1-Explain in your own words what FOMO is, wherein the cycle it occurs, and why. (crypto chart screenshot explanations needed)

Fear Of Missing Out (FOMO)

FOMO simply refers to the feeling which makes a trader to think in an irrational toxic way. It would make a trader to believe that he is missing out or has already missed out on a perticular market trend. Consequently, this trader goes ahead to see if he can still join the trend or cover what he has missed.

Fomo as earlier said brings about irrationality in the mind of the trader and makes him to only see one thing which is 'What He Has Missed'.

A FOMO driven trader may not bother to observe carefully the chart of his concerned asset or may observe the chart in a shallow manner just to justify the mentality that FOMO has already created in him. A FOMO trader will go ahead to buy where he is supposed to sell and sell where he is supposed to buy in an attempt to take advantage of any of the market trends.

What can spark Up FOMO in A Trader?

• Market Volatility: Since the cryto market is a very volatile place, the thought of making it big at both trends(Uptrend and downtrend) could spark FOMO in a trader.

• News and rumours: When a trader listens to news and rumors about how a particular coin is skyrocketing in price, FOMO begins to creep into their mind. In reality, almost everybody will have FOMO on hearing the news about a continuous Uptrend or downtrend move of a coin but the ability to subject that news to critical technical and fundamental analysis distinguishes a trader from others.

• Social Media: The social media is also a stimulant of FOMO in many traders today. For example, when ever the billionaire Tesler CEO, 'Elon Musk' makes a tweet on his Twitter handle, most people adjuge it to relate to certain cryptocoins and this alone can ignite FOMO in a trader.

• Lack of Information: like they say, "if you are not informed, then you are deformed". If a trader does not know some or all the principles working behind the rise and fall of a coin, then he will surely be FOMO ignited when ever he sights a continuous trend move. Informations such as whales and their activities, market Psychology, and even data in a protocols white paper will help a trader to know when to invest and when not to.

Where Fomo occurs and Why

.png)

p

The graph above shows how fomo influenced traders operate in the crypto market. They donnot give careful analysis toward the coin of their choice and as a result, they keep on entering and exiting trade at the wrong time.

Some of the psychology that come into play in FOMO include

• Greed/excitement: This emotional psychology plays in the initial stage of FOMO. At first, when the whales make a bulky market order, it affects the price and because it is a buy order, the price rises drastically. The FOMO influenced trader on seeing this will speedily invest at this point instead of taking profit.

2-Explain in your own words what FUD is, wherein the cycle it occurs, and why. (crypto chart screenshot explanations needed)

Fear, Uncertainty and Doubt (FUD)

FUD are those trading psychology that

comes into play at the end of a FOMO trade. While the price of the coin is continuously declining, FUD comes in and it is this FUD that causes the trader to sell.

Below is a chart to describe FUD

• First, the trader will be uncertain what the next trend will be but will still hold on to his asset.

• Next, with continuous decline in price of his asset, he begins to develop some doubt about the coin. He starts wonder if it was the right investment to do.

• At last Fear comes in. It is this fear that causes the trader to sell his coin for fear of losing totally from his asset. At this point, the cycle of a FOMO trader has been completed.

3- Choose two crypto-asset and through screenshots explain in which emotional phase of the cycle it is and why. Must be different phases

• Below is the screenshot of XRP coin in 7days interval.

(screenshot from coinmarketcap)

One can easily spot out that XRP is in the first phase of the Wall Street cycle.

Here, XRP is at the maximum price but unfortunately, this is the point where the FOMO trader is going to invest hugely believing that the price is going to move up more. Just moments after euphoria, comes the bearish trend. At euphoria, the whales start to take their profit and then leaves the loss to the small traders.

• The chart below shows the price of SUSHI/BNB pair in a 14 days interval.

(screenshot from Binance app)

It is evident that the coin is back to the disbelief level. This is just after the trader has sold out his coin just to avoid 100% loss or sells his coin just because others are steadily selling their coin to avoid total loss.

4- Based on the analysis done in question 3, and the principles learned in class, make the purchase of 1 cryptocurrency in the correct market cycle. The minimum amount of 5USD (mandatory), add screenshots of the operation and the validated account.

For the purpose of this task, I am going to use KUCOIN exchange.

