From the Season 1 of the Steemit Crypto Academy till date, I must confess that I have enjoyed every experience and I am so happy that the season 5 began already. In today's post, I will be writing in respect to @kouba01 class on Average True Range (ATR) Indicator. Without any further ado, I will begin with the assignment.

Average True Range (ATR)

J. Welles Wilder Jr in 1978 introduced the Average True Range (ATR) in his book New Concepts in Technical Trading Systems, as a tool in technical analysis used to measure the volatility of an asset price caused by gaps or sharp movements in a particular period.

While many oscillating indicators such as the MACD, and RSI calculate the direction or momentum of a market, ATR on the other hand calculates the strength of a price movement. The ATR indicator is an oscillating indicator plotting a continuous line below the main market chart. When measuring volatility, it is the rate at which the price of a market changes compared to it average, while momentum used to determine the direction of a market. The price of an asset in the market can be volatile if there is a wide price range (movement) compared to its previous average, and can be less volatile when it has a narrow/slim price range compare to its previous average.

Just like Bollinger bands, and other volatility indicators, the aim of Average True Range (ATR) is to help traders determine when the market is more sporadic or less sporadic and as such, it is no surprise that it does not follow trends at all times as the market might be increasing while it won't be volatile

Calculating Average True Range

When calculating the Average True Range of a market, the True Range should be considered. and when calculating the true range, the previous closing price of the market should be considered. To calculate the Average True Range of a market, one of the three True Range method must be calculated;

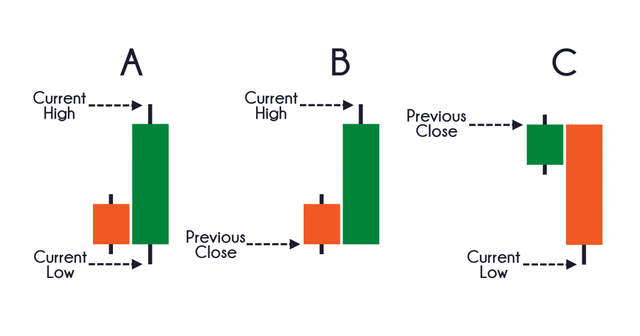

a. Current high minus the previous close

b. Current low minus the previous close

c. Current high minus the current low

To understand this, I will explain when each of these methods can be calculated

A Is used when the current candle stick is larger than the previous candle stick.

B is used when the current candle stick closes higher than the previous candle stick.

C is used when the current candle stick closes lower than the previous candle stick.

TR = Max[(High − Low), Abs(High − Close Previous), Abs(Low − Close Previous)]

TRi=A particular true range

n=The time period employed

Max: Difference between the high and low of a day.

abs: Absolute value

When Calculating for ATR, it does not matter if the value is positive or negative, the highest absolute value is what is necessary for calculation.

To calculate the current ATR;

Current ATR = (Previous ATR * (n - 1) + TR) / n

Current ATR = ((Prior ATR x 13) + Current TR) / 14

Example (Illustrative)

With a True Range (TR) of 109 and a Prior day ATR of 142, calculate the current ATR at a 14 day period.

Current ATR = ((Prior ATR x 13) + Current TR) / 14)

= ((142 x 13) + 109)/14

= 1955/14

= 139.6

Current ATR = 139.6

What do you think is the best setting of the ATR indicator period?

Average True Range has a default setting of 14 day-period. While the period can defer depending on the trading strategy, it is important to stress that the smaller the period, the more volatile the reading will be, and so, it is advisable to use smaller period for shorter trades and larger periods for longer trades. Using a shorter period for a longer trade could lead to error while trading.

While trading, shorter averages, such as 2 to 10 periods will be useful for short-term trades while longer averages such as 20 to 50 periods would be useful for longer-term trades.

How to read the ATR indicator? And is it better to read it alone or with other tools? If so, show the importance. (Screenshot required)

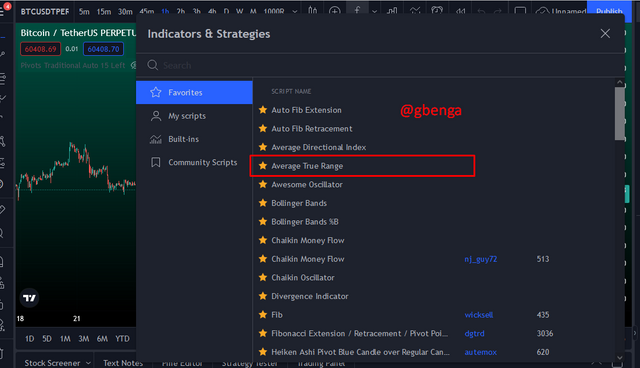

Reading the ATR indicator isn't a difficult thing but before then, I will like to explain how to get Average True Range indicator on a chart and to do this, I will be using TradingView. The first step is to search for the Average True Range indicator on the indicator tab.

The Indicator appears below the price chart and it is a continuous line that moves up and down.

In the case of reading the ATR indicator, it is done by observing the single line in the indicator that goes up and down in a cyclic motion. The higher the ATR increases, the more volatile the price is and the lower the ATR indicator moves, the less volatile the price is in the market.

Never mistake the ATR indicator as a trend indicator, the ATR indicator might be increasing while the price is dropping and vice-versa

Is it better to read it alone or with other tools?

Since it isn't a directional indicator, then using it alone wouldn't be a good idea, as it can't be trusted as a standalone tool for trading. ATR can be combined with other indicators that predicts directions and momentum. ATR can be combined with other indicators such as the Parabolic SAR, RSI, and Stochastics

Parabolic SAR and ATR

Parabolic SAR is an indicator used to identify reversal and stops based on time and price. In trading when combining Parabolic SAR and ATR, it is useful for allowing traders set a price point to allow traders take advantage of a trending market.

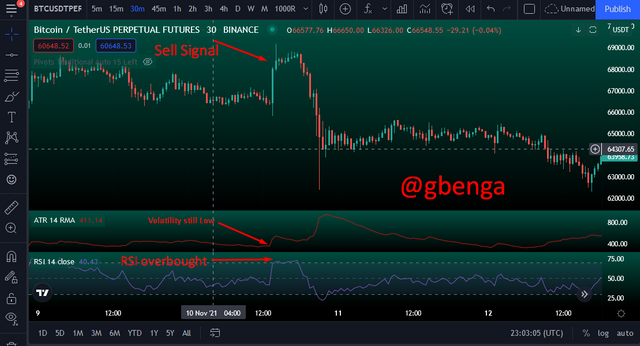

ATR and RSI

Since the Relative Strength Index is used to identify the point of overbought or oversold, using the ATR to identify points of early volatily allows the trader to prepare well for a good entry as well as exit. When the ATR becomes too volatile above the middle range, then it volatility is gradually reducing.

To prevent error when trading, it is advisable to use the ATR with other indicators that indicates prices movement, direction and momentum.

How to know the price volatility and how one can determine the dominant price force using the ATR indicator? (Screenshot required)

Determining Price Volatility

With the ATR indicator, it has been established that price volatility will lead to a large candlestick body which can either be upward or downward, while the ATR indicator increases.

The ATR indicator increases where there is a strong bullish or bearish move in the market causing a spike in price (bullish) or a fall in price (bearish) of the price.At the minimum ATR value, there is always a change upwards.

