Trading is what keeps the market going up and down, changing prices. When there is an object of value, people would place different price worth to it as they all expect that it should be valued at their prices. In an auction, these prices are regarded as bids, but then these bids are not arranged and kept ready in the market, rather, they are discarded once there is a better rate. Now, this isn't an auction, it is trading and all bids count as they make the market order book and determine the liquidity of the asset.

Before I go on with the assignment, I should give credit to the @awesononso who took time to create such an awesome class as well as make the topic easy to understand. Without wasting any time, let's begin with the assignment.

Order Book Explained

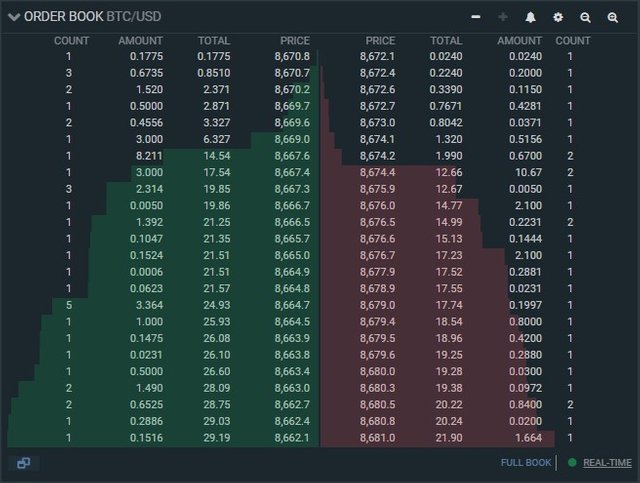

While trading, different trader set different prices which they expect a particular asset to be worth and at this price, they expect that their order be filled. This set prices are arranged electronically from the lowest to the highest in the sell order book, and from the highest to the lowest in the buy order book.

It shows the buying pressure of the market, how liquid the asset is. Order books are price orders that aren't filled yet, and they can be found either at the top, bottom, left or right corner of the market screen depending on the exchange and the way the exchange interface is designed for the trader.

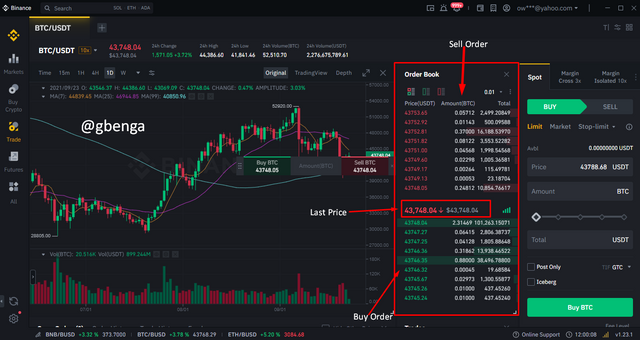

Binance is one of the leading exchanges and does it isn't new to a lot of people. The Order book of Binance has the Buy Order, the Sell Order and the last price.

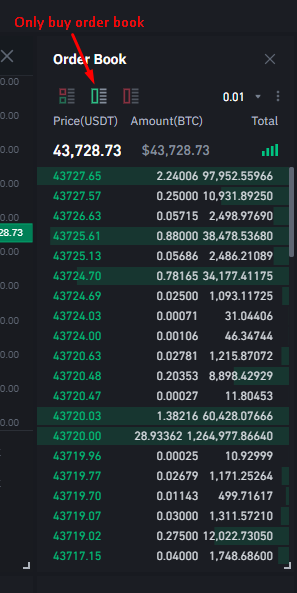

The order can be placed in different layouts the layout can be changed showing only buy orders

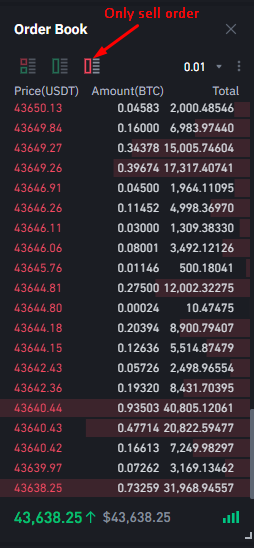

Orders can also be changed to only sell an order when layouts are changed.

Market Makers and Market Takers

Market Makers, either on the buy or the sell side, are individuals or firms who provide funds to the market by setting bids. When you sell a token/coin, there is someone at the other end of the market who is either going to buy it and vice versa. Market makers are liquidity providers.

Market Takers, just like the name implies, are individuals who pick an already existing bid to buy or sell a coin/token/commodity to get immediate sale or buy. Unlike market makers who are concerned about creating liquidity, Market takers do not care about setting a bid, they are interested in getting value for their trade from what is available in the market.

Market Order and a Limit order

Market order is a type of order that doesn't involve setting a bid, but rather it involves the buying or selling of financial instruments at the current available price at the market.

Limit Order allows the trader to buy a commodity at a current price or at a better rate compared to the market rate, after which the market will execute the order when the price reaches the set price of the order.

With no doubt, market takers use market orders thereby taking from the market liquidity, while market makers use limit orders to set prices in the market thereby creating liquidity. Everyone cannot be a market taker as the market liquidity will be dried up.

Place an order of at lease 1 SBD for Steem on the Steemit Market place by

a) accepting the Lowest ask. Was it instant? Why?

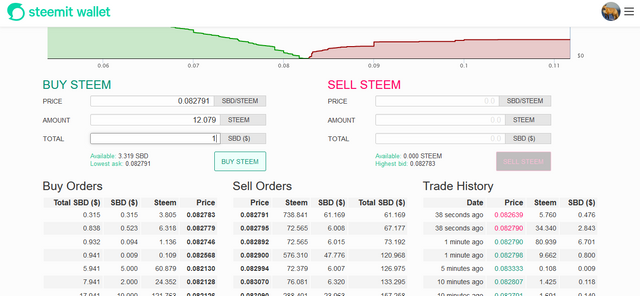

To do this, I will go to the steemit wallet market and pick the last price on the buy STEEM. If the price doesn't change during the process of the trading, then the trade will be executed but if the lowest price changes, it will appear on the order book.

While trying to perform this trade, the Lowest ask was $0.082791 to buy STEEM.

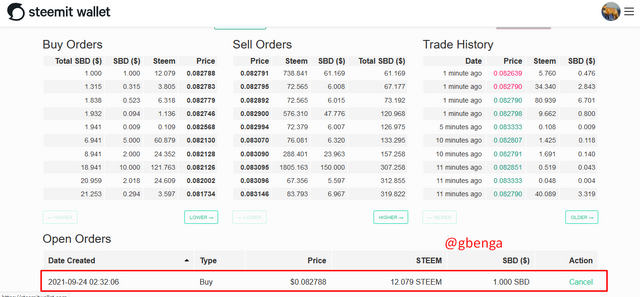

After placing the trade, my trade appeared in the order book which means before the trade was executed, the price had changed.

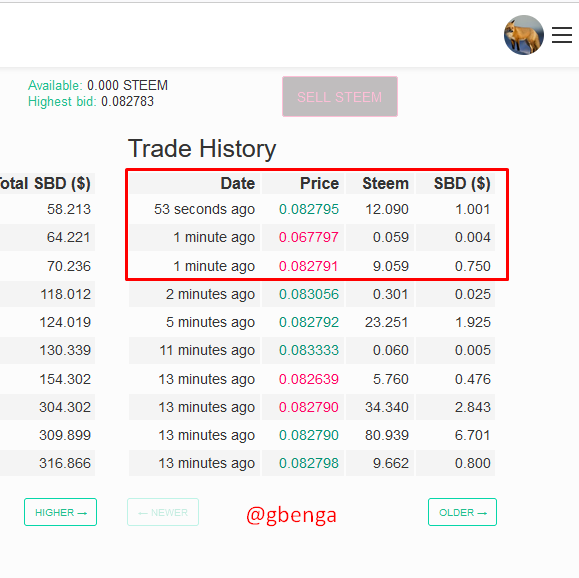

I set the lowest price and part of it was picked while being an open order which is what appear in the red and then i set the next lowest price of $0.082795 and the market was approved.

b) changing the lowest ask. Explain what happens.

Upon changing the price to a preferred price $0.082892 against the lowest price $0.082791 and executed it, the trade was complete immediately, making a market taker at that point.

Place a TRX/USDT Buy Limit order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market.

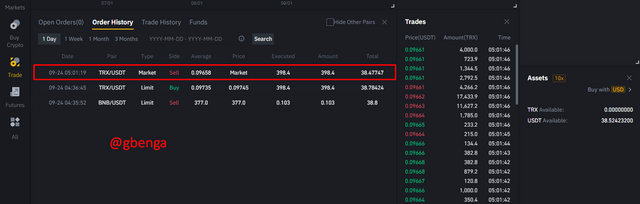

Using the limit order on Binance, I traded $38 USDT for TRX and the trade was immediately filled. Traded a buy limit order at $0.09735. Since the lowest price didn't change while I made the trade, the order was filled immediately.

Trading this made me a market taker and not a market maker. Since the market is very liquid. If the lowest price had changed, it would have made me a market maker.

Place a TRX/USDT Buy Market order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots of the completed order).

Without the ability to determine the price, market orders are immediately filled at the current market price. I traded TRX for USDT with the sell market order which sold TRX for USDT at $0.09658. The order was immediately filled making me a market taker at all time as the order was filled at the market price.

####

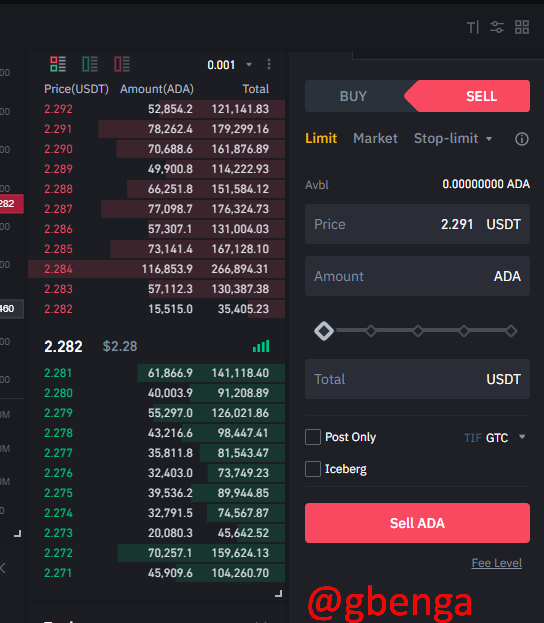

From the screenshot, I will be calculating the Bid-Ask spread after which I will be calculating the mid-market price of ADA/USDT

a) Calculate the Bid-Ask.

Bid price = $2.281

Ask Price = $2.282

Bid-Ask= Ask price - Bid price

Bid-ask = 2.282-2.281

Bid-Ask = 0.001 USDT

b) Calculate the Mid-Market Price

Mid-Market Price = (Bid Price + Ask Price)/2

Highest Ask = $2.292

Lowest Bid = $2.271

Mid-Market Price = (2.271 + 2.292)/2

Mid-Market Price = 4.562/2

Mid-Market Price = $2.2815

Conclusion

The market is determined by buyers and sellers alike, who are either creating orders adding to the liquidity of the market or taking from the liquidity of the market. The pressure of buyers and sellers determine the volatility of a market.