- Define the Order Book and explain its components with Screenshots from Binance.

An Order book refers to an electronically generated list that displays the various buy and sell prices of an asset. At each market depth or price point, the order book displays the amount of that asset that is being offered. The order book is employed by crypto exchanges to display the bid and ask price of various crypto assets which they support.

Components of An Order Book

The order book consist of two parts which are the;

1. Buy Order

This is the part of the order book that displays the prices at which the buyers are willing to buy a cryptocoin. On the screenshot below, the buy order is denoted by the green shaded prices.

2. Sell Order

This is the part of the order book that displays the prices at which the sellers are willing to sell a given cryptocoin. The sell order is denoted by the red shaded prices on the order book below.

- Who are Market Makers and Market Takers?

Market Makers

Literally, this refers to those people who make the market. They achieve this by inputting or stating the price which they want to buy or sell their cryptocoin. These set of people in the market has a choice and a specific target they want to trade at and are majorly traders. These set of people always buy at the bid price and sell at the ask price (of course they are the ones that create the ask and bid prices )

Market takers

As the name implies, they take the market for what it offers at a given time. The name refers to those set of people who purchase a cryptocoin at the market price or the readily available price. These people tend to buy at the ask price and sell at the bid price.

- What is a Market Order and a Limit order?

• Market Order

This refers to the order placed by a person to purchase a cryptocoin without inputting his own prices. Hence, such an order will execute by buying at the highest bid price or selling at the lowest ask price. There is no form of choice or negotiation in this kind of Order. It is usually used by the market takers.

• Limit Order

This kind of order is one in which the person placing it inputs or sets the prices at which he wants to buy or sell his crypto. With this order, the person has a choice of what price he wants to sell or buy. This order is usually executed by the market Makers.

- Explain how Market Makers and Market Takers relate with the two order types and liquidity in a market.

The market Makers are the price makers or the price givers while the market takers are the price takers. Without any of such people in the market, then the market cannot exist. That is to say that some people must set the price so that when the market takers arrive, they could readily see a price level to trade with. This activity in turn affects the liquidity of the asset. Since the liquidity of an asset could be measured by how readily orders for the asset can be filled, then the activities of both the market Makers and market takers determines and could improve the liquidity of the asset.

- Place an order of at lease 1 SBD for Steem on the Steemit Market place by

a) accepting the Lowest ask. Was it instant? Why?

b) changing the lowest ask. Explain what happens.

(Make sure you are logged in to your wallet).

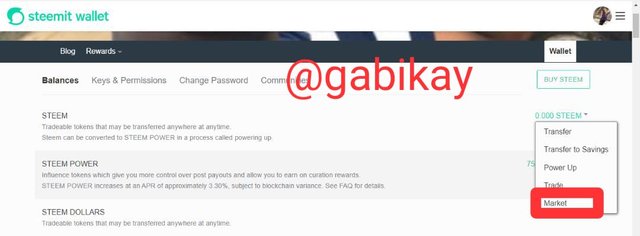

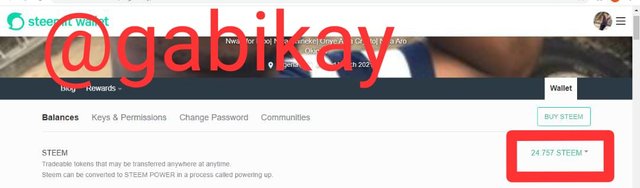

Firstly, I log into my steem wallet. On my steem balance, I click on the drop down menu, then click on market.

a) On inputting 2 SBD to buy STEEM at a lowest ask of 0.080787 the order was filled immediately. This was because I had used the market price also known as the lowest ask so my order got readily filled.

b) Next, I, input my own ask to be 0.07 but still with 2 SBD. The order did not get filled immediately rather, it was now piled up as one of my open orders. This was due to me using a limit order or not using the market price to buy.

.jpeg)

.jpeg)

- Place a TRX/USDT Buy Limit order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots).

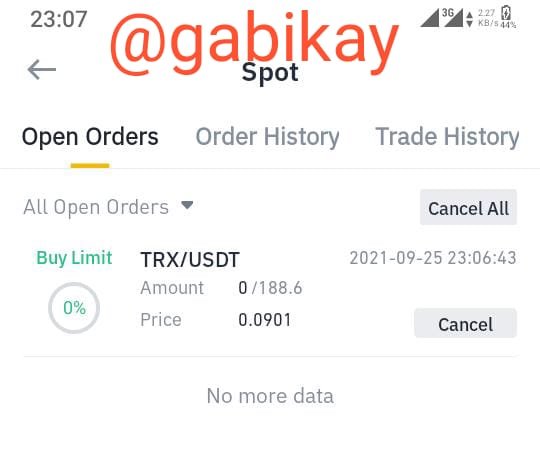

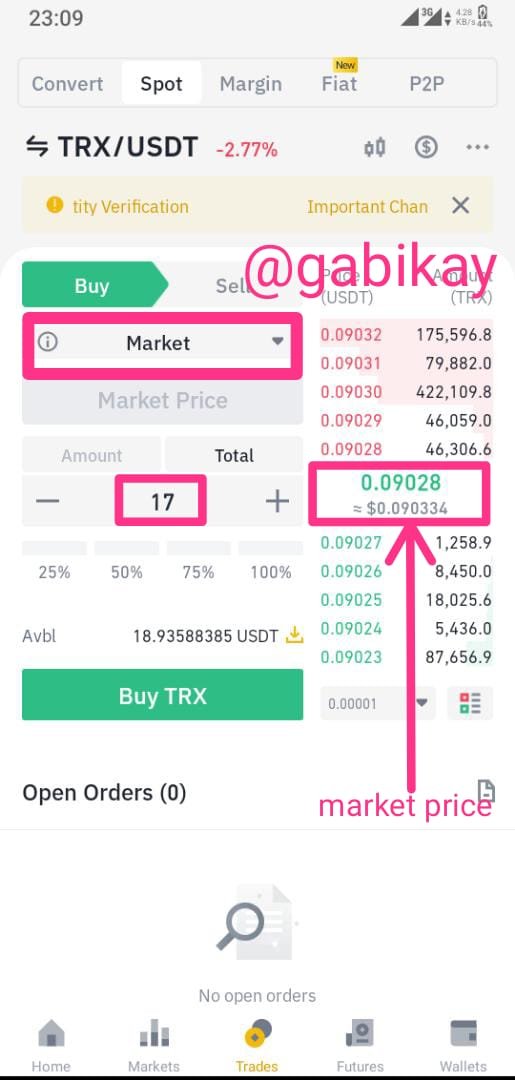

First, I open my Binance app on my mobile. Next, I login and then I click on trade. At the trade platform, I click on spot

Next, I set my order type to become limit. Next, I proceed to buy TRX with $17USDT.

I input the price at which I want to buy TRX to be

0.09010 (while the market price was 0.09033)

Next I input the amount of usdt I wish to use in the purchase of TRX which is

$17USDT

Next, I click on buy TRX as in the screenshot below.

.jpeg)

After this, I could observe that I now have an open order that is yet to be filled as in the screenshot below

The effect of his transaction is that I have now made an attempt to pull down the price of TRX. If any other trader comes accross my order in the order book, it could influence his price decision in buying TRX.

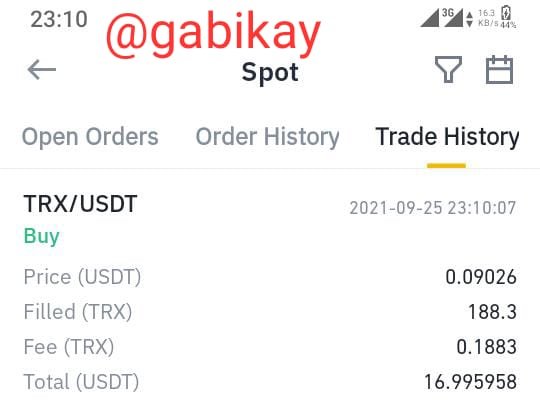

- Place a TRX/USDT Buy Market order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots of the completed order).

On the same page as in the answer above, I just change the limit order to market order. Next I input the amount of USDT which I want to use in buying TRX which is

$17USDT

Next, I click on buy TRX and immediately, my order is filled.

8.Take a Screenshot of the order book of ADA/USDT pair from Binance on the day you are performing this task. Take note of the highest bid and Lowest ask prices:

a) Calculate the Bid-Ask.

b) Calculate the Mid-Market Price.

a) The bid ask spread can be stated as

Lowest ask price - Highest bid price = Spread

Then I have my

lowest ask = $2.295

highest bid= $2.294

So, the bid ask spread will be

Ask - bid = $2.295 - $2.294 = $0.001

b) Mid market price is given by

(Lowest ask + Highest bid)/ 2

Hence, the mid market price for the ADA/USDT is

($2.295 + $2.294) / 2. = $2.2945

Regards to professor @awesononso