Hello Everyone, this is another week, and I will be participating in the first trading content courtesy of the Steemit Crypto Academy, and I will be joining the Team FRONTLINE by @dilchamo, & @shemul21. In this post, I will be writing about a trade or investment I performed with proof of trade.

The name and introduction of the project token, and which exchange can be traded on, project/technical/team background, etc.

Let me state clearly that when it comes to trading on futures contract, I usually advise that trader never trade an extremely volatile coin as this doesn't give a fair chance to play your trading game. Secondly, never trade with a fund you cannot overlook. It is important to let a trade run its course throughout it time, so you do not keep adjusting and keep making mistakes.

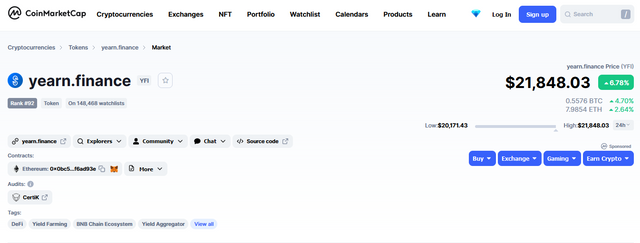

Today, I will be trading Yearn Finance token, which is a Defi aggregator platform that allow its users make profit as they participate in yield farming. Formerly known as iEarn, Yearn Finance was launched in February of 2020 by Andre Cronje.

SInce it is a Defi project, the project makes profit by charging users for withdrawal, and gas subsidization, thereby allowing it to be able to pay investors. Yearn.Finance native token is the YFI and it can be traded on major exchanges including Binance FTX, Poloniex, Huobi, Coinbase Exchange, Kucoin, Gate.io, Bybit, Gemini, Kraken and many more.

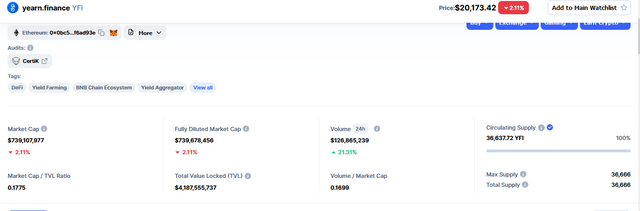

YFI has a total supply of $36,638, a 24 hour volume of $126,792,758 and a market capitalization of $738,918,176

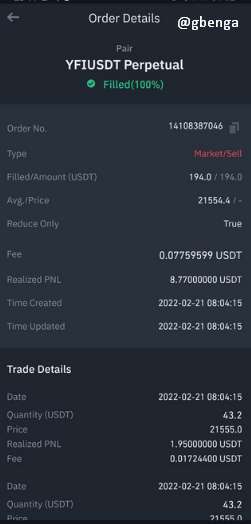

Trade Summary:

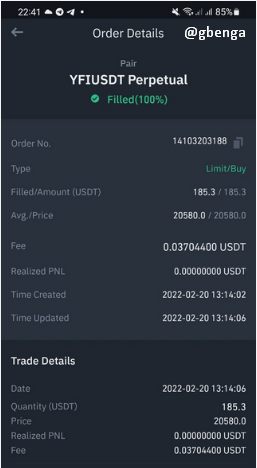

| Coin Name | Yearn Finance |

|---|---|

| Exchange | Binance |

| Trade Type | Futures Contract |

| Trade Contract | YFI/USDT Perpetual |

| Trading Position | Buy/Long |

| Trade Volume | $37 USDT |

| Leverage | 5X |

| Entry Price | $20580 |

| Stop Loss | $20040 |

| Take Profit | $21554 |

| Profit/loss Amount | +$8.77 |

Why are you optimistic on this token today, and how long do you think it can rise?

This trade started Immediately after reading the post by @dilchamo on the contest. Let me state clearly that as a trader, I will trade on a rise or a fall provided my analysis tells me to. To perform this trade, I combined price action and with using line chart (@dilchamo course), and moving average (@shemul21). First, trading is a combination of rules and unless price denies the rule. With this, I will be showing my analysis.

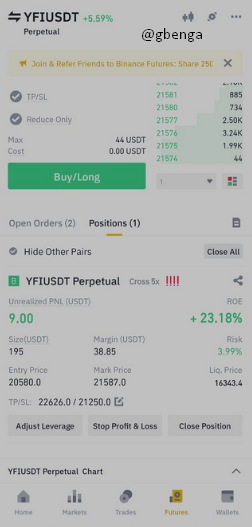

First, support and resistance, second is trend. Currently, in the 1-hour timeframe, YFI/USDT is in a downtrend and it will be touching a major support in the chart as the price had shown a support in the past

After showing that the market is in a downtrend, it is now to prove that it was going to hit a support. AT the support, the price can either break through the support or reject the support but from the chart, that support region looks like a point of demand as price often go upwards at that point.

With the 5-minutes Timeframe, a line graph gives it a better view. Showing the support in a very easy form as well as showing a sideways movement where large investors perform more activities.

After the support was price breaking through at once after which it stood as a resistance before going upwards and price never returned to it making this support level a fresh level.

Price went upwards and started falling to that point of support and since the support can still be regarded as a fresh level, there was a high possibility that buyers would want to fight to keep that support for a while and I expect that the price would go upwards and possibly return downwards when it hits a major resistance where there is a lot of volume.

To confirm my entry I used the Moving average crossing thought by @shemul21. I used the 50 and 100 Moving Average and took and entry when the faster moving average was above the slower moving average and price was above both Moving Averages. I entered the trading position at $20580

As hoped for, the price went upwards as expected and also, the resistance fought against it at the top.

Although the price hit the resistance mark, I actually took profit when the good was going at $21554.4

Here is a link to a video of the trade https://files.fm/f/q29jmpd3v

Hold it for a long time or sell, Recommendation to other users to buy or not to buy

This is purely an intraday trade and as a crypto futures contract trader, when trading, I do not hold the coin/token, what I trade are contracts of such tokens. I trade against USDT, so i hold the USDT but for the sake of long term investing, a coin with a very low supply and very high volume is a good catch in the midterm/long term.

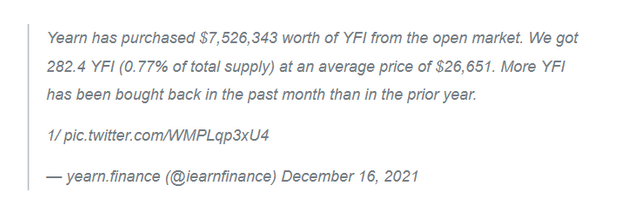

While this is not a financial advice, any asset with a finite amount of supply is a good buy for the future. Not to forget that Yeild.Finance give its users profit from their holdings. In the near future, it is possible that it would hit $50,000. Something to also look at is its team buying back YFI from the profit they got from charging users for fees. (source from yahoo news)

Conclusion

Never trade out of guessing, it will surely lead to more bad trades than good ones. Also, the fact that you trade with the rules doesn't mean that trades can't go wrong, market can be very funny sometimes and on a final note, it is good to leave the market when the good is going and never over-trade or be too confident, it can lead to a bad trade.