Hello, wonderful people of steemit, hello professor @pelon53, it is another day of the steemit Crypto Academy trading Contest week 3 and as a participant today, I will be trading on Bitcoin Cash (BCH).

1.The name and introduction of the project token, and which exchange can be traded on, project/technical/team background, etc.

What is Bitcoin Cash

Bitcoin cash refers to a Blockchain project that is a look alike of Bitcoin itself with the goal of bringing ease to financial transactions by employing peer-to-peer feature. This implies that the need for middlemen is eliminated in the transaction of Bitcoin Cash and also the identity of the users are kept secured since it is a decentralized project.

The token Bitcoin cash was created in august 2017 as a hard fork of he Bitcoin network. Since it was a carbon copy of Bitcoin, then it had an aim which is to operate with increase in scalability and blocksize that is greater than that of Bitcoin blockchain.

Founder of Bitcoin Cash

The hard fork that brought about Bitcoin splitting on 15 November 2018 that resulted in the creation Bitcoin cash was spear headed by Roger Ver and Johan Wu of Bitmain. They were part of the development team of Bitcoin then and they proposed a software that is known as Adjustable BlockSize Cap which would see the block size of Bitcoin move from 1 MB to 32 MB. However, the whole community was not in support and so the hard fork happened.

About Bitcoin Cash token

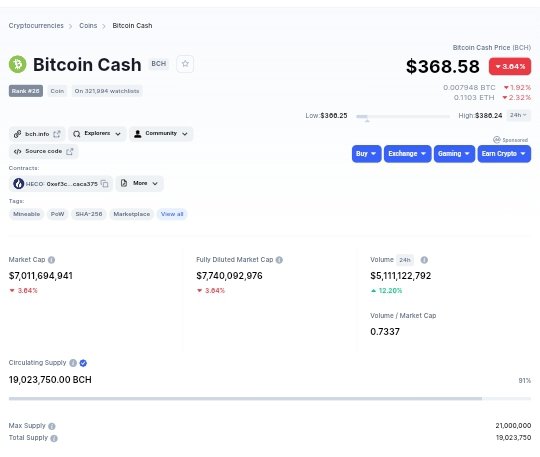

Bitcoin cash BCH is the native token of he Bitcoin Cash network. At the time of writing, the BCH price is $368.50. it has a market cap of $7,738,478,732 and a trading volume of $7,738,478,732. BCH has a circulating supply of 19,023,750.00 BCH out of a total supply of 21,000,000. Some other fundamentals of BCH are below

screenshot taken from coinmarketcap

| Metric | Value |

|---|---|

| Explorer | explorer.bitcoin.com, blockchair.com, bscscan.com, bch.tokenview.com, www.oklink.com |

| Contract address | HECO: 0xef3cebd77e0c52cb6f60875d9306397b5caca375, BNB Smart Chain (bep20); 0x4338665cbb7b2485a8855a139b75d5e34ab0db94 |

| Link | bch.info |

| Rank | 26 |

| All time high/ Low | $4,355.62 / $75.08 |

| Consensus algorithm | Proof of Work (PoW) |

| Source code | https://gitlab.com/bitcoin-cash-node/ |

Market place of Bitcoin Cash

Some places where BCH can be traded include;

| sn | Exchange | Pair |

|---|---|---|

| 1 | Binance | BCH/USDT, BCH/BNB, BCH/EUR, BCH/USDC |

| 2 | KUCOIN | BTC/USDT, BCH/BTC, BCH/USDC, BCH/KCS |

| 3 | Coinbase exchange | BCH/USD, BCH/EUR, BCH/BTC, BCH/GBP |

| 4 | Houbi Global | BCH/USDT, BCH/HUSD, BCH/BTC, BCH/HT |

| 5 | Gate.io | BCH/USD, BCH/BTC, BCH/USDT |

2. Why are you optimistic about this token today, and how long do you think it can rise?

1. Decentralized System: Bitcoin Cash uses a cryptographic method to send and recieve value. Cryptography is a means of sending information or value between two participants. The both participants posses special keys which are unique to only the both of them. One of the keys is used for encryption and the other for decryption. Without these keys, then a sent message cannot be uncovered. Bitcoin Cash uses this technology to transfer value thereby making the need for middlemen unecessary or irrelevant. The anonymous transaction identity of Bitcoin Cash has attracted investors to it and is still attracting.

2. Increase in Use Case/ Adoption: Ever since the birth of Bitcoin Cash, it has continued to remain relevant with an increase in its number of use cases. The major use of Bitcoin cash is as a means of exchange or as a payment system. Also, it's adoption rate has increased ever since then. Some establishment today now accept payments of goods and services using Bitcoin Cash. With an increase in its use case, it is sure that BCH will experience an increase in price.

3. How to analyze the token? (using the analysis knowledge learned from professors’ courses) —- important part

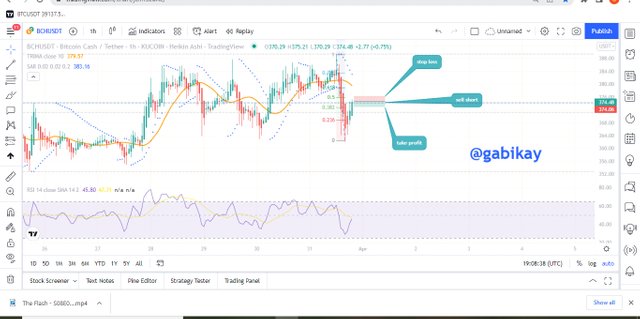

For today's trading excercise, I will use KUCOIN exchange and I will trade on BCH/USDT pair. The analysis tools I will employ are double TRIMA, parabolic SAR and Relative Strength Index (RSI). I will use tradingview for my chart Analysis.

Firstly, I open the tradingview chart and then input Heiken Ashi Chart for clearing out the market noise. Next, I input the Triangular moving average (TRIMA) and set the period as (10). The TRIMA curve has gone above the price to signal a bearish market.

screenshot taken from Tradingview

Next, I input the Heiken Ashi indicator. The dots of the indicator can be spotted above the price to signal a bearish market.

screenshot taken from Tradingview

Next, I input the RSI indicator. The price has previously tested the overbought region hence a reversal should be expected.

screenshot taken from Tradingview

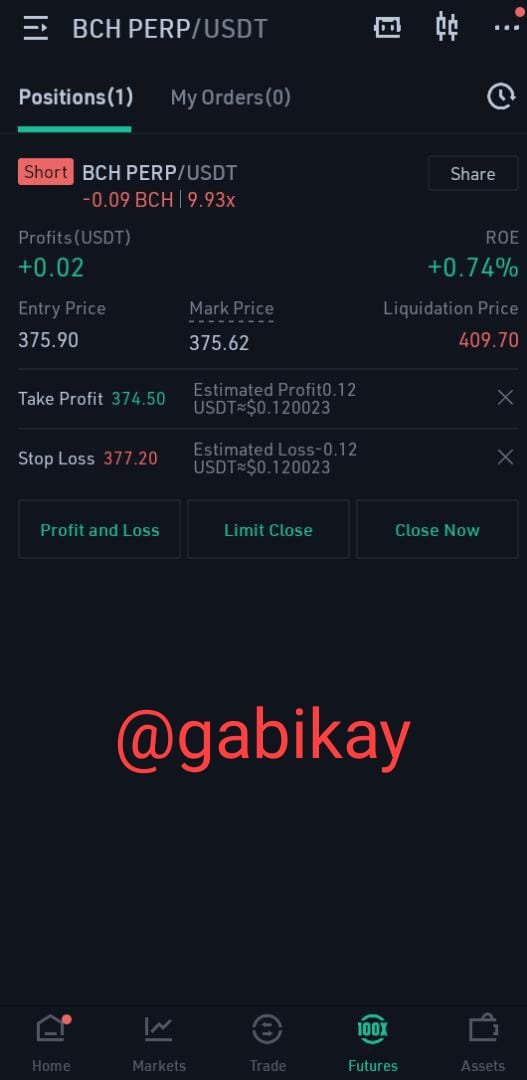

At this point, I open a sell/short trade. I have used the fibonacci retracement levels to understand the next possibility support level and I place my take profit at the next support level of the fibonacci levels. I also input my stop-loss at a risk reward ratio of 1:1.

screenshot taken from kucoin mobile app

screenshot taken from kucoin mobile app

4. Your plan to hold it for a long time or when to sell? / Do you recommend everyone to buy? and the reasons for recommending/not recommending

Bitcoin as we all know is the first ever Cryptocurrency to exist which was created by the anonymous Satoshi Nakamoto. As contained in the whitepaper of Satoshi Nakamoto, Bitcoin is to be halved after every 210,000 blocks which is approximately four years. Halving refers to the division of the block reward by 2 after 210,000 blocks have been has been added to the blockchain. This is done to reduce inflation with intensions to decrease supply of Bitcoin and increase its demand. Bitcoin Cash being a hard fork of Bitcoin network also shares this fate. The next halving should have a positive effect in the price of Bitcoin Cash given the positive effect it has had on it in the past.

Hence, I believe that buying Bitcoin Cash now to HODL is a wise choice because Bitcoin Cash is already half way to it's next halving. I plan to buy and hold Bitcoin Cash before it's next halving.

.jpeg)