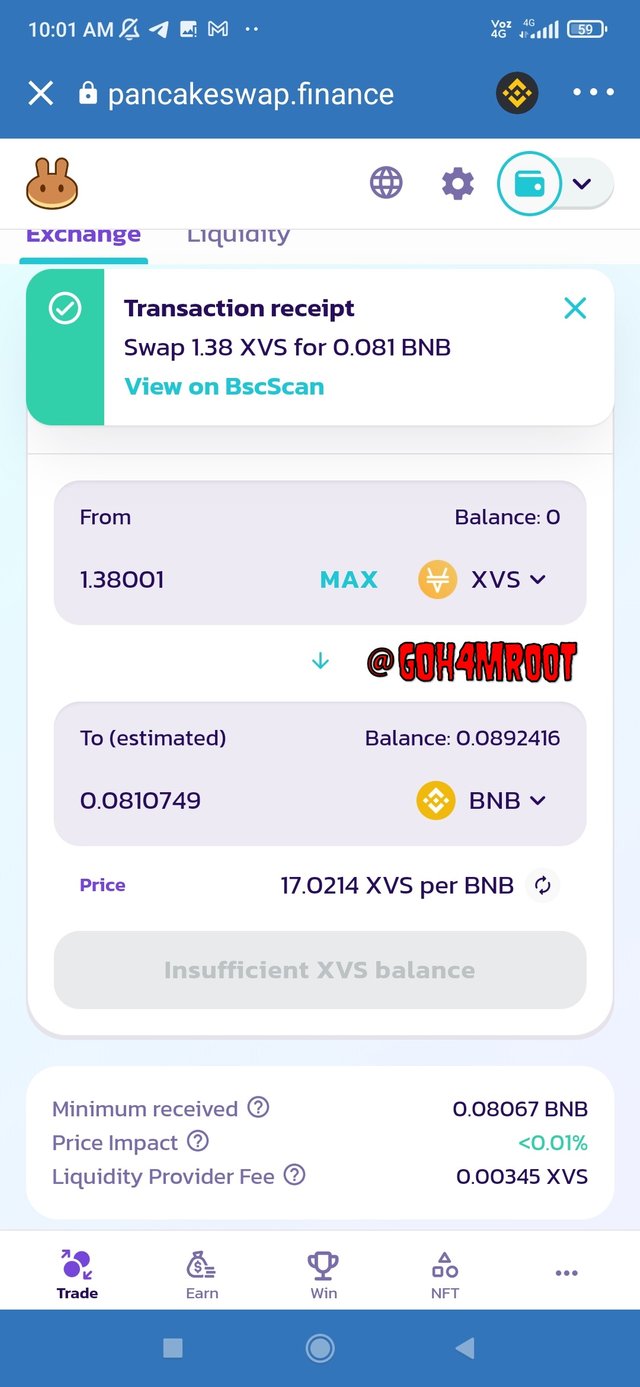

- And my tokens in Pancakeswap I proceed to exchange them again for BNB but at a higher price of $24.25 per unit.

I already sold my tokens and received 0.08107BNB.

Conclusion:

