Hello, wonderful people of steemit, hello professor @kouba01, it is another day of the steemit Crypto Academy trading Contest week 3 and as a participant today, I will be trading on Maker protocol (MKR)

1.The name and introduction of the project token, and which exchange can be traded on, project/technical/team background, etc.

About Maker

Maker protocol is a decentralized software platform and organization that resides in the Ethereum blockchain. It gives users access to the management and issuance of the DAI stablecoin.

The Maker protocol was first initiated in 2015 and was launched successfully in December 2017. The Maker protocol is poised the task of operating DAI (DAI is a decentralized cryptocurrency value is soft-peggged to US dollar and it is community managed). Maker ecosystem is one of the initial DeFi projects to ever surface on the Blockchain technology.

DAI token is one of the famous stable coins as of October 2020. Amongst Cryptocurrencies that have over $800 million market cap, it is the 25th largest with more active addresses than USDT.

Founders of Maker?

Rube Christensen created MakerDAO in 2015. The Maker ecosystem is a large one with the MakerDAO being the first entity built in it.

Rune Christensen hails from Sealand in Denmark. He has a degree in biochemistry from the University of Copenhagen and also studied international business. Before involving in MakerDAO, he is the manager and co-founder of Try China International Recruiting company.

About Maker Token

For the organization in charge of DAI, the Maker token acts like a voting share to them. The Maker token confers voting right upon it's holders over the development of the Maker protocol.

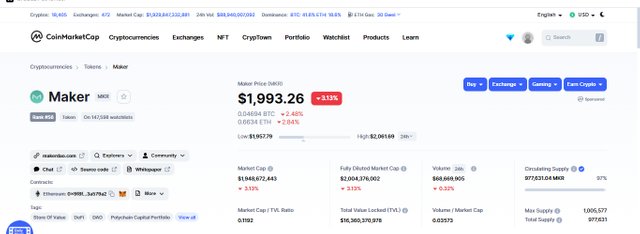

At the time of writing, the price of Maker token (MKR) is $1,993.26 with a market cap of $1,948,672,443 and a trading volume of $68,669,906. It is ranked coin number 56 on coinmarketcap and it has a circulating supply of 977,631 MKR tokens out of a total supply of 1,005,577 MKr tokens. Below are some other fundamentals of the MKR token.

screenshot from coinmarketcap

| Fundamental | value |

|---|---|

| Link | MakerDAO.com/en/ |

| Explorer | etherscan.io, ethplorer.io, blockchair.com, eth.tokenview.com, avascan.info |

| Source code | github.com/MakerDAO |

| Whitepaper | . |

| Contract address | Ethereum: 0x9f8f72aa9304c8b593d555f12ef6589cc3a579a2, Binance Smart Chain: 0x5f0da599bb2cccfcf6fdfd7d81743b6020864350, Avalanche c-chain: 0x88128fd4b259552A9A1D457f435a6527AAb72d42 |

| All-time high/ low | $6,339.02/ $21.06 |

Market Place of Maker token (MKR)

The Maker token can be traded in the following exchanges

| Sn | Exchange | Pair |

|---|---|---|

| 1 | Binance | MKR/USDT, MKR/BTC, MKR/USD, MKR/BUSD |

| 2 | Kucoin | MKR/USDT, MKR/BTC, MKR/ETH, MKR/DAI |

| 3 | BYBIT | MKR/USDT |

| 4 | FTX | MKR/USD, MKR/USDT |

| 5 | Coinbase | MKR/USDT, MKR/USD, MKR/BTC |

| 6 | Gate.io | MKR/USDT, MKR/ETH |

| 7 | Houbi Global | MKR/USDT, MKR/BTC, MKR/ETH, MKR/HUSD |

2. Why are you optimistic about this token today, and how long do you think it can rise?

I am optimistic about the Maker token today because of the following reason

• Maker protocol aims at bringing remedy to the multiple challenges faced by the traditional financial sector. It accomplishes this by employing a unique selection of proprietary technologies. Maker also has a key role in the functioning of DeFi communities.

• Makers seeks to correct the issue of transparency. The Maker protocol makes use of Smart contracts to remove the need for Middlemen or third parties in transactions.

As of today, most stable coins such as Tether USD (USDT) assures it's holders with its network reserve. Most times, to verify the company's holdings/reserve, the holders of the token will need to rely upon a third party auditors.

Maker completely removed this necessity of trusting a centralized body. This is because the company's entire network can be seen by all on the blockchain. Also, Maker company staffs always publish their meeting recordings on the companys SoundCloud page hence making it possible for everyone to review.

• Holders of MKR token earn the right to participate in the governance of the Makers protocol hence the holders can have a say on the future the network. Also, there is no discrimination as anyone can be a holder of the MKR token and can join in the shaping of the protocol.

3. How to analyze the token? (using the analysis knowledge learned from professors’ courses) —- important part

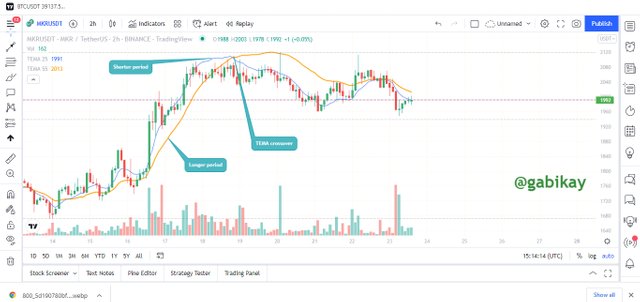

For today's trading excercise, I will use KUCOIN exchange and I will trade on MKR/USDT pair. The analysis tools I will employ are Tripple exponential moving average (TEMA) and fibonacci retracement.

Tripple exponential moving average (TEMA) is a kind of moving average that seeks to eliminate noise or page which is common with other types of moving averages. It aims to bring about clear signal by Smoothening the price flunctuation. TEMA gives an improved output since it is a combination of three Exponential moving averages (EMA) and while computing it, the lag is subtracted hence giving a better indication than other moving averages.

• Fibonacci Retracement: Fibonacci Retracement refers to horizontal lines that tries to expose places where there is a possibility of the price to reverse direction. It Shows this points in the market using support and resistance lines. Traders tend to buy at a Fibonacci support level at the Retracement when the the market is in an uptrend.

screenshot from tradingview

On adding the Double TEMA cross, I could observe that the longer period TEMA has already crossed over and gone above of the shorter period. This is a bearish signal.

screenshot from tradingview

Next, I add the fibonacci retracement to obtain levels of possible support and resistance. With the help of the fibonacci levels, I place a trade, take profit and stop loss as well.

screenshot from kucoin mobile app

| Entry | Take Profit | Stop-loss | PNL |

|---|---|---|---|

| 1996.4 | 1983 | 2013 | $*** |

screenshot from kucoin mobile app

4. Your plan to hold it for a long time or when to sell and Do you recommend everyone to buy? and the reasons for recommending/not recommending

The function of Maker protocol can not be underated in the DeFi ecosystem and blockchain industry at large. Maker token is poised with the task of ensuring that the price of DAI remains pegged to US dollar. It has a solid transparency policy with an open arm to welcome its users. With its price today, and a relatively limited supply, I believe that the Maker token is a good project to invest in but before any investment in any blockchain project, an intending investor should make his/her own fundamental analysis.

.jpeg)

Hello @gabikay,

Thank you for choosing our team to participate in the 3rd week of Season 6 of our trading competition, hoping that you will make gains during this period, you deserve a Total|6.5/10 rating, according to the following scale:

My Review on your choice of pair:

My Review on your trading style:

We thank you again for your effort and we look forward to reading your next article.

Sincerely, @kouba01

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit