Hello everyone, I am really starting to see this practical exiting, not because I have been having wins or maybe because I will be seeing so many losses (because yes for sure, trading is a game of wins and losses), but because it is an avenue to learn and put into practice what we have learnt while teaching others what we have learnt in the past.

Today, I will still be trading the YFI/USDT pair and I will be sharing another day's trade. Actually trading stocks, bonds, indexes, forex, and crypto have the same rules, you just need to understand the market well and in this case, understanding cryptocurrency is what is needed to trade cryptocurrency. Being a part of Team FRONTLINE which @dilchamo, & @shemul21 are leading the team.

The name and introduction of the project token, and which exchange can be traded on, project/technical/team background, etc

I gave a simple introduction into YFI in my previous post and I will be doing straight trading today, but for the sake of a few people who do not even know anything about the project I will give a bit of introduction, but then you can check out my previous post [YFI/USDT] Steemit Crypto Academy Trading Competition Season 6 week 1 - TEAM FRONTLINE by @dilchamo.

As at the time of writing , YFI is at number 92 of coins based on market capitalization, with a market capitalization of $755,891,810 with a daily Low of $19,323.76, and a daily High of $20,805.90. YFI has a circulating supply of 36,637.72 YFI which make its a good coin to either invest in or trade as its volatility will be low. There are a total of 46,604 holders of the YFI token (very little compared to the holders of BTC, ETH, TRON, STEEM and so on), with an active 24 hours address of 1,240 with its top ten holders holding 38.33% of the total circulation while the top 100 holders own 81.45% of the entire YFI in circulation (this would be exchanges and crypt hedge funds), leaving the remaining holders to deal with 18.65% of the remaining coin.

Why are you optimistic on this token today, and how long do you think it can rise?

First, the market is in a downtrend but in the long-run, YFI is going to be a very good investment in the future. WHy I think so? YFI is a Defi token with little supply. Do you remember that Defi is the future of exchange and the fact that Decentralized Finance gave people rewards for their stakes, and this makes Defi a project for the future. YFI could be the Bitcoin of the DeFi world.

How to analyze the token? (Using the analysis knowledge learned from professors’ courses)

Like I said in my previous post, I will be trading and my trading could be Swing, Intraday, Scalping and so on, depending on whichever one I decide to trade (you can also trade on whichever one feel comfortable with). I will be performing intra-day trading using demand/supply, support/resistance strategy with a combination of line chart and Moving Average. I will be using the 30-minutes chart for this trade.

As an intra-day trader, I am not concerned about the long history of the coin either in a long term uptrend or downtrend, I am concerned about the short term, of up to 24 hours but in some cases, it could get a little longer than a day if the market is still doing well and hasn't reached target.

Let the Trade Begin

Trade Summary:

| Coin Name | Yearn Finance |

|---|---|

| Exchange | Binance |

| Trade Type | Futures Contract |

| Trade Contract | YFI/USDT Perpetual |

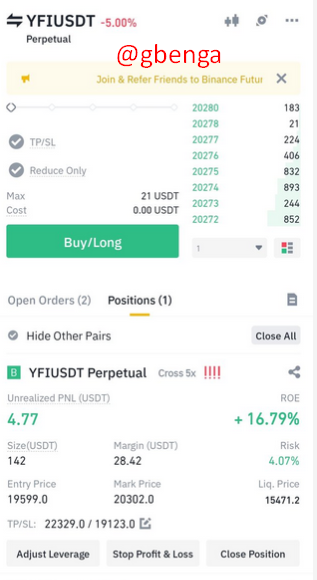

| Trading Position | Buy/Long |

| Trade Volume | $27.4 USDT |

| Leverage | 5X |

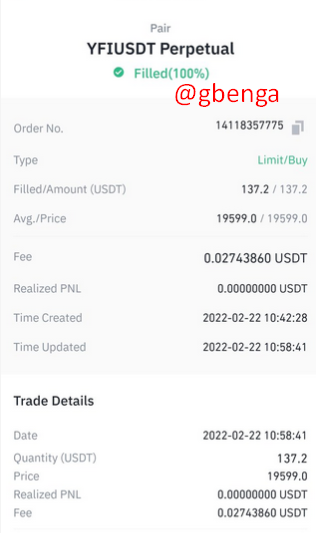

| Entry Price | $19599 |

| Stop Loss | $19123 |

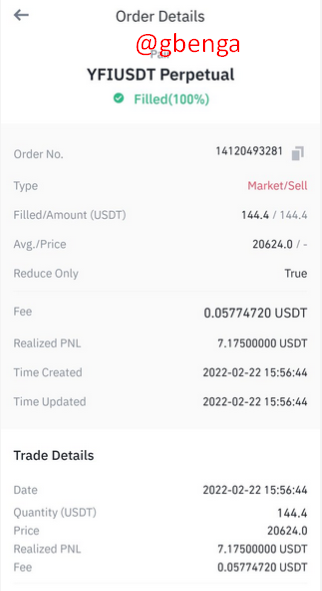

| Take Profit | $20624 |

| Profit/loss Amount | + $7.175 |

Using the 1 hour chart, I met the price at $19664 which was a very good point to the previous support. The price previously went down but didn't touch the support and that support was a point of accumulation depicting a point of demand and the price just got to that point when I saw it. I decided to play the market demand/supply, support/resistance game.

Using the 5 minutes chart, I can see clearly that there was a price accumulation which depicted that the buyers were fighting the sellers too get their position, and since the market never move in one straight direction, I decided to set my entry above the minor resistance which is above the support zone. If the price break the resistance point after obeying the support rule, then it will be that the buyers are having thee market. (I would have included volume profile, but it isn't what we are discussing today).

The next step is picking points of supply/resistances that held. The point of resistance and supply where sellers took over the market in the past, that will be our take profit region.

Now that we know our entry and suppose take profit, we should identify our stop-loss and confirm trade. Setting Stop-loss, I need to follow the rule. If price breaks below support, it will possibly keep going downwards. So, i set my stop-loss below the support region $19123.

To confirm my entry, I use the Moving Average MA 20 and MA 70 and as we can see, when the faster moving Average crosses the Slower moving average, a buy signal was triggered and i made an entry.

I allowed the market rest and set an alarm when the price ht my first take-profit.

This is a screenshot of the trade, and it can be seen, the trade kept on increasing until it reached the supply region. I took profit at $20624.0, and made a profit of $7.175.

Conclusion

Trading is not a quest to begin in a day, it takes several period of learning and growing... It has to do with developing oneself in the process. In trading there can be days of gains as well as days of losses, it is very important to set a stop loss so as to mitigate the losses.

I hope to give another trade tomorrow, and I am trying to reduce the size of the video, when i am done, i will add the link in the post as an edit.

Hello dear @gbenga,

You have chosen the same pair that should not do. Try to select separate pairs and post them on separate dates. Thanks.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I do not understand why you didn't nullify my previous post which wasn't voted on because you failed to submit the video list early. Secondly, in the first week of the practical, there was no rule that said we couldn't trade the same tokens or coin, what was stated was trade any coin or token of your choice. In conclusion, cancelling a post you gave 9.+ percent review?

I will appreciate an explanation to how the invisible rules become visible and why my previous post of over 7 days with no vote as a result of you not submitting the list early wasn't edited but this post... Thanks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

With this comment of yours, it has shown that my entire week work is a waste.. Also, the trades were done on different days not the same days and that is why they have a time stamp

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit