CRYPTO ASSET DIVERSIFICATION

The term diversification is used in all financial markets. It means distributing funds meant for investments into varied assets rather than investing all the funds in a portfolio into a single asset. In the context of cryptocurrency; its means investing into different types of crypto assets to reduced risk of losing funds due to market fluctuations.

This strategy (diversification)is a way of mitigating against risk even when it comes to investing in projects hosted on the same ecosystem such as (Defi) or non-fungible tokens (NFTs). For example, the Ethereum blockchain has a lot of projects hosted on its ecosystem such as Basic Attention Token (BAT), Bancor (BNT), Civic (CVC), and Augur (REP). Although, many people feel that diversification is not necessary because Bitcoin encompass all that the crypto market has to offer.

Therefore, they will just put all their funds in Bitcoin because whatever happen to Bitcoin will invariably affects all other crypto assets. But nothing can be compare to having a heterogeneous portfolio with well balance assets backed with accurate fundamental and technical analysis. Most investor agreed to the adage that says “it is risky to put all our eggs in one basket”. Personally, I will advise investors with significant capital to diversify.

The growth of cryptocurrency has gone to the moon since the founding of Bitcoin network in 2009 by Nakamoto. Presently, there are over 5,300 crypto assets with the first 20 by traded volume constituting most of investors choice. These suggest there is great potential in crypto market which can be harnessed with appropriate diversification skills.

The different reasons for crypto portfolio diversification

There are different kind of coins such as privacy coins, tokens and altcoins all beaconing for a share of the investor investment funds. There are different reasons people choose different crypto assets for their portfolio diversification, some can select assets based on their past records or potential future trends. I have further categorized some of these reasons under broad subheadings:

Diversification based on region or geographical locations

There are certain investors that choose their portfolio based on the region the block chain projects are located. For example some investors preferred European or American projects. Currently, due to the massive followership enjoined by Asian projects. They are getting more attention from investors whereas some investors can decide to mix up their assets based on their regions.

Diversification based on time intervals

This method involves buying crypto assets based on pre-sets timed intervals. For example during a crypto currency dip or bearish market, there is always temptation to buy the dip with all of our portfolio at once but with this method different or even the same asset can be bought with maybe 10% or 20% of total portfolio fund every week with projected price movement or target. This will help the investor to adequate maximize price movement and be better prepared for it.

Diversification based on industry or use cases

This particular reason deals with diversifying portfolio based on the industrial application of the coin. The case use of coin varies from one coin to another. Therefore, the performance of the coin will depend on the level of industrial acceptance or suitability. Many people tend to compare crypto coin directly just based on the current market value but this can be wrong and misleading; it is very good to conduct fundamental analysis on the white paper of the coin to determine the goals and objectives of the crypto asset and the level of industrial engagement its hope to achieve.

For example Ripple was created to solve the problem of payment transfer in the conventional banking industry while Bitcoin was designed to function as a virtual currency. Also, diversification should tend avoid crypto assets whose prices trail themselves.

THE BENEFITS AND EFFECTS OF DIVERSIFYING ONE'S PORTFOLIO

Because of the volatility of the crypto market; diversifying ones asset has benefit and it also has effects.

Benefit

Its help to reduce losses: it is a common knowledge that Bitcoin can incur about 50% loss within a single day. Therefore if ones portfolio is solely on Bitcoin than the losses will be heavy but if it is diversified other assets can cover up for the drop in the price of Bitcoin.

Effect

It can reduce profits. Just the same way it can reduce losses it can also reduce profit. The same way the price of Bitcoin can go down by 50% within a day; it can also go up by 50% within a day. Therefore, if ones asset is channel towards Bitcoin 50% profit on the overall portfolio can easily the made.

A very good question is that “what happens when the overall crypto market is experiencing a bearish movement?” My answer is that it is still safer to diversify one`s portfolio because the overall crash in portfolio value cannot still be compared to when the funds is in a single asset . Therefore, in whatever way we might want to look at it; crypto portfolio diversification is a strategy to manage risk in financial market.

MY FOUR ASSETS USING RULE 1-4 WITH AT LEAST 15 USD TRADING EACH USING A USDT PORTFOLIO

The following the detailed fundamental and technical analysis about while I choose to invest in Binance coin (BNB), Bitcoin(BTC), Ethereum(ETH) and Solana(SOL) as part of my portfolio diversification strategy:

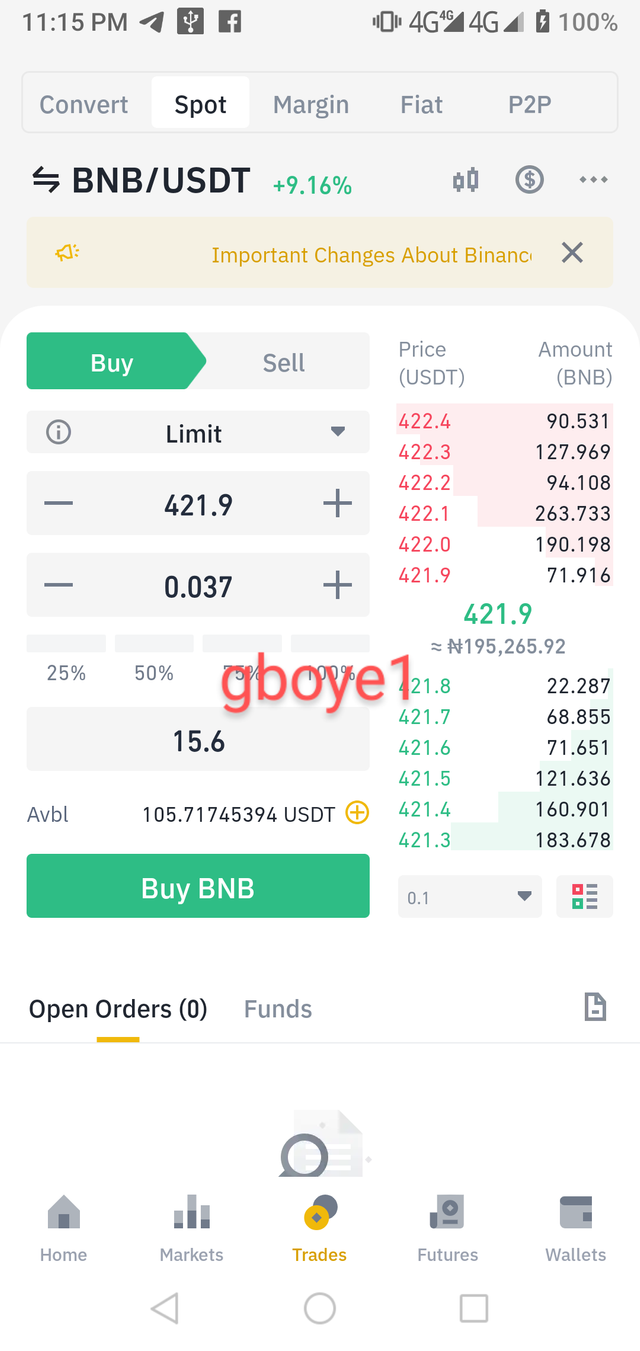

1.Binance coin(BNB)

This coin is popularly referred to as BNB. It is owned by the Binance exchange with happens to be the largest cryptocurrency exchange in the whole world as at 2018 carrying out almost 1.4 million transaction every second. The BNB coin is used on Binance to pay fees, trade and also facilitate credit card payment.

It can pair with several coins such as Bitcoin, Ethereum and Litcoin which are all hosted on the Binance platform. Technically, the demand and value for the coin will always increase as long as the Binance platform continuing to witness great patronage. Looking at the screenshot below:

The graph also put to a bullish movement soon because it is just experiencing price colleretion:

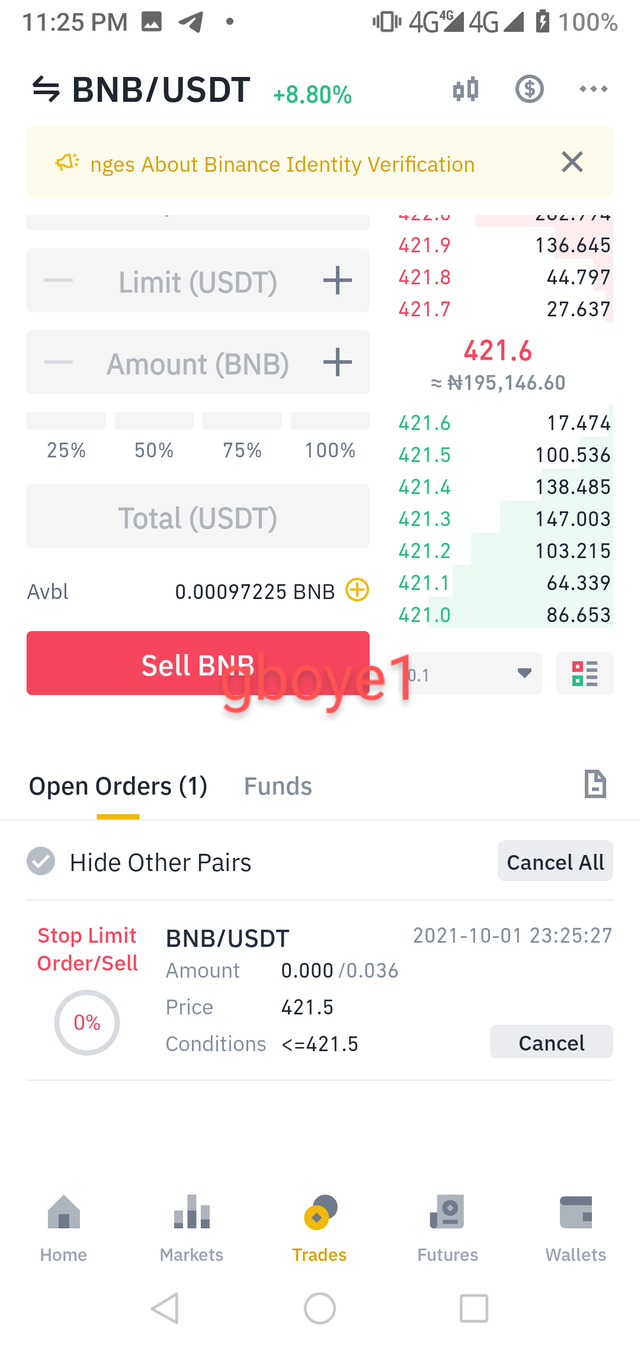

My at least $15 investment in BNB with stop profit are shown in the screenshot below:

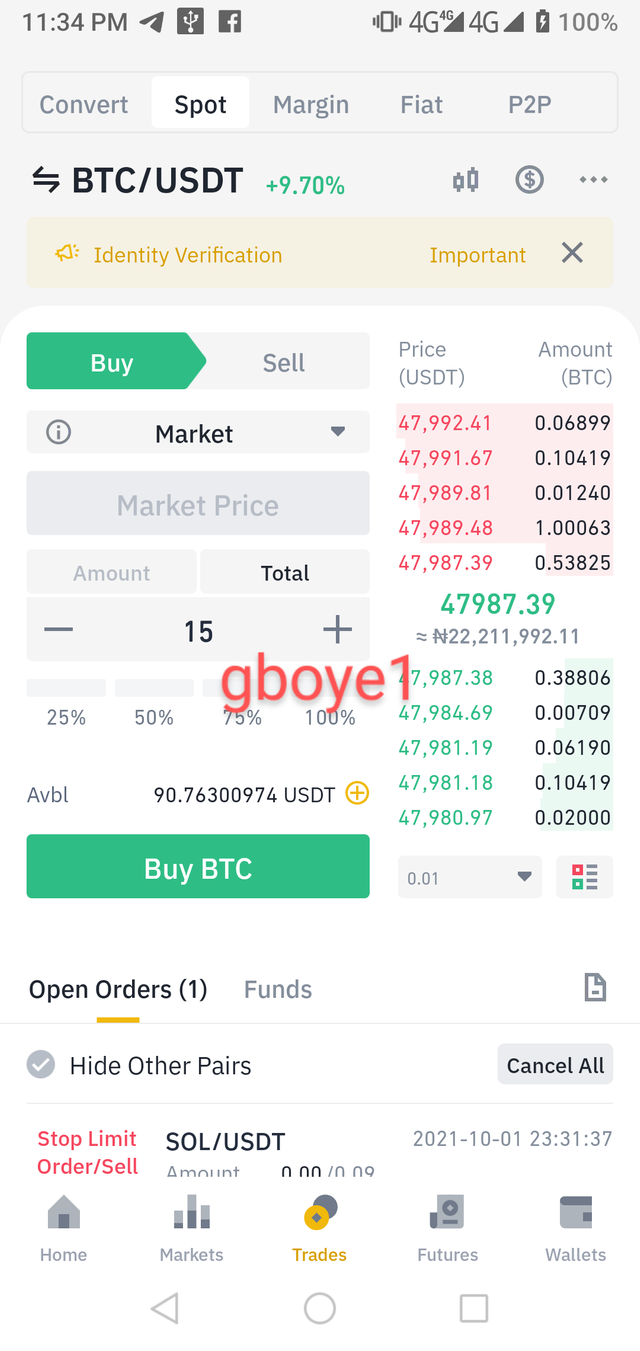

2.Bitcoin (BTC)

Bitcoin(BTC) has been around for over a decade with its blockcain adopted by several industries. Presently it is at $43,000. This is a very good time to buy because earlier this year will have seen Bitcoin get to record high of about $60,000. Many crypto experts still believes Bitcoin will hit $100,000 before the end of 2021.

My fundamental analysis based on precedence has shown that September is usually not too good for the cryptocurrency market in general but October and November are usually seasons for bullish movements. Looking at the present chat of Bitcoin below, it has experience some up and down in price recently but the indicators shows a bullish movement soon.

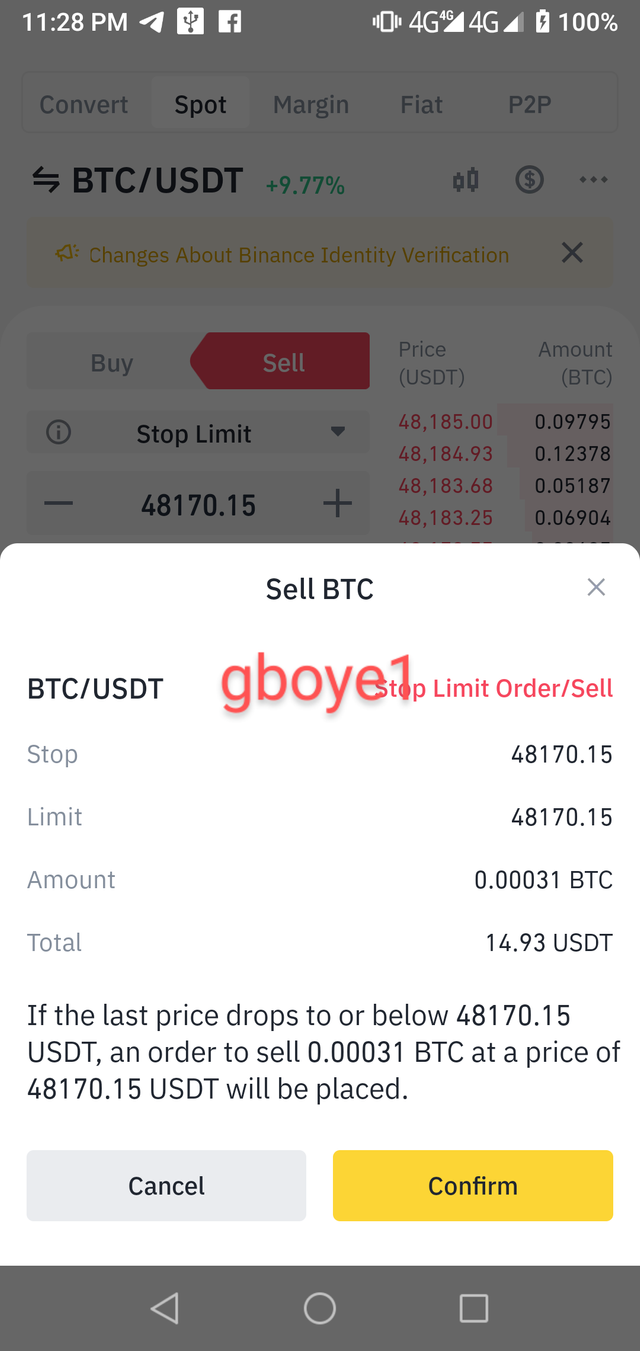

My at least $15 investment in BTC/USDT with stop profit are shown in the screenshot below:

3.Ethereum(ETH)

Ethereum have been at the fore front of the revolution happening in the NFTs world through the art of generating unique IDs for NFTs. Also, there are over 3,000 Dapps scattered across 16 different block chain platform with Ethereum blockchain alone hosting about 2,835 of them. This feet attract about 100, 000 users to the ecosystem daily. The founded also have a vision of reducing the present energy consumption by 90% through the translation from proof of work to proof of stake by the end of 2021. These facts highlighted above shows that Ethereum is a viable project and it is appropriate for both long and short time investment.

Looking at the present graph below it will soon go bullish:

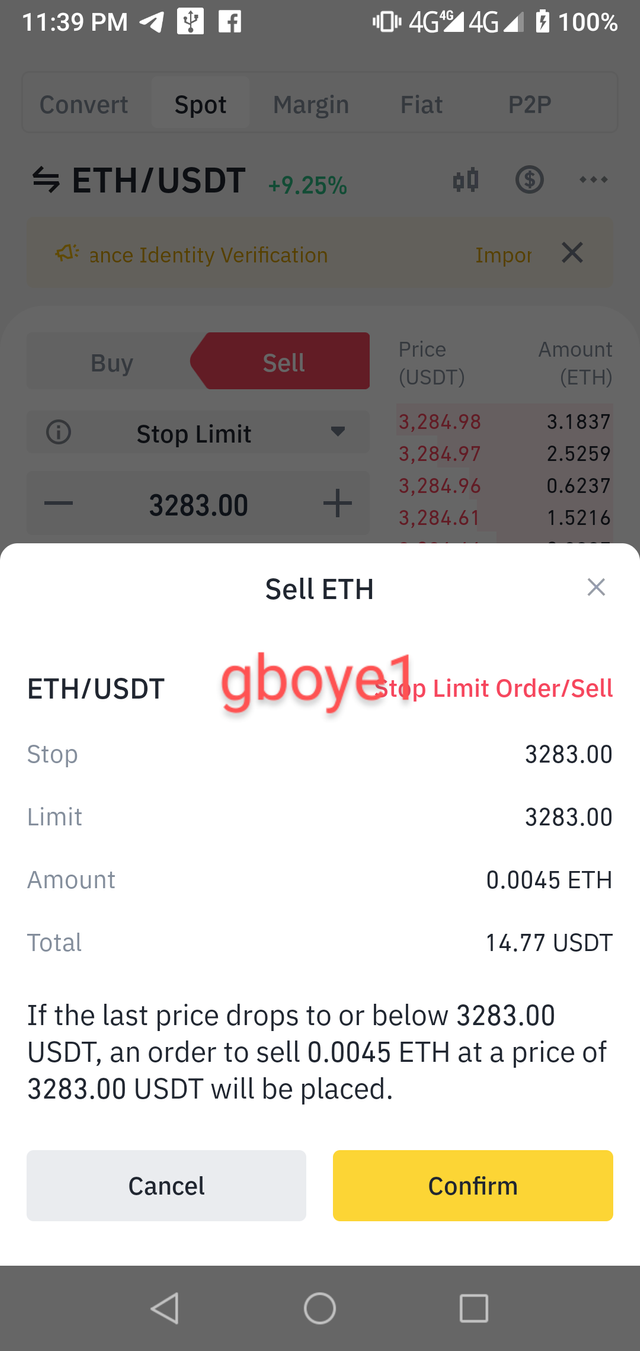

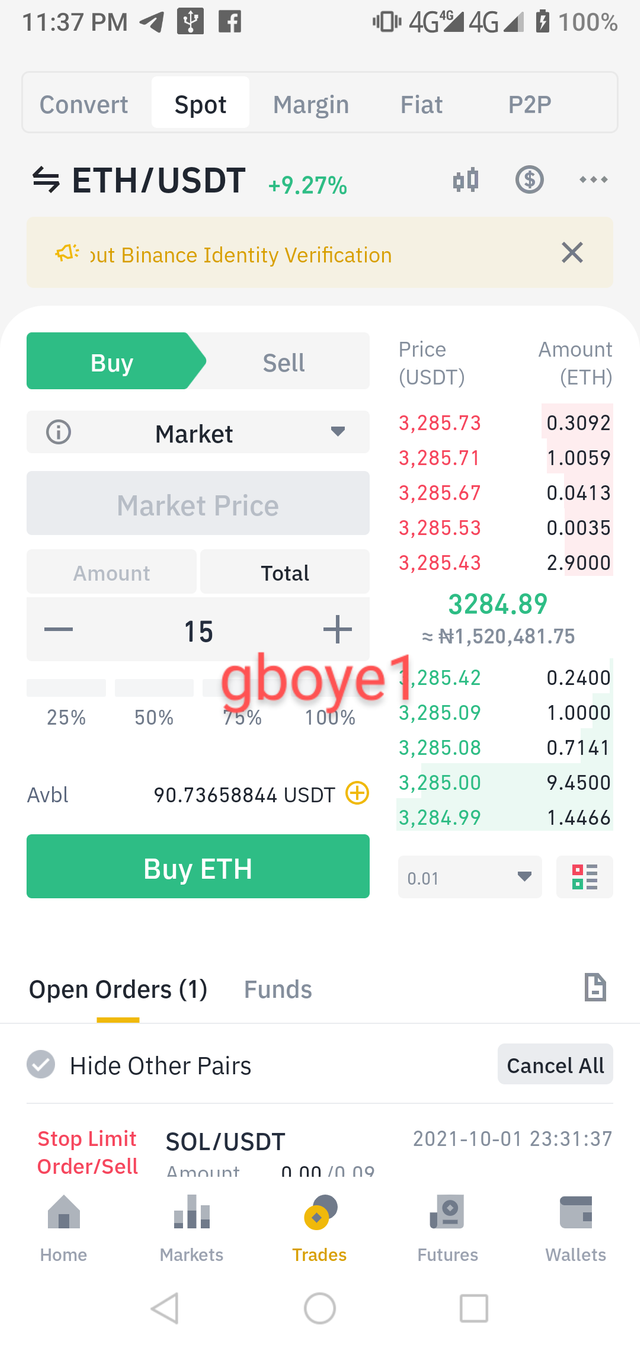

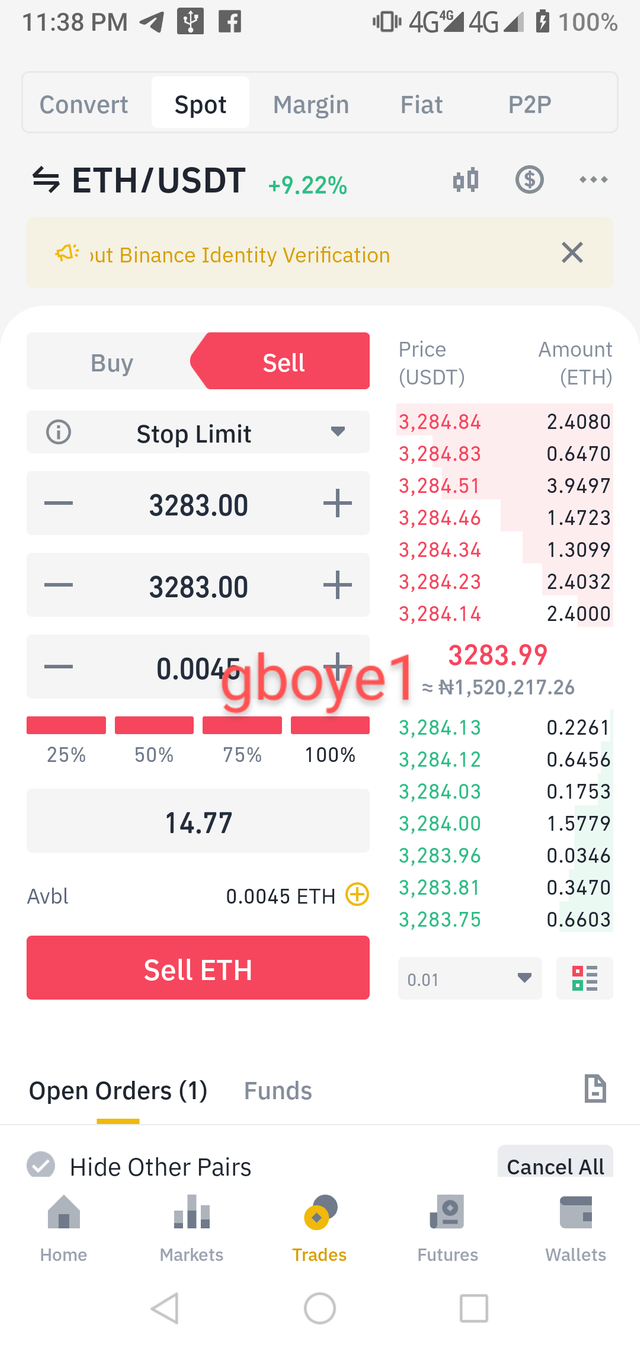

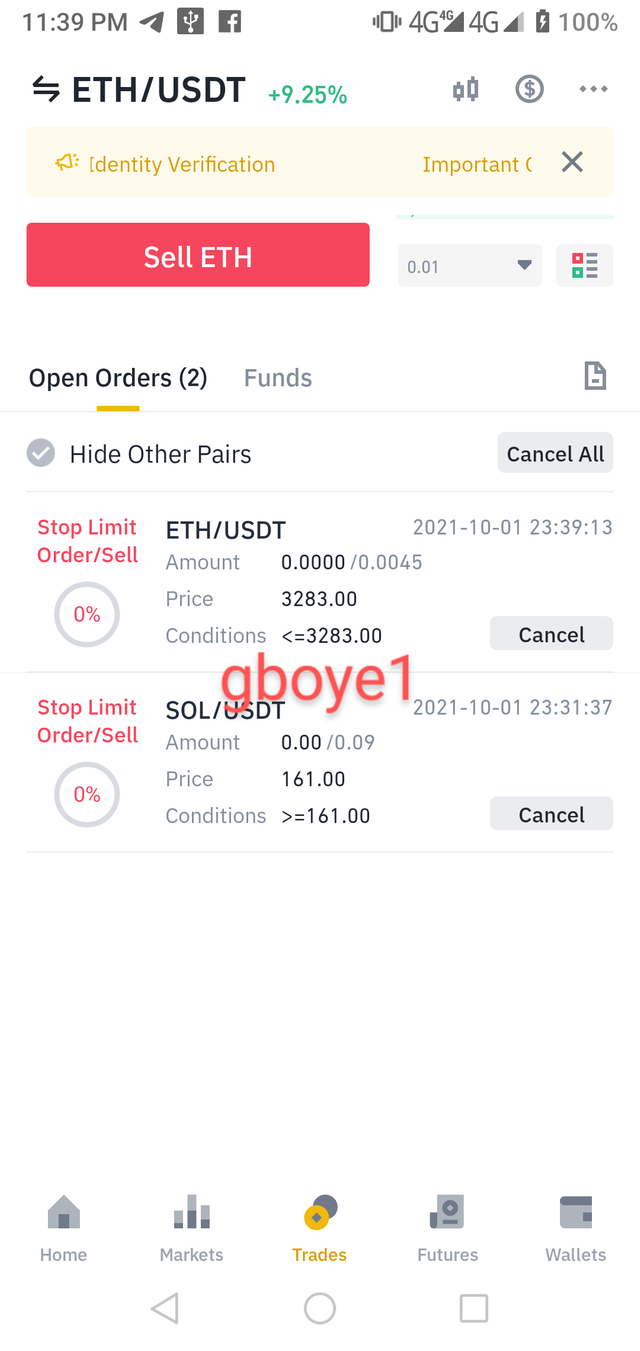

My at least $15 investment in ETH/USDT with stop profit are shown in the screenshot below:

**4.Solana(SOL) **

Solana has witnessed tremendous growth since the start of last year with about $47 billion in market cap according to data from Coinmarketcap. It has also benefit from the boom in non-fungible tokens (NFTs). It has also launched its own NFT collection called Degenerate Apes. Developers are already looking the direction of Solana for alternatives to Ethereum fee issues and congestion. Recently, Solana has enter the spotlight has an asset to hold for the future and it is presently looking bullish at the time of this writing this post.

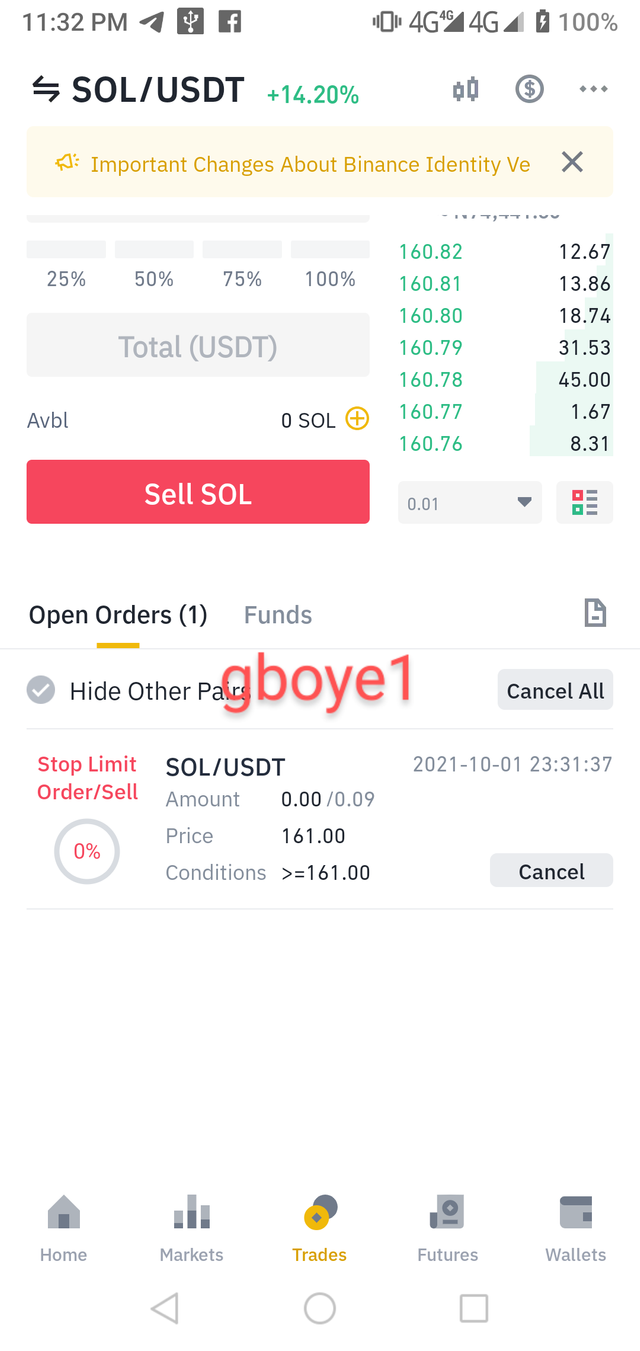

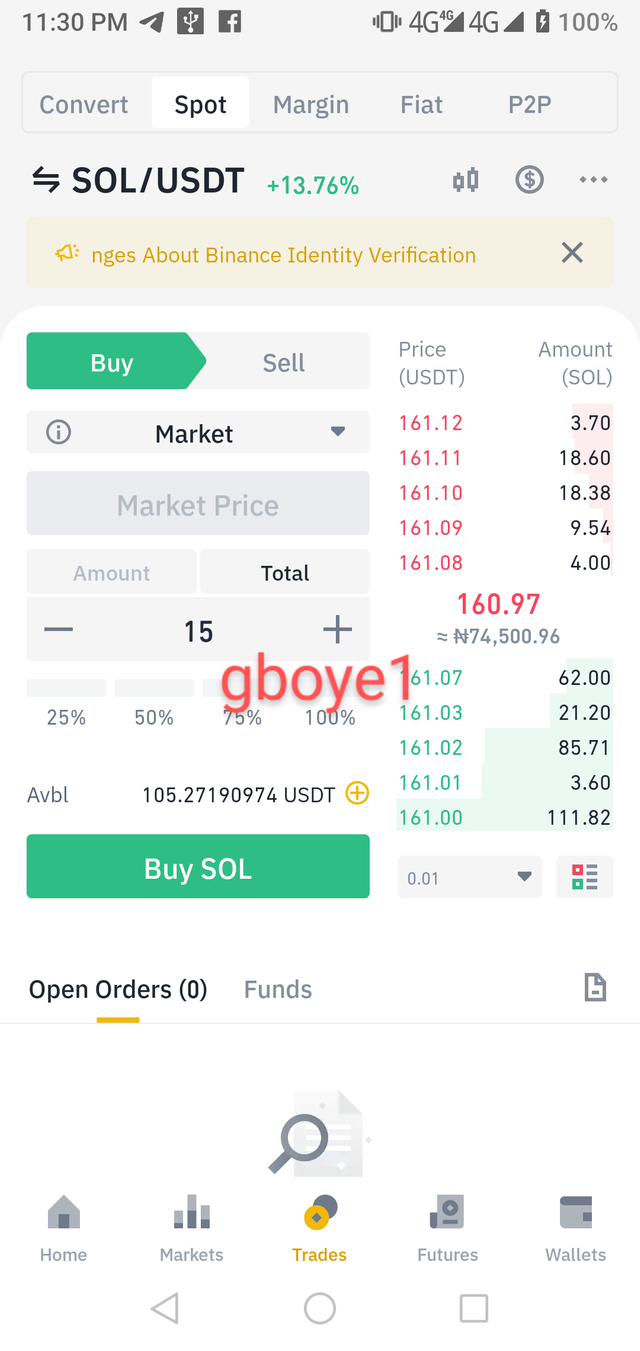

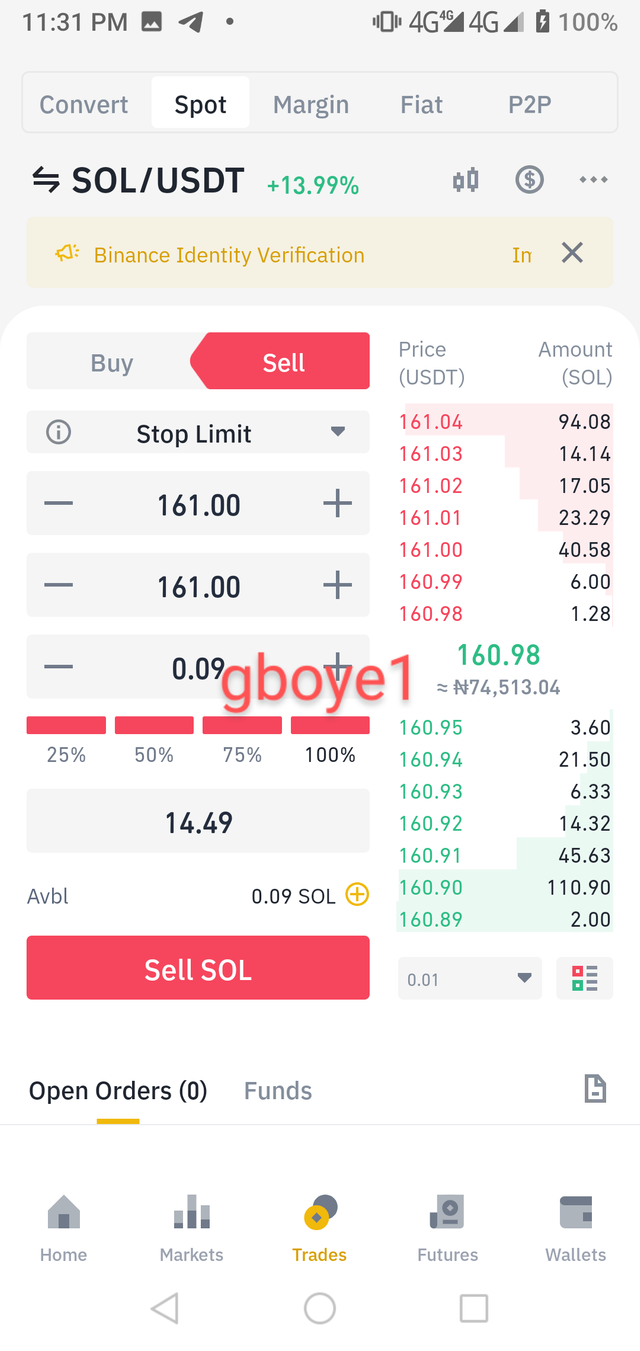

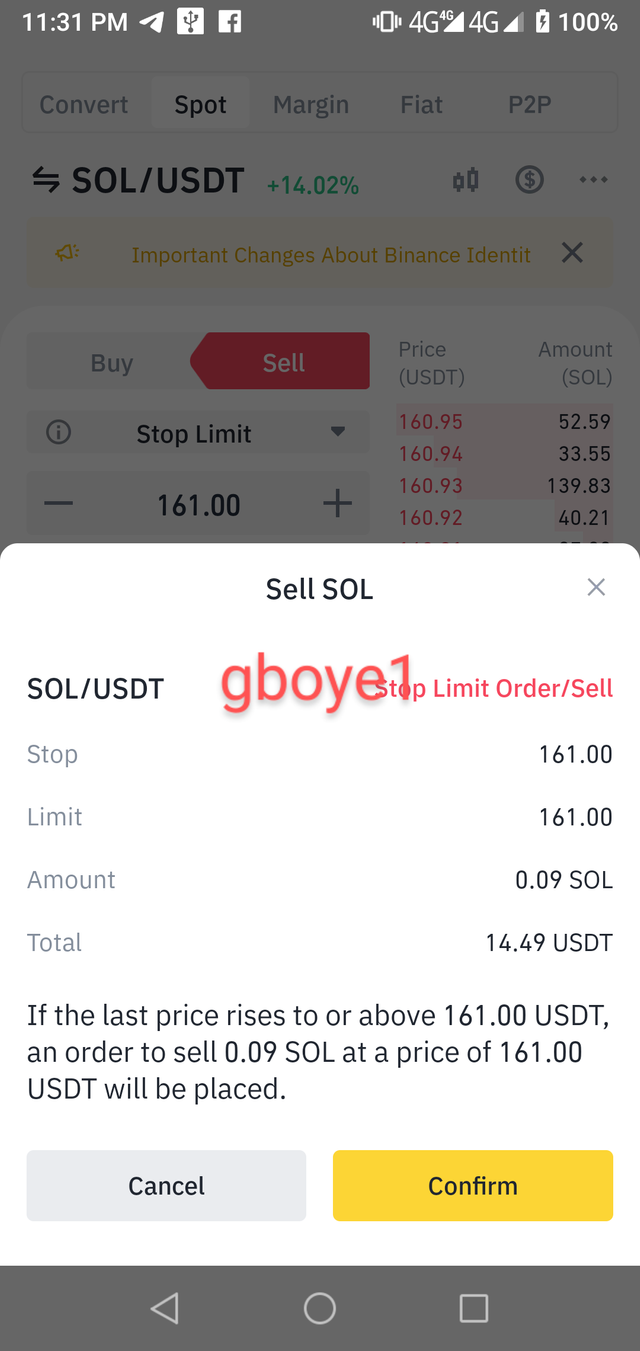

My at least $15 investment in SOL/USDT with stop profit are shown in the screenshot below:

**Below are the screenshot of my order book showing stop loss and take profit level; **

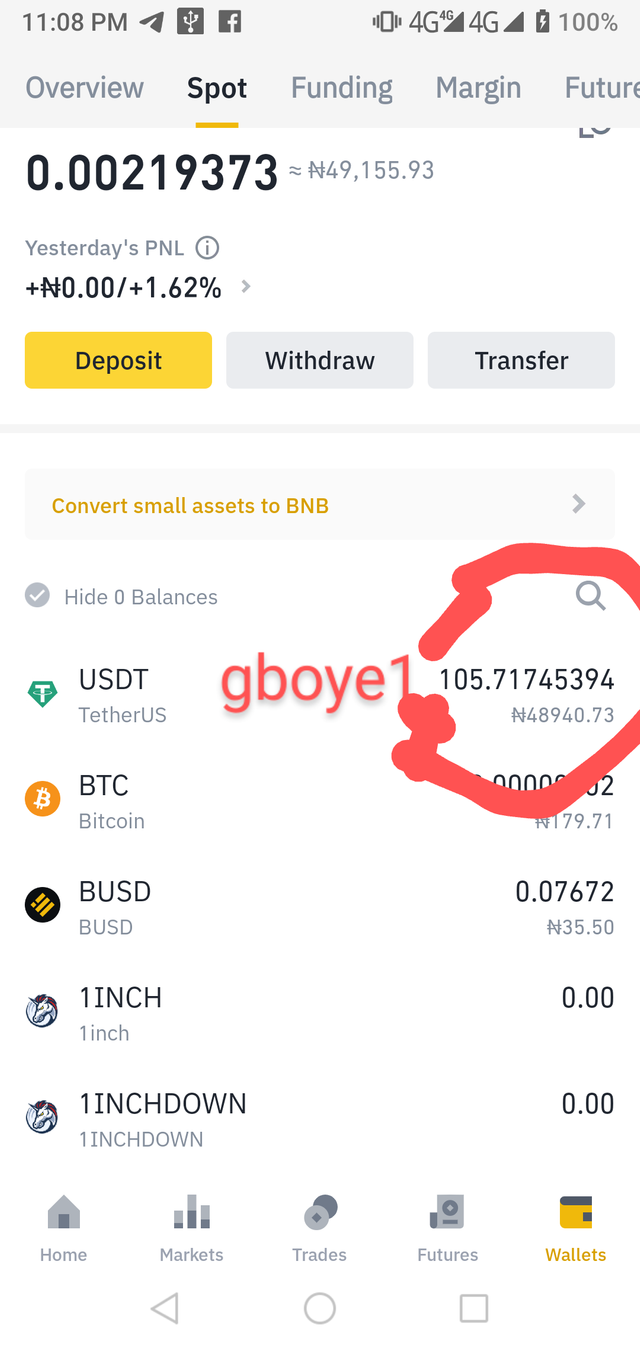

N.B My total portfolio(USDT) which was used for the trading is shown below:

CRYPTOCURRENCY ARBITRAGE TRADING AND ITS BENEFITS

Cryptocurrency arbitrage has to do with taking advantage of the variation that exits in crypto prices of the same asset across different crypto exchanges. This difference in price can also happen within assets hosted on the same exchange and it is often known as triangular arbitrage. These difference in prices can be due to different reasons such as trading volumes or limitation due to exchange inefficiencies. In addition, upcoming platform tend to follow prices set by bigger exchanges but these does not take effect instantaneously. This delay in price updates often lead to price arbitrage which can be maximized by smart investors because traders can take advantage of the gap to profit by buying low on one platform and selling at higher price on another platform.

Although, the asset involved must be the same on the different exchange. It’s must also be performed immediately in order to avoid losses due to market price fluctuations. To be successful in arbitrage trading one need to be able to analyzed price chart patterns and use it to predict the movement of price in the future. For example, if the price of asset A/C on Binance exchange is $200 and the same asset A/C is $195 on Coinbase exchange; one can buy on Coinbase and sell on Binance to maximum profit through the difference.

TAKING ADVANTAGE OF THE ARBITRAGE THAT EXIST ON EXCHANGES

From the screenshots below; there is a $42.1 difference in the price of 1 Bitcoin across Binance ($47,063) and Coinstore ($47,021) exchanges. It is possible to make about $20-$30 per day taking advantage of similar difference in price especially if the trader set a target of maximizing ten (10) of such opportunities in a day. There might be days when the differences in price among exchange can be bigger, hence there is more profit opportunities for traders.

Computerization has taken over crypto space with prices been monitored 24/7 and most of the trades are now executed almost immediately. These modernizations tend to reduce error and close arbitrage opportunities, however; to effectively maximize such opportunities; the trader should acquire the right tools and software that will help him/her to make prices list of assets across different exchanges at almost the same time. This will help to spot and maximizing arbitrage opportunities faster.

A major aspect people should mind when conducting arbitrage trading is the exchange fees or charges on individual exchanges which if not properly calculated can reduce or even eliminate the supposed profit. For example, if a trader is to earn 4% ($40) on an asset but will have to pay 1% extra fees then the suppose profit will be reduced to 3% ($30).

IDENTIFYING TRIANGULAR ARBITRAGE OPPORTUNITIES

Triangular arbitrage means trading three (3) different coin or on three different exchanges. It is possible for three different exchanges to offer different prices. Although it somehow difficult to practice because it prices can change with slightest minutes or seconds but with the tool of mathematical modeling coupled with strong technical analysis.

Also, it is possible to trade three different crypto assets on the same exchange and maximize the difference in price to maximize profit.

For example, I will use the following demo trades to illustrate triangular arbitrage trading:

**Stage One (1) **: from the screenshot below I sold my 500BNB to buy 4.328000BTC at the current limit price.

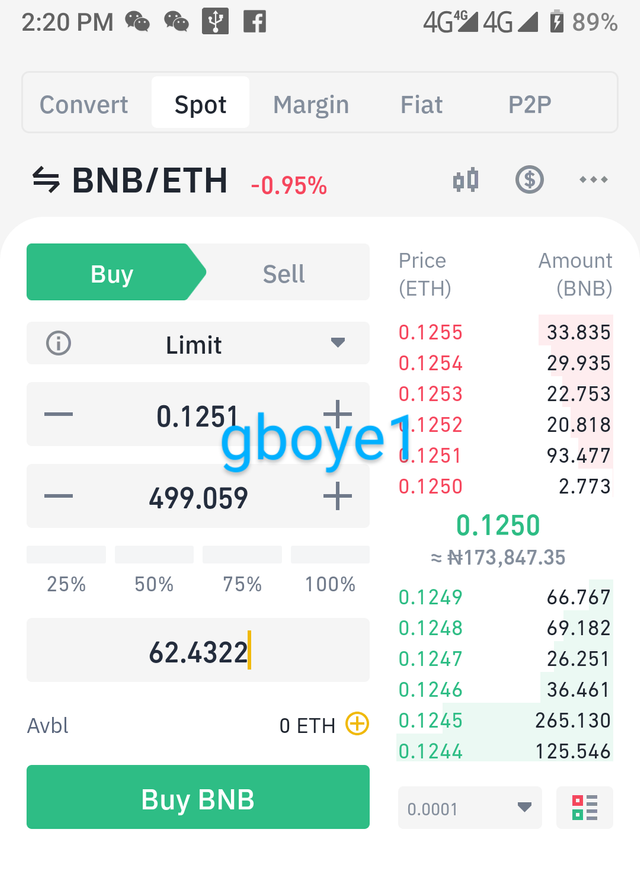

**Stage Two (2) ** I now bought 62.4323ETH with my 4.328000BTC

**Stage Three (3) ** I finally bought back 499.059BNB with my 62.4323ETH

Finally, we can see that it is not all triangular arbitrage trading that result into profit some can result into losses as shown above. This might be due to market forces or speed of transaction. I deliberately left the result this way because of our next sub-heading which has to do with associated risk in arbitrage trading, although with proper diligence it often result to profit.

The following are some of the risks associated with triangular arbitrage:

It is possible for the trade to be stagnated because of short fall in market liquidity.

It is possible to experience crash in price of the final asset because of unexpected volatility in price.

It can result in huge losses especially if the trader enters the market at a wrong price.

Trading fees that might affect the final outcome might apply.

CONCLUSION

From the writing above it is very clear that asset diversification is no doubt a potent investment risk mitigation strategy that has proven to be useful for most crypto traders. Also, arbitrage trading is also a good way to profit from cryptocurrency market if the art is well mastered.