If you must play, decide upon three things at the start; the rules of the game, the stakes, and the quitting time chinese proverb

The Chinese proverb above can be extensively seen in trading and following it heartedly gives a good insight into when to get into a trade and when to get out of the trade. Thanks to @yohan2on for the class on Risk Management, it is one of the important classes in trading even after studying candlesticks, charts patterns, and indicators. This said, in this post, I will be giving answers to the questions asked in the class.

Buy stop

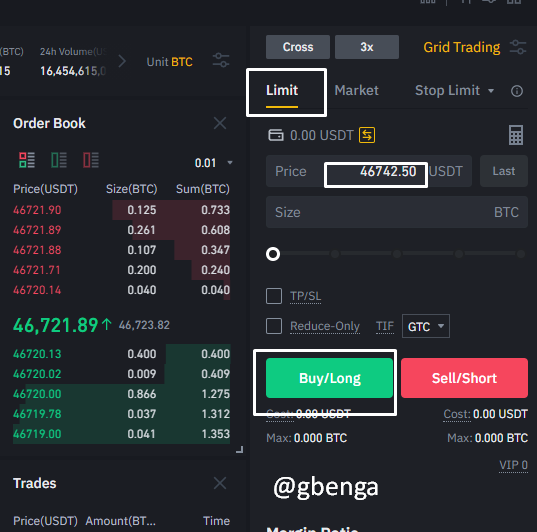

As traders, we often have our entry and exit point before entering a trade but then, the market price might not be at the point at which we want it to be coupled with the fact that there might be several analyses to make and do not want to lose as a result of pull-backs but decided to play safe, then, this is where the Buy stop order is useful. It is used to set buy order prices at a price above the market current price.

As of the time of writing, the current price of BTC/USDT is $46320, if I had gotten an uptrend signal after checking the chart that a successful breakout from the $46643 resistance point and will be reaching $50000, then I could set my Buy Stop limit at $47000 in other to mitigate loss from pull-back and wait for the price to go up to expectation. I would set your stop price at $46320 and set my limit price at $47000, when the price reaches my stop price, the limit order will immediately be triggered as an order and will be executed at $47000. If the price do not reach the stop price, the trade isn't executed.

Sell Stop

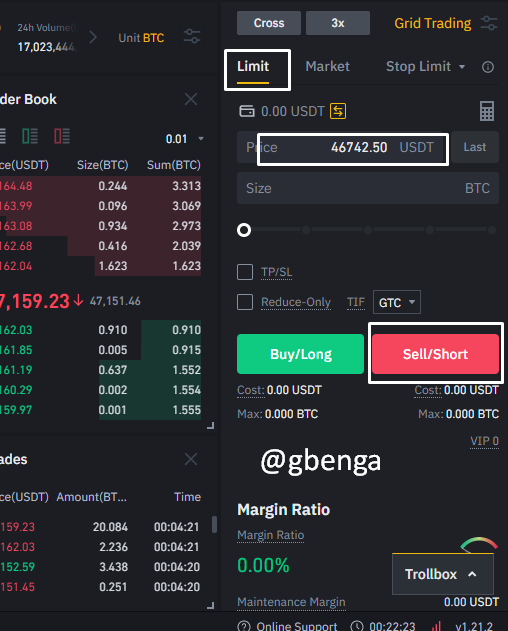

SImilar to the Buy Stop but opposite, Sell Stop is the used during a short position thereby allowing traders to set price above the immediate pull back period. The market price is executed as an order when it reaches the stop price and the sell/short position is filled in next price.

If I want to go short on BTC/USDT pair, I will set my stop price at a point lower than the current market price (If BTC is a $46320 and I plan to short my trade at $46000 as it would have broken a major support at 46100 and would be heading down, I will set my stop at $46100), the market order is executed at the stop price and filled when the price reaches the expected price (a sell order is created $46100 and it is filled at $46000). If the market doesn't get to the stop price, the order will not be executed and the trade will not exist.

Buy limit

Compared to the market order where traders buy contracts, tokens, stocks and other financial assets at the current market price, with Buy Limit, traders can choose the price at which they want to get into the market. With the buy Limit, the trader can set a price at the price they wish and it is not guaranteed that the price limit will be executed especially when the market doesn't meet the price limit.

Once the Buy limit has been set, the order is immediately placed but it isn't filled until the market hit the limit price which has preset. (this is associated to long positions).

Sell limit

Similar to the buy limit, the sell limit also allows traders to set their prefferred price. It allows traders to set a higher price to sell short on a trade. Unlike trading with the market price, Sell Limit allows for better risk to reward management, prevents market chasing and reduces tension and emotions in traders.

If the market price for BTC/USDT is $47100 and you speculate that the market will reach a resistance of $48000 and then retrace/reverses than you can set your Sell Limit at $47990 or at $48000.

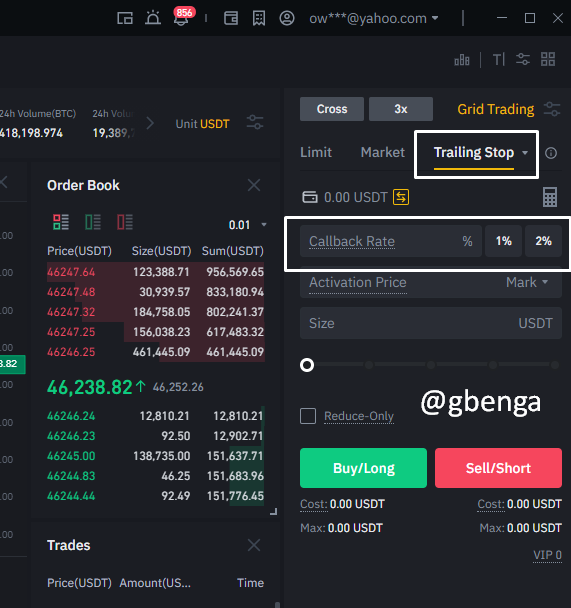

Trailing stop loss

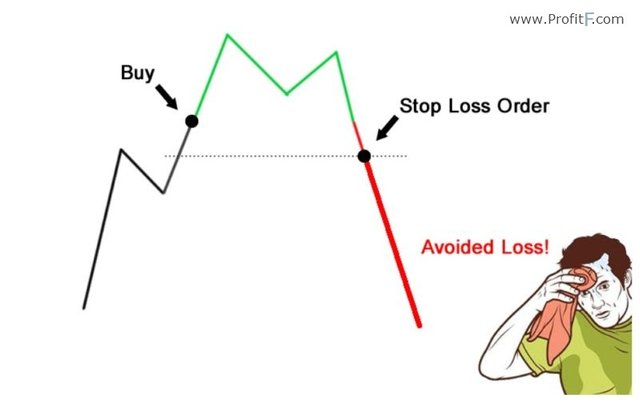

As a trader, it is necessary to keep your profit as well as mitigate loss and this is where trailing stop loss comes into place. Trailing stop loss looks like a regular stop loss which is placed below the entry point for a long position and above the entry price for a short position so as to stop a trade when the trade goes in the wrong direction but the difference is that the trailing stop loss is established as the price moves instead of being stable in one position.

A trailing stop uses a callback rate which is the percentage at which the trade should stop loss. Once the trade goes X% against the highest price set at trailing stop loss, the trade automatically cuts. For instance, If I long a coin at an entry point of $50 and place a trailing stop loss at 3%, then when the coin goes to $48.5, the trade should automatically stop. On the other handm if the trade goes up to $100 and then goes down by 3% ($97), the trade will automaically end because the trailing stop loss automatically updates with price.

Margin call

This call is common with new traders but for me, it is a heartbreak message. Margin call is recieved a trade is enhanced with margin (let me remind you that margin is an enhancer, allowing you to be more positioned in the market with quantity. it enhances both profit and loss) and the trade goes against the trader without an active stop loss to mitigate the loss incured during the trade. A margin call is when the broker sends a message to the trader requesting them to add more funds to their trade as they have gone below the maintainance margin.

Risk management

This is the most important part of trading. I have seen people recieve liquidation messages when trading as a result of lack of risk management. Not risking anything is not trading and not expecting rewards but then, when risk is involved, they should be calculated and worth it. There would be losses, but then a good trading system should have more profits than loss on a long run.

Risk management covers being able to set a stop loss, and take profit, being able to set a good risk to reward ration which is a minimum of 1:2 (risk : reward). Most times, the reason why traders end up lossing their money and not managing risk is emotions. Emotions such as greed, fear, hopes, and so on are very dangerous in trading. Having the hopes that a trade will pull back to profit when losing about 1/4 of your capital is wrong, being too greedy expecting that a trade will give more profit without trailing stop loss or taking profit could lead to the trade taking a turn around and becoming a loss, also the fear of lossing a large amount of money and rather waiting for a miracle to bring the trade back to an even point can create a lot of damage to a trader's capital.

One rule I follow is the 2% rule which says that I should not lose more than two percent of my capital to a trade. With this, i can only risk 2% of my funds to a trade. in some cases when I have strong believe in my signal and expect a move towards my gain, I could let go of 3-5% but this is on a very rare case. On a regular trading day, I do not take beyond three trades leaving my total risk at 6% for the total of trades.

Moving Average Trading Strategy

Moving Average is a good indicator for the trend of a market and more fascinating is the way it can be used at different period. Moving averages help to smoothout prices of the market. Moving averages can be divided into several period of trend indication as the 9, 20, 25 period moving averages are for short term trends, 45, to 65 period moving average for medium term trend indications and 100 to 200 for long term trend indications.

Moving averages are used to confirm a bullish, bearish or sideways market and with this, one can comfirm trade trends and trade with the trend. For this, I will be using the different timeframe and 2 moving averages.

Trading Pair: BTC/USDT

Timeframe 4 Hours and 30 minutes

Indicators SSL Channel, 200MA and 50MA (having the same timeframe with the chart)

Risk/Reward ratio 1:3 (average)

Entry point: $45929.87

Stop Loss: $46630.15

Take Profit: TP1 - $45005.39, TP2- $44287.02 and TP3 - $43858.90

The Moving Average Reversal Strategy

This strategy is usefful for both golden cross (when a short term moving average crosses above a long term moving average) and a death cross (when a short term moving average crosses below the long term moving average). On the 4 hour chart it is advisable to check for the direction of the market and this is done with the use of SSL channel. The SSL channel has two lines (the red and the green). When the Green is above the red, it is a bullish market and when the red is above the green, it is a bearish market.

On the 30 minutes trade, I check for the trend of the market if it is bullish or bearish. If the 50MA is above the 200MA, it means it is a bullish market but if the 50MA is below the 200MA, then it is a bearish market.

On the chart, it is a death cross which means it is a bearish market. once this is confirmed, the next step is to get an entry signal. To get an entry signal, I will wait for a cross (golden/death) and then wait for the price to touch the 50MA and begin a reversal abve the 50MA to pick an entry signal.

Pictograph:

Wait for a cross (in the case of a bear trend, it would be a death cross.)

Wait for price to retest and touch the 50MA and then reverse back in the same trend

A signal isn't confirmed if the price doesn't reverse touching the 50MA but once it touches the 50MA in its reversal, the trade can be triggered in the next candlestick. In this case, it is a short position. I entered my short position at $45929.87, set my stop loss at $46630.15 (often between the range of 1-2% of my trade, or the nearest resistance).

Profit will be taken at TP1 - $45005.39, TP2 - $44287.02 and TP3 - $43858.90

Conclusion

The Strategy isn't 100% winning formular but I have tried it over 50 times and I can say that it is profitable. I do not trade with more than 3X leverage since I am not willing to lose all I have in the trade. I am very careful with my trading funds, as much as I know that I can lose part or all of my money on a trade, I ensure it never happens so I am very disciplined with risk management.

You've got a free upvote from witness fuli.

Peace & Love!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @gbenga

Thanks for participating in the Steemit Crypto Academy

Feedback

This is good content. Well done with your practical study on Risk management.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks a lot for taking the time to read through my post, Weldone friend.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations! Your post has been selected as a daily Steemit truffle! It is listed on rank 22 of all contributions awarded today. You can find the TOP DAILY TRUFFLE PICKS HERE.

I upvoted your contribution because to my mind your post is at least 6 SBD worth and should receive 34 votes. It's now up to the lovely Steemit community to make this come true.

I am

TrufflePig, an Artificial Intelligence Bot that helps minnows and content curators using Machine Learning. If you are curious how I select content, you can find an explanation here!Have a nice day and sincerely yours,

TrufflePigDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit