INTRODUCTION

Since the inception of cryptocurrency, a large number of people have invested in a variety of cryptocurrency projects in the hopes of making money. More importantly, as time goes, the number of opportunities in the crypto field expands, and new crypto investment approaches emerge. Let's have a look at what "crypto investments" are, the numerous tools that can help us make the best selection, and the benefits they provide.

WHAT ARE CRYPTO INVESTMENTS

Simply explained, Crypto Investment is the act of investing one's resources in a cryptocurrency project so as to generate profit. This can take a variety of forms. For example, I have a few coins that I have stored over the years in the hopes of selling them at a profit at a later date. The term "long-term hold" refers to this type of crypto investing. That is, buying digital assets and holding them for a long time before selling them for a profit.

Also, there is the short-term buying/selling - where a crypto investor or trader buys a crypto asset and then sells it when the price rises a little, and then repeats the process. Day traders are the majority of those participating in this type of investment.

WHAT ARE THE FACTORS THAT SHOULD BE PUT INTO CONSIDERATION WHEN MAKING A CRYPTO-INVESTMENT

The main goal of crypto and other forms of investment is to make money. However, there are some things to think about before investing in crypto projects or cryptocurrencies to ensure that resources are not wasted and profits are maximized:

1. PUT INTO CONSIDERATION THE REAL LIFE USE OF THE CRYPTO PROJECT: There are a lot of seemingly good crypto investments out there that don't have any real-world applications or a credible project to back them up. These types of crypto investments have a tendency to pull the wool over investors' eyes and make off with their money. So, rather than relying on nebulous promises of "mooning," think about the project's use-case before investing.

2. MAKE ADEQUATE RESEARCH ABOUT THE PROJECT: Doing your own research is never a waste of time because it can spare you a lifetime of regret if you make the wrong financial decision. When you're at a decision point, you can join crypto groups and ask questions. Then, most essential, try to get your hands on a copy of the Whitepaper and read it thoroughly. All of this is designed to keep you from making a poor investing selection.

3. EVALUATE THE REASON WHY YOU CHOSE THIS PROJECT: Obviously there has to be a reason for picking that one project. You must ascertain the reason for this because it will have an impact on your decision-making. If you're looking for a long-term investment, for example, you should look for a project with a solid foundation.

INVESTMENT TOOLS IN CRYPTOCURRENCY

Below is the breakdown of the tools that help our crypto-investment:

MARKET DATA

Drawing in market data necessitates integrating with various exchanges, normalizing data, and calculating average prices while ensuring that no errors are present. To become a successful investor or trader, you must have a good understanding of the market and accurate data.

These are the tools that display information on a certain cryptocurrency, the market in which it is traded, and accurate market statistics such as price, supply, market capitalization, volumes, and indices to the user. Among these are:

1. GLASSNODE: Glassnode is a data and intelligence platform based on the blockchain that provides a variety of data and insights. Any coin's market indicators can be unchained using Glassnode. The platform also gives statistics that can be used to examine the inflow and outflow of various coins on the exchange.

Viewing the amount of new and active addresses might give you an idea of what's going on in the crypto market, this is what the platform affords you. The platform Glassnode is available for free. You'll need to upgrade to premium for a more advanced version.

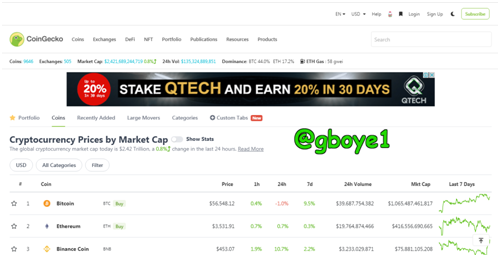

2.COINGECKO: CoinGecko is one of the most popular data aggregators for tracking cryptocurrency prices based on market capitalization. More than 7,800 cryptocurrencies and 450 exchanges have live price updates available.

The platform offers an in-depth study of the crypto market in addition to tracking and measuring coins and tokens by market size and exchanges by trading volume. CoinGecko also has stats for Facebook, Twitter, Reddit, and other social media platforms. With CoinGecko, you can make use of a variety of other valuable features to gain a comprehensive perspective of a certain coin.

CHARTING TOOLS

Charting tools can be highly useful for establishing technical trading strategies, whether you are new to crypto trading or an experienced trader. There are numerous charting solutions in the market, but these three have been the best in terms of feature sets, the convenience of use, and exchange integration that we could use.

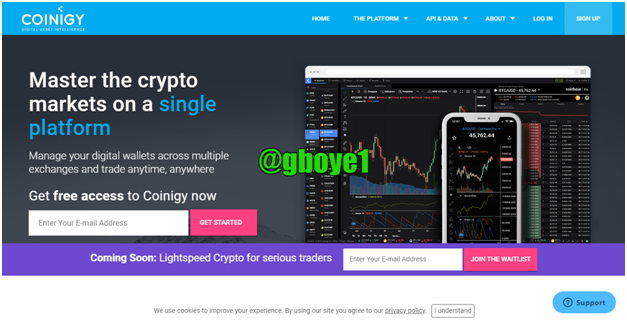

1. COINGY: In the area of cryptocurrency, Coinigy is another well-known technical analysis tool. This tool is classified as a charting tool, but it comes with several extra features to aid traders in developing and executing strategies. Coinigy's charting service is based on the TradingView platform, but it integrates with over 45 cryptocurrency exchanges using unique data feeds. Users can set up SMS text alerts on specific events, as well as place trade orders across their exchanges, in addition to using the same indicators available on TradingView.

Coingy does not have a free plan, but its feature set is definitely worth it if you trade on various exchanges.

2. TRADINGVIEW: TradingView is the most widely used charting and technical analysis tool for traders across all markets. They've been pushing to combine their toolset with the most prominent cryptocurrency exchange in recent years, and the results have been amazing. Both free and paid customers can use their online charting tools.

Most traders should be able to get started and learn the basics of technical analysis with a free account. The same professional tools are available to free users as they are to paid users, however, they are limited to three technical indicators and overlays per chart.

3. CRYPTOWATCH: Cryptowatch, which is owned by Kraken, is another comprehensive charting platform that gives traders live-streamed price, volume, and order book data from over 800 exchanges. Despite the intimidating dashboard that greets you when you first visit the site, Cryptowatch is a simple to use tool that is a valuable addition to any trader's toolset.

CryptoWatch features a number of technical analysis indicators and overlays to assist you in making your decisions, in addition to seeing current exchange data. While this charting tool lacks some indicators and sketching capabilities, Kraken is constantly updating the site to add more.

There are more tools that are available for crypto investment like the calendar tools, trading bot, and a host of others. Understanding how to use these tools will grant the trader the upper hand when carrying out trading activities as you will be familiar with the market trends, you are updated with crypto news and so many advantages.

PRIVATE SALE IN CRYPTOCURRENCY

The initial coin offering (ICO) held privately is usually done during the project's development phase, when the project's developers and investors meet to review the project's documentation, the problem, and the project's proposed solution with the goal of persuading investors to invest in the project in exchange for shares of the project's token offered at a heavily discounted rate.

Investors definitely will want to make money, which necessitates a detailed check of the project and its suggested solution. Institutional investors, such as hedge funds, corporate bodies, companies, and individual investors, are the most common types of investors.

Private sales, according to research, raise a significant amount of money for projects, often in millions of dollars. Private Sales helps to get a project off the ground before other investors become interested. The project's developers set aside a percentage of the project's equity for this private sale, and sell it to early investors at a significantly reduced price. Private sales can be conducted in batches to allow additional investors to contribute to the project's funding.

WHAT ARE THE BENEFITS OF PRIVATE SALE IN CRYPTOCURRENCY

The private sale, which is the project's initial token sale, is given at a discounted (lower) rate per token to early investors. As a result, private investors can hold a significant portion of the project.

Investing during private sales provides investors with lower token prices, which will result in profits throughout the early phases of other coin offering sales as token sell prices rise.

In contrast to the shared hard cap during other rounds of token sales, the private Sales coin offering allows private investors to invest as much as the mapped percentages permit.

WHAT ARE THE RISKS ASSOCIATED WITH PRIVATE SALE IN CRYPTOCURRENCY

in case the project fails, the possibilities of receiving a refund of a private sales investment are slim.

Because of the project's unexpected result and other coin offerings, the private sales investment is deemed a high-risk investment. There is no exact way to evaluate the suggested solution's real-life application because the project's proposed solution is currently being developed.

Because of the uncertainties surrounding the project's progress, token payouts are almost always negative after the private sale investment.

PRESALE IN CRYPTOCURRENCY

Before the main token sales, there is a pre-sale period. In some situations, a presale is done near the end of a project's development, allowing a bigger number of investors to invest by exchanging other coins (usually significant coins such as ETH, BTC, and others) for the token.

Pre-sales should ideally be held in public, with only a small number of investors required and only a small proportion of the project token available at a low (discounted) price. This sale raises initial public knowledge of the project and its proposed solution (documentation) while also providing the necessary funds to properly launch the project for exchange listing.

BENEFITS OF PRESALE IN CRYPTOCURRENCY

When compared to the intended public sale price, the presale of the project's token share is provided to investors at a discounted (cheap) price per token. Investors will be able to own a stake in the project as a result of this.

In comparison to public sales with a bigger investor audience, the presale coin offering allows fewer investors to invest as much as the specified percentages allowed.

Investing during presales provides investors with low token prices, which result in swift profits during the public sale coin offering due to higher token values.

RISKS ASSOCIATED WITH PRESALE IN CRYPTOCURRENCY

The coins purchased during the presale may lack liquidity and hence become unsellable.

Investing in a young or shady token carries a higher risk.

Pre-sale participation is frequently subject to a condition.

PUBLIC SALE IN CRYPTOCURRENCY

This is the final and most crucial stage of an ICO when the entire public is invited to join the fundraising. This is the final stage of a crypto project's funding, following which the coin can be traded on a decentralized or centralized exchange.

In comparison to the earlier ICO phases, the public sale typically offers a lesser discount and potentially involves a reduced risk.

BENEFITS OF PUBLIC SALE IN CRYPTOCURRENCY

It's easier to predict the success rate of the ICO at this stage than it is at the beginning.

Based on KYC and the volume of tokens acquired, the minimum requirements are the simplest.

It may be less risky than a private sale or a presale.

RISKS ASSOCIATED WITH PUBLIC SALE IN CRYPTOCURRENCY

After buying at the public sale, there's a probability that the token's price will plummet.

The public sale may be canceled if the tokens are sold out during the ICO's first and second phases.

In comparison to the ICO's early stages, there is a lesser discount.

METHODS USED FOR PUBLIC/PRE-SALE/PUBLIC SALE IN CRYPTOCURRENCY

There are a variety of mediums that project owners can utilize to efficiently carry out their ICO - whether it's a Public, Presale, or Public sale. The following are the options:

BY THE USE OF LAUNCHPADS

This is a platform that project owners can use to obtain funding for their initiatives by launching an initial coin offering (ICO). There are a variety of launchpads accessible, each built on a different Blockchain, such as BSC, ERC, TRC, and Solana. The following are a few examples of launchpads that are frequently used:

1. TRUSTSWAP LAUNCHPAD: I'm sure most of us have used TrustSwap for other Defi purposes, but they also offer a launchpad for cryptocurrency project owners. The "SmartLaunchToolKit," which is a lockup token system that prevents possibly fraudulent tokens from commencing a rug-pull after the ICO, is a crucial component of TrustSwaplaunchpad.

2. BINANCE LAUNCHPAD: Binance is a well-known name in the cryptocurrency sector, first as an exchange platform, and now as a token launchpad. Binance Launchpad is a platform that allows projects to raise funding for their crypto projects by hosting an IEO/ICO.

3. RED KITE LAUNCHPAD: Because of its status as one of the largest launchpads, Red Kite Launchpad is a multi-chain launchpad that enables project owners to conduct effective ICOs with a higher success rate. The "vesting schedule" is a new feature that allows project owners to distribute their tokens for secondary or post-ICO offers.

4. FUNDING DIRECTLY VIA THE PROJECT'S WEBSITE: Some projects invite investors to contribute directly to their projects by providing a contract address, which is usually made public via their website. This is how it's done: Typically, the project owner(s) establishes an ICO website or uses their own website. Investors will then send funds to the provided address in the recognized coin (the accepted cryptocurrency can be Sol, ETH, BNB - depending on the chain on which the token will be based).

The equivalent of the token will be issued to the investor's wallet after payment of the accepted cryptocurrency and the minimum criterion has been met.

RECENT 2021 ICO THAT WAS SUCCESSFUL

SOLRAZR

It was designed to act as the de-facto platform that will raise funds and develop Solana-based projects, the aim of the SolRazr is to ensure the growth of Defi, NFTs, and scalable web3 apps. SolRazr is Solana's first decentralized developer ecosystem. Using the power of NFTs on Solana, we're reimagining token sale whitelists and allocations. We incubate projects and assist with go-to-market strategies to enable them to launch fast through the Accelerator program. With a set of sophisticated developer tools, you may accelerate the construction of your Solana dApp.

With sophisticated developer tools, you can accelerate your Solana development. Solana is the most rapidly expanding blockchain, with significant platforms such as Serum, Raydium, and several Defi protocols built on top of it. SolRazr intends to accelerate the adoption of the Solana network by assisting developers and projects in raising finance and completing projects quickly.

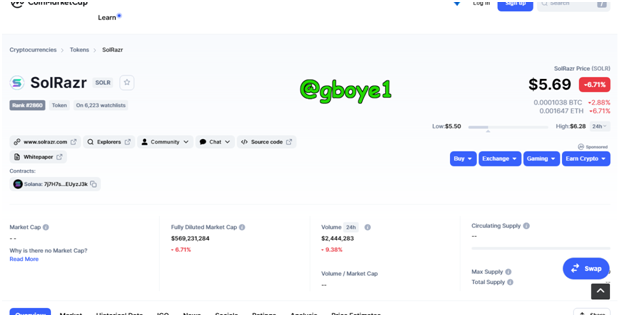

With a 24-hour trading volume of $2,476,426 USD, the current SolRazr price is $5.79 USD. In real-time, we update the price of SOLR to USD. In the last 24 hours, SolRazr is down 5.20 %. CoinMarketCap now ranks #2860. The circulating supply of SOLR coins is unknown, with a maximum supply of 100,000,000 coins.

KEY PROBLEMS SOLRAZR IS SOLVING

When it comes to funding and becoming a part of the early growth phase of next-gen ideas and enterprises based on the fastest growing network - Solana - retail investors are facing an increasing hurdle. SolRazr solves this problem by granting project access through decentralized and fair allocations.

SolRazr gives projects and developers the opportunity to acquire funds quickly and in a genuinely decentralized manner, allowing them to build strong communities for long-term support. SolRazr not only helps projects obtain funds but also gives them access to a variety of development tools to help them build quickly on Solana and get to market quickly.

MY IMAGINARY TOKEN

To answer this question, I will be creating my own imaginary token, it’s an excellent token actually and I choose to name it the Yebojay token

THE YEBOJAY TOKEN

Yebojay Token is a decentralized Proof-of-Work token designed to reward local content creators for their daily activity. However, by leveraging the popularity of mainstream social networking, this currency is aimed precisely at spreading crypto acceptance to the outside.

Yebojay Token is a multi-chain token that will primarily operate on the Ethereum, TRC, SOL, and HSC blockchain networks, removing interoperability obstacles and reducing scalability difficulties to the barest minimum.

Additionally, the Yebojay Token will be linked into prominent exchange platforms like as BreadSwap, GarriDEX, and AgegeSwap, allowing users to bridge between different blockchain networks while keeping the same token value.

Yebojay is the name of my token, YEBO is the symbol for the token.

FIRST PRIVATE SALES

Date of ICO - 21st –23rd October 2021

YEBO token value: $0.1

25% token Allocation - 3,125,000M

Expected value at end of fundraising - $312,500

SECOND PRIVATE SALES

Date of ICO - 25th - 27th October 2021

YEBO token value: $0.15

25% token Allocation - 3,125,000M

Expected value at end of fundraising - $468,750

THIRD PRIVATE SALES

Date of ICO –29th–31st October 2021

YEBO token value: $0.2

25% token Allocation - 3,125,000M

Expected value at end of fundraising - $625,000

We won't be entering into the Pre-Sale phase, instead of going right to the Public Sales phase, due to the way we've organized the multiple stages included in the ICO, with Private Sales holding 75 % of the allotted 25 % of total tokens

available for ICO phases.

PUBLIC SALES PHASE

Date of ICO –3rd–12th November 2021

YEBO token value: $0.25

25% token Allocation - 3,125,000M

Expected value at end of fundraising - $781,250

The total expected value to be generated, with realized values derived from each of the stages and phases, is estimated to be $2,187,500, which is well on target for full execution of Blockchain growth and software advancements.

The token will be listed on DEX and CEX after the Private Sale and Public Sale, and will then be added to Market Data Tracking Sites like CoinMarketCap and CoinGecko.

WHAT ARE THE CRITERIA’S FOR LISTING TOKENS ON THE COINMARKETCAP

The process of listing a crypto asset on the Coinmarketcap platform entails the company doing a thorough analysis of the coin. Before the token may be put to the tracking list and the possibility of the listing is examined, several requirements must be completed.

The fact that a crypto asset is being tracked by Coinmarketcap does not guarantee that it will be listed; it just implies that the conditions have been completed and that further analyses will be conducted internally.

These criteria’s can be seen in website

Some of the listing criteria that the coin must meet include:

1. IN THE CASE OF CRYPTOCURRENCIES

A block explorer and a working webpage or website are required for the token to function.

The token must already be publicly traded on at least one active exchange platform.

CMC must receive and verify at least one communication from a representative of token owners.

2. FOR TOKENS OF EXCHANGE

Prior to the application, the exchange must have been operational for at least 60 days.

Users should be able to easily find the exchange's URL

For verification, a project representative must be provided.

Active users and a fully operating trading website.

Following the completion of these requirements, token owners will fill out the CMC request form, following which the application will be evaluated based on the aforementioned criteria.

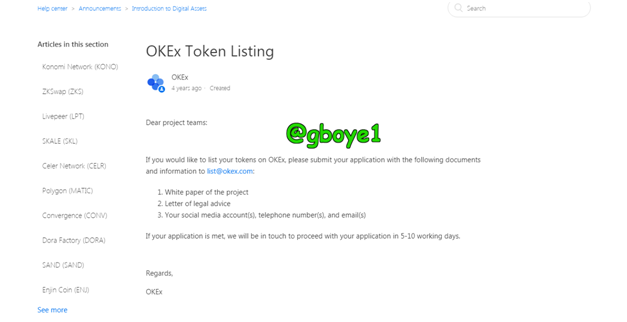

Let's look at the requirements for a centralized exchange platform to publish a token now that we've seen the CoinMarketCap listing requirements. We will be looking at the OKEX exchange for the purposes of this sub-topic:

OKEX is a well-known centralized exchange among cryptocurrency users and traders. I chose to examine the OKEX exchange since its listing standards are less demanding than those of other mainstream exchanges such as Binance.

The following minimum requirements must be completed in order to list a token on OKEX, as stated on the official Support page website

Your token should have a functioning block explorer that can be used to track transactions.

OKEX should be notified of any updates to your tokenomics.

The token must have a live web presence, such as a website, portal, or webpage.

Having a vibrant community will offer your coin an edge.

OKEX should get your Whitepaper for review.

In addition, you must send a letter of legal counsel.

Your contact information, social media handles, and those of your representatives must also be included.

[email protected] is the official email address for submitting all documents.

CONCLUSION

The activities involved in the analysis, purchase and holding of cryptocurrencies for a length of time with the goal of profiting from the cryptocurrency's rising value are referred to as cryptocurrency investment. Crypto investment tools are resources that investors may use to monitor the crypto market so that they can invest in better financial conditions. Developers have a long history of using coin offering sales to raise investment cash while also creating investment opportunities.

This is a big and somewhat complicated topic for me, but it is interesting... Thank you for the article. I have to read it more than twenty times to understand it well.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit