Introduction

Cryptocurrency came with the aim of having a decentralized and private way of finance. While it has been in its genesis role to bring privacy, a lot of cryptocurrency project have improved on making sure privacy is privacy compared to the pseudonymous character used when transferring using Bitcoin. With Bitcoin pseudonymous address, it is very easy to identify a wallet which buys BTC, transfers it and where it was transferred to. While the name of the holder isn't displayed openly, it is very easy for people to track transactions and link a supposed owner of the wallet, but people want more, a lot of people want a coin, and an exchange where everything done is below the radar and the eagle eye of the public and this brought about what is known as Privacy coin. Also, the Dark pool concept was also adopted to improve the privacy level when transacting.

Discuss Dark Pools in Cryptocurrency in your own words. How does dark pool works?

Let me give a brief definition of the Dark Pool, it is a privately organized, exchange, platform, or portal where investors can purchase financial securities without the eyes of the public. This exchanges are not accessible by the general public thereby making purchases discreet and private.

Dark pool being a private portal for financial securities also makes it applicable in cryptocurrency and with that, it was introduced into the crypto space. Dark Pool in cryptocurrency are exchanges that operates differently from the public exchange, thereby allowing users to buy large quantity of crypto assets a predetermined price. There are no order book in dark pools rather, trade are executed at a predetermined price. This implies that the trader purchase at the dark pool price and trades are done with limit orders thereby not leaving room for the creation of a order book.

In the crypto world, whales are known to trade using dark pools as it will shield them from the public as well as make their intent not visible to smaller traders. With this, Whales could purchase a lot in the accumulation stage of a crypto asset thereby leaving the smaller traders off guard.

Price are set on the average best of both bid and ask price and so, traders just purchase at the Dark pool limit price, from the Dark pool liquidity. The trades done in the Dark pool are block trades and since they get the best average of bid and ask, slippage is eliminated.

Discuss any crypto exchange that offers a dark pool. How does its dark pool work?

Kraken Dark Pool

Launched in 2011, Kraken is one of the worlds' largest cryptocurrency exchanges which offers both public exchanging and dark pool exchange (currently not available based on last update). The dark pool allows large traders to trade anonymously since the order book is not visible to anyone while each trader can only see their personal order. With this, the market is not affected either by panic or anxiety over seeing a large amount to be filled. In most cases, large amounts usually affect the price movement as traders would either rush to dump if the large order is a sell order or be it can also keep the price stagnant if the large order is a buy order as filling will be difficult.

With Kraken Dark pool, only dark pool orders can be matched with dark pool orders and at such, in Kraken dark pool, only limit orders are allowed thereby allowing the trader to purchase the current best price in the pool. The dark pool only allows for spot trading with large amount, margin or futures trading cannot be performed on this market since the order book is not visible to the eyes, and since the order book is not visible to the eyes, there are no takers or makers, neither are there takers fee or makers fee, everyone trade at the same fee.

What are the supported assets on the dark pool mentioned in (2) above? What are the requirements for getting involved in dark pool trading on the platform? Is there any fee attracted? Explain

Only pro level traders, with a minimum order size of $100k for BTC and a minimum of $50k for ETH are allowed to participate in this dark pool. (I still see this as low amount for a few traders because currently, users can own 3 BTC and trade with them even on public order books). Also, tradings are done with limit orders.

Fees

Like i said, there are no takers or makers in the dark pool, so all traders have virtually same fee to pay depending on the 30 days trading volume of the individual. Fees could range from 0.20% to 0.36%

The following pairs are available on Kraken Dark pool;

Ethereum:

ETH/CAD

ETH/EUR

ETH/GBP

ETH/JPY

ETH/USD

Bitcoin

BTC/CAD

BTC/EUR

BTC/GBP

BTC/JPY

BTC/USD

and BTC/ETH.

For the chosen dark pool, give a brief illustration of how to perform block trading on the platform. (Screenshots required)

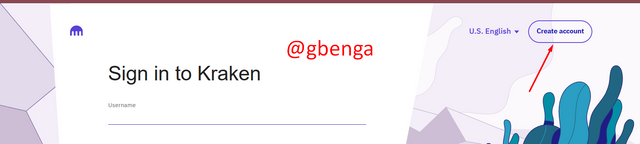

To perform a block trade on Kraken exchange, you first visit https://www.kraken.com and then head straight to creating an account. To do that, click on the create account button, and you will be redirected to the account creation page.

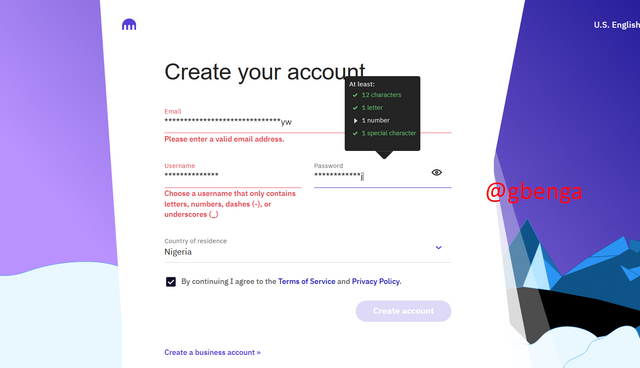

Account creation is quite easy, what is required is an email address, a username, password and country of residence.

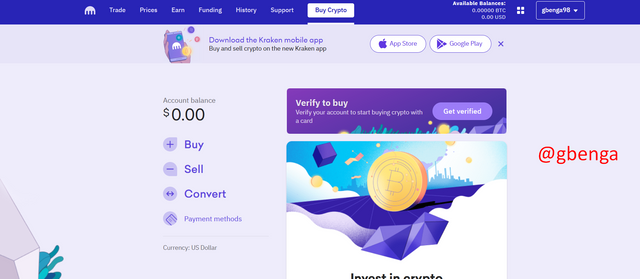

After creation of account, the next step is to log into the Kraken exchange.

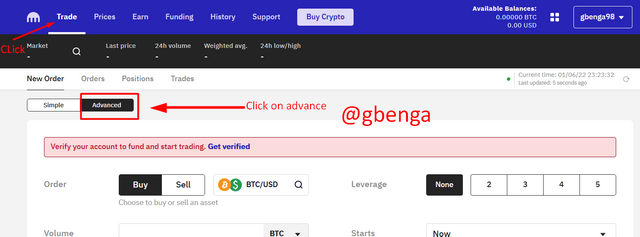

On the homepage, click on the Trade tab, after which you click on advance

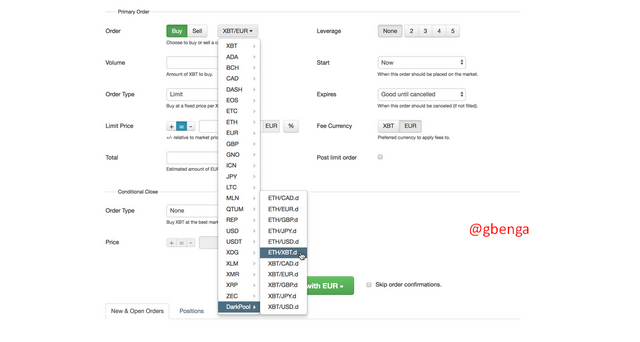

On the pair section, you search for the Darkpool listed under the pair section. On the DarkPool, pairs such as ETH to Fiats (USD, CAD, EUR...), BTC to Fiats (USD, CAD, EUR...) but due to its temporary unavailability, It isn't available on the exchange.

What's your understanding of the Decentralized dark pool? What do you understand by Zero-Knowledge Proofs?

Just like we have decentralized exchanges, so do we have decentralized darkpool, and just as the decentralized public exchanges allow user trade without the interference of a third party, so does decentralized darkpool allow for traders to trade outside the public decentralized market but rather in a private platform without the interference of a third party. In a decentralized darkpool, both the traders trade without an intermediary holding the funds. The decentralized darkpool allows for pair to pair trading across different chains via Atomic swaps and this means that there are no pools in a decentralized darkpool.

The decentralized darkpool break down orders into smaller orders and then match the orders with different orders in different chains. These trades are done via nodes and while the trades is ongoing, successful nodes are rewarded for their work with the transaction fee charged on the transaction. To do this, the decentralized darknet uses ZKP (Zero-Knowledge Protocol/proof).

Zero-Knowledge Proof is an encryption that allows the verification of a data without revealing the detail of the data. It was proposed by Shafi Goldwasser, Silvio Micali, and Charles Rackoff. The protocol allows two or more parties verify information without revealing the content of the information to both parties both the verifier and the prover. The prover provides the information and the verifier verifies the information without the content of the information being disclosed.

For a Zero-Knowledge proof it must meet the following criteria;

Completeness, Soundness, Zero-knowledge.

Completeness: The ability for the prover to convince the verifier that the information holding is complete.

Soundness: The ability for the verifier to verify the prover information if correct and if not correct, the ability to remain sound that the information isn't the correct information.

Zero-Knowledge: Both prover and verifier should not know one another, also, the prover should not the content of the information but rather just certify if the information is what the prover provides or not.

State one decentralized dark pool in cryptocurrency and discuss it. How does it work?

RENEX Protocol Darkpool

RenEXProtocol is one of the famous decentralized dark pool that allows dark pool trading for atomic and cross-chain trading. The OTC (Over-the-counter) trade is done with the help of the REN Virtual Machine (RENVM) which powers the REN protocol. The RENVM allows the computation of multiple algorithm thereby allowing for the provision of private, scalable, and interoperable solutions between multiple nodes. RENVM has its own order book and OTC transaction called "SubZero". It allows the purchase of ERC20 tokens as well as other blockchain.

RENEX protocol also uses ZK-Snarks to build, run and deploy privacy decentralize applications and also allows for Zero Knowledge Protocol (ZKP). REN EX protocol is built on the Ethereum blockchain and it allows inter-blockchain transactions through several decentralized dark pools thereby allowing the trader to protect their privacy. The REN protocol wraps coins from different blockchain in it native minted token Ren; when a coin from a different blockchain gets into the protocol a Ren equivalent of the token. Eg, BTC in the REN protocol will be regarded as RenBTC.

Compare a crypto centralized exchange dark pool with a decentralized dark pool. What are the distinctive differences?

| Kraken (Centralized Darkpool Exchange) | RenEX Protocol (Decentralized Darkpool Exchange ) |

|---|---|

| Registration can be a very long process, also KYC can be a very tedious procedure | No need for registration and KYC |

| Privacy is not complete as KYC is required | Privacy and Anonymity is guaranteed as no KYC is required. |

| Order are trader in whole with no order book and so there is a minimum to be traded | Orders can be broken down into smaller orders. |

| It does not involve direct nodes | it does uses nodes to transact thereby sharing the information to allow easy trade |

| Trading can be slow due to a single transaction being filled at once in whole | Trading is fast as the transactions as split into smaller orders. |

Research any recent huge sale in any market in the crypto ecosystem and how it has affected the market. What difference would it have made if the dark pool was utilized for such sales?

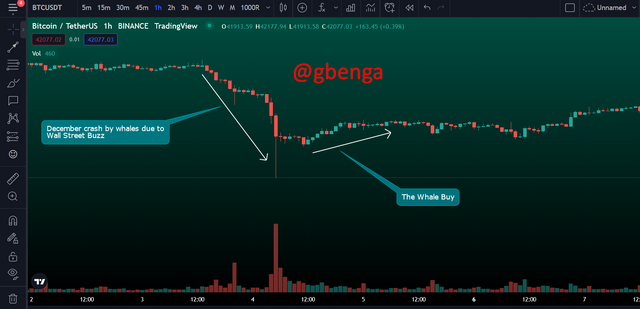

On december 3, after the Wall street buzzle and stock sell-offs, whales started to sell off BTC causing a major dip in the market of BTC and other cryptocurrency. According to Wall street Journal, the market tumbled and the president of El-savador tried to mitigate the fall and also but in the deep before another major whale bought on the 5th of December. The crash cause a fall of 12% from BTC all time high as at the time, from $57,495 to about $45,967.

If these sell offs where done in the dark pool, the panic in the market wouldn't be as much as it was as the market had it causing the president of El-savador to mitigate the fall and the buy the deep.

In your own opinion, qualitatively discuss the impacts of trades carried out in the dark pool on the market price of an asset. (At least 150 words)

The market is believed to be run by non-emotional people known as traders and investors, in fact, a lot of successful traders will tell you not to trade with emotions but the fact remains that the market is controlled by emotions such as greed, fear, and prejudice. When there is a large buy order in an open market, one thing comes to the mind of retail traders "A whale is here to buy" and with this comes excessive buying which could push the market to a quick pump. The Large buy orders will drive the price upwards and the same applies with a large sell order in a public market. A large sell order is accompanied by panic from traders making traders to sell off in a large proportion. This would lead to a deep and a large drop in the price of the cryptocurrency/asset.

Using the dark pool to sell off large cryptocurrency as well as buy large cryptocurrency will make it less impacting on people's bias judgement, and since with the dark pool, large orders are filled with equivalent of such large amount, it could provide a liquidity for crypto asset and when the order is filled, the fall could be easily countered by enthusiastic traders who want the coin to remain at such position.

What are the advantages and disadvantages of Dark pool in Cryptocurrency?

Advantages

- Allows large sale without slippage as well as maintain fee

- Privacy while trading, not knowing who is buying/selling and the amount to be traded

- Traders get favorable limit price based on the best bid and ask price so as to trade.

Disadvantages

- There is no transparency with the trade as things are done in secrecy

- Instantly trading with limit means price can be greatly affected and without the order book being seen, keeps the smaller traders at a disadvantage.

- There is no guarantee that the trade will be executed at the best price as it picks the average best of bid and ask, and do the trade.

Conclusion

Dark pool actually brings about one of the blockchains characteristics which is anonymity but then when it done by a centralized exchange, I do not believe that it is completely decentralized. To have a truly decentralized and anonymous dark pool, then decentralized dark pool will be the best as there are no intermediaries between the traders.

I must confess that I had a great time with this topic and I glad I could be a part of @fredquantum class. I hope to be a part of steemit crypto academy in the future. Thanks for reading, I hope to see more of you here on my blog.