If you must play, decide upon three things at the start; the rule of the game, the stakes, and the quitting time - Chinese Proverb.

Trading without a rule is trading to fail and in other to work with rules, trading analysis, tools, and indicators must be understood and adhere to. In this post, I will be discussing the Super Trend Indicator, which was lectured by @kouba01. Without no further Ado, I should get into the task for the lecture.

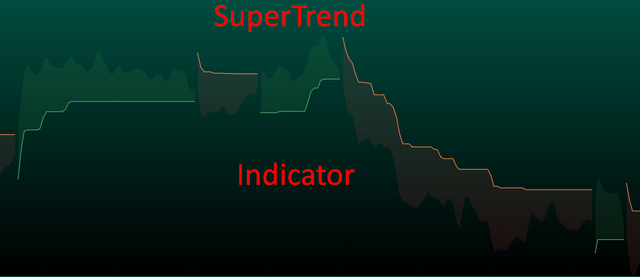

SuperTrend As a Trading Indicator

One of the rules of trading is "never trade against the trend because the trend is your friend". The market moves in an upward, downward, sideways direction, these moves are regarded as uptrend, downtrend, and trading range respectively. A trend can so be increasing or decrease and in other to identify these trends easily, a SuperTrend indicator is required.

The SuperTrend Indicator which was developed by Olivier Seban is an Indicator that can be used to identify a trend. It is a continuous line of greens and reds used to identify trends either going upwards or downwards. When indicating an uptrend, the continuous green line shows below the price, and when it is indicating a downtrend, the red continuous line shows at the top of the price going downwards. The indicator calculates the volatility of an asset by making use of Average True Range (ATR) and multiplier (factor) with a default length of 10 and a factor multiplier of 3.

Calculating SuperTrend Indicator

To calculate SuperTrend Indicator, the Average True range of a particular period and multiplier. The indicator calculation for both uptrend and downtrend are;

Uptrend = (High + Low)/ 2 + factor (multiplier) × Period (ATR )

Downtrend = (High + Low) / 2 - factor(multiplier) × Period (ATR)

While the addition of multiple of the volatility is used to identify uptrend, it is a subtraction for downtrend. To calculate the SuperTrend Indicator, the ATR needs to be calculated but to do that True Range needs to be calculated. True Range is calculated as;

1st True Range = Current High - Current Low

2nd True Range = Current High - Previous Close

3rd True Range = Current Low - Previous CloseATRn = [ATRn-1 x (n-1) + TRn] / n

Calculating SuperTrend for uptrend example:

Calculate the Uptrend SuperTrend for asset A with High = 54.1, Low= 46.2, ATR = 2.0 (10 periods default), Multiplier = 3.

Formulae: Uptrend = (High + Low)/ 2 + factor (multiplier) × Period (ATR )

SuperTrend = (54.1 + 46.2)/2 + 3 x 2

SuperTrend = 50.15 +6

SuperTrend = 56.15

Calculating SuperTrend for Downtrend example

Calculate the Downtrend SuperTrend for asset B with High = 12.4, Low = 12.2, ATR = 0.1 (10 period default), Multiplier =3

Formulae: Downtrend = (High + Low) / 2 - factor(multiplier) × Period (ATR)

SuperTrend = (12.4 + 12.2)/2 - 0.1 x 3

SuperTrend = 12.3 - 0.3

SuperTrend = 12

(All examples are imaginary and are required to explain the formula)

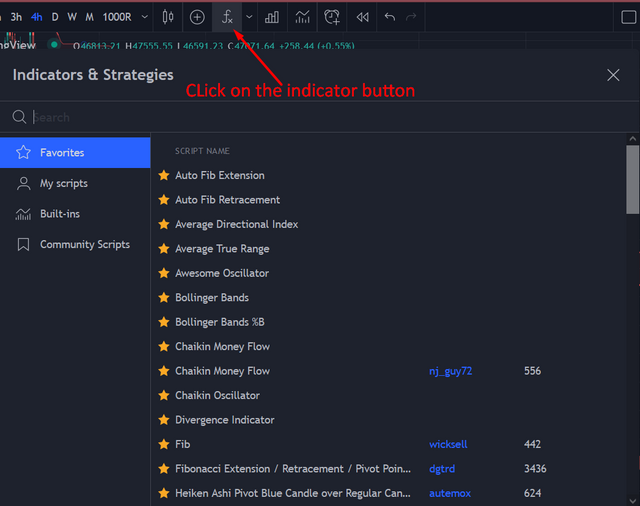

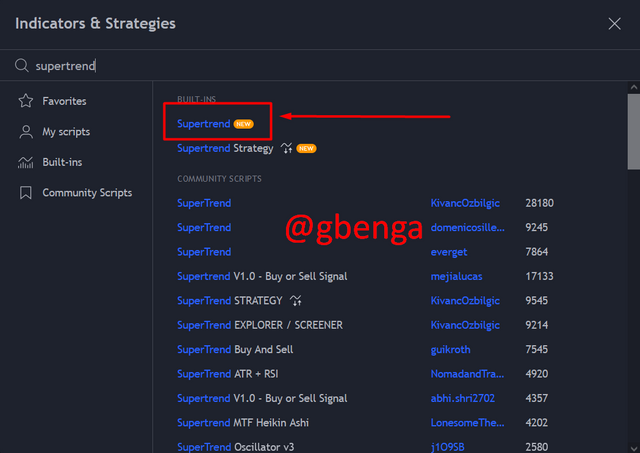

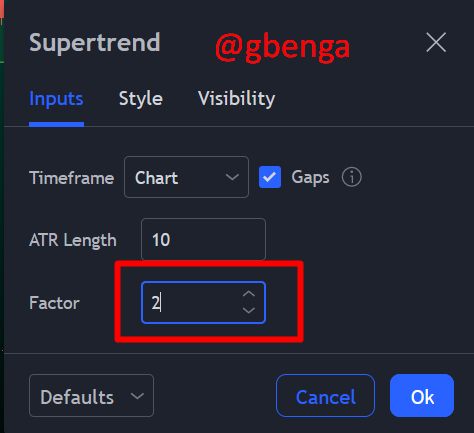

What are the main parameters of the Supertrend indicator and How to configure them and is it advisable to change its default settings? (Screenshot required)

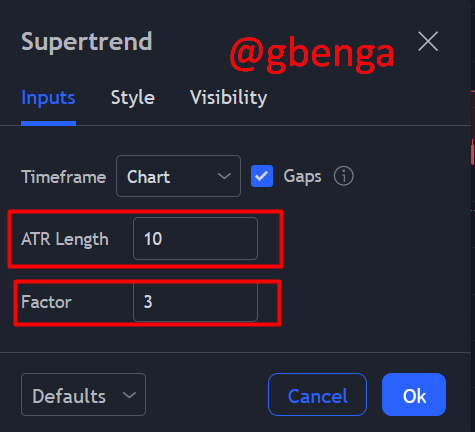

The SuperTrend as an indicator has two parameters which are Factor (Multiplier) and Average True Range (ATR) Length and the step to configuring the Supertrend is shown below thus;

To get this done, I will be using TradingView to read the chart. First click on the indicator button to add the indicator into the chart, then search for SuperTrend.

After adding the indicator to the chart, click on the settings button to see the parameters. On clicking on the settings button, the input column which has the parameter listed appears.

In the settings menu, the ability to change the parameters from the default ATR length (10), and Factor (3) to whatever option i would love to use for my trade.

ATR Length

I could change the ATR length to 20 to see what is being noticed and also change the ATR length to 5 to observe the changes.

With the ATR length at 20, the ATR showed early signals as the lines starts close to each new trend candlesticks where it peaks. Also, the lines are flattened thereby not causing confusion when looking for an exit point.

When the ATR length is changed to 5, the lines are farther to the beginning candlestick of a new trend movement, the line less flattened with more contours in the line.

Multiplier (factor)

Just the same way I changed the ATR length, changing the Multiplier is also possible. I will be changing the Multiplier from its default 3 to other preferred numbers including 2 and 5.

Changing the Multiplier to 2, reduces the length of the line based on the time frame with respect to the volatility of price. When the ATR is shorter the line changes in a more volatile manner. The lines are closer to the price.

When the Multiplier is changed to 5, the line is farther to the price, thereby displaying a less volatile line. This allows the trader to trade for longer term as it filters the errors that can be found while trading with the indicator.

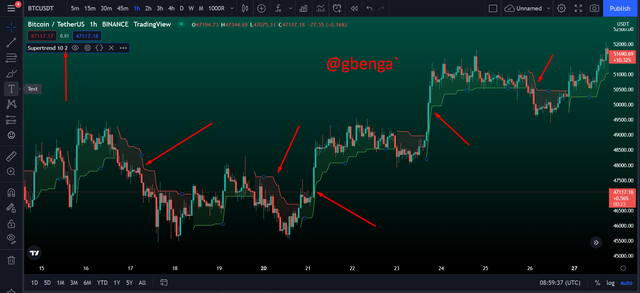

Based on the use of the SuperTend indicator, how can one predict whether the trend will be bullish or bearish (screenshot required)

Remember clearly that I previously said that the SuperTrend indicator is a trend indicator used to identify the trend movement of the price. I will be explaining how to identify a bullish and bearish trend in a market.

Bullish Trend

When the trend is bullish, the indicator is plotted from below the price action and it is identified with the color green. The line stays below the price action serving as a support line.

Bearish Trend

The bearish trend with the indicator is plotted above the price action and it is identified with the color red. The line stays above the price action serving as a resistance line.

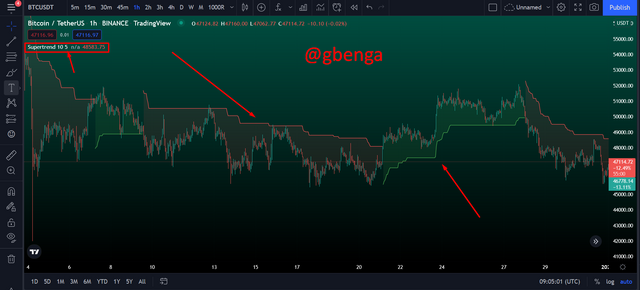

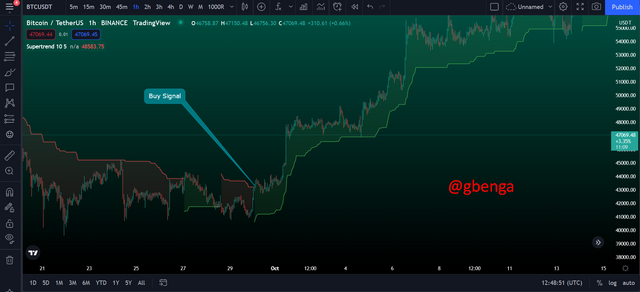

Explain how the Supertrend indicator is also used to understand sell / buy signals, by analyzing its different movements.(screenshot required)

This is one indicator that I must say is very easy to read and understand. Identifying buying and selling signals will be explained below:

Buy Signal

To identify when to buy using the SuperTrend indicator the SuperTrend would be in a downtrend while the price begins to move in an opposite direction upwards. When the price touches the downwards SuperTrend, then a buy signal is triggered and an entry is required.

Sell Signal

To identify a sell signal using the SuperTrend Indicator, the SuperTrend Indicator would be moving in an upward direction while the price will be heading downwards. When price heading downwards touches the SuperTrend indicator, then a sell signal has been called and an sell entry is required.

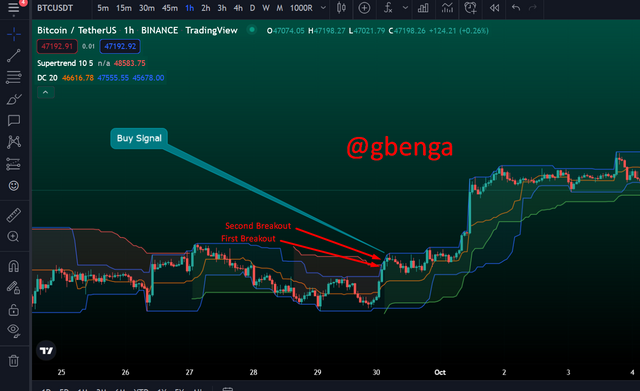

How can we determine breakout points using Supertrend and Donchian Channel indicators? Explain this based on a clear examples. (Screenshot required))

To identify the breakout point, Donchain Channel indicator is used along side with the SuperTrend indicator.

Bullish Breakout

To get a bullish breakout with Supertrend and Donchain Channel, two candlesticks have to breakout of the Donchain Channel. and at this point, the SUpertrend would have appeared below the price action with a greenish color confirming the breakout. When the price has been confirmed as bullish, the price continues to go upwards.

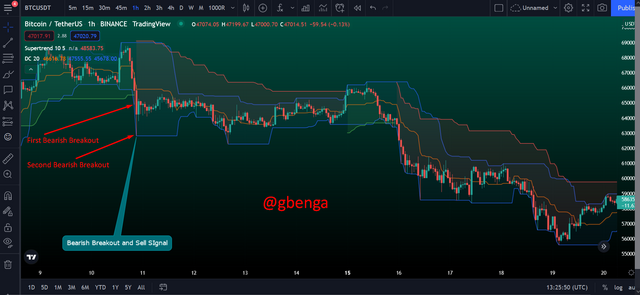

Bearish Breakout

In the bearish breakout confirmation, the Donchain Channel and the SuperTrend Indicator are used together as well. to identify a bearish breakout, the breakout has to have two consecutive candlesticks breaking out of the Donchain Channel to trigger a breakout. When the breakout is triggered, the Supertrend being at the top of the price action with a red color confirms the breakout.

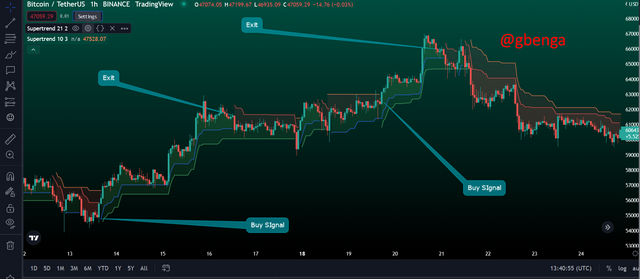

Do you see the effectiveness of combining two SuperTrend indicators (fast and slow) in crypto trading? Explain this based on a clear example. (Screenshot required)

Yes, I see the effectiveness of combining two supertrend indicator while trading cryptocurrency or any other financial market. Using a fast parameter indicator and a slow parameter indicator is a very good strategy to confirm a trade and so is using 2 SuperTrend Indicators as it confirm trades when the indicators crosses one another and their location. To explain this further, I will be using two Supertrend indicators of 10,3 (Slow), and 21,2 (Fast).

Buy Signal

For a buy signal to be confirmed using the fast and slow supertrend, the fast green supertrend will cross the slow green supertrend upwards. At this point, an entry signal is called and then the fast supertrend turns red while still in the trade, it is a signal to exit the trade.

Sell Signal

For a sell signal to be confirmed, the fast supertrend will have to cross the slow supertrend downwards and both supertrends need to be red. When the fast SUperTrend indicator turns, green, it is a signal to exit the position.

Is there a need to pair another indicator to make this indicator work better as a filter and help get rid of false signals? Use a graphic to support your answer. (screenshot required)

Yes, there is a need to combine two or more indicator to the SuperTrend Indicator. I will be using the RSI (14 period) which is an Oscillator indicator along with the SuperTrend Indicator.

BUY Signal

In the buy signal, the RSI crosses over the SMA line upwards (updated RSI on tradingview) and crosses the 50 middle band line upwards signalling a bullish trend. To confirm the buy signal, the price goes upwards and crosses the downwards SuperTrend going upwards and the SuperTrend changes to green showing below the price action, confirming the buy signal.

Sell Signal

In the Sell Signal, the RSI crosses over the SMA line downwards and below the 50 middle band line signalling a downtrend. To confirm with the SuperTrend, the price goes down touching the opposite Supertrend which was going upwards. The price keeps going down and the SuperTrend shows a bearish trend with red color, confirming the signal.

List the advantages and disadvantages of the Supertrend indicator

Advantages of SuperTrend

- It helps to identify trends easily without stress

- It is clear and easy to use and its signal can be understood for a beginner trader

- It can act as a resistance during downtrends and a support during uptrends

- It combines both price movement and volatility making it a very good indicator for trading

- It can be used to identify the start of a new trend

Disadvantages of SuperTrend

- It is not a 100% correct so it will require two or more indicators to verify its signals. It can give false signals during trade.

- SuperTrend gives late signals sometimes as the trend might be a short trend and would have peaked before the Supertrend signals.

- Reducing the ATR and Multiple makes it very noisy and so it can give false signals

- It is not recommended for markets that aren't in a trend. It is advisable not to trade using the SuperTrend indicator during a sideways market as well as in very volatile markets.

Conclusion

The Supertrend indicator is a very easy to use and can give accurate readings when being used. While I must confess that I haven't used this indicator in the past, it is a very good indicator that can easily identify trends thereby making trend trading and scalping very easy. While i used the indicator and liked it, I realize that it performs poorly in very volatile market meaning that it would give false signals with such trades.

On a final note, I have to say a very big thank you to @kouba01 for the time taking to get this lecture available. I hope to be a part of other classes in the future.

All images in this post are screenshots from tradingview.com unless stated otherwise