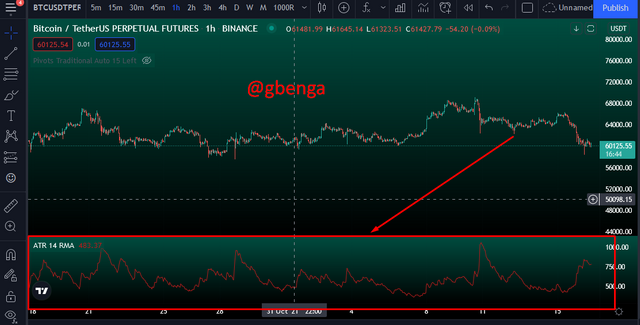

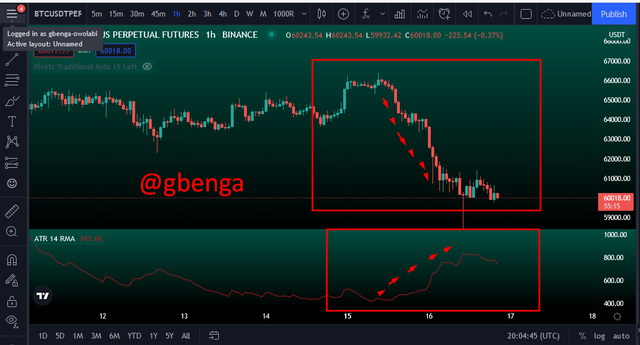

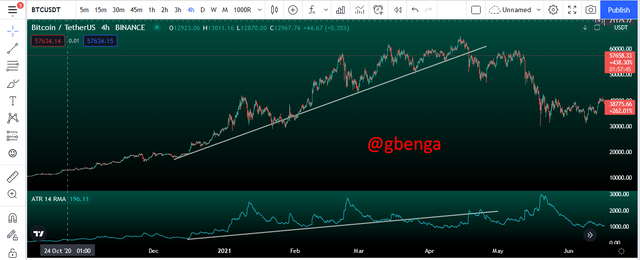

Using BTC/USDT trading pair, price volatility can be found in prices as they either go up or down while the ATR indicator moves upward.

From the Chart above, at $68800, the price was at a high but there was low volatility while the price gradually climed to that point (1). It can be seen that at point (1), the ATR was low and the price was high which showed there was no volatility but then, the price started to drop and the ATR starts to Spike showing that the market was volatile. This price volatility occured from point (1) $68800 to point (2) $62460.

When there is no volatility in the market, the candlestick starts to reduce. From the chart above, after the ATR spikes, it starts to drop signalling that there is no volatility in the market. The candlestick bodies start to become small and the ATR indicator drops gradually.

Determining the dominant price force using the ATR indicator

Without holding back, it is important to state that the rise in price of a market does not gurantee that there will be a rise in the ATR indicator. The ATR indicator can rise when there is a bullish or bearish market, it's purpose is to ensure volatility in the market. If the market has an increased volatility thereby causing the market candlestick to increase upwards, the ATR would increase upwards, also if there is a high volatility with a bearish movement in price, the ATR will increase upwards.

There are cases where the price would increase upwards gradually without the ATR increasing, this is because at this point, the market isn't volatile, and while this is done, the market could begin to fall in price very fast and the ATR begins to Rise, this is because the fall made the market volatile.

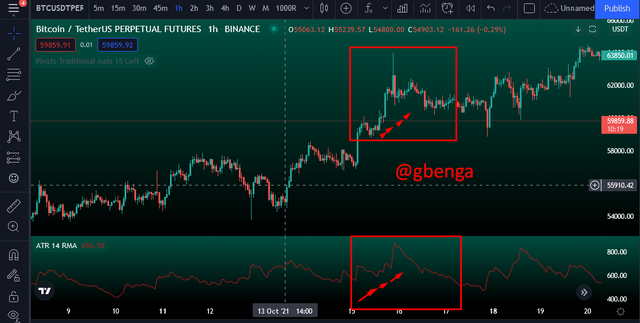

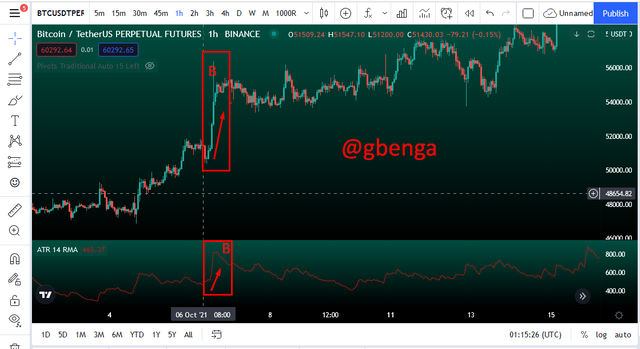

From the chart Above, the dominant price forces are points where there is volatility and the market is pushed in one direction as a result of this volatility. From the chart above, the ATR increased while the price of the market was dropping at point A, meaning the dominant force was available when the price was dropping.

In the chart above, the ATR increased when there was a sharp rise in price at point B, this is to say that the dominant force was upwards.

Remember that the ATR indicator goes up and down meaning that if it goes up, to would go down and when it goes down, it should pick upwards again. With this in mind, it is easy to explain that in the chart above, there was a dominant force moving upwards in A which caused the rise in ATR displaying volatility, while the price kept increasing in the B, the ATR was dropping to confirm that there wasn't any volatility with that movement, then at point C, the market started to drop drastically with the ATR starting to rise showing another Dominant point.

How to use the ATR indicator to manage trading risk ?(screenshot required)

Liquidation is one story I hear every now and then even in the trading news, and then I ask myself, do this traders apply any trading risk management at all while trading?

When trading, there are two tools for risk management to put into consideration, Take-profit and Stop-Loss.

Take Profit

While soo many people can make different trade analysis and strategy, it is left to the market to decide on the movement based on traders instict to which would hold the market (bulls/bears). Take profit allows for traders to set price at which a trade isexpecte to get to with a positive movement in the direction of the speculation.

With ATR being an Indicator to check volatility, it can be used to set take profit. The take profit level could be calculated by adding either 1x ATR, 2X ATR, and 3X ATR to the Entry point in terms of a long position and subtracing in terms of a short position.

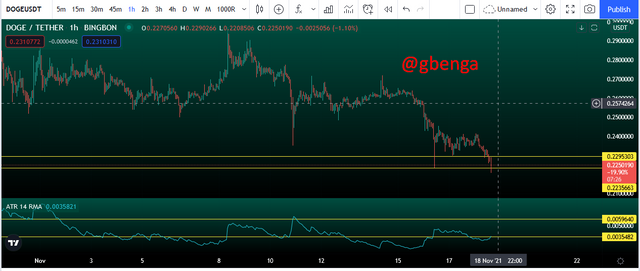

Using the chart of DOGE/USDT on a short open position.

Entry price = 0.2235663

ATR at Entry = 0.0035482

3X ATR = 0.005964

Take Profit price = 0.2235663 - 0.0035482

Take profit price level = 0.2176023

On the other hand, I were to use the same DOGE/USDT chart for a long position and Take profit, I would add the entry price with 3X ATR.

Entry price = 0.2235663

ATR at Entry = 0.0035482

3X ATR = 0.005964

Take Profit price = 0.2235663 + 0.0035482

Take profit price level = 0.2295303

Stop Loss

Just like take profit is used to harness profit when trade goes in the right direction as speculation, so does Stop Loss mitigate losses when trade go in the wrong direction. To get the point to place a stop loss in a trade, ATR can be relevant. Just like the process used in term of take profit, this time, the reverse is the case. In a long position, the 1X ATR, 2X ATR or 3X ATR is subtracted from the entry price.

Using DOGE/USDT in a long position

Entry price = 0.2174725

ATR at Entry = 0.0038949

3X ATR = 0.0116847

Take Profit price = 0.2174725 - 0.0116847

Take profit price level = 0.2057878

On the sell position, the stop loss would be an addition of the entry point and the either one of 1X ATR, 2X ATR, or 3X ATR.

Using DOGE/USDT in a short position

Entry price = 0.2174725

ATR at Entry = 0.0038949

3X ATR = 0.0116847

Take Profit price = 0.2174725 + 0.0116847

Take profit price level = 0.2291572

How does this indicator allow us to highlight the strength of a trend and identify any signs of change in the trend itself? (Screenshot required)

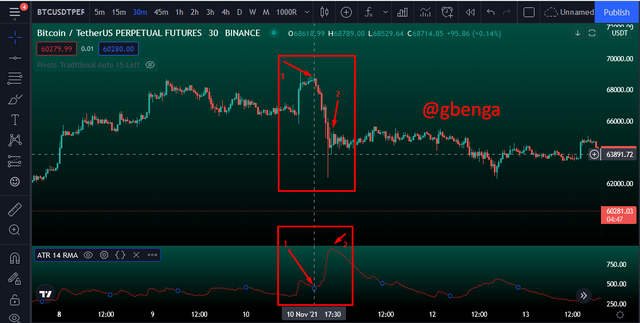

To determine a trend, there must be an impulsive buy/sell causing a movement in a direction. It has been said in the past that ATR cannot identify trend but it can be used to tell the strenght of a trend combining the movement of the ATR and price action.

During an impulse move, there would be pullbacks. These moves are defined by volatility caused by pressure during impulse. With this, it is easy to determine that the momentum gathered during impulse can be seen through the ATR indicator. Since a price movement is determined by an inbalance in pressure of either the buyers or the sellers, ATR movement upward confirms an inmpulse movement which leads to a trend.

ATR indicator confirming price movement during impulse is used to determine the strength of a trend. When the ATR keeps increasing during an impulse, then the trend strenght is confirmed.

According to the chart above, the market is in an uptrend and the strength of the trend is shown in the impulse which is also confirmed by the ATR indicator which goes upward during the uptrend impulse.

The strength of a trend can be further confirmed when the impulse breaks a resistance or support and the ATR indicator rises, then there is strength in the trend.

Identifying signs of change in the trend

Since the ATR indicator can be used to determine the volatility of a market, it can be easily spotted then if a trend is about to change. When there is going to be a change in trend, then the ATR indicator begins to reduce while the trend still continues. At this point, it is becoming clear that the trend is peaking and coming to an end. It is most likely that the trend is about to experience a change.

The trend which was going upwards was had the ATR going upwards at each impulse but when the ATR started to reduce at impulses, it was a sign that there wasn't much momentum in the market thereby reducing volatility. At this point, there is a possible change in the trend. From the chart, it is visible that when there was a change in trend, the ATR begins to rise.

List the advantages and disadvantages of this indicator

Advantages of ATR

ATR indicator allows traders to identify when there is an inbalance in the market leading to an impulse either to buy or sell since the ATR line rises showing volatility.

ATR indicator gives a clear reading of the market with noise being removed thereby showing when thereby making reading easier.

Can be used to identify point of exhaustion in a trend, a point identified by the ATR line reducing when the trend is still ongoing.

Helps serves as a good risk management indcator during trades, thereby allowing traders to put stop-loss and Take-profit in a trade before initiating the trade.

Disadvantages of ATR

While ATR can be a very easy to use indicator, it is important to state that it is not a directional indicator and cannot be used to determine the direction of a chart based on its upwards and downwards movement.

It cannot be used to deterine points of buy and sell in a trade thereby making it difficult to be a standalone indicator thereby eliminating false signals.

ATR does not give signals such as reversals, continuation of trends, and divergence, and so cannot be depended on for these signals. Remember that it is a volatility based indicator and not a directional based indicator.

Conclusion

Average True Range (ATR) as a tool is very good when it comes to identifying volatility which could lead to a change in price upwards or downwards but then, it should be mistaken for a directional indicator. ATR can be used ro guage the overall movement of a market which makes it an impressive tool to have when trading.

Thanks to @kouba01 dor the lecture, i must confess that it was worth the time and effort.