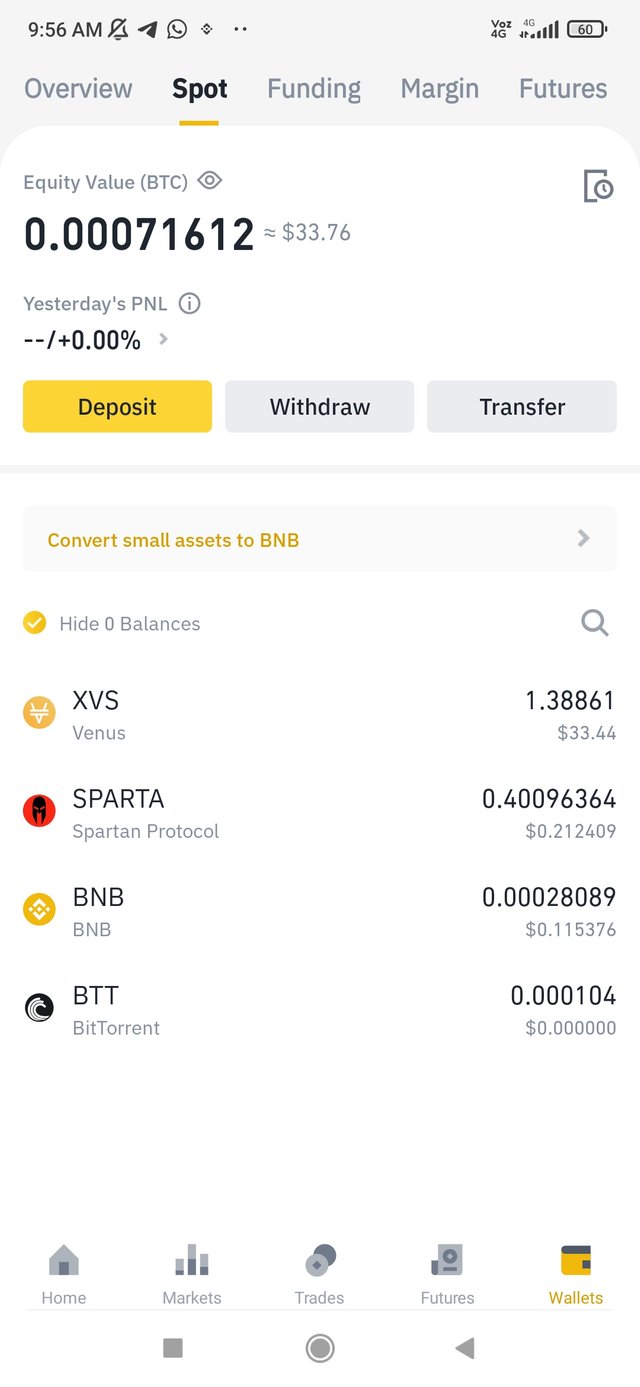

Although I have sold less amount of tokens and have spent in commissions I have not had losses, since if my investment were greater the gains would be more evident, that is, my investment was only $ 33.44, discounting the commissions that I have received 1.39 XVS, I have sent these Tokens to another wallet and I have received 1.38XVS, losing 0.01XVS for commission expenses, now I have sold the tokens and I have received a total of $ 33,465 and discounting the commissions I have obtained a profit of $ 0.025.

If a $ 300 investment were made, my profit would be about $ 3 just from buying on one exchange and selling on another.

5- Invest for at least $ 15 in a coin on a verified exchange, and then demonstrate the Triangular Arbitrage Strategy step by step using any other currency such as BTC and ETH. (Explain how you make your profit after performing the cryptocurrency triangle arbitrage strategy - you must provide screenshots of each transaction)

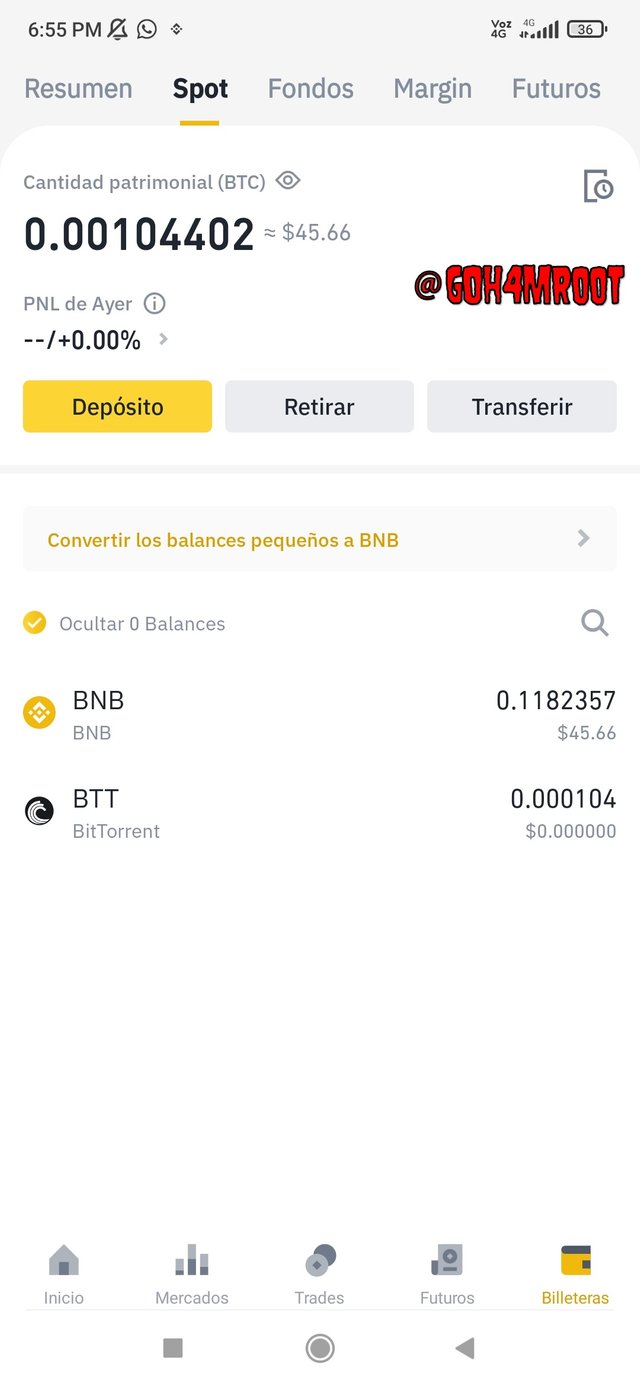

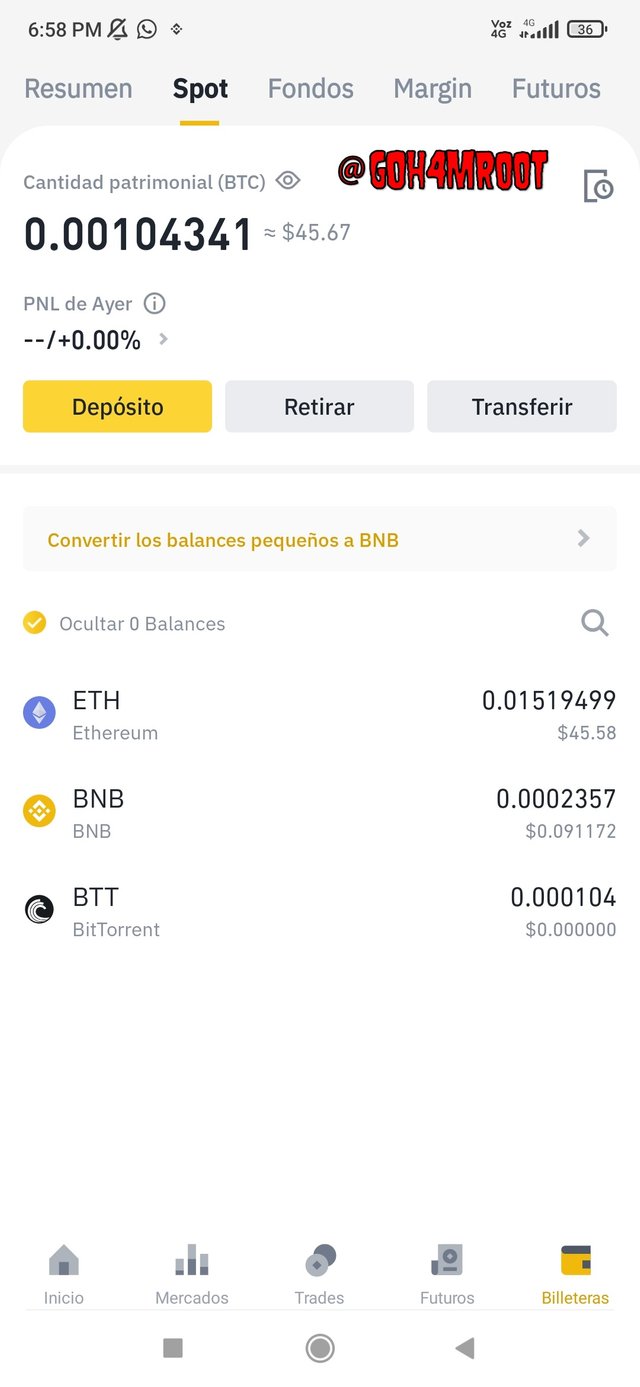

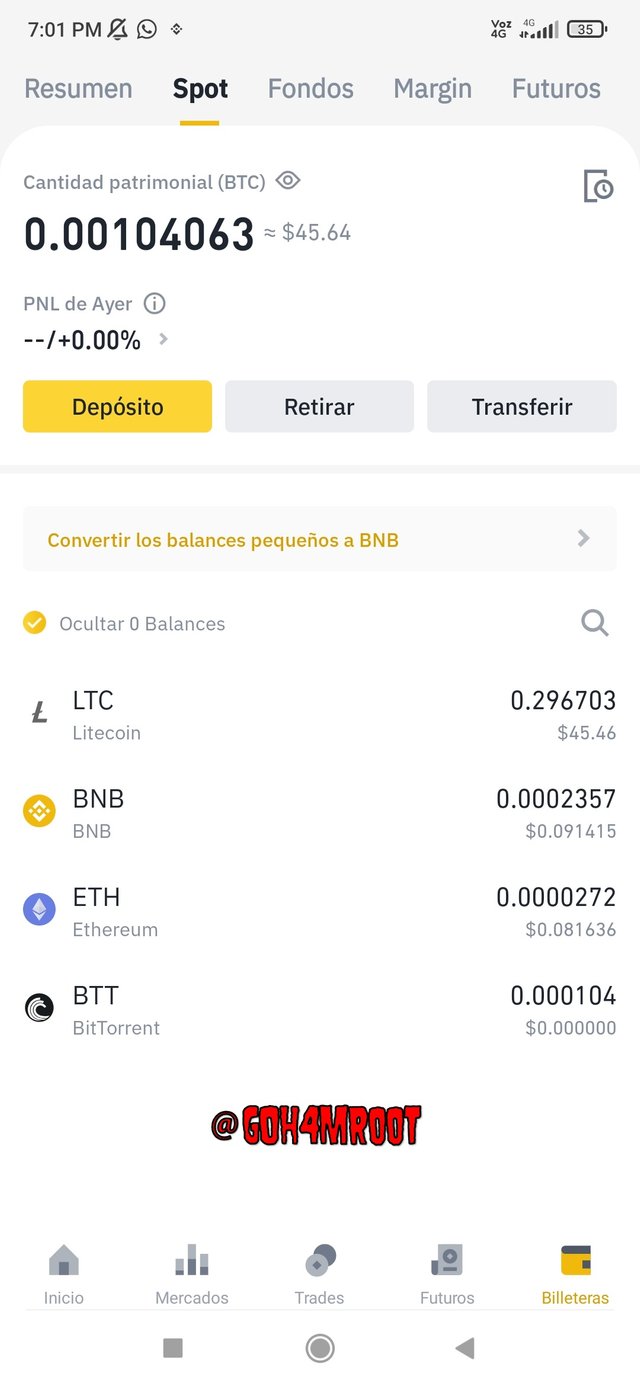

- For this activity use 45.66 $ equivalent to 0.00104402 BTC

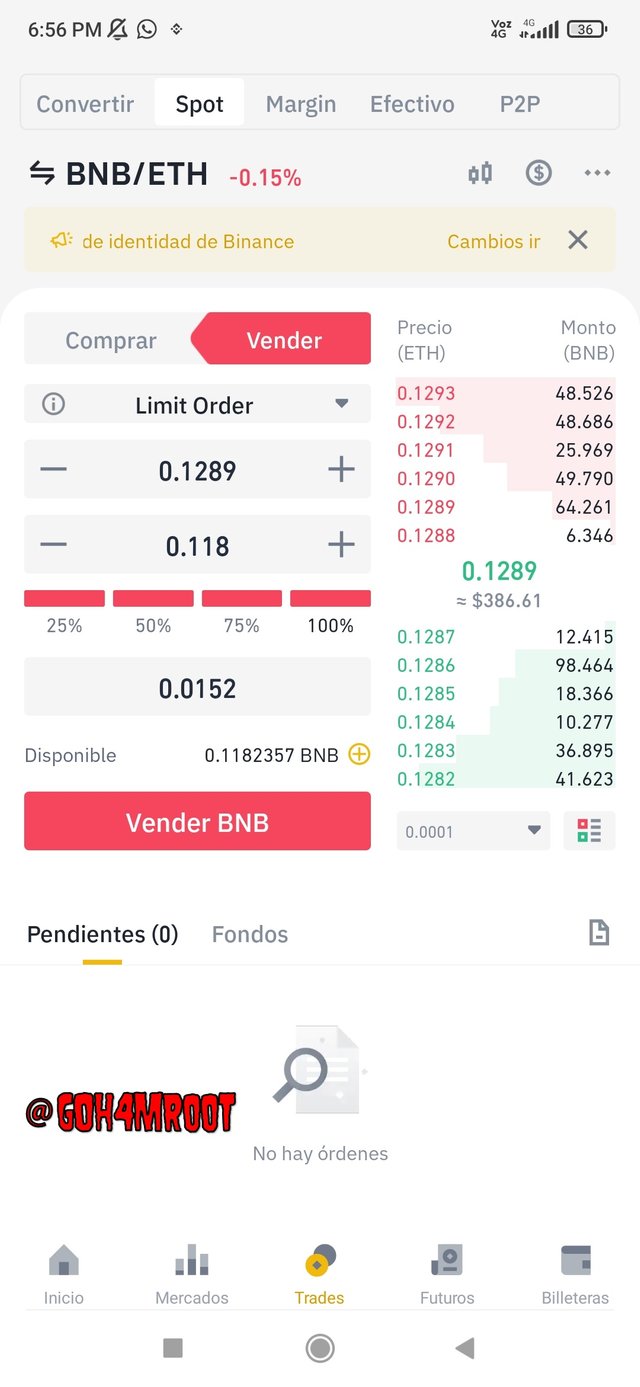

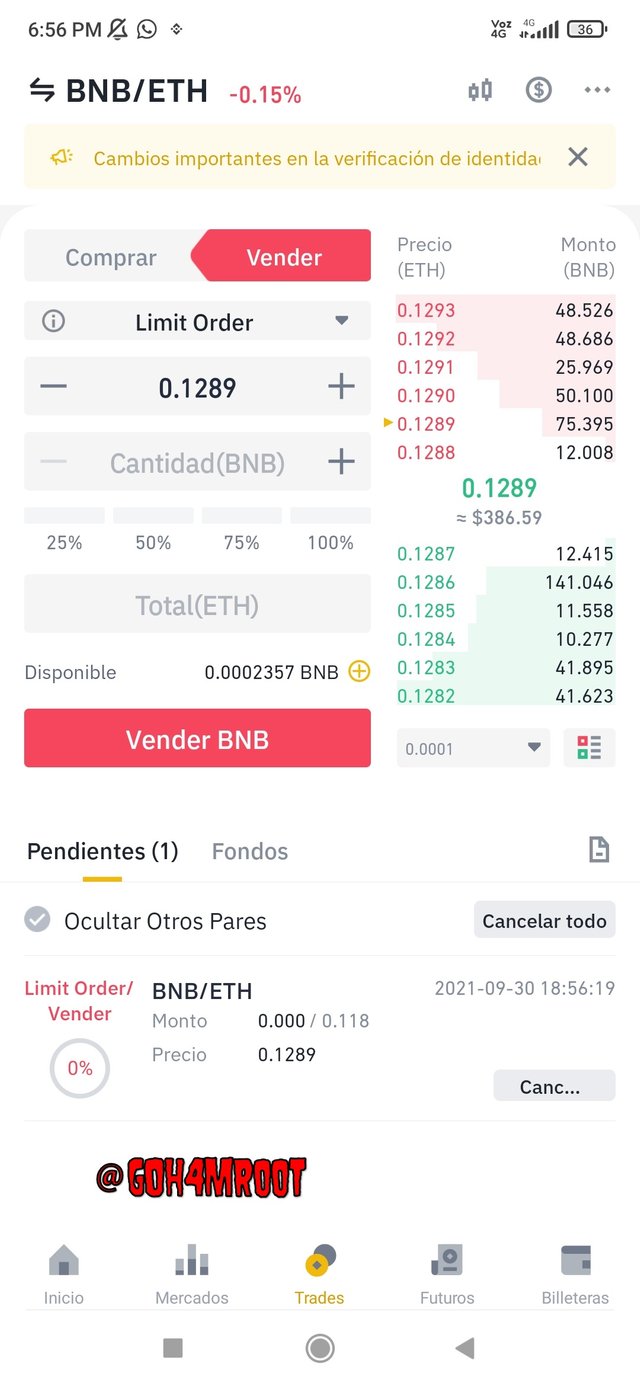

For my first trade I have 0.1182357.BNB.

- to start the arbitrage method I exchange my BNB for ETH.

I received 0.01519499 ETH.

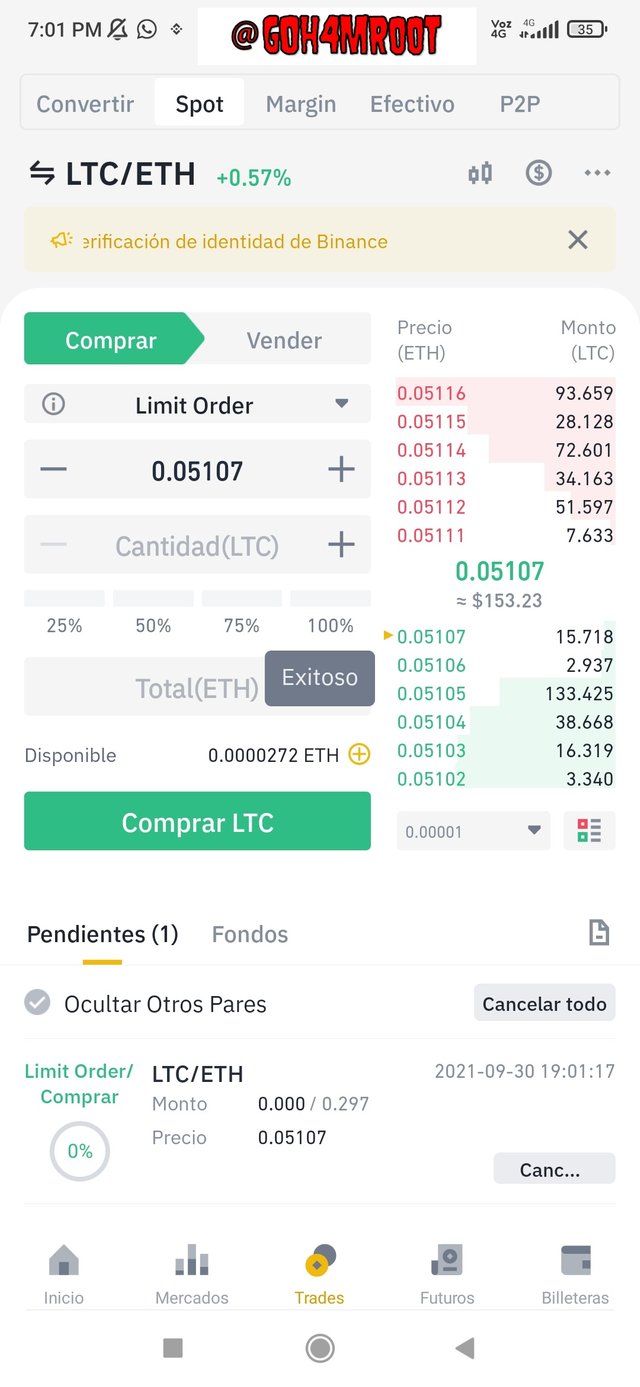

- I changed the ETH I received to LTC.

I received 0.296703. LTC.

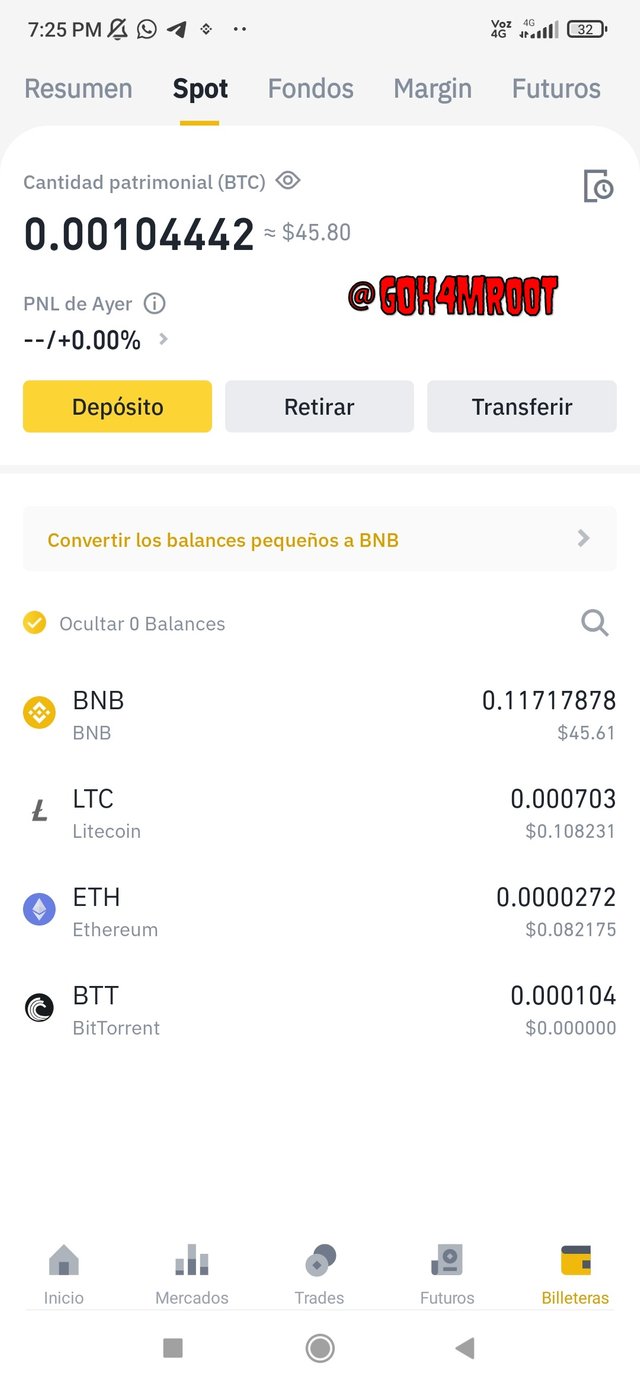

- Wait a few minutes and then change the LTC to BNB again.

obtaining as a result 0.11717878. BNB.

discounting commissions and small balances left from previous transactions

I have a total of 0.00104442 BTC.

now i started the arbitrage method with 0.00104402 btc, and finally i got 0.00104442 btc, i have had a small profit of 0.0000004 btc.

MY ACOUNT

6- Explain the advantages and disadvantages of the triangular arbitration method in your own words.

My opinion is that the Arbitrage method is a good strategy to use with a minimum capital of around $ 500, because the commission costs subtract the profits.

| ADVANTAGES | DISADVANTAGES |

|---|---|

| simple transactions | time is an enemy |

| you get profit just for sending from one exchange to another | depending on the network the commissions vary |

| Losses are minimized since if the price rises, the token can be maintained | not all exchanges have the same tokens |

| There are exchanges with somewhat cheaper prices | commissions vary on each exchange |

Arbitrage trading is a good way to trade with low risk, although there are factors that can influence our operation as we saw in the class.

Trading with little investment decreases profits due to commission costs.

In this class we made a triangle arbitrage change and demonstrated it using screenshots.

We demonstrated a purchase of a coin on the binance exchange and sold it on pancakeswap, having fulfilled the items requested by the crypto teacher, it is expected that you will like it.