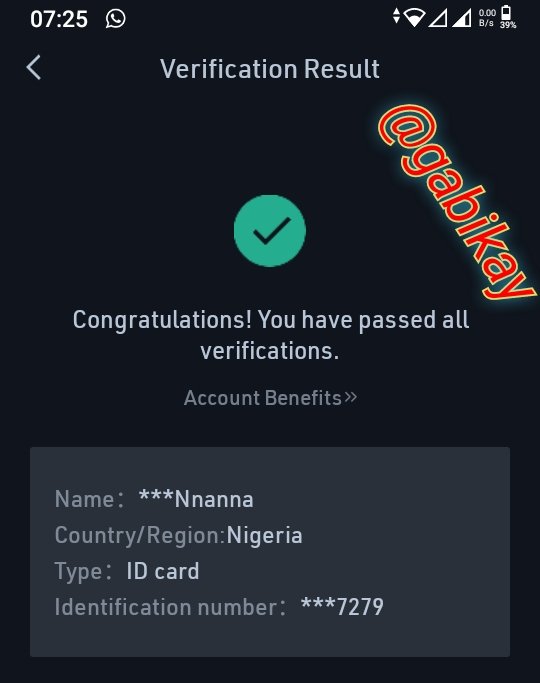

Below is a screenshot of my verified KUCOIN exchange account.

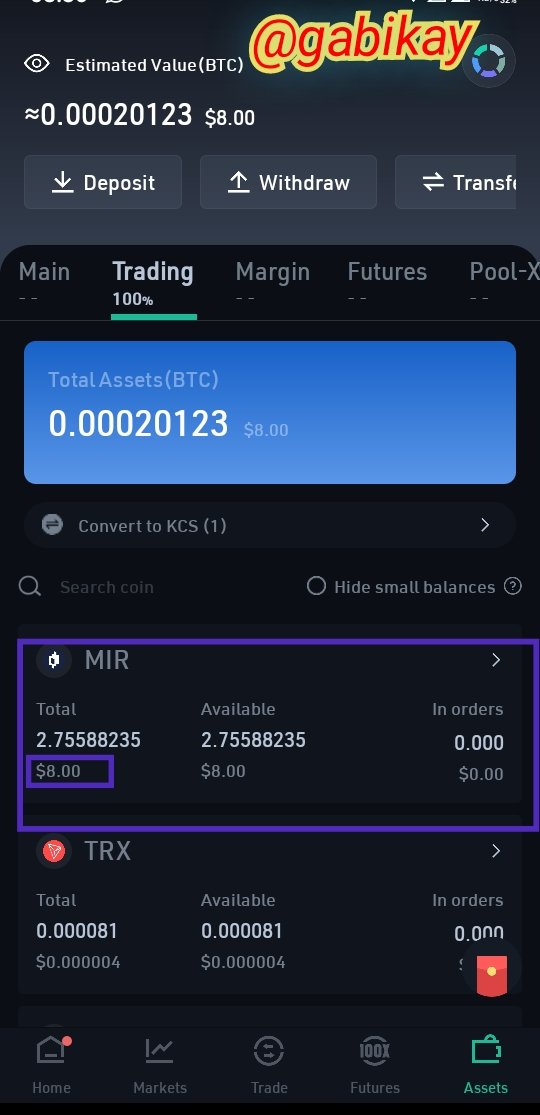

First thing I did was to spot a good trading pair for the transaction. I chose MIR/KCS pair. MIR is the native token of the mirror protocol while KCS is the native token of the KUCOIN.

I detect that the market is just starting a bearish reversal and so I click on *buy to buy MIR.

On the the picture below, I chose best market price to buy at the current market price. I click on 100% as seen on the picture to buy MIR with the maximum KCS coin which I have. Next I click on buy.

On my list of assets, it can be seen that I have successfully purchased MIR coin worth $8.

Conclusion

To overcome FOMO, a trader must understand that another trading opportunity will surely show up and so there is no need to get too excited about a market Uptrend.

Also, investing what you can afford to lose is another factor in FOMO control and lastly, don't just invest because everyone is investing or because you were tipped about the potential of the coin. Make your own analysis and then spot the market circle of the coin.

Regards to professor @allbert

Hello @gabikay, Thank you for participating in Steemit Crypto Academy season 3 week 5.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit